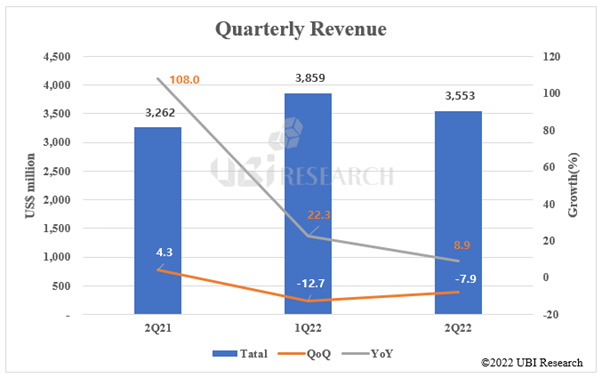

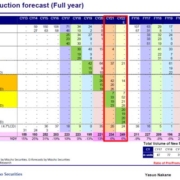

BOE is reviewing investment in a module line for certification evaluation for Apple iPhone

It was found that BOE is considering investing in the golden line of modules for Apple’s iPhone at the B11 Mianyang plant. The module golden line invested this time is a line for iPhone certification evaluation, and the investment is expected to be confirmed in early 2023. Since evaluation and verification take a lot of time, it is analyzed that the verification line is invested first before the full-scale module line investment. The line is expected to be used for verification when investing in new iPhone 15 or iPhone 16 models.

After investing in module lines for verification and evaluation in 2023, it was found that BOE is preparing additional investment plans for between 14 and 20 Apple-oriented module lines at the B11 Mianyang plant. If BOE’s 20 module lines are completed, the annual volume of iPhone modules that BOE can produce is about 120 million units. However, since Apple’s demand is less than this and there are variables in negotiations with Apple, the investment is likely to proceed gradually.

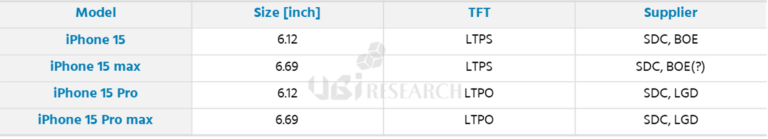

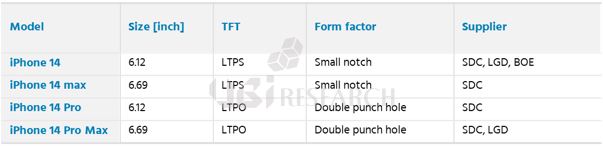

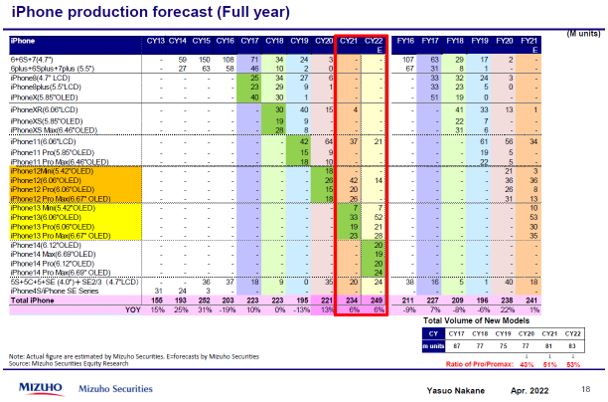

BOE’s total supply of iPhones to Apple in 2022 is expected to be around 30 million units. BOE is supplying Apple with panels for the iPhone 12, 13, and 14 basic models, and is expected to supply panels for the iPhone 15 basic models to be released in 2023. It is not yet decided whether BOE will supply panels for the 6.7-inch iPhone 15 max model.

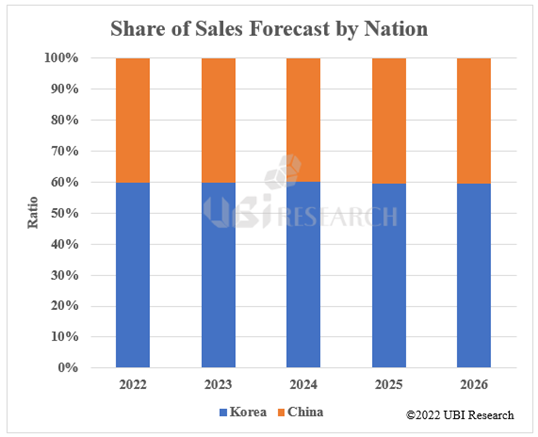

China Trend Report Inquiry

China Trend Report Inquiry

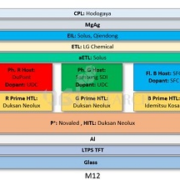

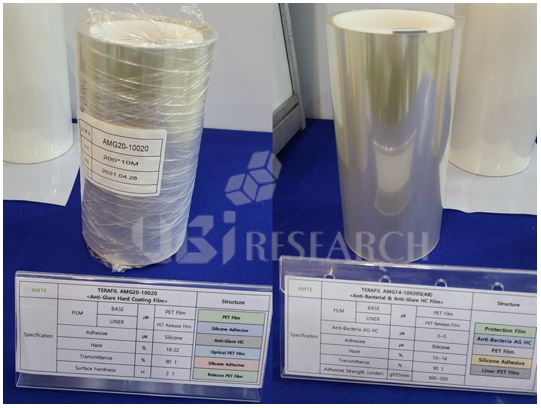

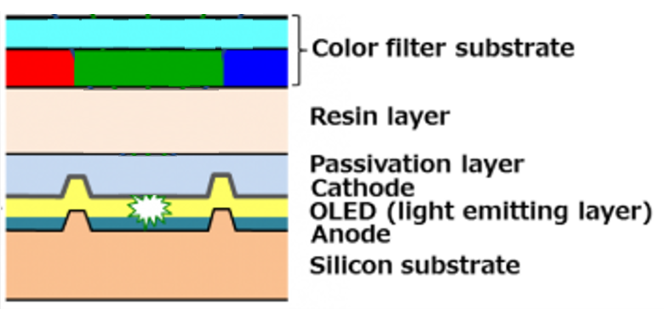

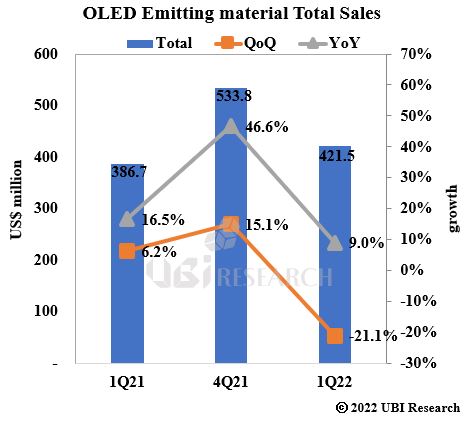

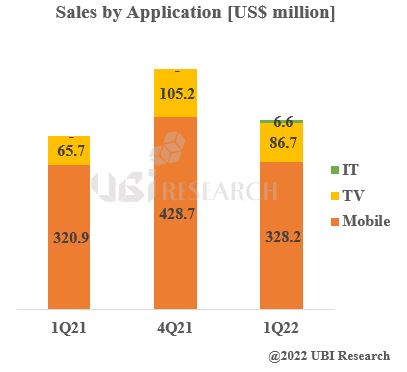

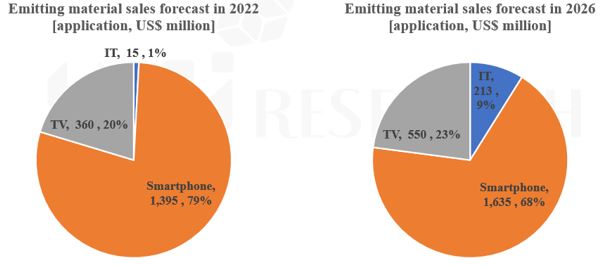

4Q22 AMOLED Materials and Components Market Track

4Q22 AMOLED Materials and Components Market Track