Samsung Display research center is accelerating the development of QNED as the next-generation display following OLED.

The reason Samsung Display is developing QNED as part of its large-size display business is that it is the only display that can produce the image quality that Samsung Display’s biggest customer, Samsung Electronics, can satisfy.

Samsung Electronics’ TV business direction, which has the world’s No. 1 TV market share, is to use QD to make color gamut better than OLED, and to use a display that can maximize HDR performance with high luminance and excellent gradation characteristics on a bright screen.

The only display that can satisfy the needs of Samsung Electronics is QNED.

QNED is a self-luminous display and because it uses QD, it has the best color gamut, HDR, luminance, contrast ratio, and motion blur, etc., and is a product expected by Samsung Electronics.

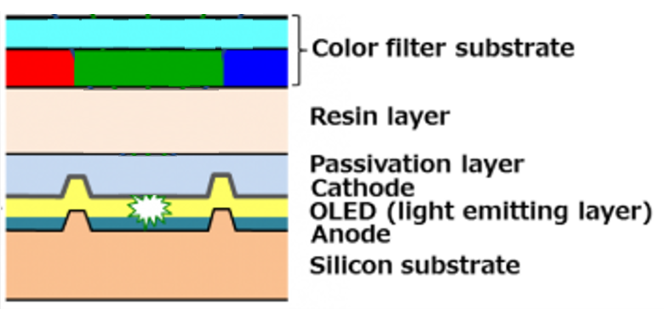

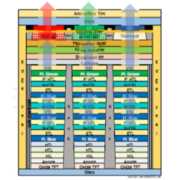

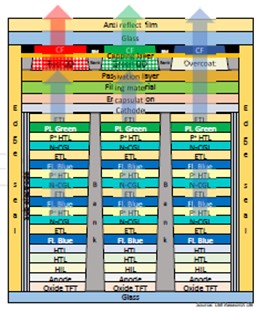

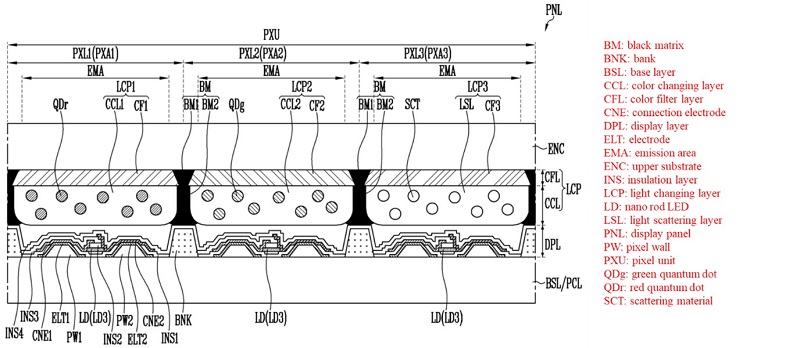

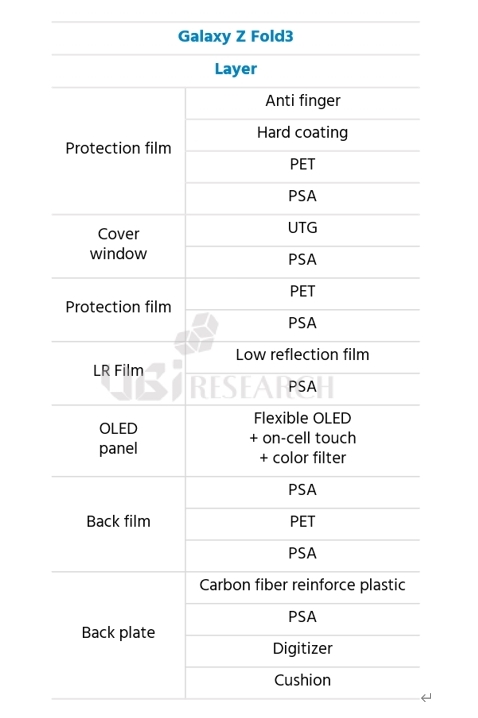

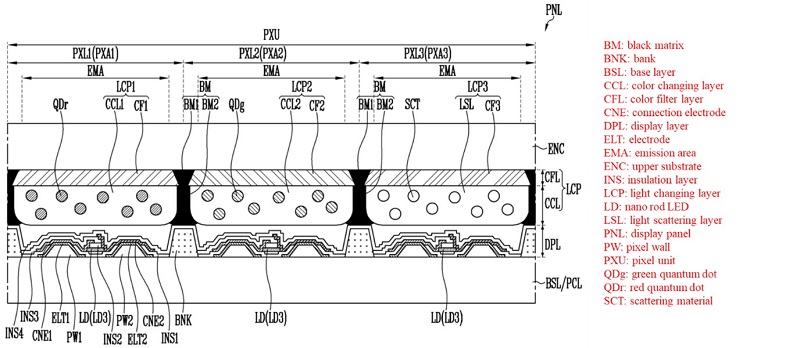

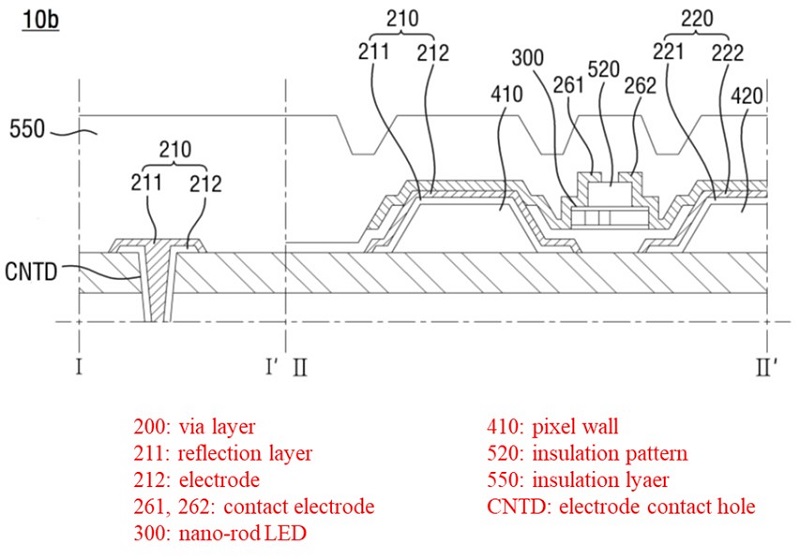

It can be confirmed by the structure that QNED is the display with the best characteristics. QNED consists of a pixel layer with a nano-rod LED on the TFT structure of 3T1C used in large OLEDs, and a color conversion layer consisting of QD and CF (color filter) on top.

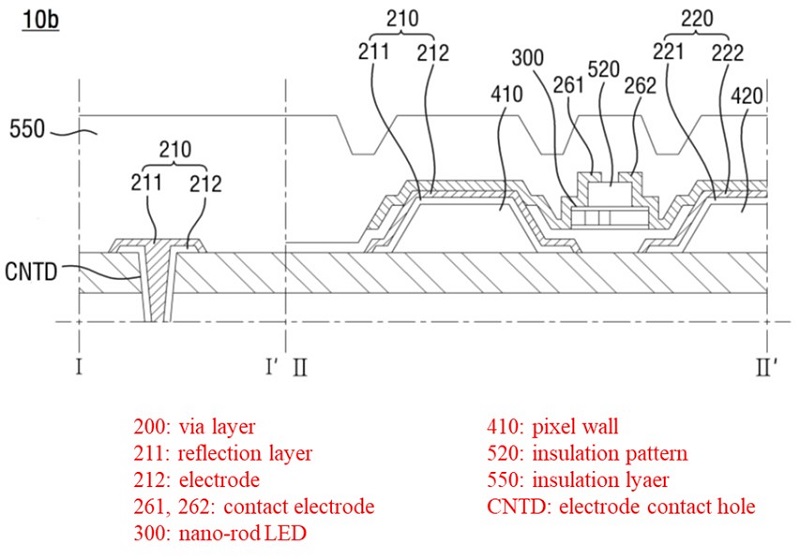

In OLED, electrodes (cathode and anode) and electrode line for transmitting a signal to a pixel are located above and below the light emitting material, whereas in QNED, both the signal transmitting electrode (pixel electrode) and electrode line are located on the same plane. In addition to the pixel electrode, the QNED additionally includes a reflective electrode to increase light output efficiency. The pixel electrode serves as an alignment electrode for aligning the nano-rod LED.

< QNED section structure >

< QNED pixel structure >

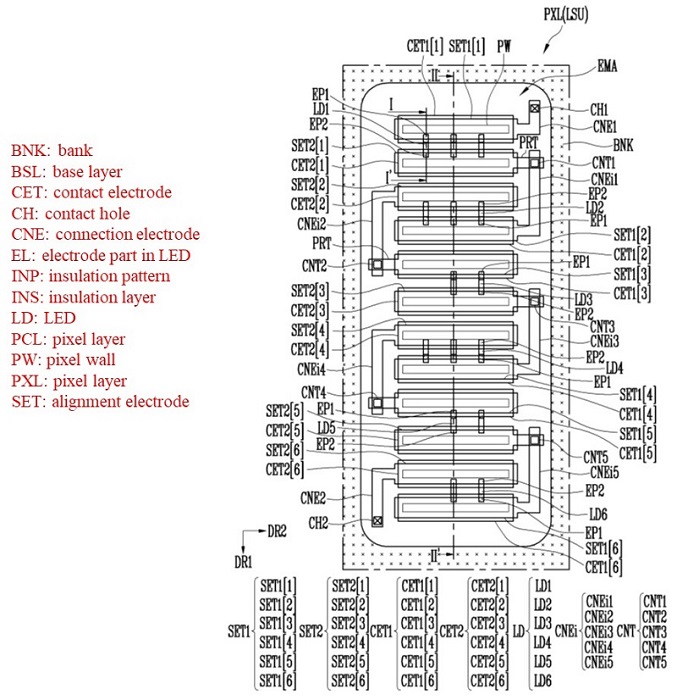

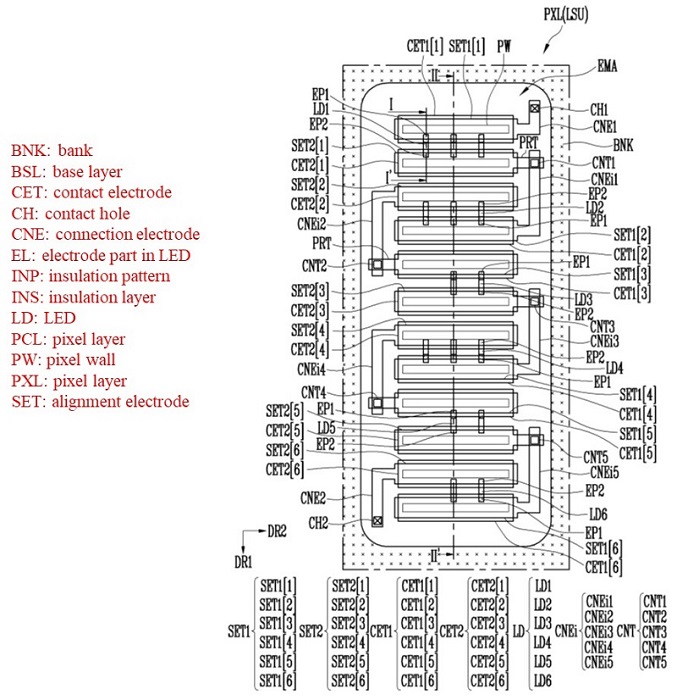

< QNED pixel planar structure >

Looking at the planar structure of a QNED pixel, a plurality of pixel electrodes are connected in series in one pixel, and a nano-rod LED is positioned between the pixel electrodes. The pixel electrode is on the pixel wall (PW) formed of an insulating material, and each pixel is surrounded by a bank (BNK) to separate regions.

The core technology of QNED is driving technology and sensing technology.

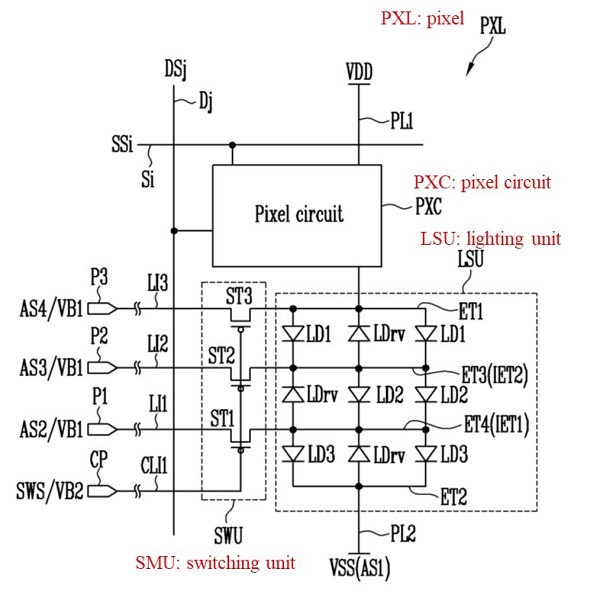

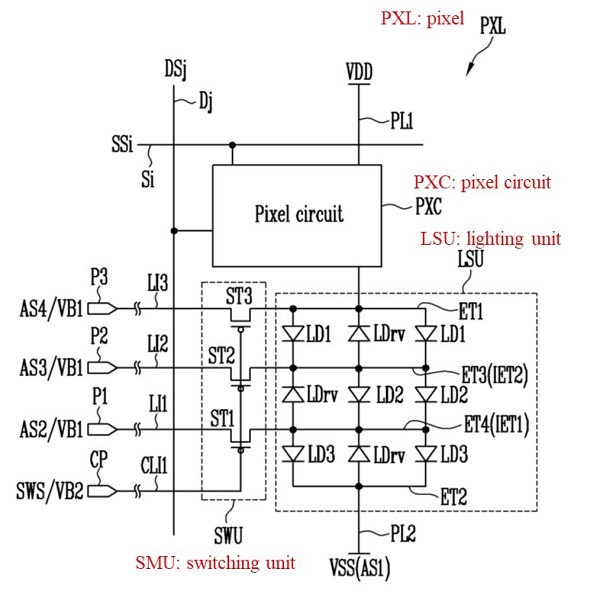

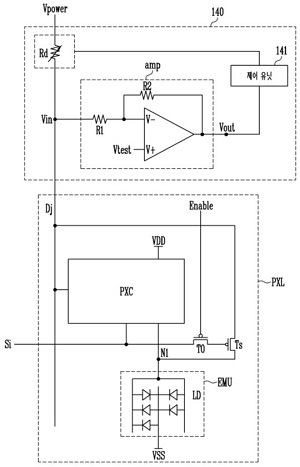

The driving technology includes a driving technique for aligning nano-rod LEDs and a driving technique for uniformly controlling pixels that may have a deviation in the number of nano-rod LEDs. The alignment circuit includes switching elements for each pixel, and the switching element applies an alignment signal to the pixel. The alignment state of the nano-rod LED is determined depending on which alignment signal is given to each pixel.

< Drive circuit for alignment >

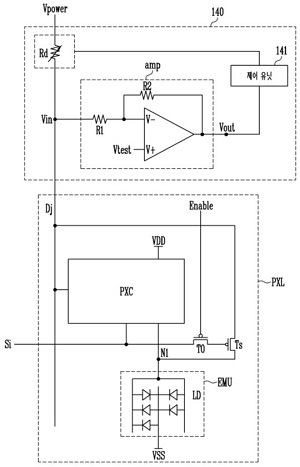

< Sensing transistor for checking alignment >

The most important driving technology is a technology that supplies current to each pixel so that the luminance can be uniform across the entire screen even if the number of nano-rod LEDs per pixel is different. It is a method of controlling each pixel based on the data read from the sensing transistor.

[QNED Technology Completion Analysis Report] details the sensing transistor, sensing wiring, and sensing signals that can check the nano-rod LED alignment status on the panel.

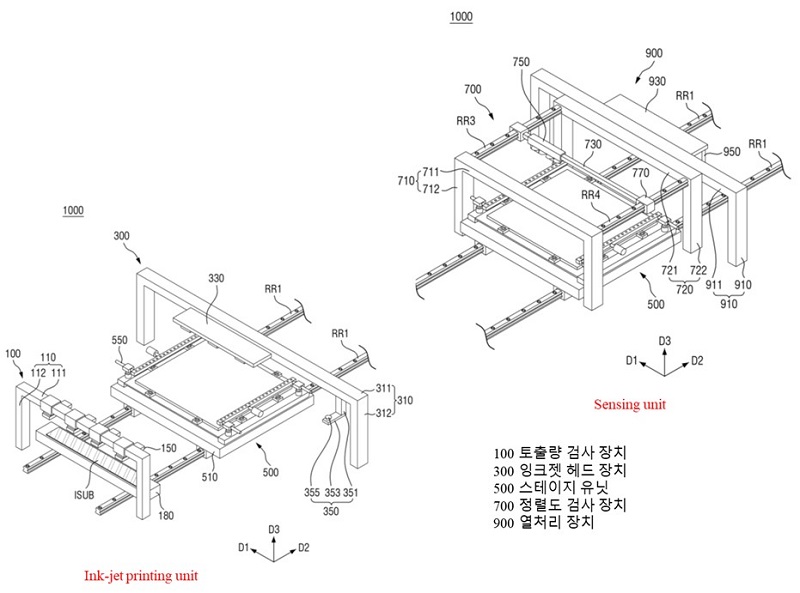

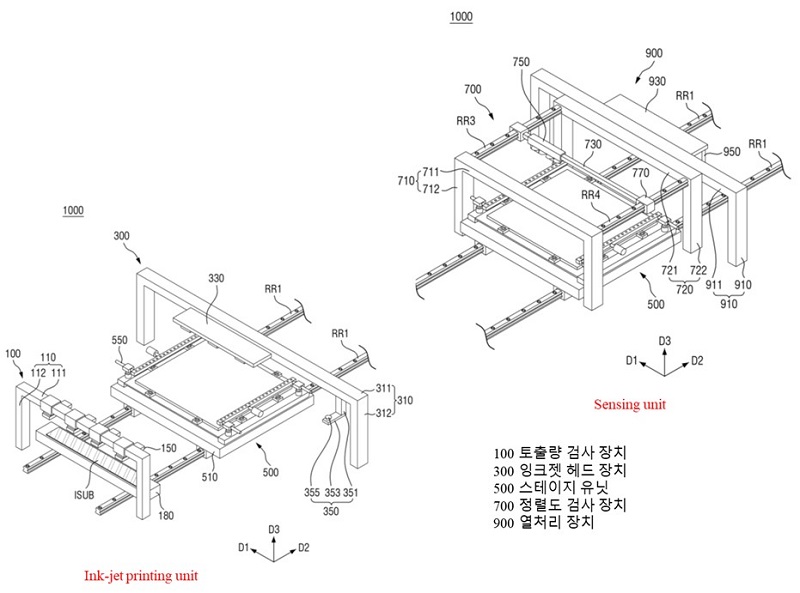

As sensing technology, there are sensing technology (sensing transistor) designed inside QNED and sensing technology used in QNED manufacturing. The sensing technology used to manufacture QNEDs is inherent in inkjet systems. There are three sensing technologies in the inkjet system: the number of nano-rod LEDs in the ink and the viscosity analysis of the solvent, the analysis of the number of nano-rod LEDs sprayed on the panel, and the analysis of the nano-rod LED alignment state.

< Inkjet system configuration >

QNED has already proven that 4K 65 inches can be driven two years ago. Samsung Display is concentrating on finishing work to secure the screen uniformity of QNED.

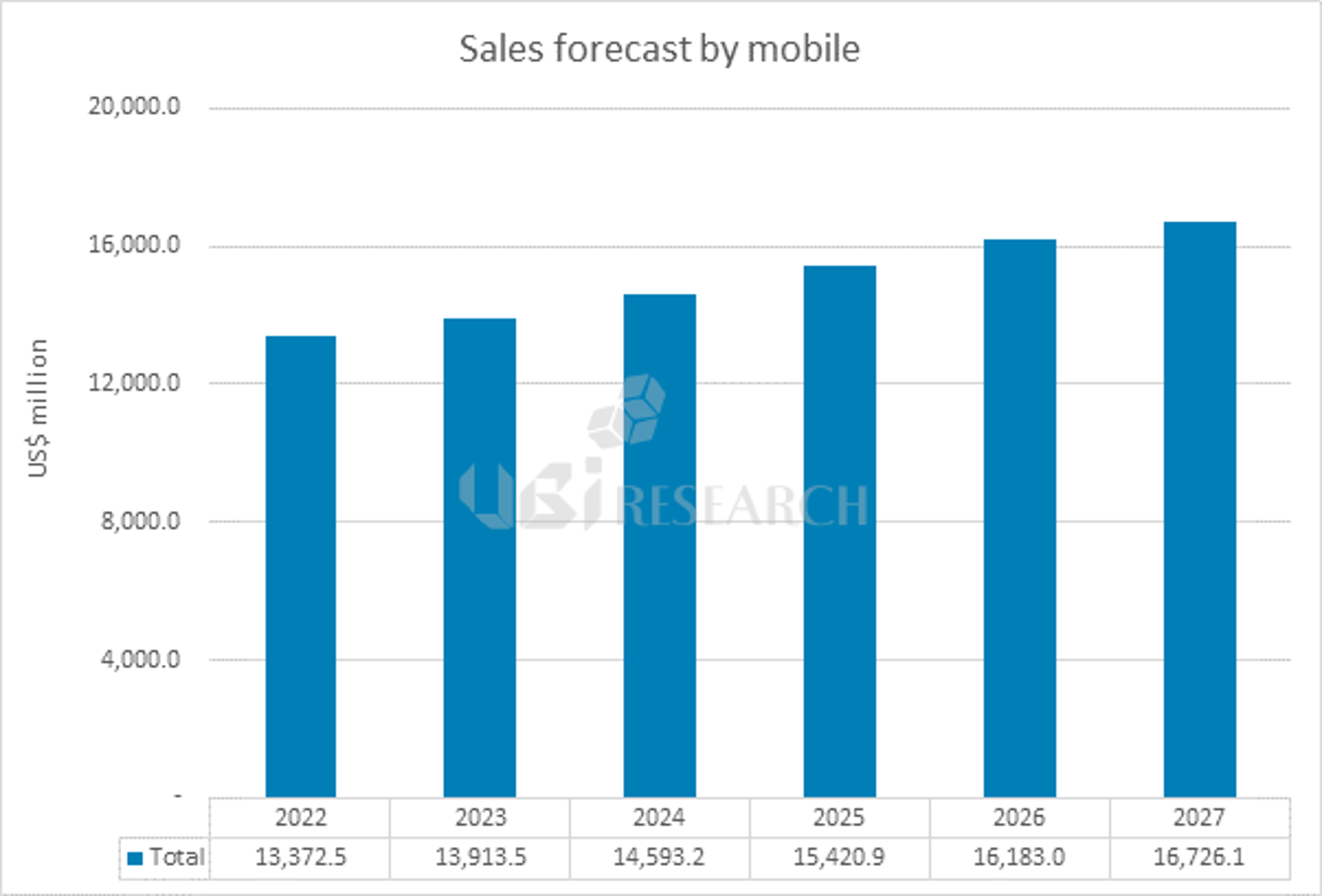

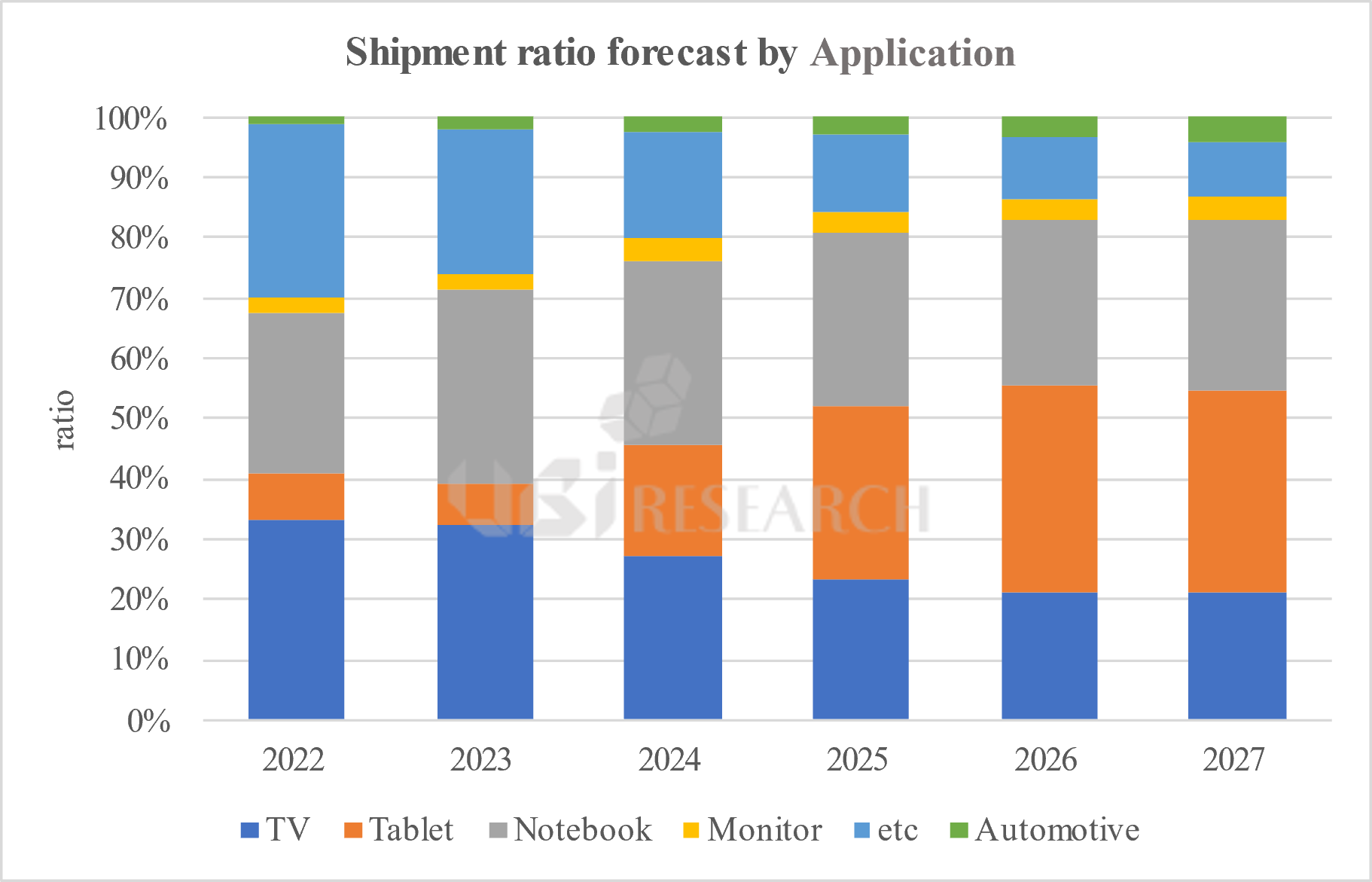

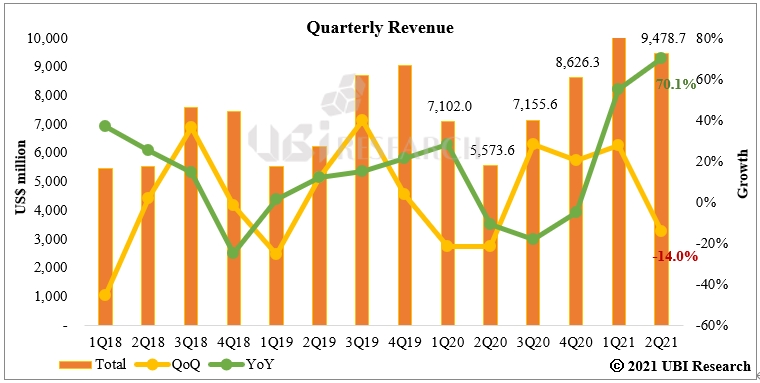

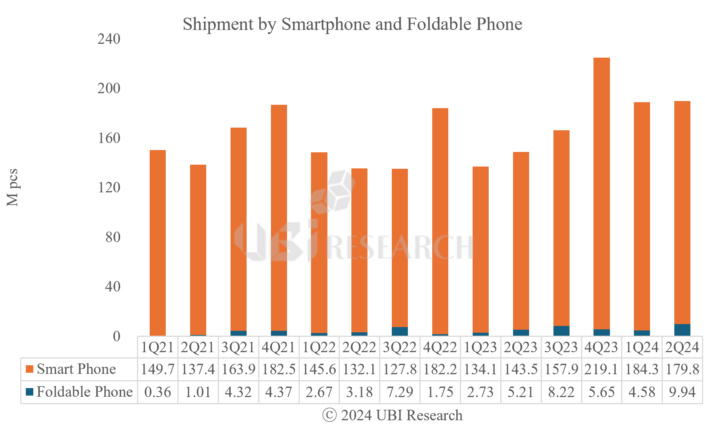

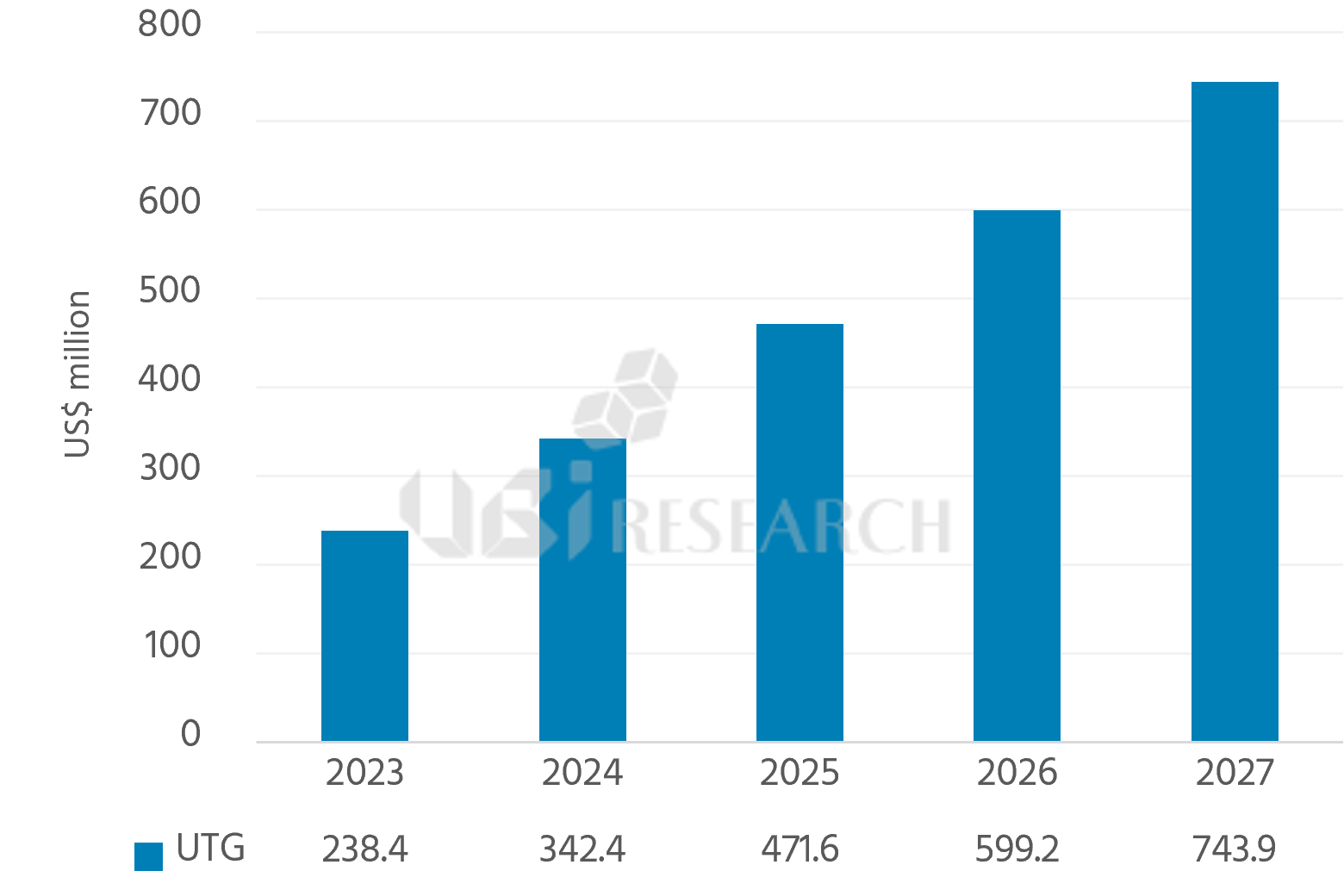

Small OLED Display Quarterly Market Track Sample

Small OLED Display Quarterly Market Track Sample

China Trend Report Inquiry

China Trend Report Inquiry