CES 2025 becomes a competition hall for panoramic HUDs

We will introduce the contents of the “2025 Automotive Display Technology and Industry Trends Analysis Report” published by UBI Research in February 2025 as a series. As the first series, we will introduce Panoramic-HUD, which is included in the report.

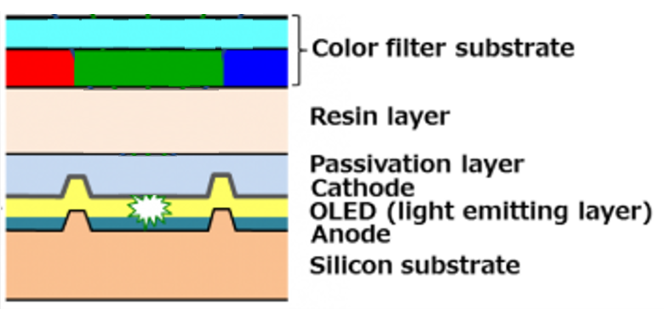

Generally, automotive head up displays are projected on the windshield, the windshield of a car, and the driver can see a virtual image generated several meters away. Unlike general HUDs, Panoramic HUDs directly reflect the image projected from the display onto a black film coated on the lower surface of the windshield, but they are classified as HUDs because they allow the driver to maintain a head-up view while driving.

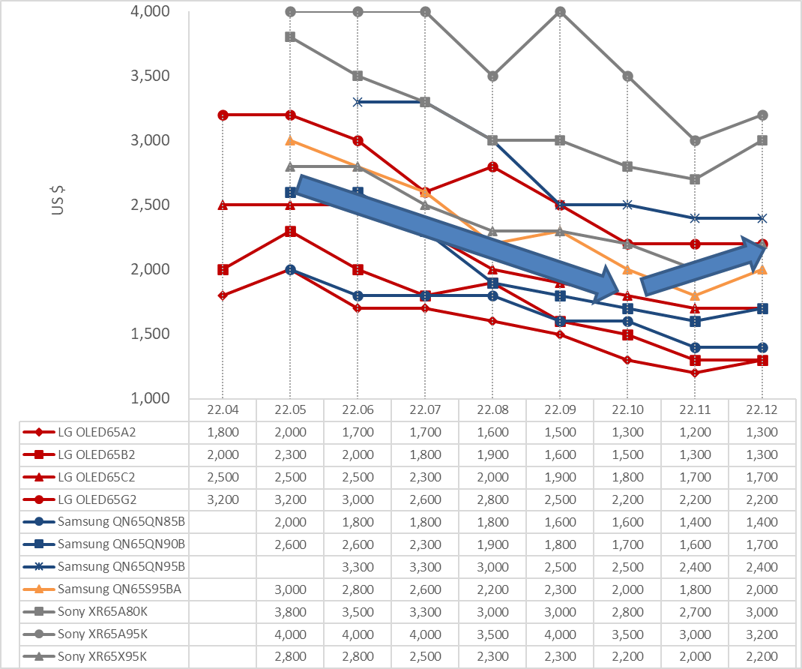

Panoramic HUDs are implemented using a direct image method, so their design is simple and the system cost is low. This reduces manufacturing costs while enabling the digital experience of premium vehicles. In addition, P-HUDs have the advantage of being able to use polarized sunglasses that prevent glare because they reflect p-polarization. Therefore, it is expected that panoramic HUDs will enter the market before AR-HUDs become widespread. At this year’s CES, several companies announced Panoramic HUDs, reminiscent of the P-HUD competition arena. BMW calls its panoramic HUD “Panoramic Vision” and announced that it will be installed in the Neue Klass model to be released from 2025. It uses TFT-LCD and has a brightness of about 5,000nits, but higher brightness is needed to improve outdoor visibility, and for this purpose, it is working closely with e-LEAD, a Taiwanese company that manufactures black films.

(Source: BMW)

BOE introduced a P-HUD with a brightness of 5,000nits (normal) / 7,000nits (10% peak) by applying a 44.8-inch oxide TFT-LCD panel and 2,850 zone local dimming, and polarized sunglasses can be used because the P-polarization reflectance is 25%.

TCL-CSOT introduced a P-HUD with a brightness of 11,000 nit by applying three 11.98-inch TFT-LCD panels and 384 zone local dimming.

CarUX, a subsidiary established by Innolux in 2019, introduced a 48-inch P-HUD and boasted a high brightness of 14,000 nit by using a micro-LED panel.

Hyundai Mobis introduced a transparent P-HUD with a transmittance of 95% by introducing holographic technology from Zeiss in Germany, and plans to mass produce it in 2027. Continental also introduced the “Scenic View HUD,” a panoramic HUD with three TFT-LCD panels and local dimming, in 2023, and plans to release it in 2026.

Since the P-HUD is located in the vent, heating, ventilation, and air conditioning hardware must be rearranged, and heat dissipation issues must be resolved, so there are many issues to be resolved in addition to the display, so it took a long time, but 2025 is expected to be the first year of the P-HUD release.

This report covers the overall trends of vehicle display technology, including HUD, as well as the status of display development and vehicle application by finished vehicles, electrical equipment manufacturers, and panel manufacturers. If you are involved in the automobile and display industries, now is an important time to analyze market trends and prepare future strategies. We hope that you will gain insight one step ahead through this report so that you can understand the future trends of the vehicle display market in advance and proactively respond to industry changes.

UBI Research Chang Wook HAN Analyst(cwhan@ubiresearch.com)

China Trend Report Inquiry

China Trend Report Inquiry