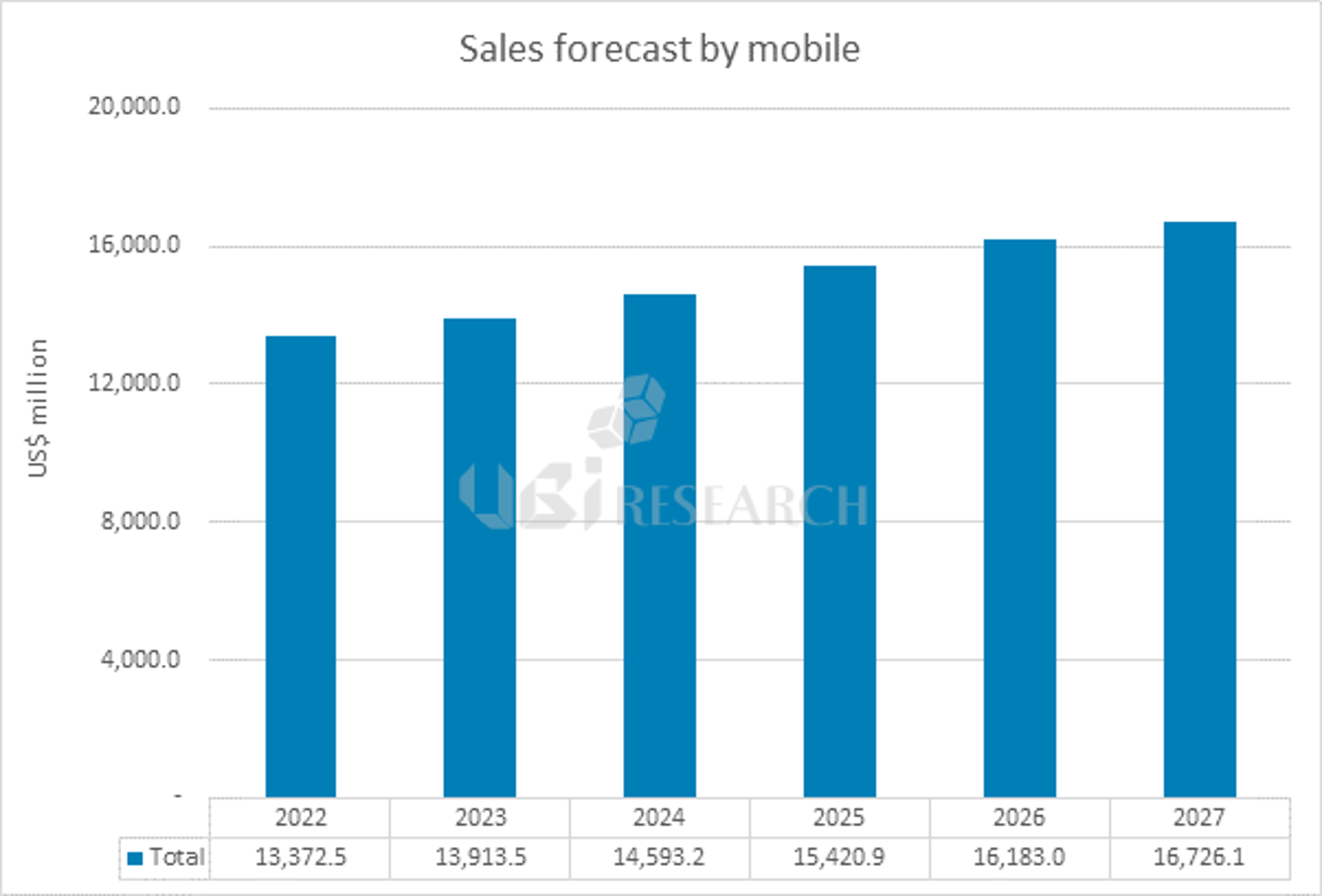

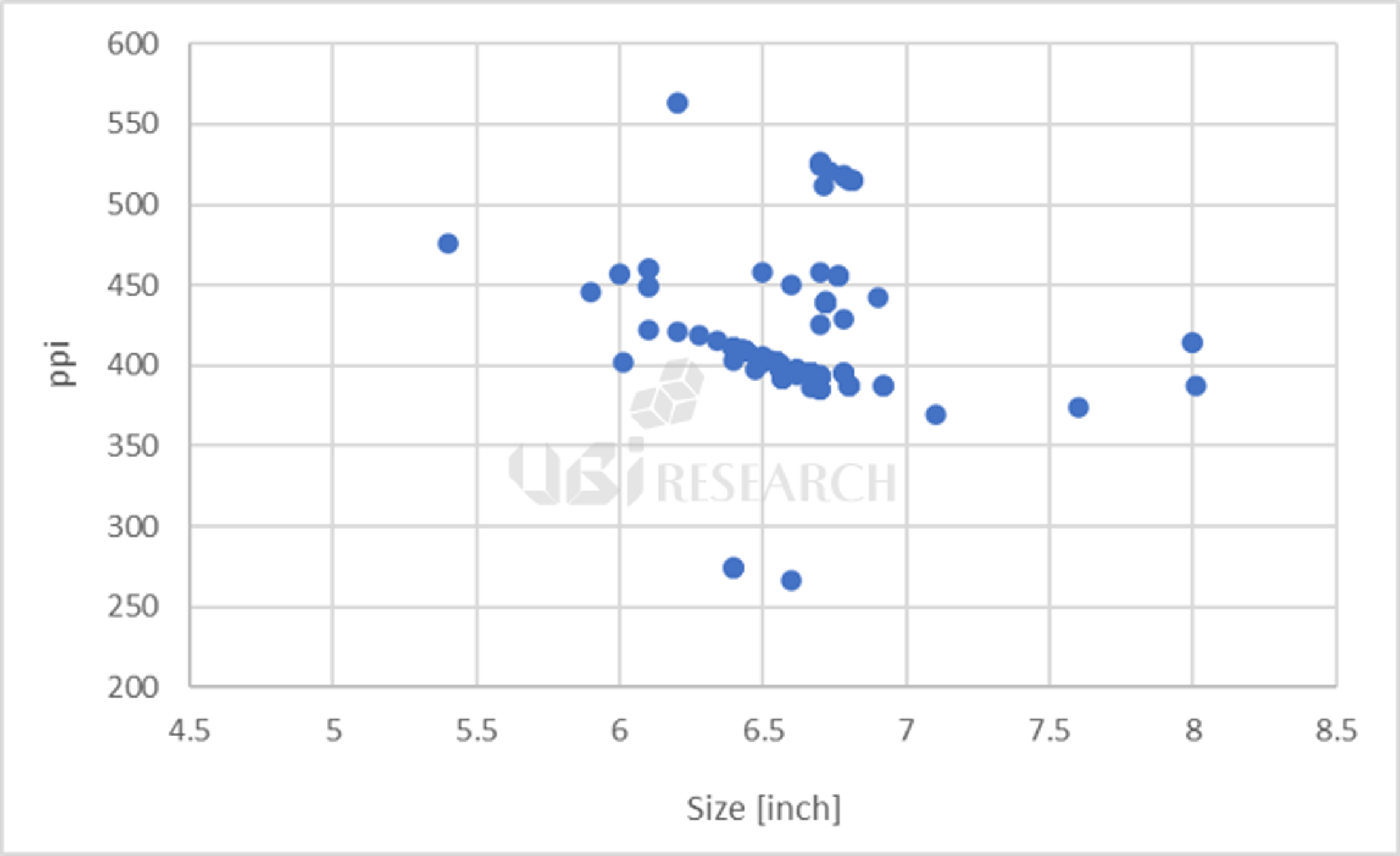

Extended reality (XR) devices, which overlay an extended reality on top of the real world, are emerging as disruptive devices that will drive a second wave of digital convergence, renewing the digital convergence brought about by smartphones. MR (mixed reality) devices will converge TVs, monitors, and laptops, while AR (augmented reality) devices will integrate smartphones, smartwatches, and tablet PCs.

UBI Research has released a new report, “XR Industry Mega Trends Analysis,” which provides a detailed analysis of the past and present of the XR industry that set manufacturers, display companies, and component/material/equipment companies need to know in order to prepare for the upcoming second wave of digital convergence.

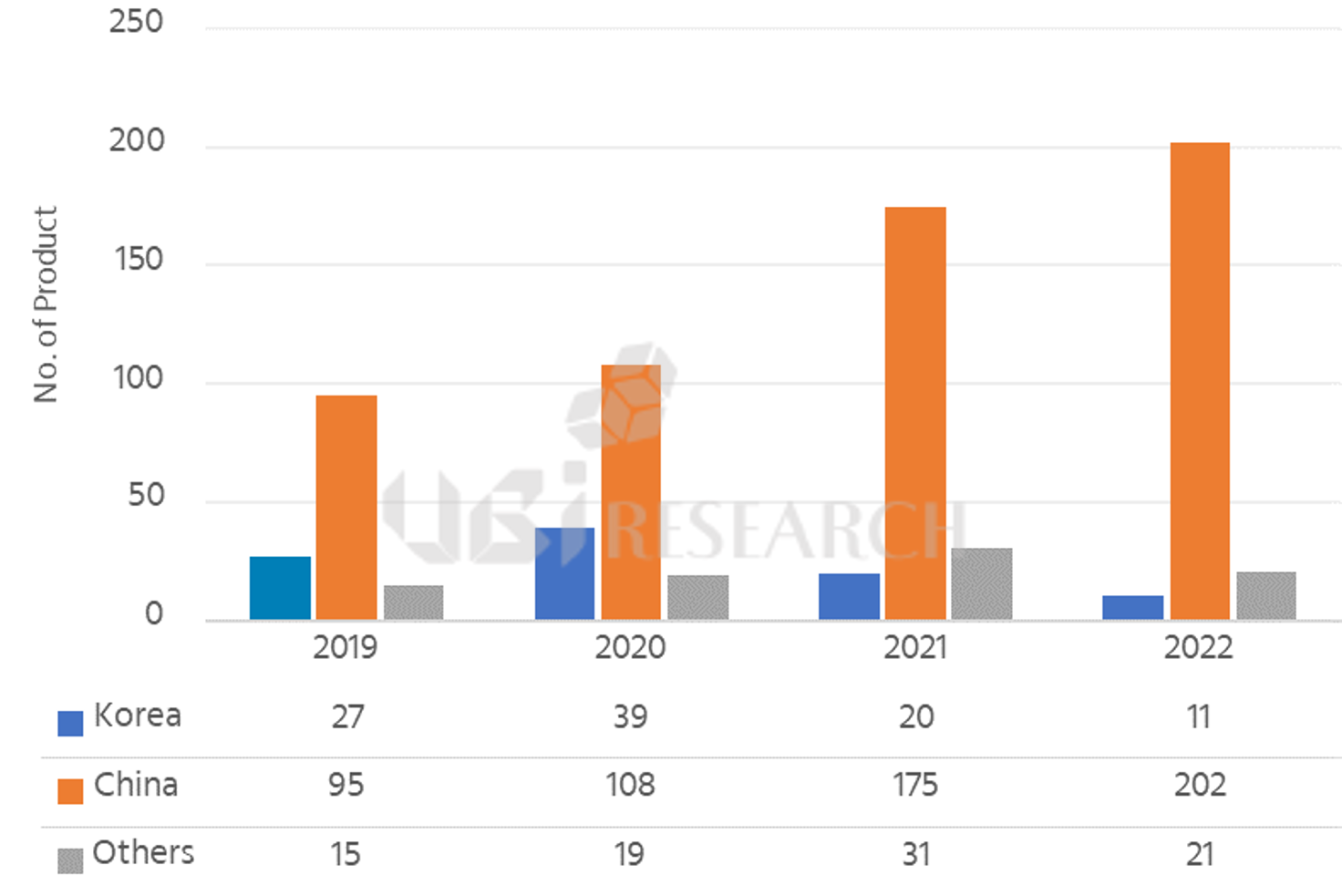

Analyzing all the models of XR devices on the market from VR devices that started to be released in 1989 to the first half of 2023, we found that XR devices have a very complex industry structure that is different from wearables, mobile devices, and IT devices that have existed before.

MR devices are characterized by being able to work while moving, unlike conventional IT products that are used while sitting in a chair, and AR devices are products that free up both hands while actively adjusting the display to provide information in all directions of head movement.

Therefore, it was analyzed that in order to succeed in the XR device industry, which is the next generation of innovative products, all related companies, including set companies, display companies, and equipment/components/materials, must first understand the composition, operation principle, and content of XR devices and prepare business directions.

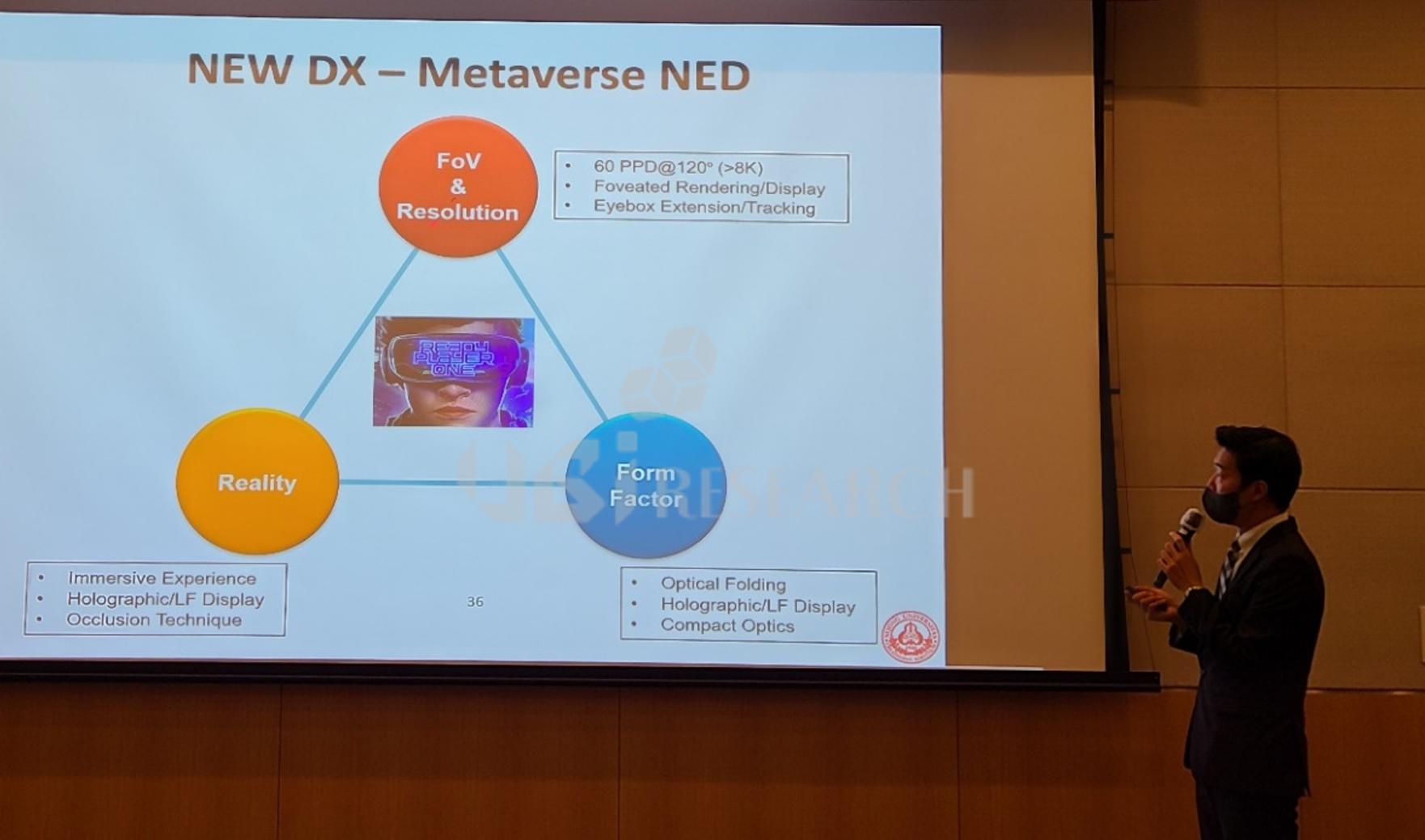

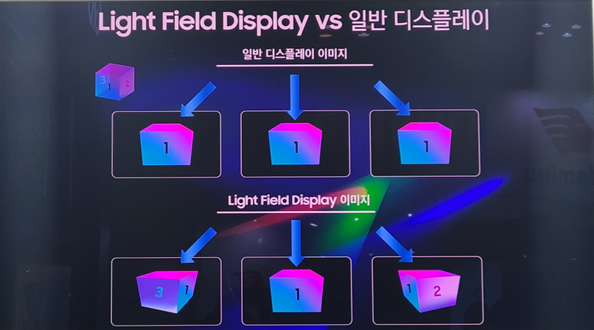

The core components of XR devices are optics, displays, and sensors for tracking, and the content used is different depending on the characteristics of these three components. While the existing IT industry has determined the content to be used based on the performance and specifications of the hardware, XR devices are expected to develop in the opposite direction, with the content determining the specifications of the XR devices.

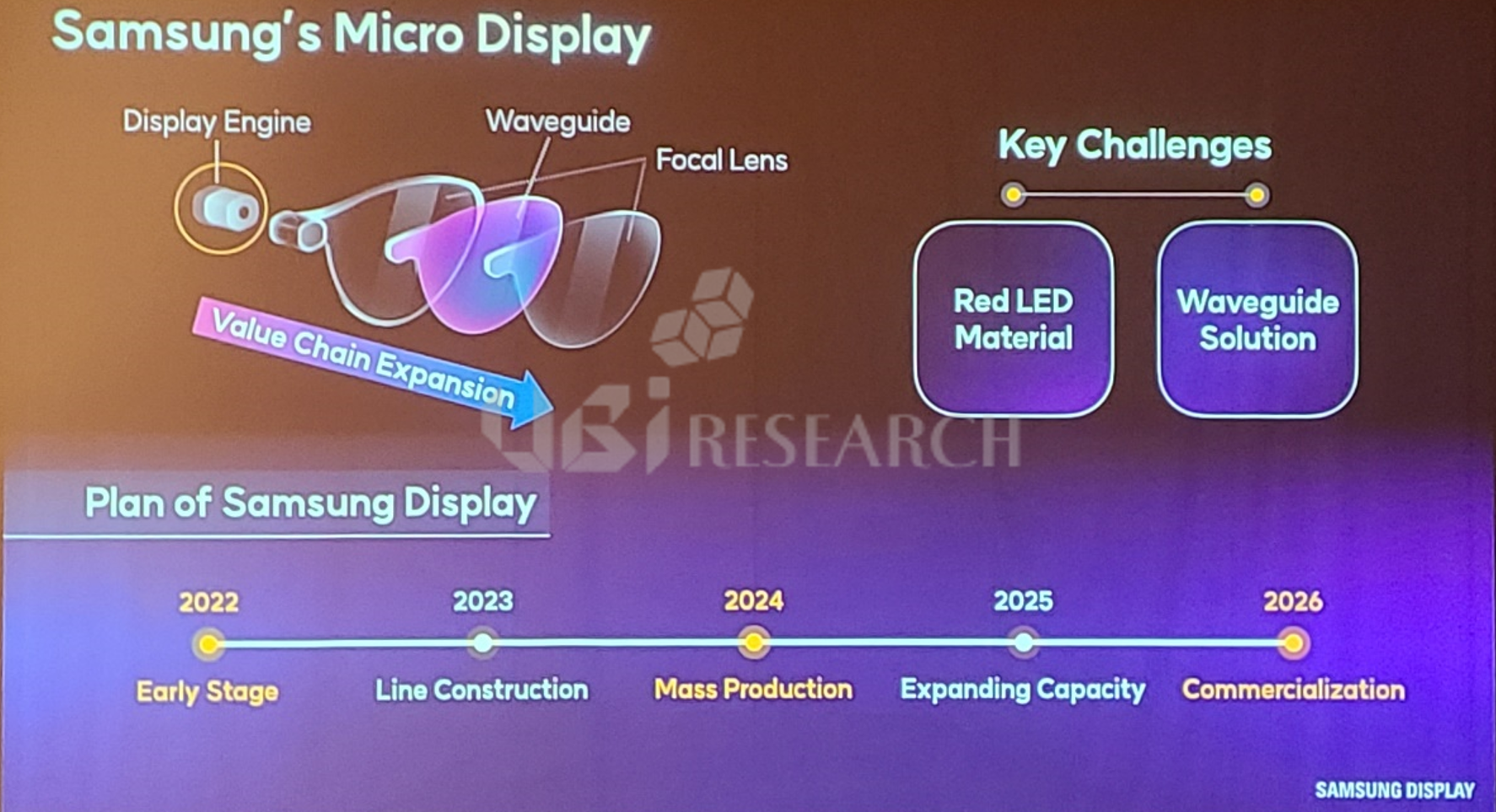

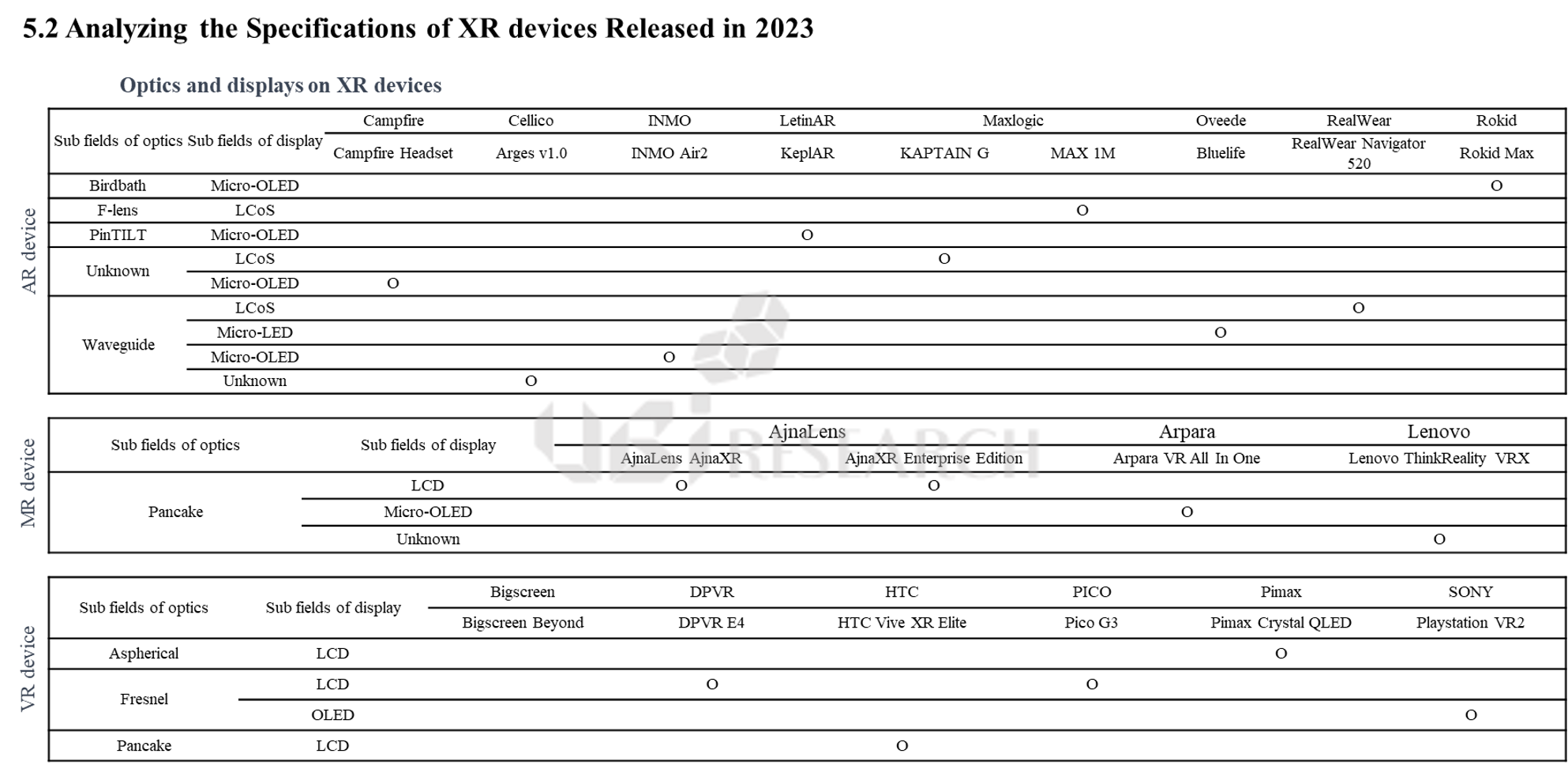

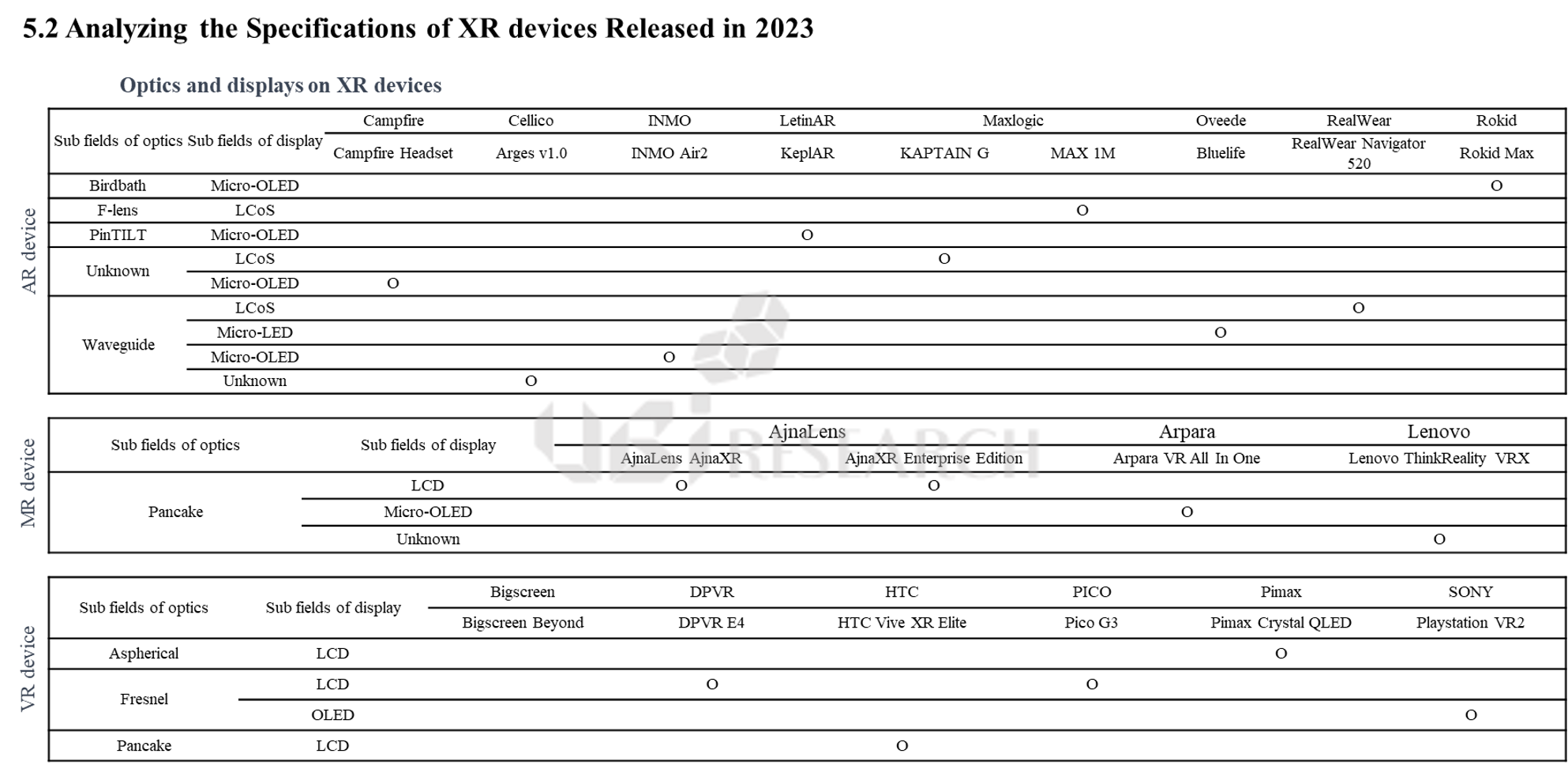

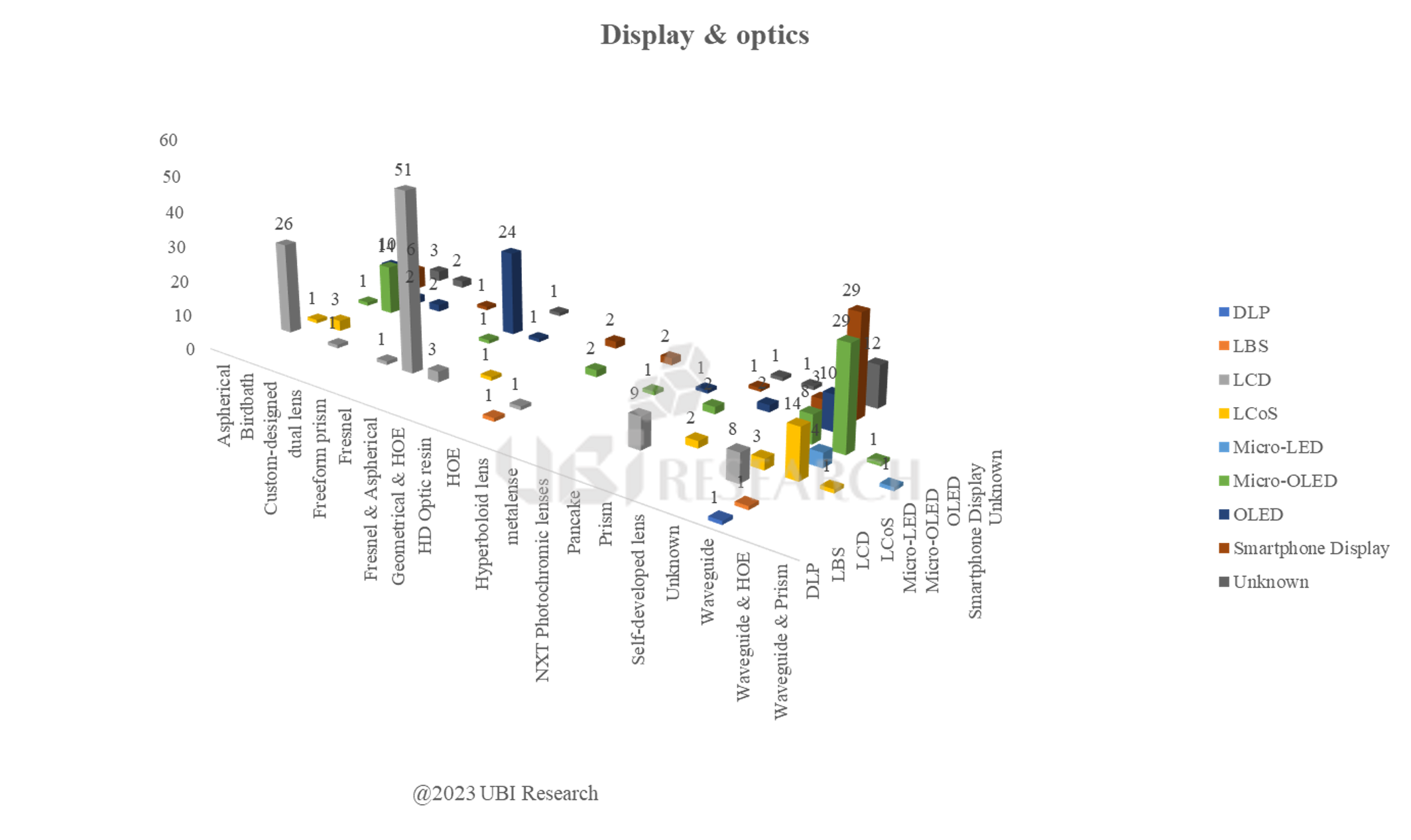

We have summarized the optics and displays of XR devices released in the first half of this year. Understanding the relationship between optics and display is an essential element of the XR device industry, as the type of content determines the specifications of the device.

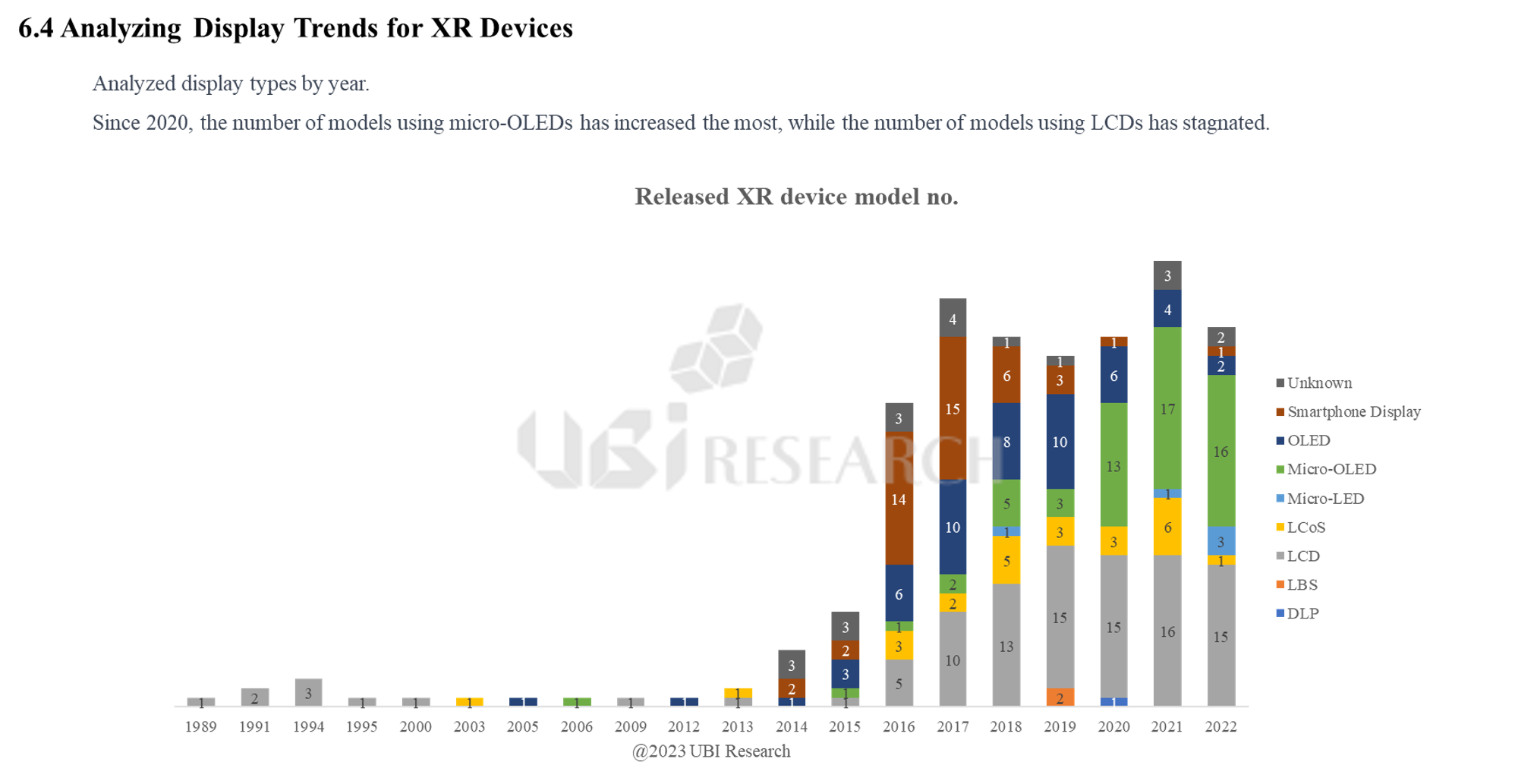

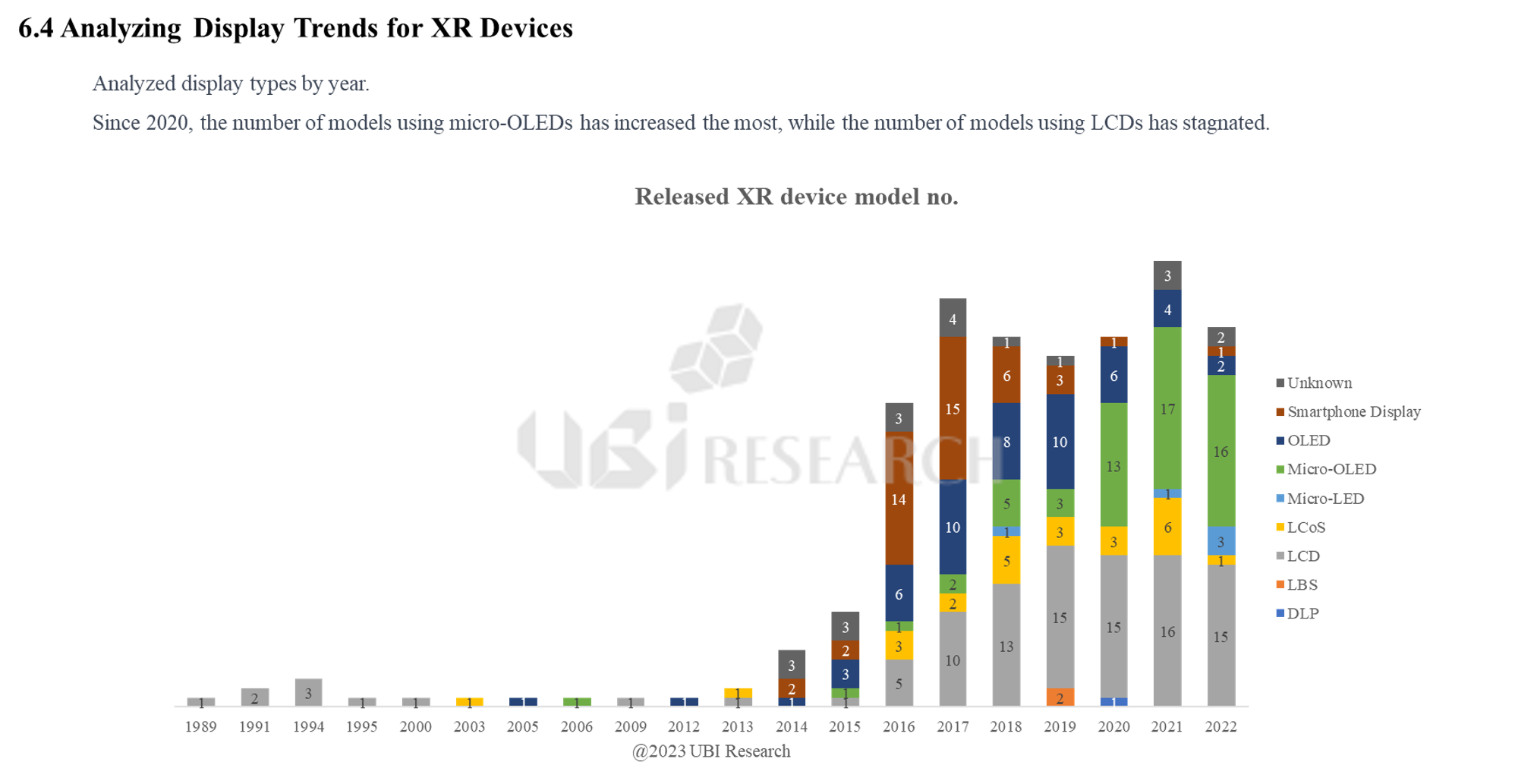

We analyzed the optics, displays, and tracking methods of all XR devices released since 1989.

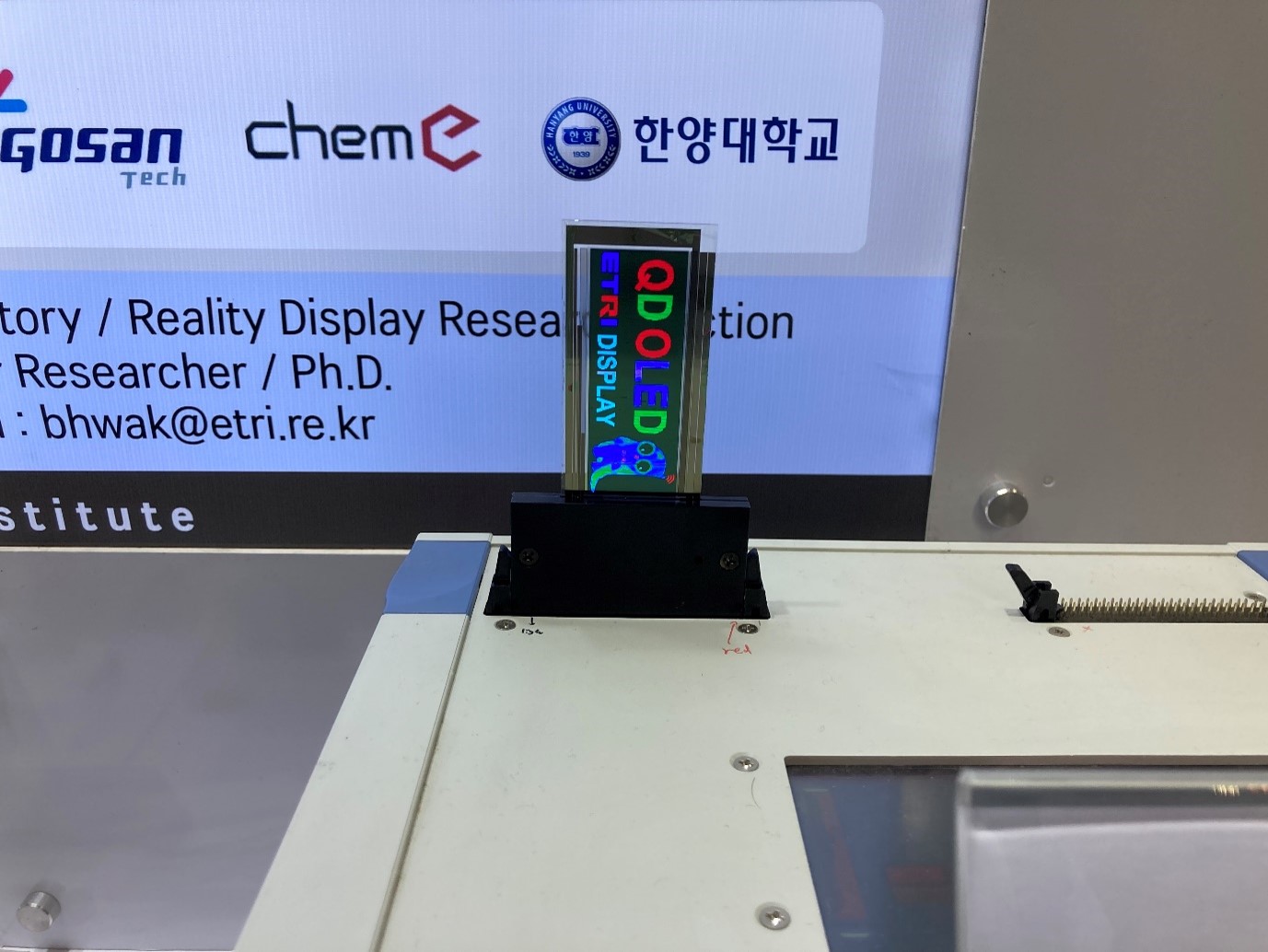

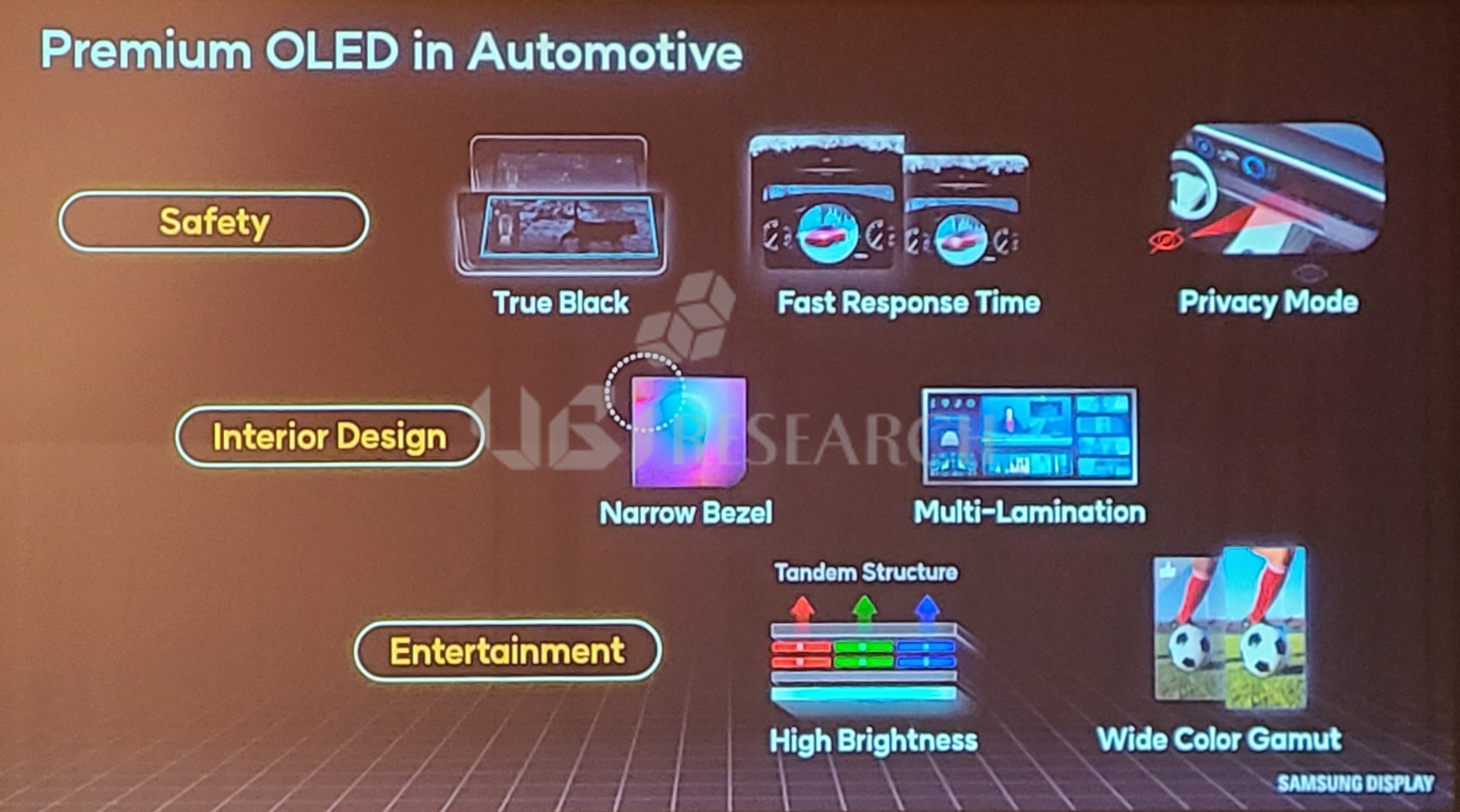

Display trends show that the number of models using LCDs is slowly decreasing, while the percentage of XR devices using micro-OLEDs is increasing.

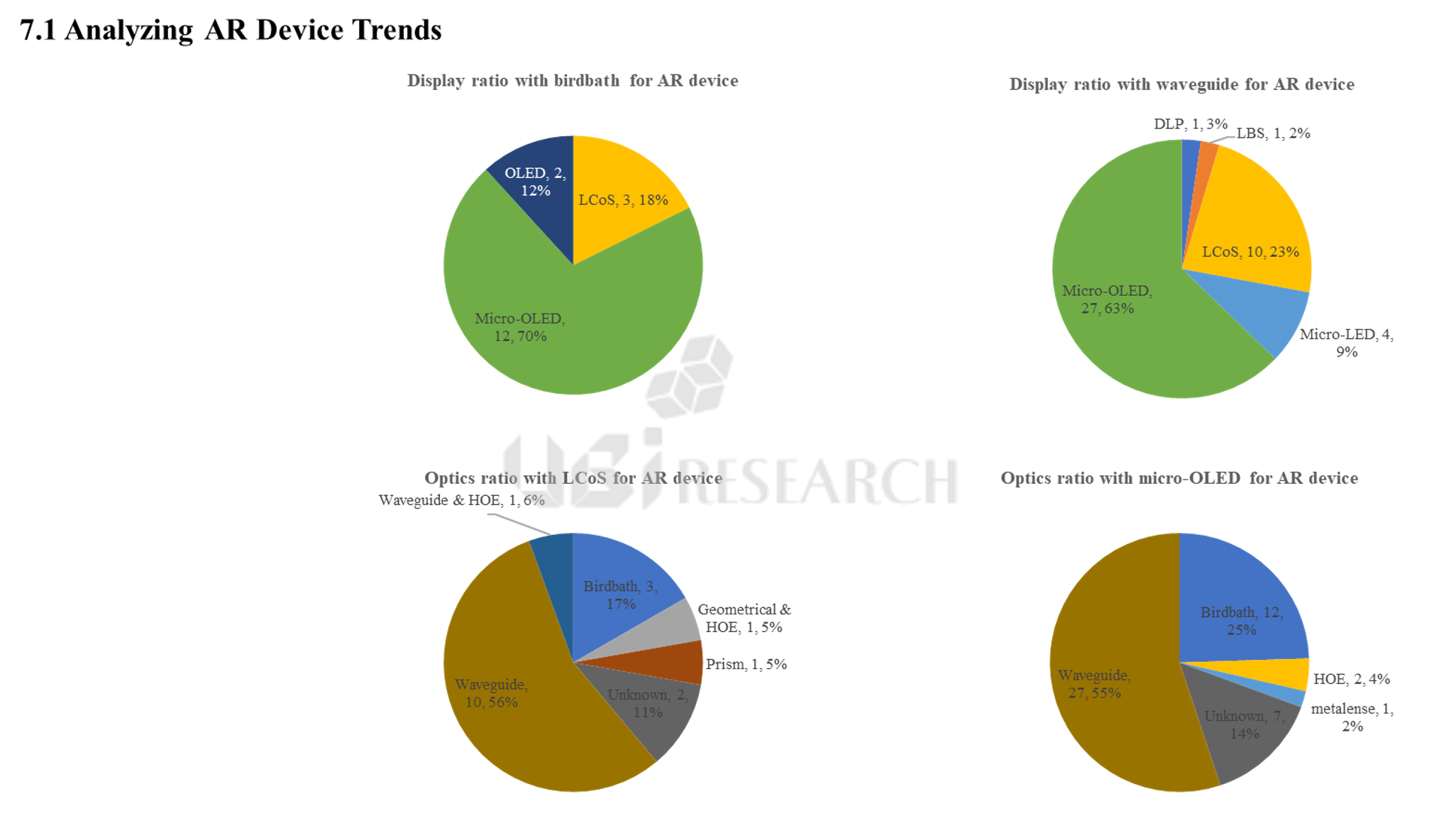

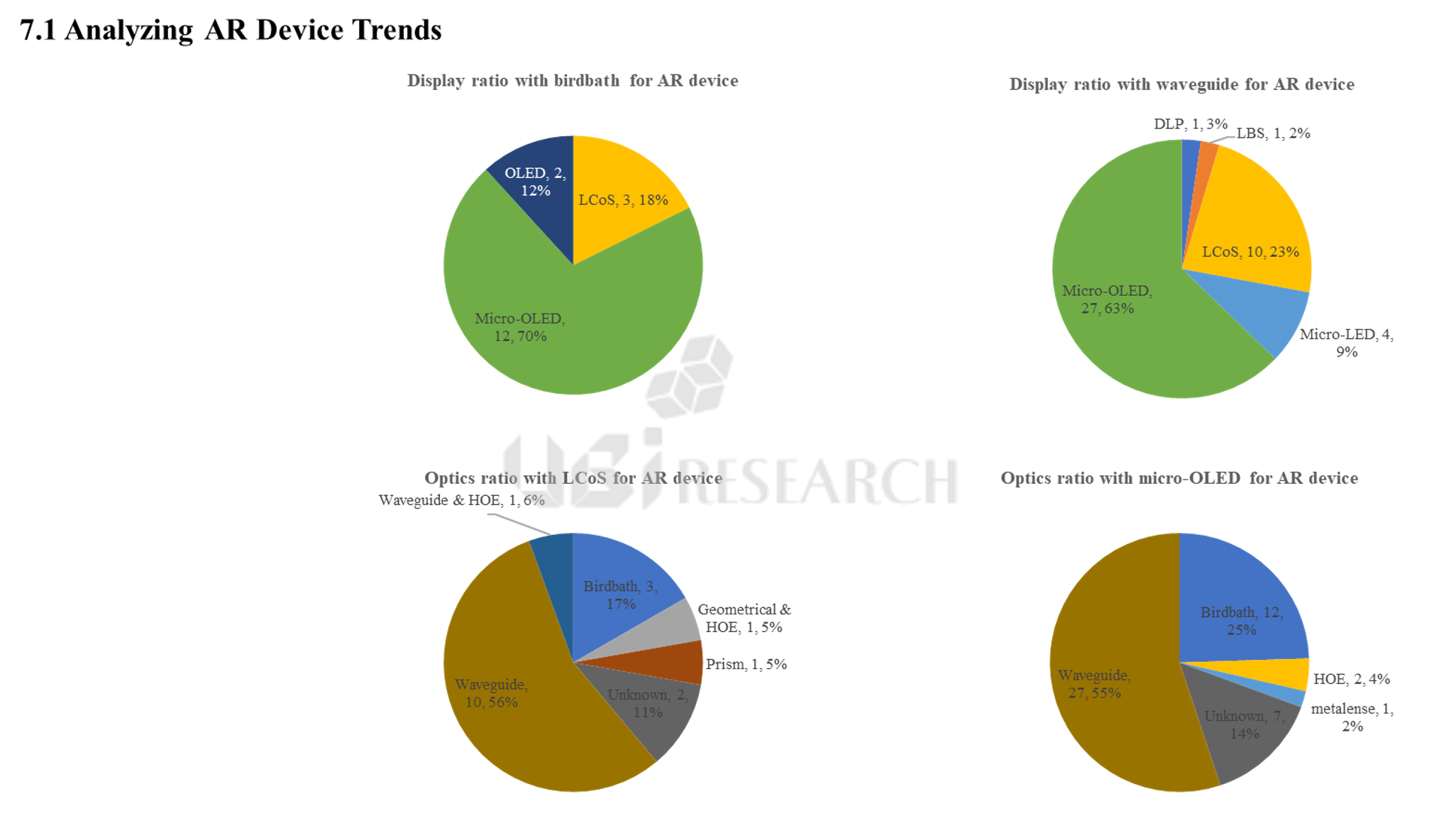

In optical see-through (OST) AR with transparent windows, micro-OLEDs are most commonly used, with waveguides and birdbaths being used as optics.

Display companies need to work together to understand which combination of optics is appropriate for the display they are developing or producing. This is because XR devices are often used for specific purposes rather than general purpose. The field of view (FoV) of the optics can determine the display of choice.

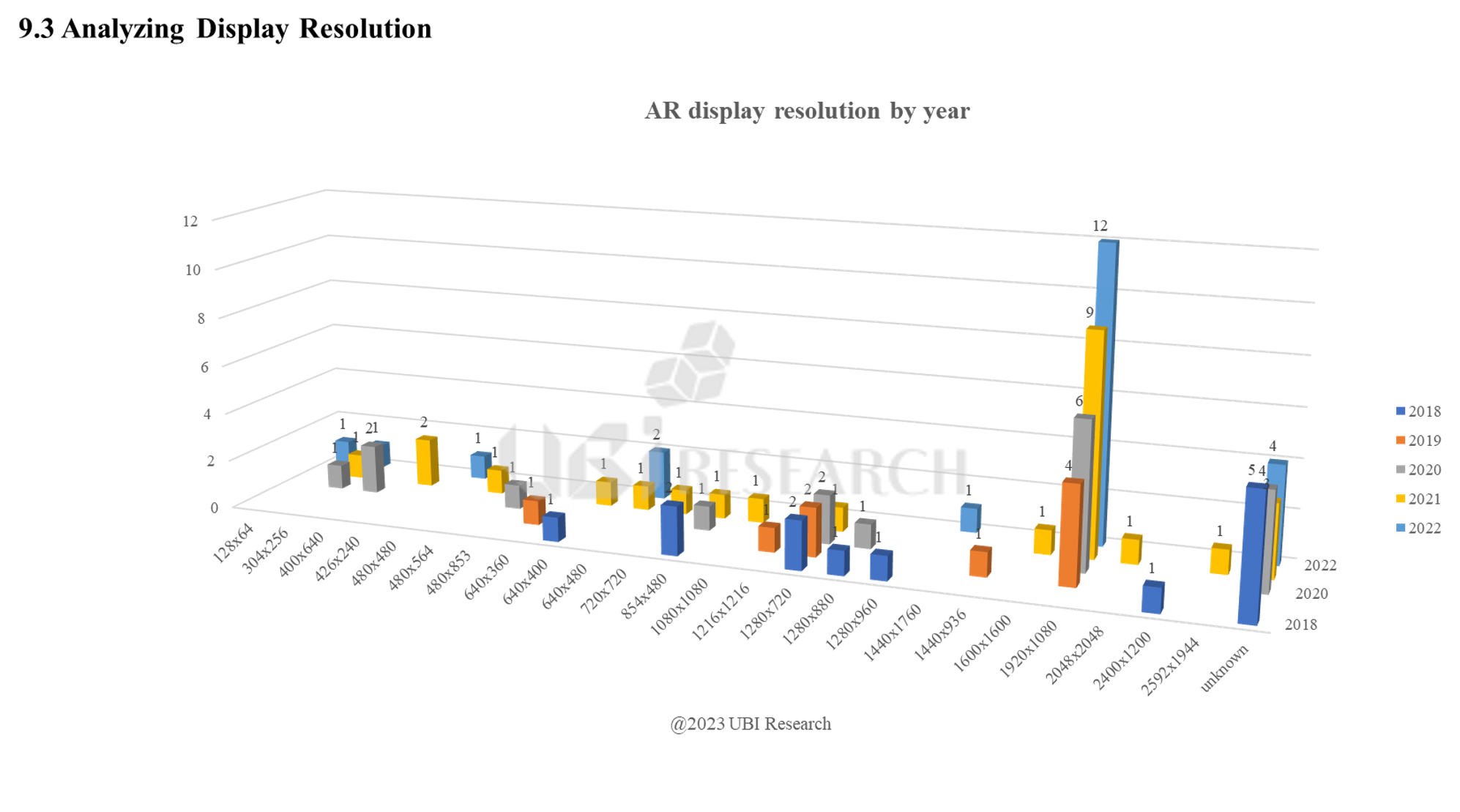

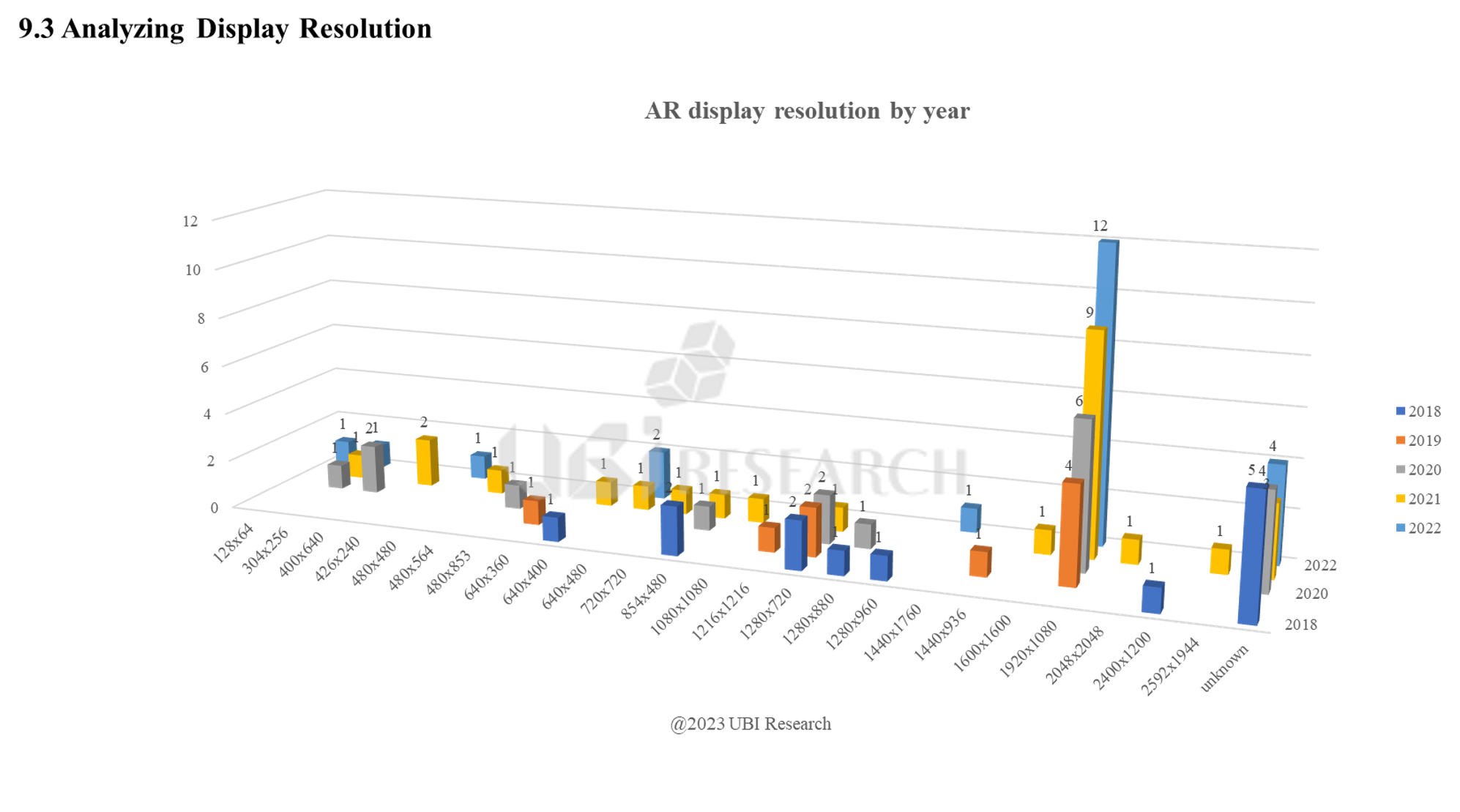

We analyzed the resolution trends in AR devices. FHD (1920×1080) resolution is becoming the main specification for AR devices. Micro-OLED is mostly used.

Micro-LEDs are attracting attention as the main display for AR devices due to their high brightness, but it will take at least five years before FHD products with a panel size of about 0.25 inches are available because panel and LED manufacturing technologies are not yet established.

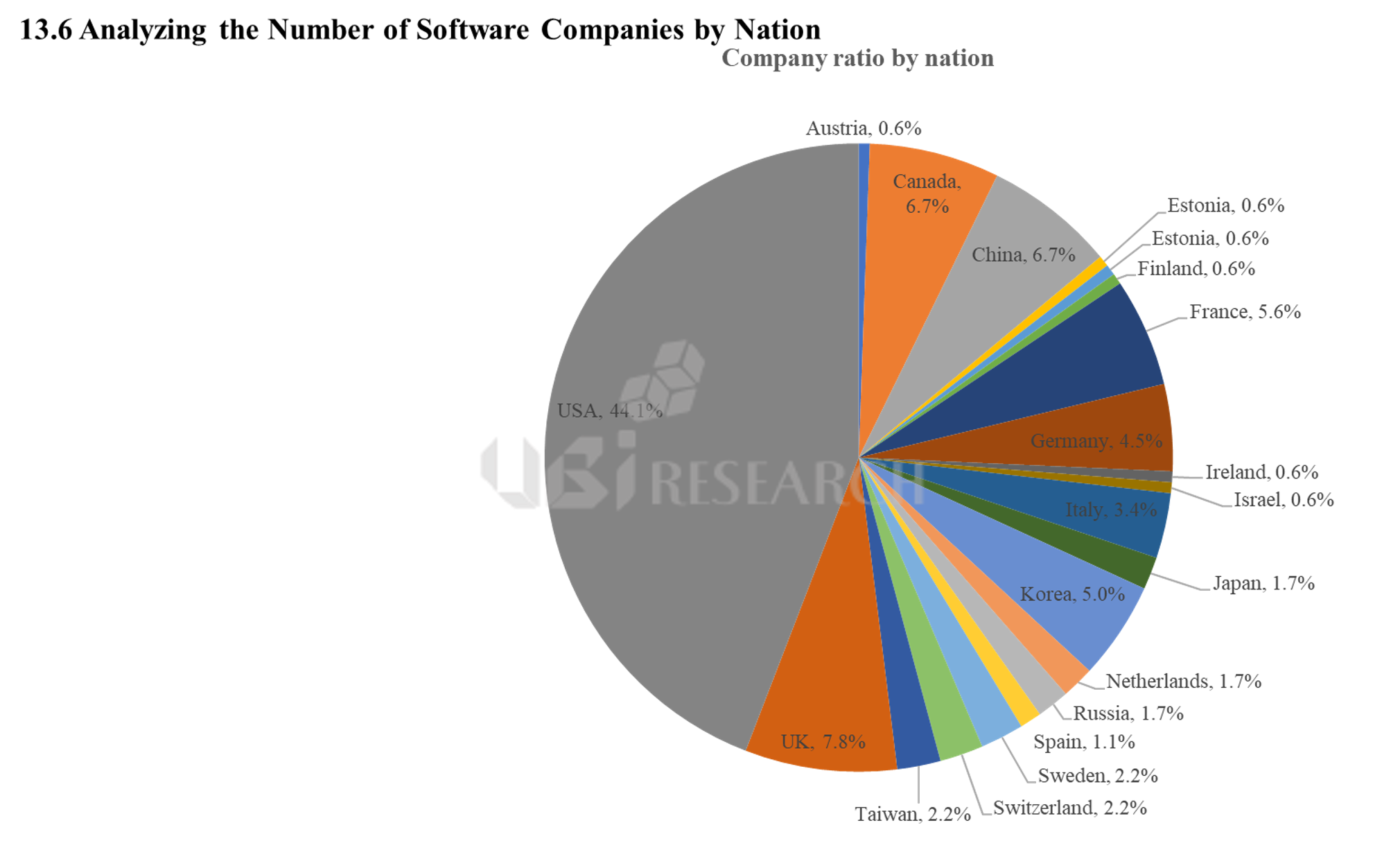

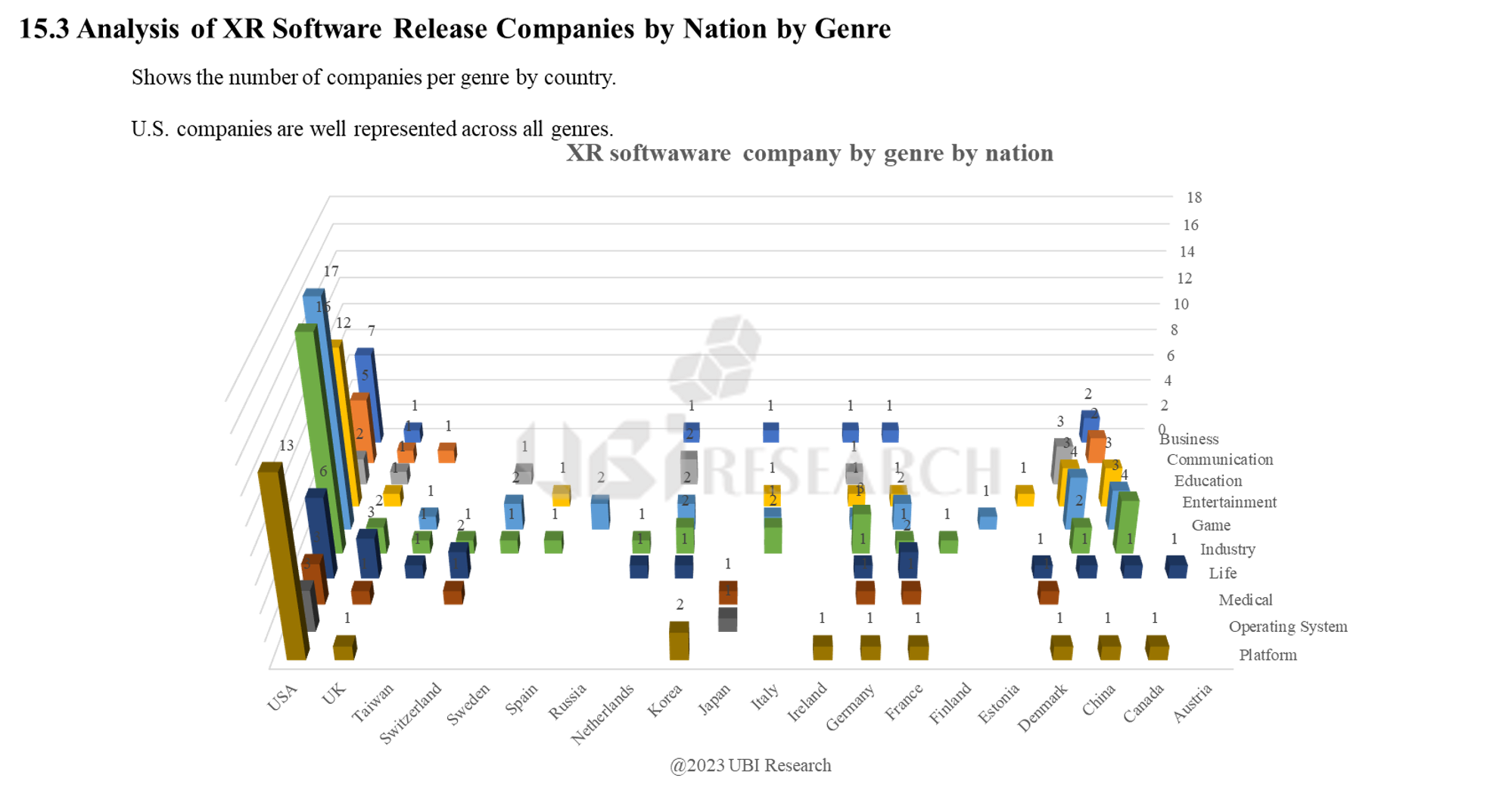

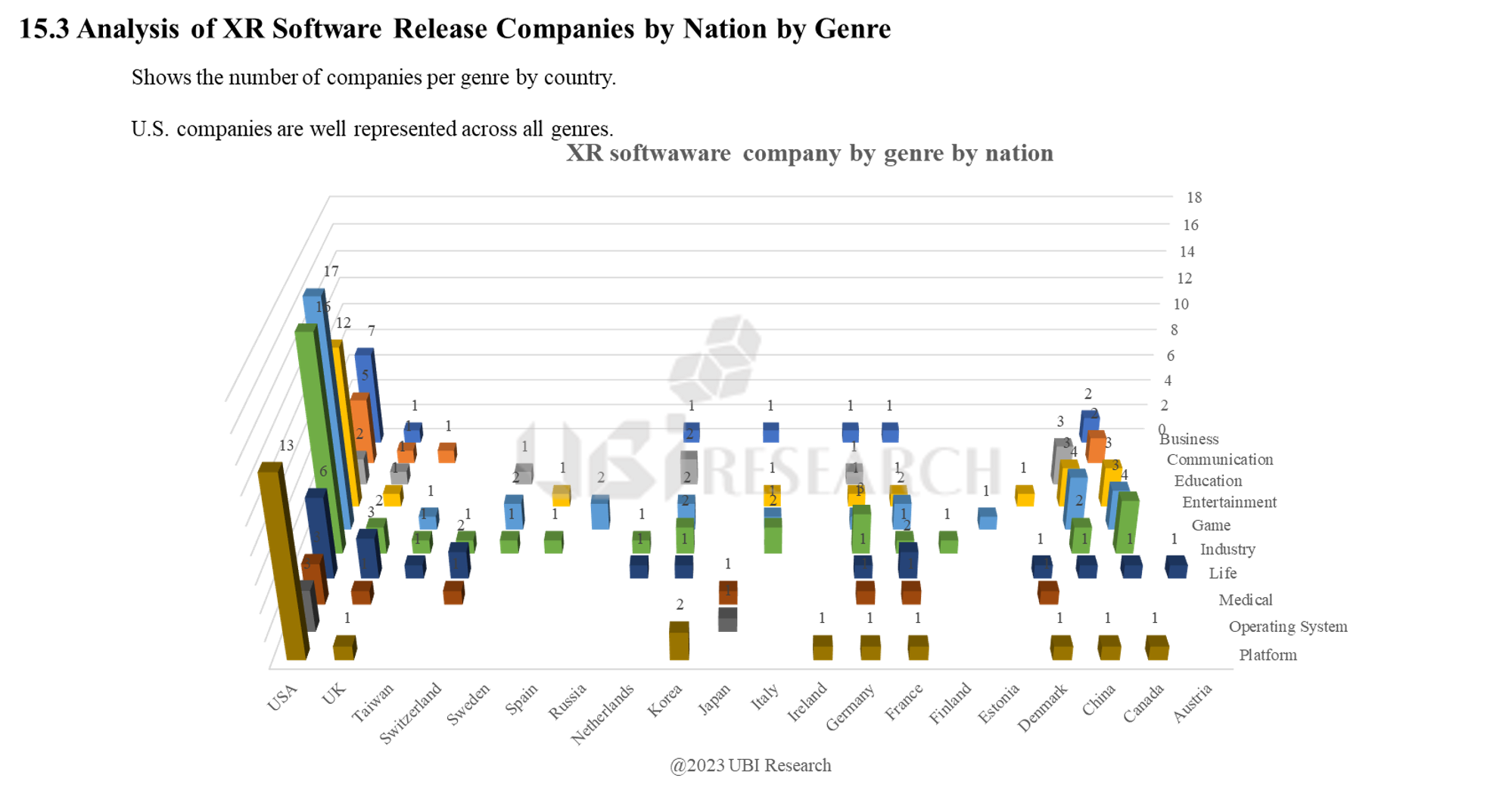

As the features and specifications of XR devices vary depending on the purpose of use, it is necessary to closely examine the software, so we analyzed 472 products from 178 companies that have released software for XR since 2010.

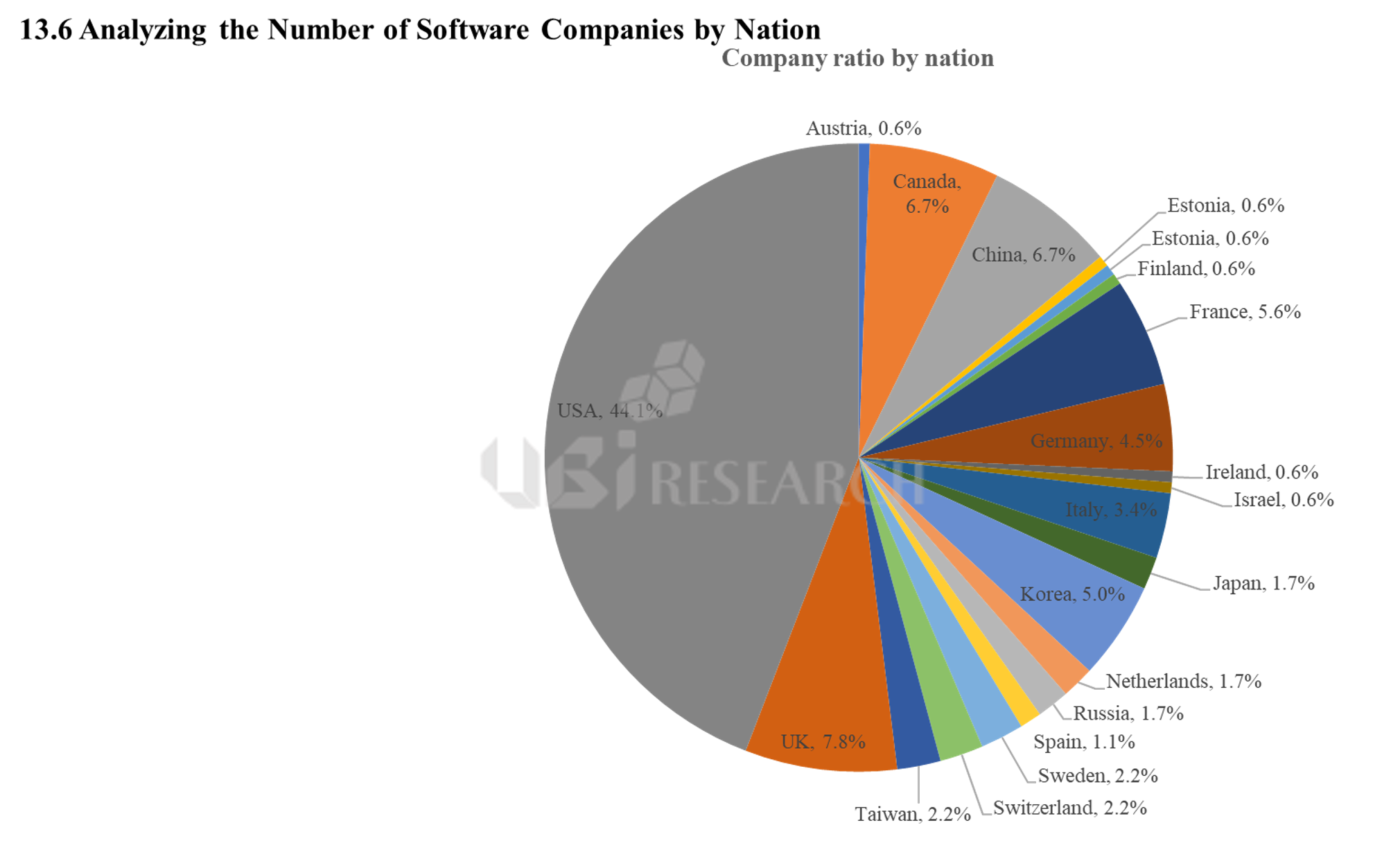

We examined the number of software companies by country, and found that the United States has 79 companies, accounting for 44.1%. It is clear that the software industry for XR is dominated by the United States.

To analyze the activity of software companies, we examined the number of companies by genre that released products between 2018 and 2022. We analyzed the number of companies by genre in each country and found that the U.S. has an even distribution of companies in all genres.

This report will serve as a cornerstone for all supply chain players in the XR industry and those who wish to enter the XR industry in the future to understand the characteristics of the XR industry and find a successful business path.

Megatrend Analysis of the XR industry Report Sample Download

Megatrend Analysis of the XR industry Report Sample Download

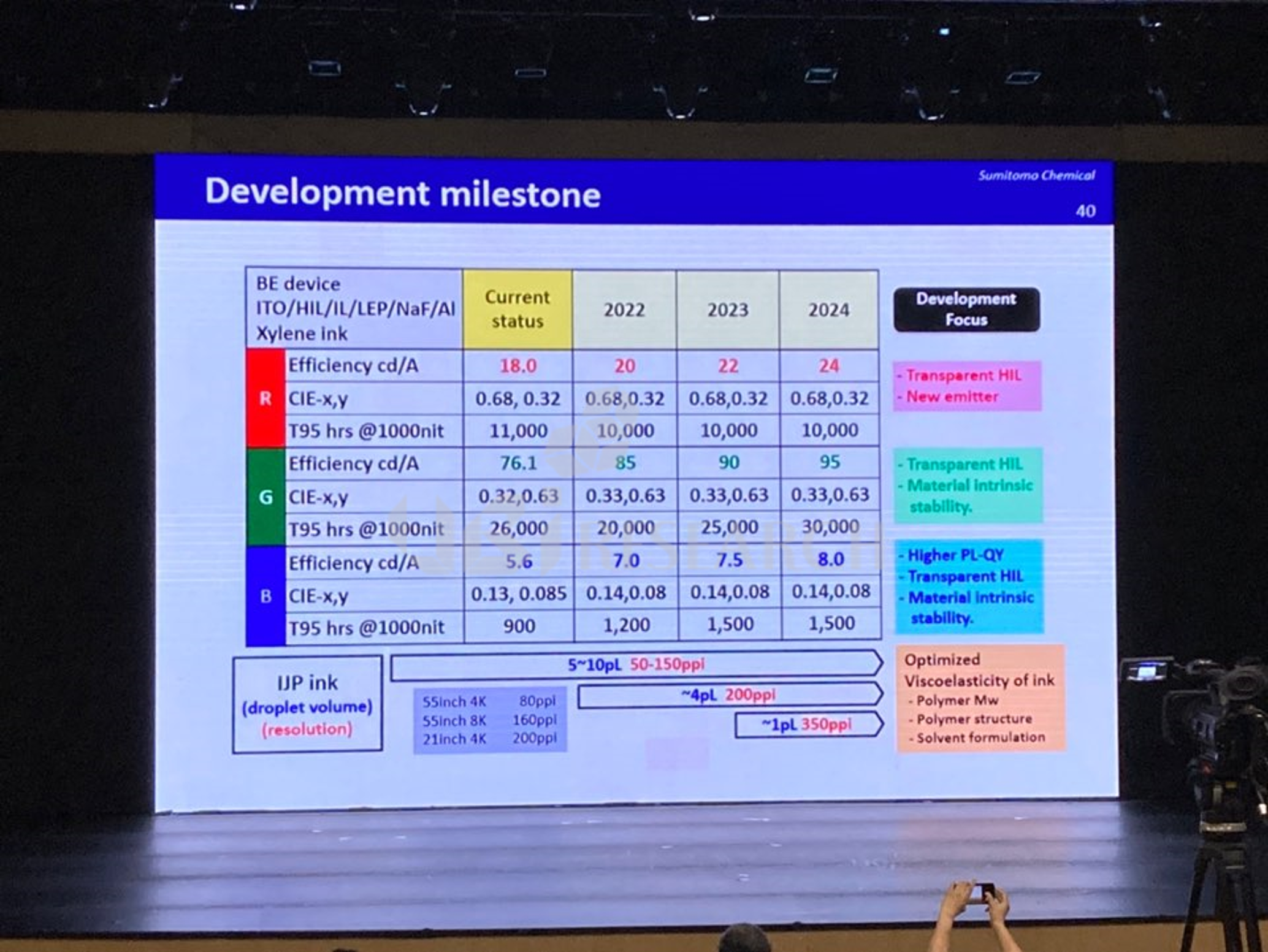

2024 OLED Emitting Materials Report Sample Download

2024 OLED Emitting Materials Report Sample Download

China Trend Report Inquiry

China Trend Report Inquiry