[KES 2022] LG Bendable OLED Monitor(OLED Flex)

#LG #OLED #KES2022

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#LG #OLED #KES2022

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

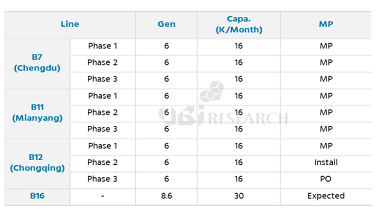

According to the ‘2022 OLED Display Semi-Annual Report’ recently published by UBI Research, it is predicted that the 6G flexible OLED line in China will be reorganized.

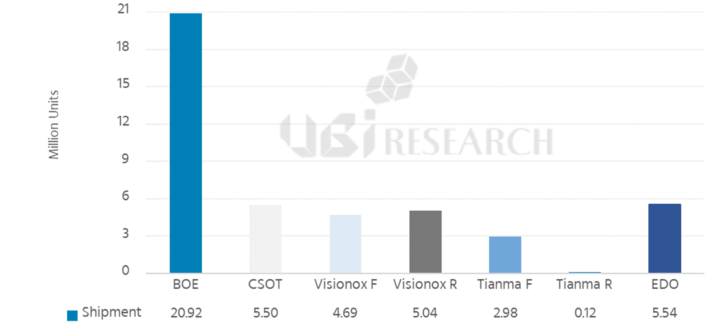

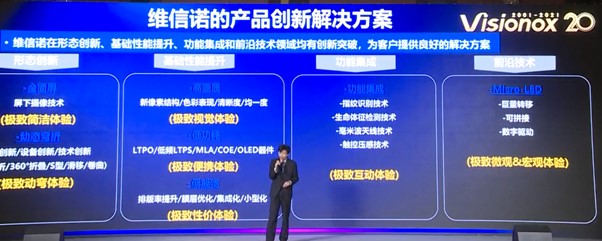

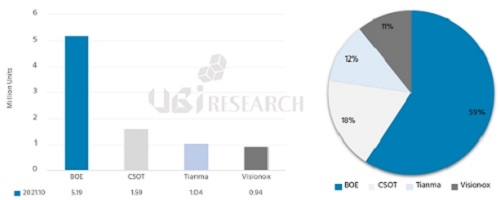

Representative companies that produce flexible OLED for smartphones in China are BOE, TCL CSOT, Tianma, and Visionox. EDO also owns some flexible OLED lines, but is mass-producing panels mainly for rigid OLED.

Among them, TCL CSOT and Visionox have recently continued to business difficulties, the possibility of reorganization of its flexible OLED line in China is being raised.

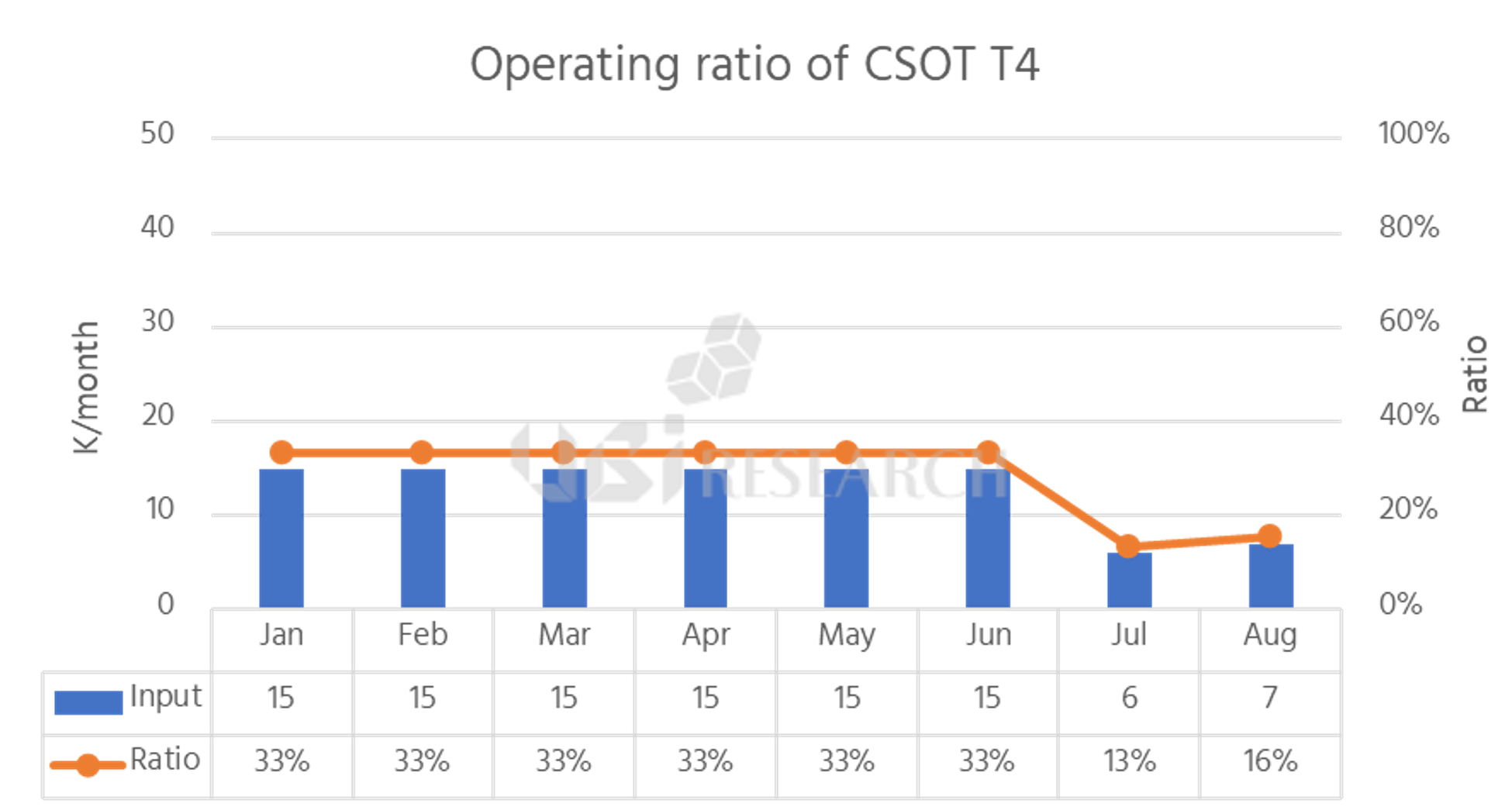

TCL CSOT mainly supplied panels to Xiaomi, but recently, due to panel performance issues and Tianma’s promotion, it was found that the 3Q utilization rate of the T4 line with a monthly capacity of 45K was only 10%.

In particular, the operation of ph-3 is being delayed indefinitely due to the low utilization rate of ph-1,2. In addition, TCL CSOT has tried to promote the panel supply for the Apple iPhone series, but it does not seem to get good results.

Utilization rate of TCL CSOT T4 line until August 2022, Source: 2022 OLED Display Semi-Annual Report

Visionox, which mainly supplies flexible OLED to Honor, has recently been operating the V3 line with a monthly scale of 30K, but the panel price is set at $30 or less, and its sales are greatly affected. It is a situation in which the utilization rate is guaranteed by securing a clear customer, but profits are not guaranteed.

For this reason, there is a possibility that BOE will take over the T4 line of TCL CSOT and the V3 line of Visionox. Daejeong Yoon, an analyst at UBI Research, said, “In the case of the T4 line, if BOE puts OLED facilities into the B20 LTPS line in the future, the possibility of taking over the T4 line of TCL CSOT and using it, or after the sale of the V3 line from Visionox, there is a possibility to acquire a part of the T4 line. In the case of the V3 line, it is also heard that the Hefei government has offered to acquire BOE.”

Although it is unlikely that China’s 6G flexible OLED line will change rapidly right now, attention is focused on how Chinese panel makers will continue to operate their lines in the future in a situation that has been evaluated as over-investment in the past and the market stagnation.

At ‘KES 2022 (Korea Electronics Show)’ held from October 4th to the 7th, LG Electronics displayed OLED TVs, OLED monitors, and transparent OLED signage according to the theme and exhibited them for direct experience.

LG OLED TV exhibited at KES 2022

Starting with the 97-inch OLED EVO TV placed at the entrance of the exhibition hall, LG Electronics exhibited LG Electronics’ signature 8K OLED TV ‘OLED88Z2’ and transparent OLED signage ‘55EW5G’. The transparent OLED signage ‘55EW5G’ had a resolution of FHD, a transparency of 38%, and a peak brightness of 400nit.

LG transparent OLED TV exhibited at KES 2022

In the separately arranged ‘OLED Flex/Ultra Gear’ zone, 32/48 inch ‘Ultra Gear’ and 42 inch ‘OLED Flex’ were exhibited. ‘Ultra Gear’ was 32-inch LCD model and 48-inch OLED model by size. 48-inch ‘Ultra Gear’ had a resolution of 4K, response speed of 0.1ms, color gamut of DCI-P3 99%, and peak brightness of APL. 600 nits based on 3%, the contrast ratio was 1.5 million to 1, and the color gamut was DCI-P3 99%.

‘OLED Flex’, which was first unveiled at ‘IFA 2022’ held in Germany last September, is a bendable gaming monitor that can adjust the curvature in 20 steps as desired by the user, with a resolution of 4K and a curvature of 900R.

‘OLED Flex’ ‘Bending’ exhibited by LG Electronics BEFORE (left) / AFTER (right)

In addition to OLED products, LG Electronics exhibited 8K mini LED beam projectors, automotive displays, kiosks, smart and medical monitors, and ‘One:Quick’, an all-in-one display. LG Electronics mentioned that it has no plans to release OLED-applied kiosks, smart and medical monitors, and all-in-one display products so far.

#Desay #automotive #display

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#BOE #automotive #display

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

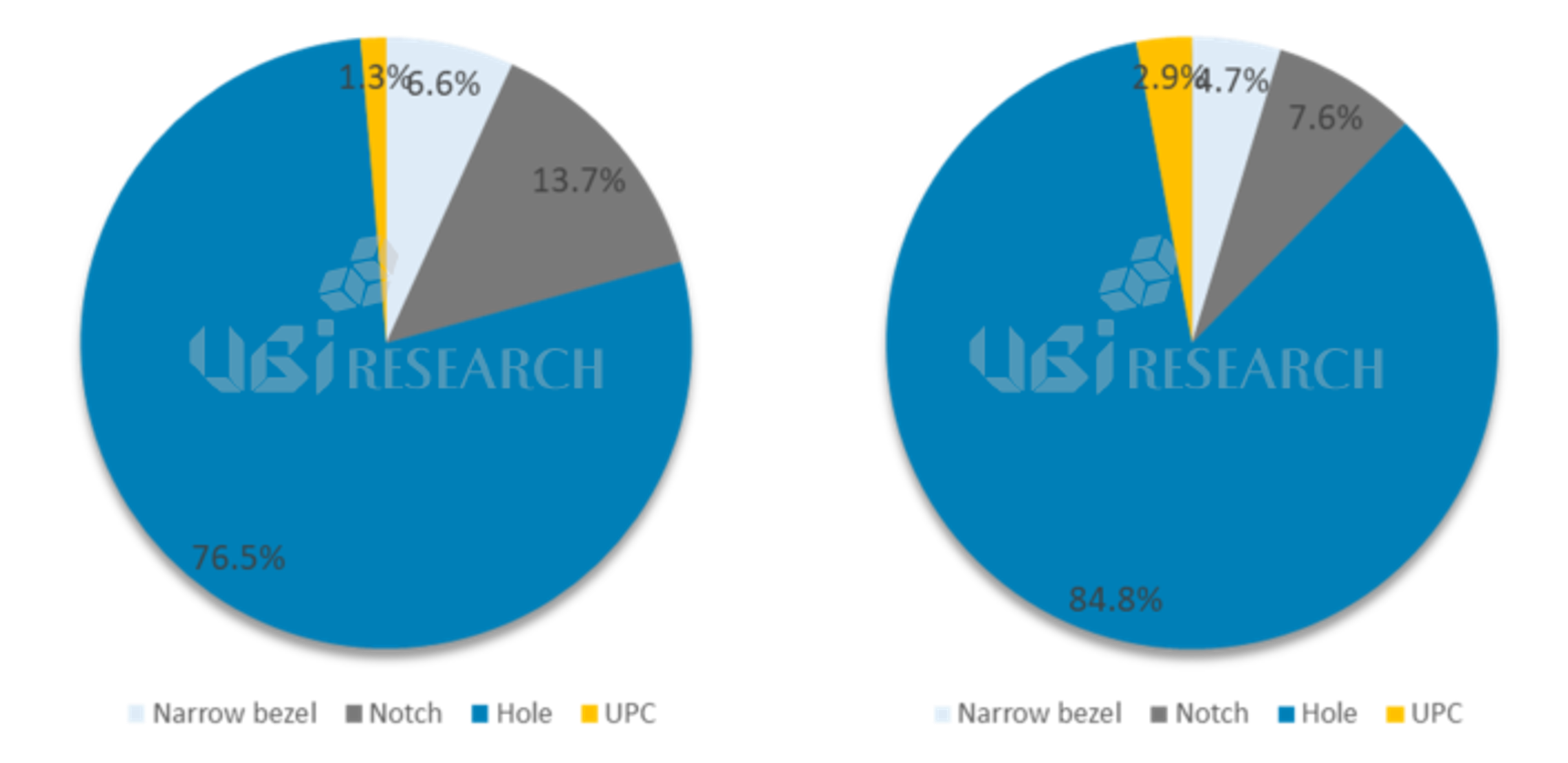

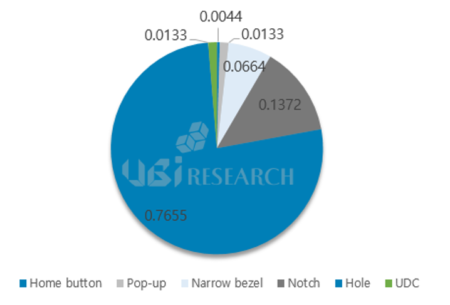

OLED Smartphone Market Share Released in 2021 (left) and 2022 (~3Q, right)

Among OLED smartphones released in 2022, the market share of smartphones with notch and narrow bezel designs decreased by 6.1% and 1.9%, respectively, compared to 2021.

Among a total of 171 OLED smartphones released by September 2022, 145 types of punch hole design, 13 types of notch, 8 types of narrow bezel, and 5 types of UPC (Under panel camera) were released. The total number of OLED smartphones released is similar to that of 2021, but the notch and narrow bezel designs are close to half of those in 2021. On the other hand, the market share of smartphones with punch-hole design increased by 8.3% compared to 2021, accounting for 84.8%.

In particular, Apple applied a punch hole design to the iPhone 14 Pro and Pro Max models instead of the previously applied notch. With Samsung Electronics and Apple, the punch hole design is expected to become more and more of the main technology in the future.

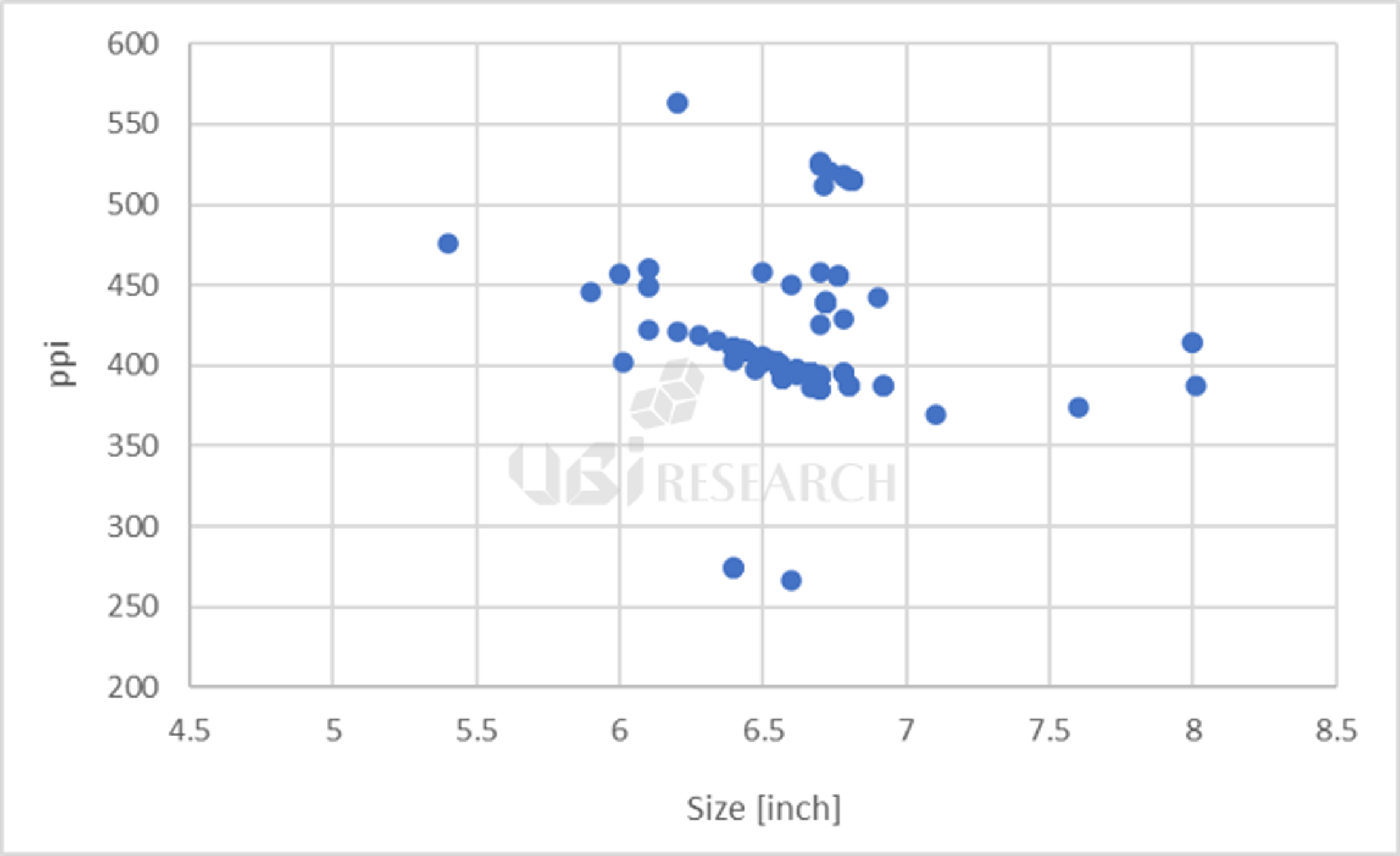

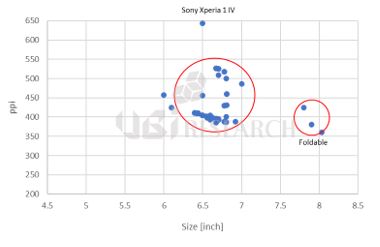

OLED smartphones released by Q3 2022 ppi by size

As for the size, there were 145 types of smartphones in the range of 6.4x to 6.7x, accounting for 84.8% of the market share. In addition, 4 products in the 7-inch range, 3 products in the 8-inch range, and 1 product in the 5-inch range were released. All 7-inch and larger products were foldable phones.

By resolution, 78 products in the 300ppi range and 80 products in the 400ppi range were released. Compared to 2021, the market share of 300ppi products increased by 7.1% and the 400ppi range products decreased by 4.5%. Thirteen products with 500ppi or higher were released and the product with the highest resolution was Sony’s ‘Xperia 1 IV’ at 643ppi.

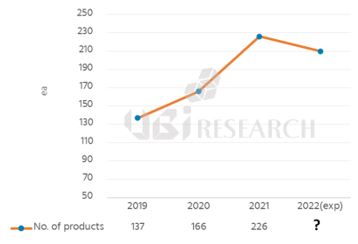

Due to the nature of the fourth quarter, where the number of products released is smaller than in the second and third quarters, the number of OLED smartphone launches in 2022 is expected to be similar to or slightly less than that of 226 in 2021.

22 inch Passenger Display : Active Privacy

– Specifications –

LCD Tech : AHVA / LTPS / VAC

Resolution (pixel) 4K 1K

Active Area : 539mm (H) x 95mm (V)

Privacy Performance : Brightness 1.65% at H = 25⁰

Color Depth : 24 bits

Color Gamut 72% NTSC

Curvature : R3000 -Concave

Brightness : 600 cd/m²

9.4 inch Flexible Micro LED Display

– Specifications –

Resolution (pixel) : 1920 x 960

Refresh Rate : 60 Hz

Brightness : > 2000 cd/m²

Contrast Ratio : 1,000,000 :1

Color Gamut : 120% NTSC

Pixel Configuration : Real RGB Stripe

Display L/R border : 3mm

ViewingAngle (U/D/L/R) : 179° / 179° / 179° / 179°

LED Size : > 30um

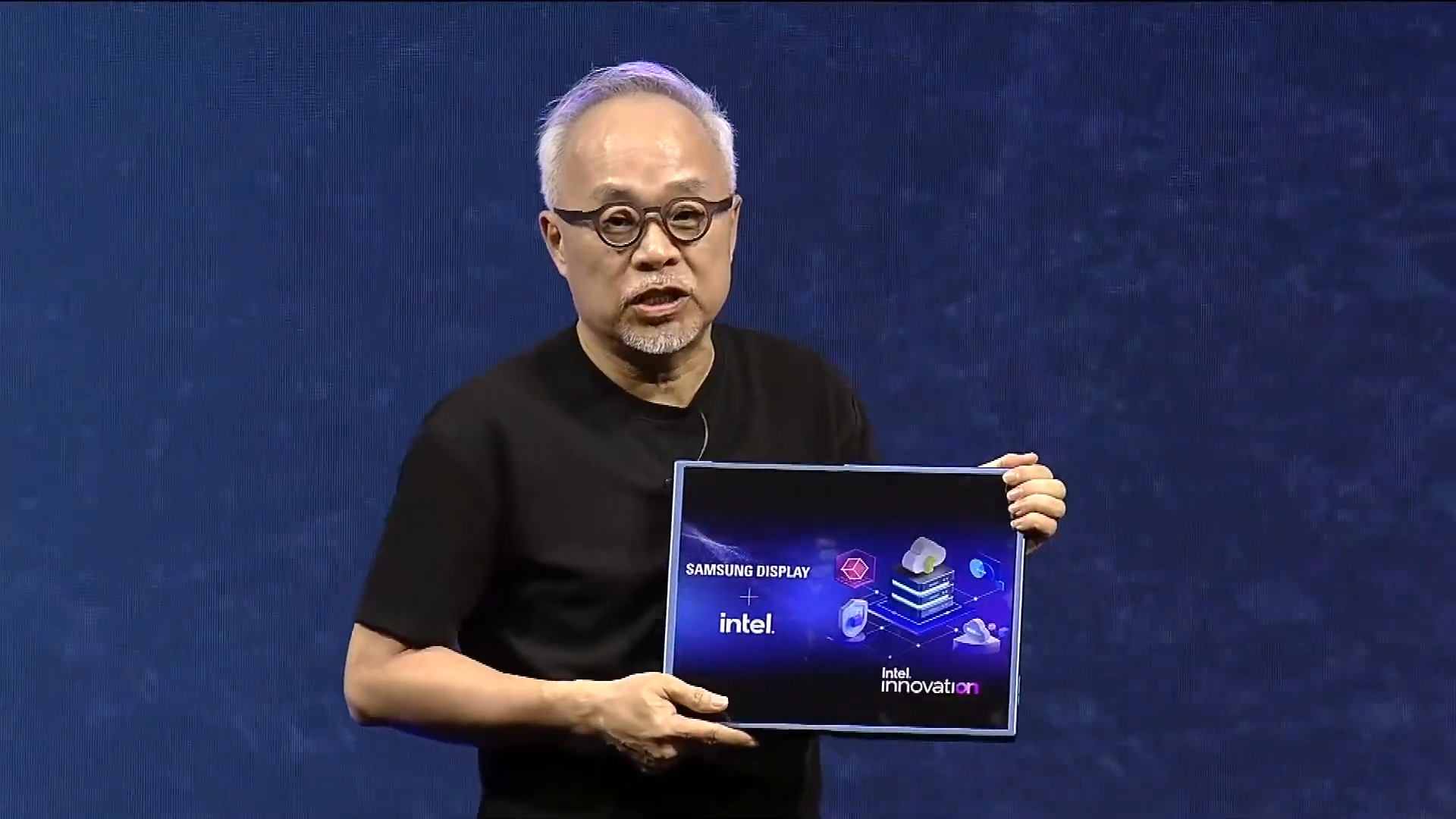

Choi Joo-sun, CEO of Samsung Display Introducing a Slidable Display.

Captured from Intel Newsroom Video

“Foldable is gone”

Samsung Display unveiled its 17-inch slidable display for the first time at the “Intel Innovation 2022” event held at the McEnery Convention Center in San Jose, California on September 27th.

When Intel CEO Pat Gelsinger announced Intel’s strategy for the user experience and said, “Let me introduce our Korean partner.” Samsung Display CEO Choi Joo-sun made a surprise appearance at the venue.

CEO Choi entered the stage and held a tablet PC-sized device in his left hand. “A few years ago, I saw this device and thought it was a good solution to the portability of a large monitor,” Pat Gelsinger said. CEO Choi added, “At the same time as demonstrating the demo version, we are here to prove that Samsung Display creates an innovative form factor through collaboration with ecosystem developers in software and hardware.”

Samsung Display’s 17-inch Slidable Display Before Expansion(Left) and After Expansion(Right). Captured from Intel Newsroom Video.

CEO Choi stated, “We sometimes need a big screen.” He went on to remark, “We will show you magic.” He then stretched the screen by pulling the slider display by hand. The 13-inch display screen has grown to 17 inches. It is a display for PCs that is applied with flexible OLED (organic light emitting diode). “Foldable is gone.” he declared and concluded that, “Slidable displays will meet the needs of large screens and portability.”

Gelsinger also introduced ‘Unison’, a software that can share information between smartphones and laptops using a slidable display. Unison supports both Android phones and iPhones.

#IFA2022 #LG #OLED

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #OLED #Metz

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #Metz

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #lg #ledtv

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #panasonic #oledtv

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #honormagic4pro #honor70

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #samsung #qdoled

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #tcl #tcltv

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #zenbook17 #oled

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#asus #vivobook #zenbook

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #galaxyfold4 #galaxyflip4

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #huawei #matexs #p50pocket

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #samsung #qled

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #lgdisplay #oledtv

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

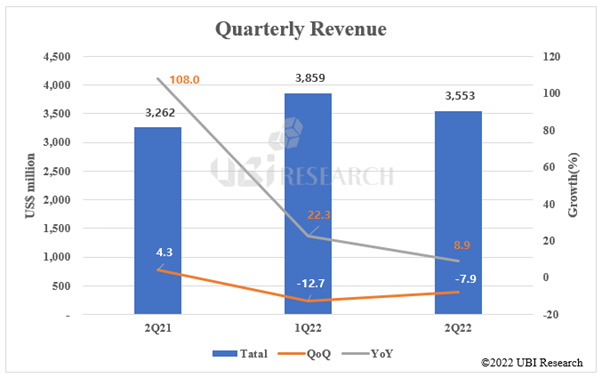

According to “3Q22 OLED Components & Material Market Track” published quarterly by UBI Research, the market for major Components & Material in the second quarter of 2022 was estimated to be $3.55 billion. It fell 7.9% from the previous quarter and rose 8.9% from the same quarter last year. The main reason why the market for Components & Material decreased in the second quarter compared to the previous quarter is that shipments of flexible OLED panels of Samsung Display, BOE, and LG Display decreased.

Samsung Display, BOE, and LG Display’s flexible OLED shipments in the second quarter of 2022 were analyzed to be 43.5 million units, 14.1 million units, and 5.7 million units, respectively. This is a drop of 17.3%, 29.9%, and 40.6%compared to the previous quarter. It was analyzed that Driver IC&COF formed a market of $1.77 billion in the second quarter of 2022, process films formed a market of $63.2 million, and OCA formed a market of $52.4 million.

OLED components & materials market in the second quarter of 2022

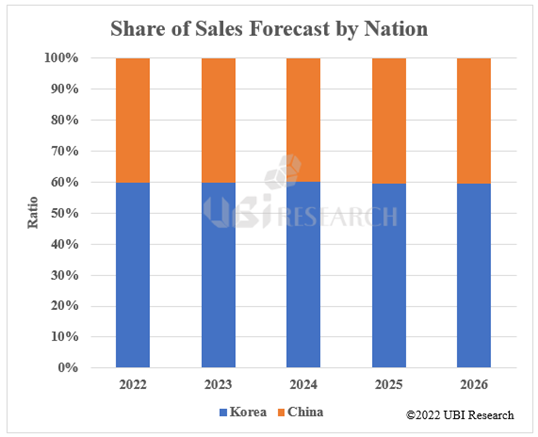

The markets for major parts and materials of OLED are divided into countries (Korea and China) and the expected markets until 2026 are shown as cumulative graphs based on 100%.

OLED components and materials main market

Chinese panel manufacturers’ purchases of Components & Material are expected to increase by 2.5% annually from $6.11 billion in 2022 to $6.76 billion in 2026, while Korean panel manufacturers are expected to purchase materials in the amount of $9.99 billion in 2026 at an annual average growth rate of 2.1%, from $9.09 billion in 2022.

Based on the purchase amount of Components & Material, Samsung Display is expected to account for 40% over the next five years, and LG Display and BOE are expected to account for 20% and 17%, respectively. Among Chinese panel manufacturers, it is predicted that material purchases will be high in the order of BOE, Visionox, TCL CSOT, and Tianma.

“3Q22 OLED Components & Material Market Track” selected 20 major OLED parts material manufacturers and conducted market research. The quarterly market was investigated by dividing it into eight categories: Substrate, TFT, Encapsulation, Touch Sensor, Polarizer, Adhesive, Cover Window, and Module, and market share was analyzed by company and application (TV, Mobile). In addition, the supply volume and market for each component material by 2026 were predicted. The Market Track Quarterly Report provides necessary information to industry leaders in OLED industries.

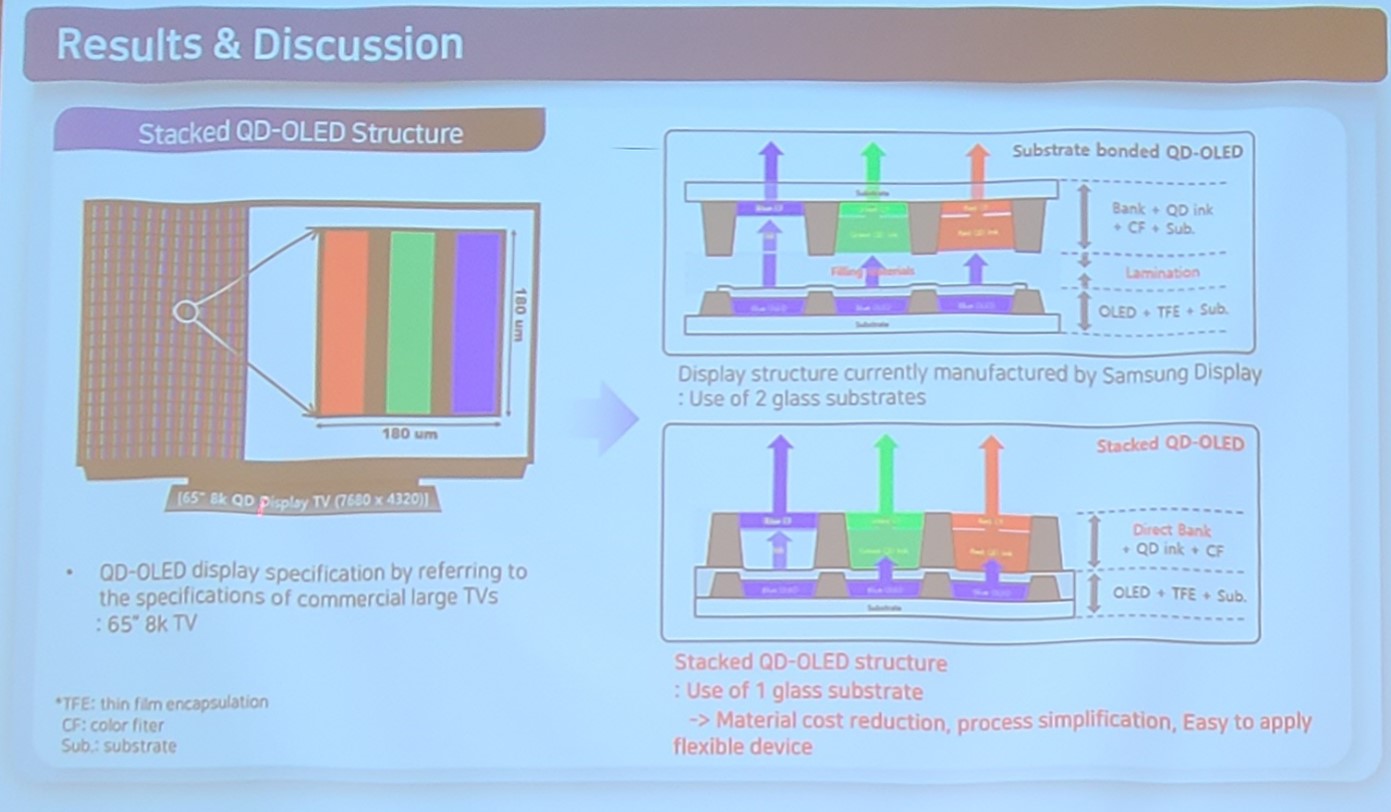

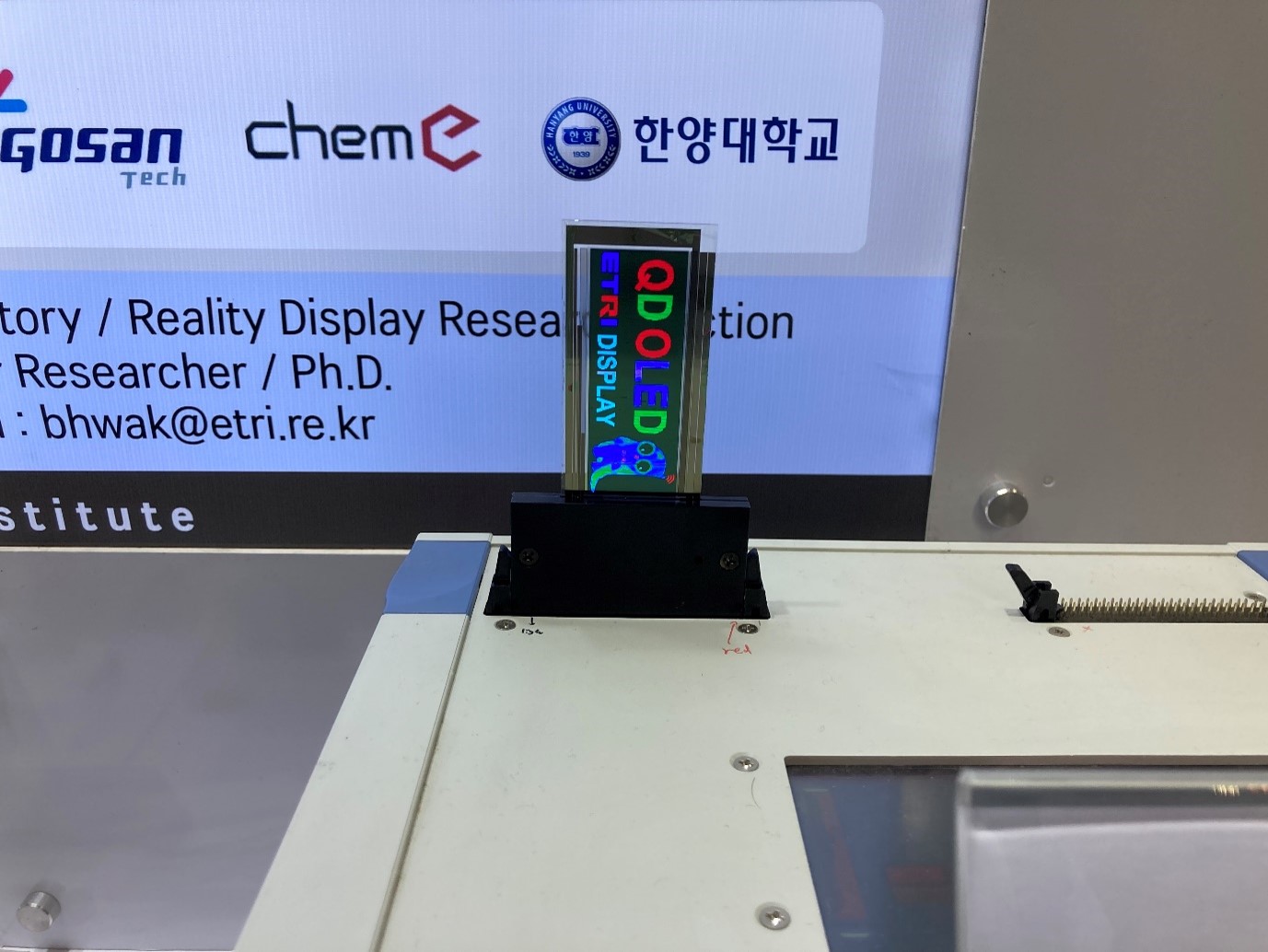

At IMID 2022 held in BEXCO, Busan, from August 23rd to the 26th, ETRI held an exhibition and presentation, ‘Development of QD-OLED Technology with Fine Quantum Dot Pixel Array using Inkjet Printing Process’.

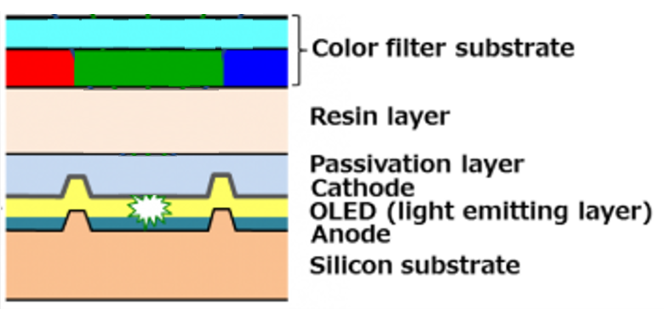

Stacked QD-OLED structure/ ETRI

Two glass substrates are used in the QD-OLED produced by Samsung Display, but the ‘Stacked QD-OLED’ developed by ETRI has a structure in which the glass with the QD color conversion layer is removed. In the stacked OLED, TFE and BM are formed on the light emitting layer, and the QD color conversion layer is formed by the inkjet printing process instead of the lamination process. The ‘Stacked QD-OLED’ structure has advantages such as material cost reduction and process simplification compared to the existing method.

ETRI explained that there are advantages of material cost reduction and process simplification compared to the existing process through this, and the thickness of the QD color conversion layer can be made thicker than before, resulting in a higher color conversion rate and less blue light leakage.

Meanwhile, ETRI collaborated with Kosan Tech for inkjet module head, Duksan Neolux for black bank material, and Chem e for QD material to develop ‘Stacked QD-OLED’.

‘Stacked QD-OLED’ Developed by ETRI

At ‘IMID 2022’, which was held in BEXCO, Busan, from August 23rd to 26th, 2022, Samsung Display exhibited 77-inch QD-OLED and foldable OLED such as ‘Flex S’, ‘Flex G’, ‘Flex Note,’ ‘Flex Gaming’, and ‘Diamond Pixel’.

77-inch QD-OLED TV/ Samsung Display

The 77-inch QD-OLED exhibited by Samsung Display was very similar to the previously released 65-inch QD-OLED TV with a resolution of 4K, a contrast ratio of 1,000,000:1, and a refresh rate of 120 Hz, but Samsung Display revealed that there was a slight improvement in luminance.

Following the existing 55-inch and 65-inch QD-OLEDs, Samsung Display plans to start mass production of 49-inch and 77-inch QD OLEDs from early next year. If the MMG (Multi model glass) process is used in the 8.5 generation (2200x2500mm) ledger used by Samsung Display, it is possible to produce two 77-inch panels and two 49-inch panels, a total of four panels.

Samsung Display concluded with, “Depending on the situation of the set makers, a new size QD-OLED TV is expected to be released as early as the second quarter of next year.”

At IMID 2022 held in BEXCO, Busan, from August 23rd to the 26th, Samsung Display CEO Joo-seon Choi gave a keynote speech, ‘Changing Display Industry with Disruptive Innovation’. He announced plans to expand the display business for automobiles and invest in micro-displays for AR/VR.

Samsung Display’s mid- to long-term plans

First, President Choi mentioned the investment in 8.5G IT OLED and said, “When 8G ledger is used, glass efficiency is improved by more than 20% compared to the existing 6G half cut. This will accelerate the penetration of OLED in the IT market. Through this, we are also targeting the automotive display market in the future.”

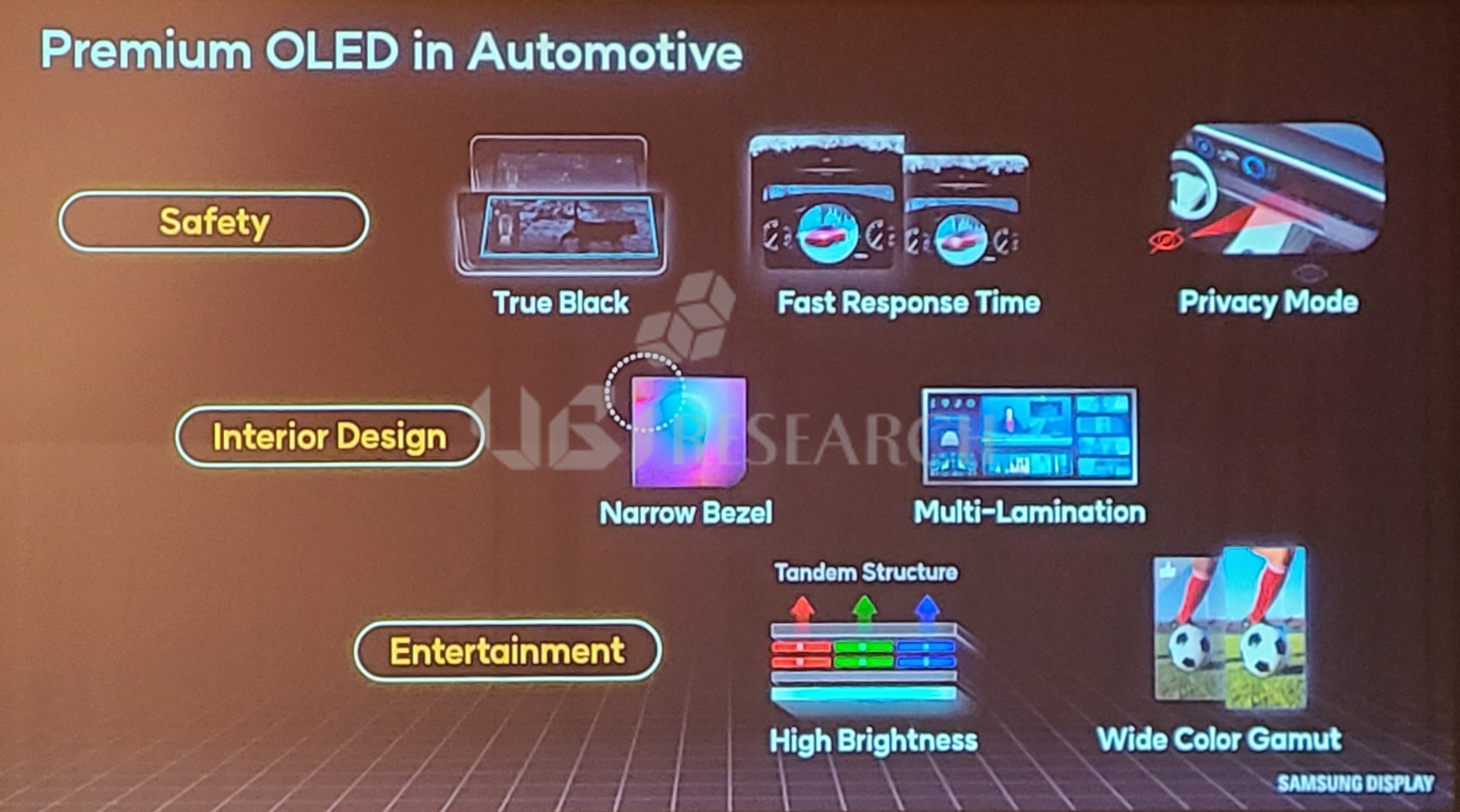

Characteristics of premium OLED for automobiles

Next, President Choi showed key features in Premium OLED in Automotive

‘Safety’ – accurate information with the characteristics of premium OLED for automobiles.

‘Interior Design’ – such as narrow bezel and multi-lamination.

‘Entertainment’ – high brightness through tandem structure and wide color gamut of OLED emphasized.

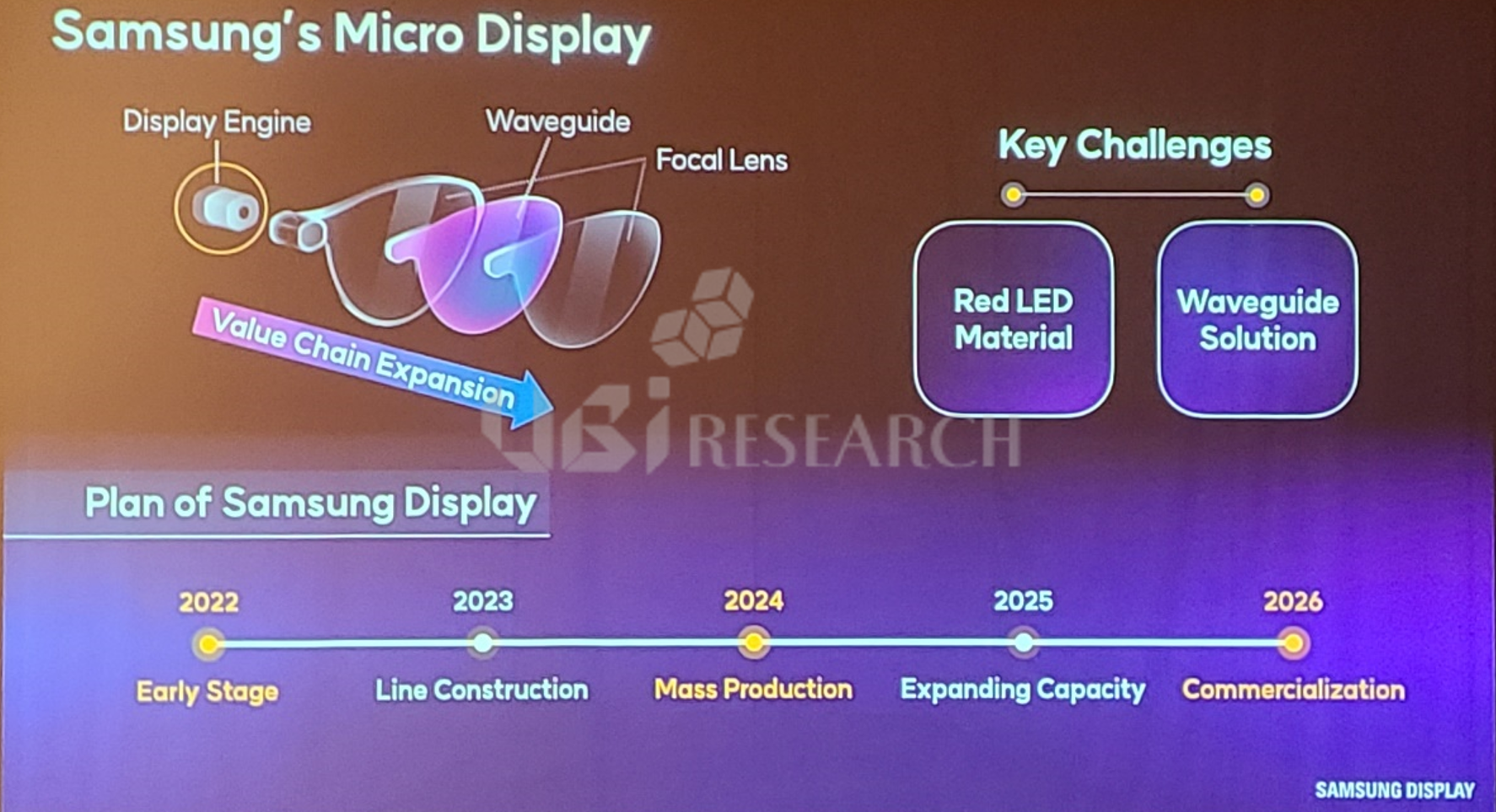

Samsung Display’s AR/VR micro display

Finally, “The AR/VR industry is a great opportunity to expand the display market. Samsung Display plans to develop micro-displays for AR/VR, such as micro-OLED and micro LED, to keep pace with the market needs. For the AR/VR industry to develop, cooperation across the ecosystem is important.”

According to the announcement, Samsung Display is aiming for commercialization in 2026 by mass-producing prototypes in 2024 and expanding the capacity in 2025. This is the first time that Samsung Display has revealed a specific time for AR/VR business.

In the announcement, CEO Joo-sun Choi predicted that the self-luminous display market would reach $100 billion in 2030 and that displays would penetrate all industries.

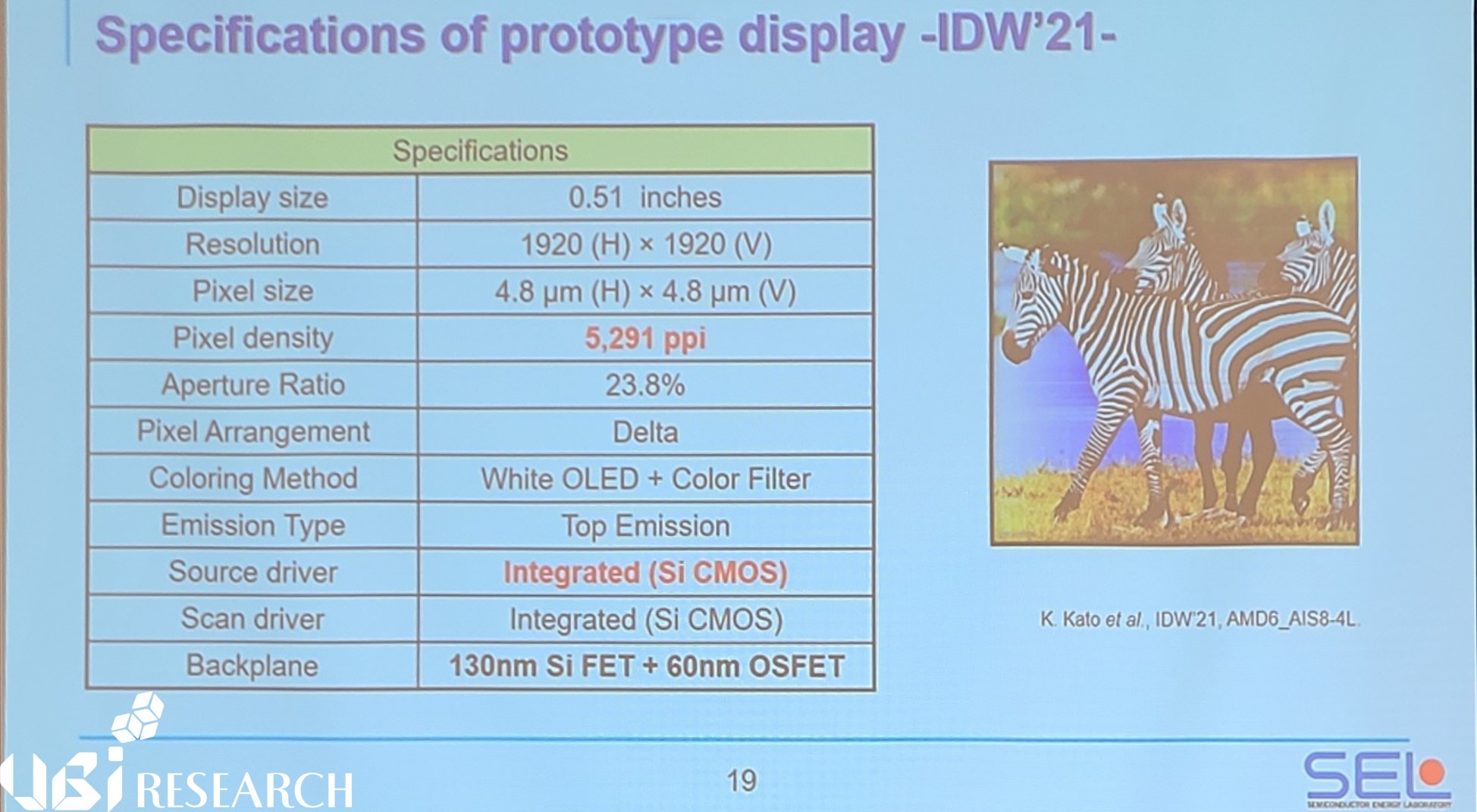

At IMID 2022 held from August 24th to the 26th, Semiconductor Energy Laboratory (SEL) announced that it has developed a 5,291ppi micro OLED display for AR/VR that integrates Si CMOS and OSFET.

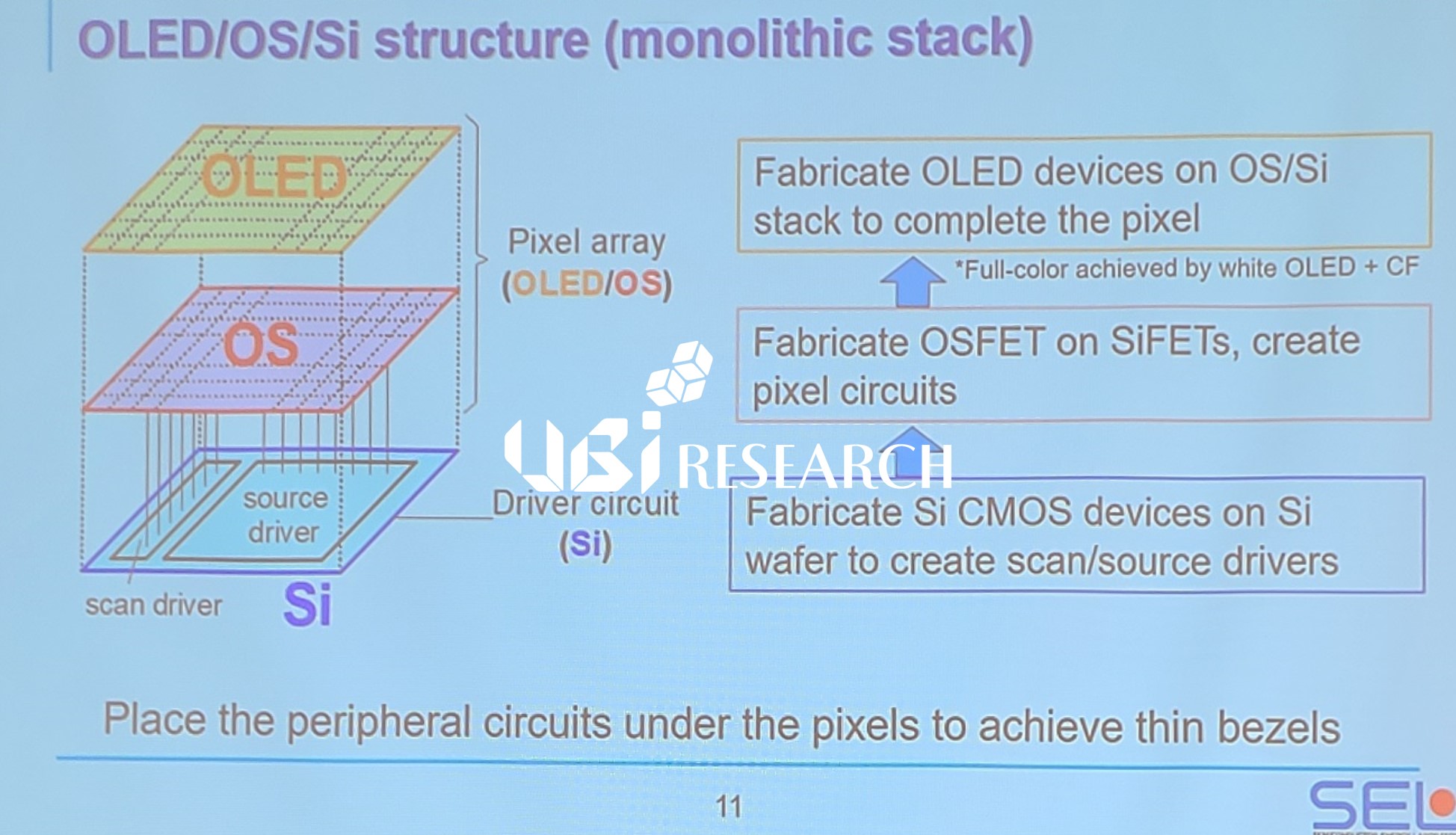

OLED, OS, Si structure/SEL

According to SEL’sannouncement, two problems arise when manufacturing an OLED display with high pixel density by integrating the existing Si FET. The first is that the source/gate drivers are located outside the display area, which increases the bezel width. A thin bezel width is a prerequisite for a decent AR/VR device size. The second issue is the high mobility of Si FETs and the balance between pixels. In order to apply Si FET to Micro OLED, it is necessary to reduce the transistor size while suppressing the increase in current.

In order to solve these problems, SEL announced that it has manufactured an OLED micro-display prototype that integrates Si CMOS and OSFET. SEL states that, “The mobility of OSFETs is not as high as Si FETs, but it is sufficient to drive OLED devices. Through the OLED/OS/Si structure in which OS (OSFET) and OLED are combined on CMOS, the width of the bezel area can be reduced by up to 40%. In addition, in the characteristic evaluation of OSFETs, it was possible to implement deep black and drive a low rate of fire, and the good distribution in a channel length of 200 nm and a breakdown voltage of about 20 V made it suitable for high voltage OLED driving of white-tandem OLED devices.”

The size of the 5,291ppi micro OLED display announced by SEL is 0.51 inches, the resolution is 1920×1920, and the pixel size is 4.8×4.8 μm. The backplane is a combined structure of 130 nm Si FET and 60 nm OSFET.

5,291ppi Micro OLED display specification/ SEL

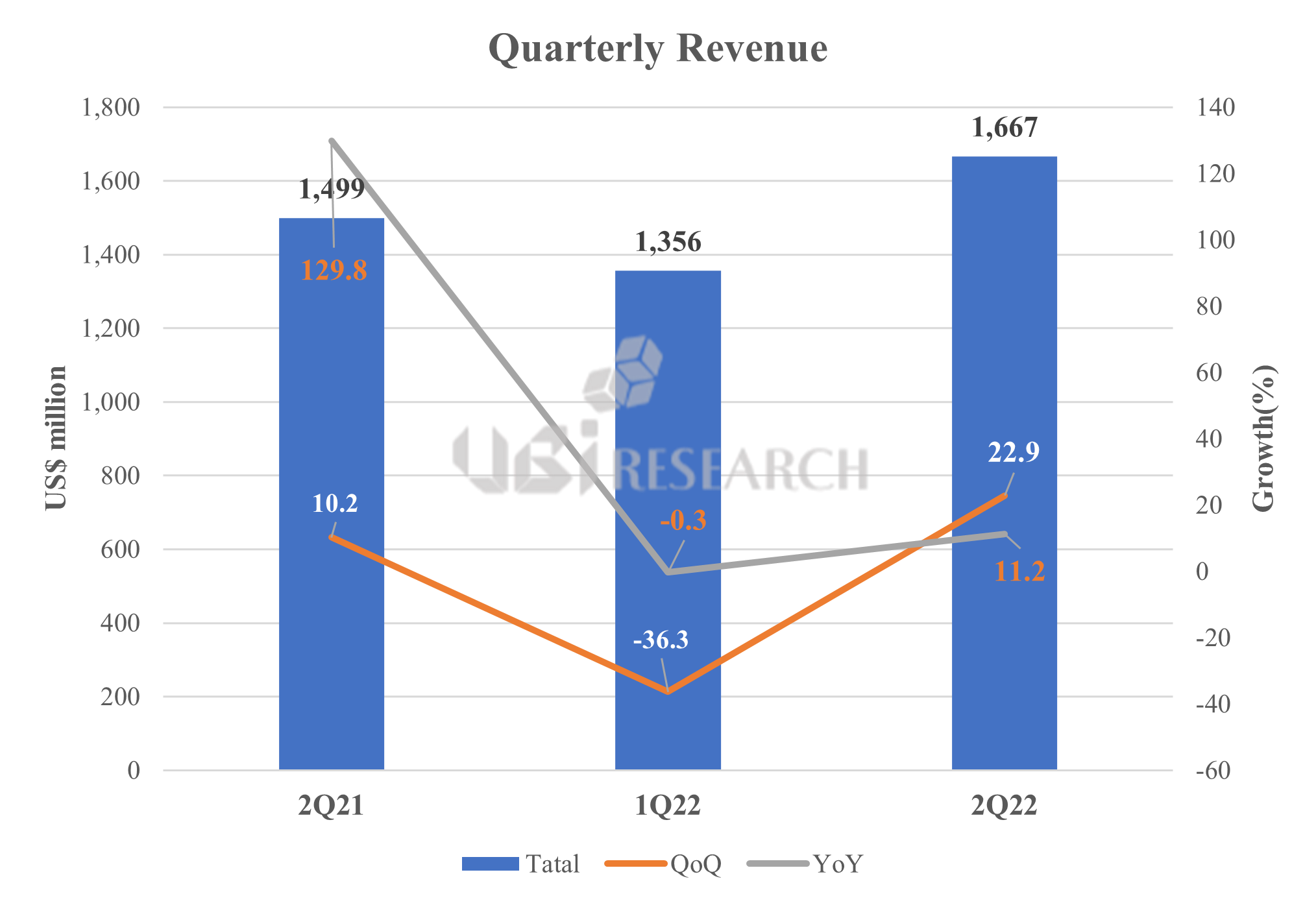

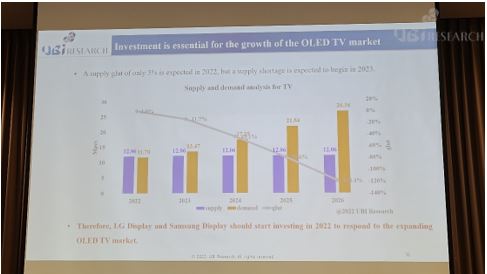

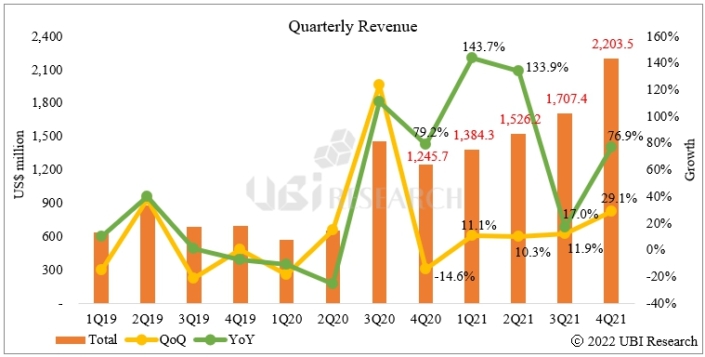

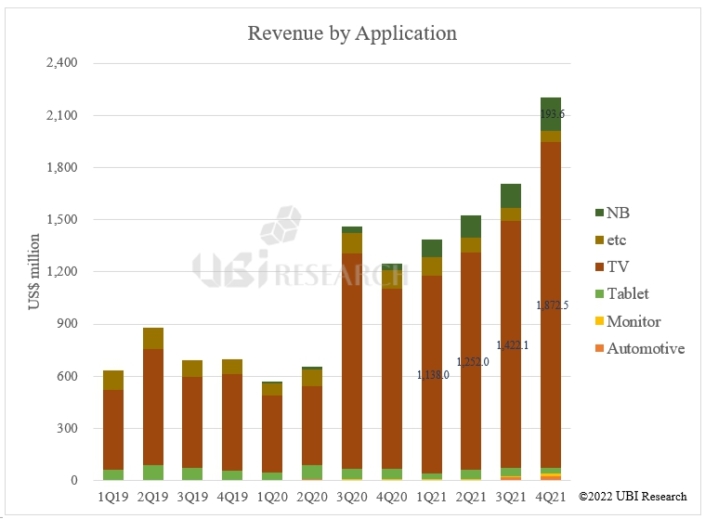

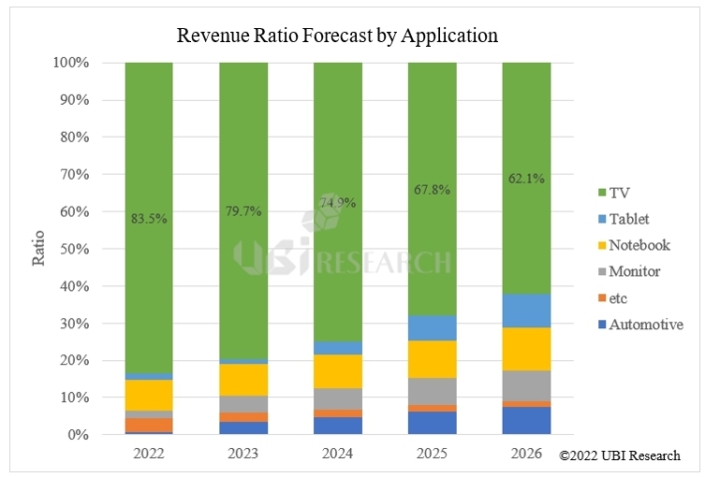

According to “3Q22 Medium & Large OLED Display Market Track” published quarterly by UBI Research, the medium and large OLED display market for the second quarter of 2022 was estimated at $1.67 billion. Medium and large OLED displays mean displays that are 10 inches or more.

In the second quarter of 2022, OLED medium to large-sized display markets rose 22.9% compared to the previous quarter and increased 11.2% compared to the same quarter last year. OLED for laptops is the largest increase in medium to large-sized OLED shipments. Shipments in the first quarter were 1.14 million units, but shipments in the second quarter were 2.18 million units, about twice that of the previous quarter.

As the war in Ukraine continues to extend, the premium TV market is being hit hard in Europe. Estimated shipments of OLED panels for TVs in 2022 were 9.2 million units in the last quarter, but revised shipments were 9.1 million units. Shipment of OLED TVs in the second quarter increased by 250,000 units from 1.71 million units in the first quarter to 1.96 million units. Of these, shipments of WRGB OLED panels are 1.71 million units and QD-OLED TV panels are 250,000 units.

Medium and Large OLED Display Market(2Q 2022)

As Samsung Electronics plans to increase sales of QD-OLED TVs to 1 million units next year, shipments of OLED TVs for TVs are expected to increase to 12 million units by 2023. LG Display is expected to convert its P7 and P8 lines into OLED lines to gradually reduce its LCD panel business, which is deteriorating profitability, and increase OLED production.

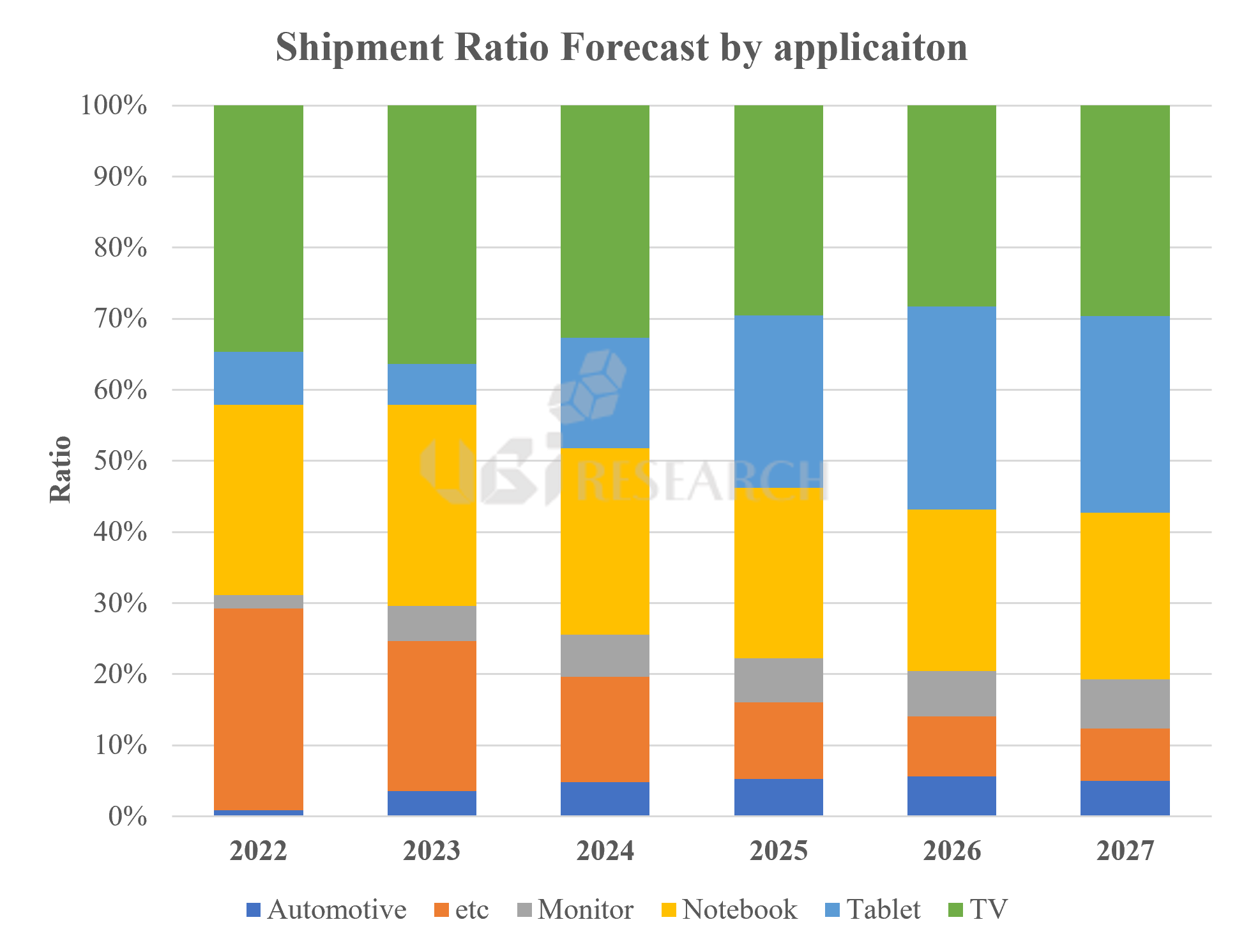

Medium and large OLED displays are categorized into application products (TV, Tablet, Notebook, Monitor, and Automotive), and the estimated shipments to 2027 are shown as a 100% cumulative graph.

Medium and Large OLED Display shipments and forecasts

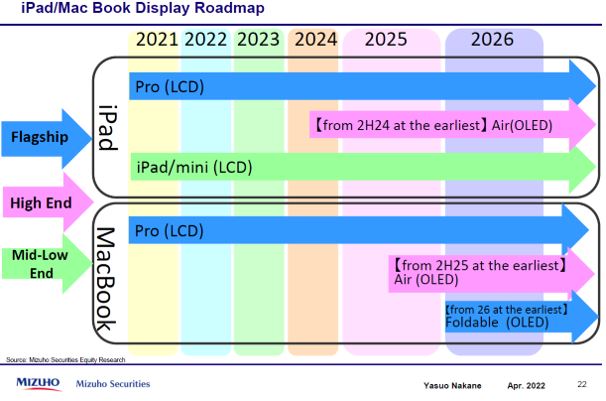

It is estimated that shipments of medium and large OLED displays will increase to 26.3 million units in 2022 and 84.2 million units in 2027. Apple expects Tablet shipments to increase sharply after 2024 as the iPad is expected to be released in 2024.

“3Q22 Medium & Large OLED Display Market Track” surveyed the current status of OLED production capacity for medium and large OLED displays over 10 inches, quarterly shipments and sales performance for major product lines such as Automotive, Note PC, Monitor, and TV by major panel manufacturers. It will also provide data on market forecast analysis of 5 years to 2027, such as ASP and OLED demand/supply analysis by application.

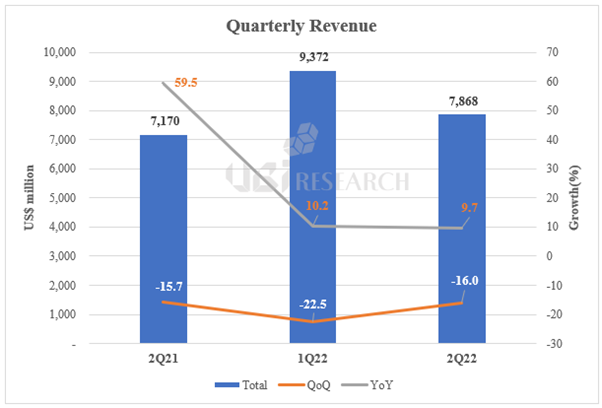

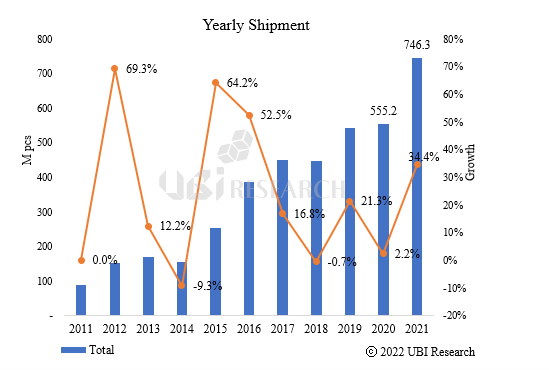

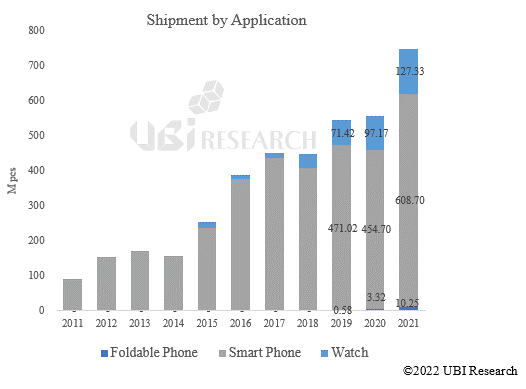

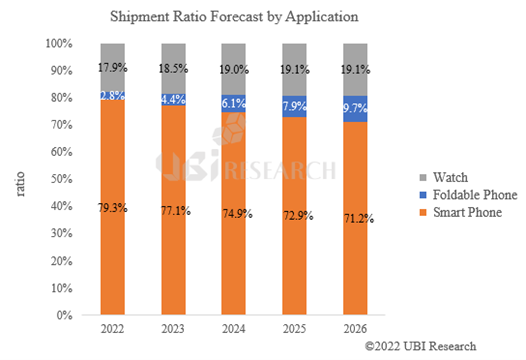

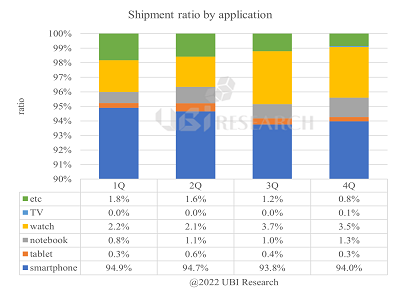

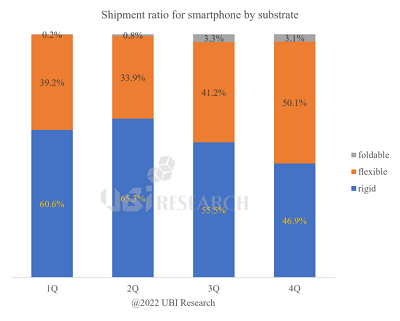

According to “3Q22 Small OLED Display Market Track” published quarterly by UBI Research, the market for small OLED displays in the second quarter of 2022 was estimated at $7.87 billion.

In the second quarter of 2022, the OLED small display market decreased by 16% compared to the previous quarter and increased by 9.7% compared to the same quarter last year. The Chinese market, the world’s largest market, has shrunk mobile devices shipment as Shanghai and some regions were quarantined due to COVID-19.

As a result, shipments of small OLED panels decreased from 150 million units in the first quarter to 130 million units in the second quarter. Although shipments of foldable OLED panels in the second quarter increased by 120,000 units from the first quarter to 3.12 million units, the market size fell short of expectations.

Small OLED market in 2Q 2022

As some Chinese panel manufacturers are offering OLED panels for Smartphones below $30 recently, the rigid OLED market is expected to shrink rapidly.

It is predicted that shipments of foldable OLEDs will increase 6.1 million units from 10.3 million units last year to 16.4 million units this year. Although foldable phones are expected to replace Samsung Electronics’ Galaxy Note, there is no additional demand. In addition, it is predicted that the growth rate of foldable OLED markets will not be fast, due to Chinese panel manufacturers’ difficulty in purchasing UTGs for foldable OLEDs and it is affecting Chinese smartphone manufacturers’ production. In 2027, OLED shipments for foldable phones were significantly revised to 42 million units.

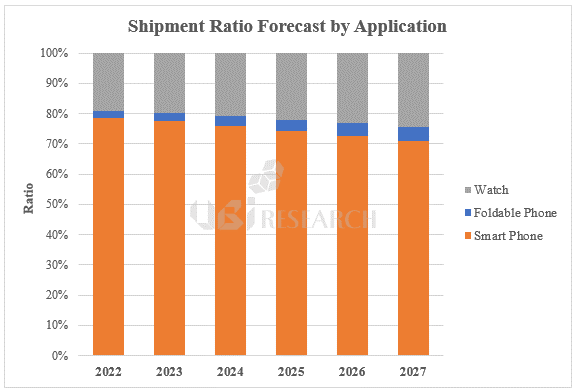

Small OLED display shipments by application (Watch, Smartphone, Foldable Phone) and the estimated shipments by 2027 are shown as a 100% cumulative graph.

Small OLED Shipments and Forecasts in 2Q 2022

Total shipments of small OLED display panels are expected to be 724.8 million units in 2022, and it is estimated that it will reach 937.8 million units in 2027. The proportion of foldable phones by application product in 2022 is 2.3% and is expected to increase to 4.5% by 2027.

“3Q22 Small OLED Display Market Track” analyzed OLED production capacity status for small OLED displays below 10 inches, and surveyed quarterly sales and shipments of major products sorted by major panel manufacturers, countries, generations, substrates, TFT technologies, and application products(Watch, Smartphone, Foldable phone). It analyzes ASP and OLED demand/supply by application and provides data on market prospects of small OLED displays from next 5 years to 2027.

(San Francisco, CA) – July 28, 2022 – Smithers, a leading provider of testing, consulting, information, and compliance services, is hosting OLED’s 2022 conference this year at the Hotel Kabuki on October 25-27 in San Francisco, CA, and virtually.

This event explores the latest developments taking place within the OLED value chain, providing attendees with timely insights surrounding the impact of COVID-19, innovation and product advancements, emerging solutions and material developments, current product trends, and new opportunities for growth and increased market share.

Plus, all networking breaks, lunches, and the networking reception will be shared with the co-located Phosphors and Quantum Dots attendees, doubling the networking possibilities!

For sponsorship opportunities, please contact Ashli Speed, aspeed@smithers.com, for more information. Don’t forget to join the mailing list to stay up to date with the latest event details.

The pricing for this event is tiered, so the earlier you book, the more you save. To learn more and register, please visit the event website: www.oledsworldsummit.com

For more information about Smithers, please visit www.smithers.com.

###

About Smithers:

Founded in 1925 and headquartered in Akron, Ohio, Smithers is a multinational provider of testing, consulting, information, and compliance services. With laboratories and operations in North America, Europe, and Asia, Smithers supports customers in the transportation, life science, packaging, materials, components, consumer, dry commodities, and energy industries. Smithers delivers accurate data, on time, with high touch, by integrating science, technology, and business expertise, so customers can innovate with confidence.

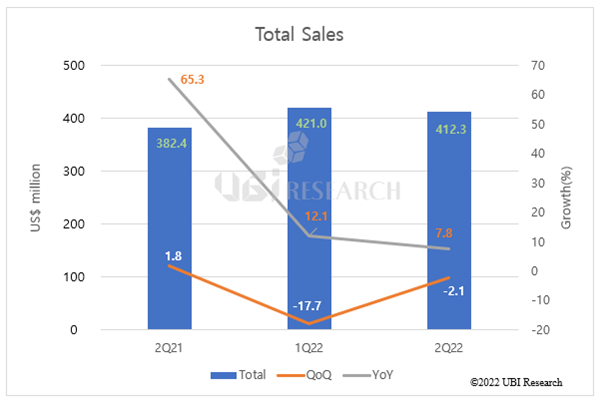

According to the “3Q22 OLED Emitting Material Market Track” published quarterly by UBI Research, purchases of OLED light-emitting materials in the second quarter of 2022 amounted to $4.12 billion.

In the second quarter of 2022, the OLED light-emitting material market decreased by 2.1% compared to the previous quarter and increased by 7.8% compared to the same quarter last year. Overall, there was a decrease in panel shipments of Samsung Display and LG Display due to the off-season, but sales did not decrease significantly from the previous quarter due to rising exchange rates and the supply of new materials.

In the small OLED panel market, Samsung Display’s second-quarter purchase of light-emitting materials fell 2.2 % from the previous quarter to $1.52 billion, BOE fell 11.7% to $53.1 million, and LG Display fell 12.6% from the previous quarter to $39.7 million.

For OLED TVs, LG Display’s second-quarter purchase of light-emitting materials was $77.3 million, similar to the previous quarter, while Samsung Display’s purchase of materials for TVs was $28.3 million, up slightly from the previous quarter.

2Q 2022 OLED Emitting Materials Market

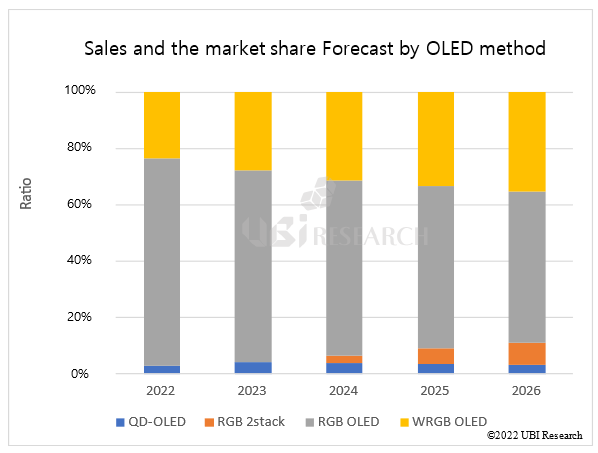

Sales of OLED light-emitting materials for each quarter were classified by layer, and the expected sales until 2026 were expressed as a 100% cumulative graph.

Sales and the market share Forecast by OLED method

The OLED light-emitting material market is predicted to be $1.81 billion in 2022 and $2.5 billion in 2026. As shipments of WRGB OLEDs are expected to exceed 20 million units in 2026, purchases of light-emitting materials for WRGB OLEDs are expected to reach $900 million in 2026 from $4.3 billion in 2022. As the RGB 2stack market for IT grows, it is expected to reach $53.4 million in 2024 and $190 million in 2026.

Sales of luminescent layer and common layer were investigated to identify the overall market of light-emitting materials, and performance was analyzed by dividing them into countries, panel companies, applied products, layers, and OLED methods (RGB, WRGB, and QD-OLED). In addition, OLED market information up to 2026 was predicted by predicting the usage and sales of light-emitting materials by each company over the next five years. The Market Track Quarterly Report provides necessary information to industry workers who lead OLED industries.

The K-Display 2022 exhibition, a Korean display industry exhibition was held at COEX in Samseong-dong from August 10 to 12.

Display-related materials, equipment, and parts companies such as Samsung Display and LG Display participated.

As OLED business is expanding from Smartphones and TVs to IT such as Notebooks, Tablet PCs and Micro OLED, related parts makers drew attention in exhibitions.

FMM for OLED Mobile(6GH)/ Philmaterials

Invar, which is used for metal masks, is an iron-nickel alloy material necessary for manufacturing FMM for depositing RGB in OLED manufacturing.

Phillmaterials is using Invar as an ultra-high resolution display material because it has a low thermal expansion rate and thin thickness using the electroplating method.

Pixel Shadow can be improved compared to the compressed FMM. 6G half-sized OLED mobile masks and IT masks were also displayed.

Unlike the existing FMM method, Olum Materials used a method of attaching individual cells to a frame.

It is effective in preventing sagging in a large area, and if a mask is defective, it has the advantage of not replacing the entire mask.

Olum Materials exhibited a mask of 6G half size, they are developing it in the lead of localization.

FMM/ Olum Material

FMM for micro OLED/ APS Materials

Because FMM for micro OLEDs requires finer holes, APS Materials introduced patterning laser technology using high-power lasers, the 2,050 ppi FMM, which can pattern on 8-inch wafer substrates used in display fields for AR and VR.

OLED material

Recently released smartphones support a fast refresh rate of 120 Hz. Such a fast refresh rate allows smooth screen transitions and can express dynamic movements, especially in games, but consumes a lot of power.

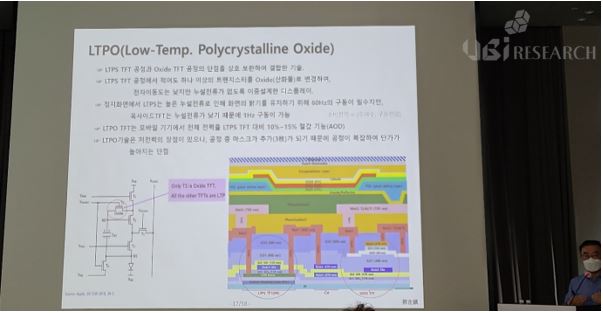

Major set makers such as Samsung Electronics and Apple started to use OLEDs with LTPO TFTs, which consume relatively low power while realizing a refresh rate of 120 Hz and OLED smartphones to which LTPO TFT is applied are positioned in each set maker’s ultra-premium lineup.

In this high refresh rate trend, the capacitance of the green emitting material is becoming an issue.

If the capacitance of the green emitting material is high, dragging may occur when switching the screen in the high refresh rate mode. Since the human eye responds the most to green, the green appears prominently, which may cause problems in color expression.

For this reason, it is understood that some material makers have recently received requests from set or panel makers to lower the capacitance characteristics of green emitting materials.

Daejeong Yoon, an analyst at UBI Research, said, “The biggest issue for material companies in the past and still is lifetime and efficiency, but recently, even the capacitance of materials has become an issue due to the trend of high refresh rate.” And “Green material with deuterium substitution technology will be applied to some mass production from the second half of this year, and material makers are immediately forced to develop green materials with low capacitance.”

As smartphones supporting a high refresh rate of 120 Hz are expected to become mainstream in the future, the use of green emitting materials with low capacitance is also expected to increase.

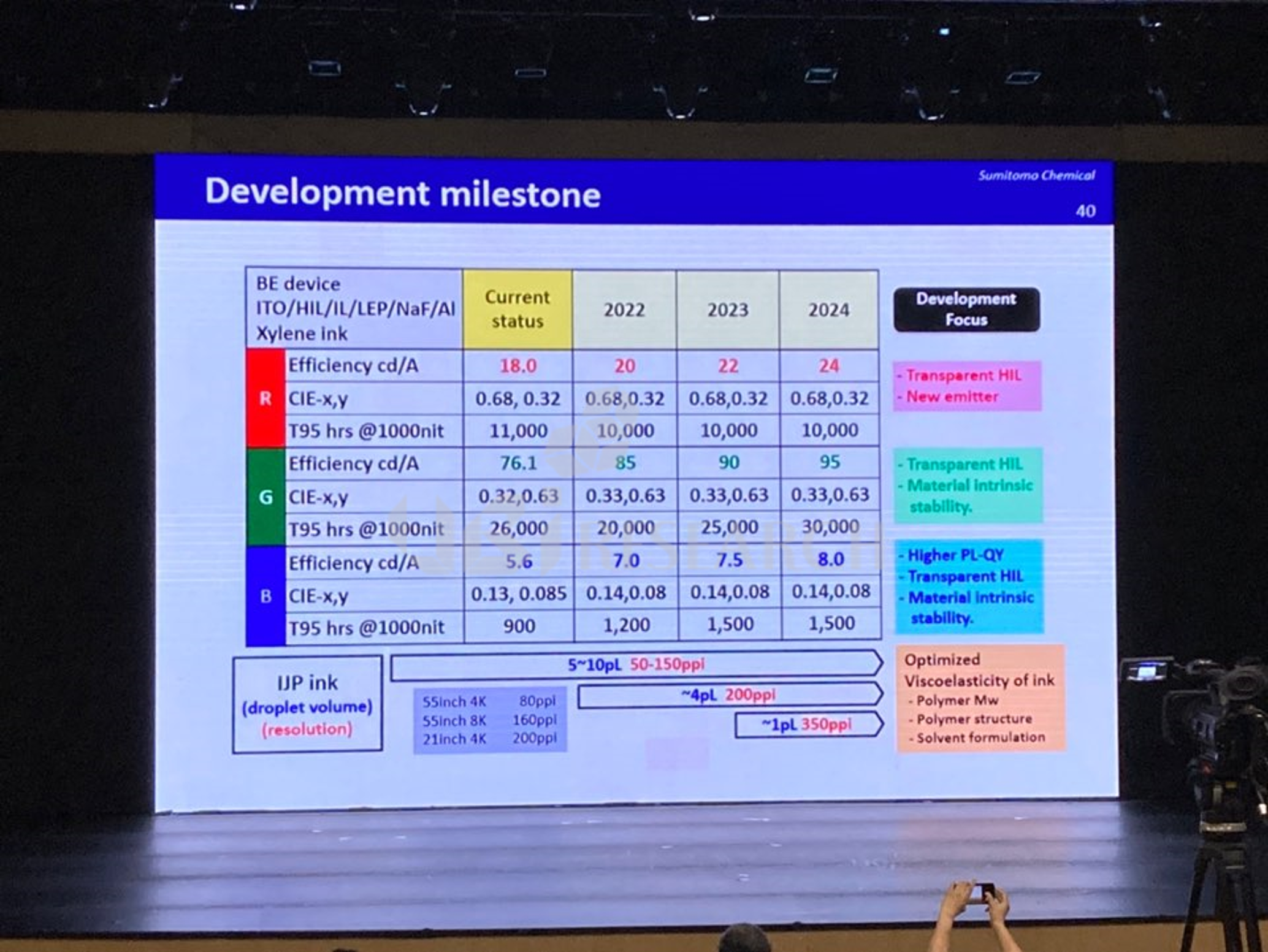

At the ‘Display Business Forum 2022’ held at COEX, Seoul from August 10 to 12, 2022, Sumitomo Chemical unveiled the performance of inkjet materials developed until recently.

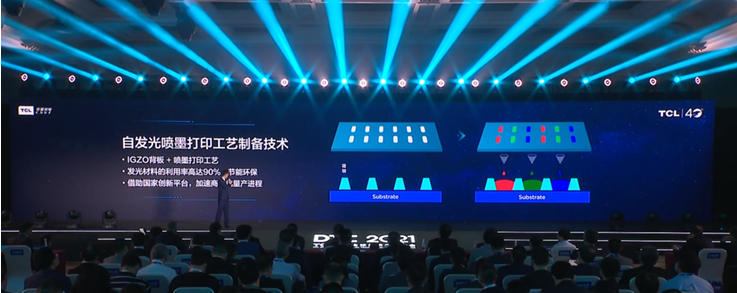

Inkjet printing technology is attracting attention as a technology that can reduce the process time and increase material usage of 3-stack OLED or 4-stack OLED, which are mainly used for medium and large-sized devices. JOLED is mass-producing panels for monitors, and TCL CSOT also are considering investing.

Sumitomo Chemical first disclosed the RGB performance of the top-emitting OLED and the bottom-emitting OLED produced by spin coating. Although there was no significant difference in the OLED of the bottom emission type from the previous year, it was confirmed that the performance of the material was improved in the OLED of the top emission type, and in particular, both the efficiency and performance of the blue material were improved.

Sumitomo Chemical’s Material Performance

Sumitomo Chemical also mentioned impurity management, ink formation, curing process, and jetting mechanism as core tasks of inkjet printing technology. In order to secure the process time, yield, and performance of inkjet printing, the aforementioned four factors must be overcome.

Lastly, Sumitomo Chemical announced the performance of RGB inkjet materials developed so far, and concluded the presentation by mentioning the target efficiency and lifetime of future materials.

Sumitomo Chemical Development Milestone

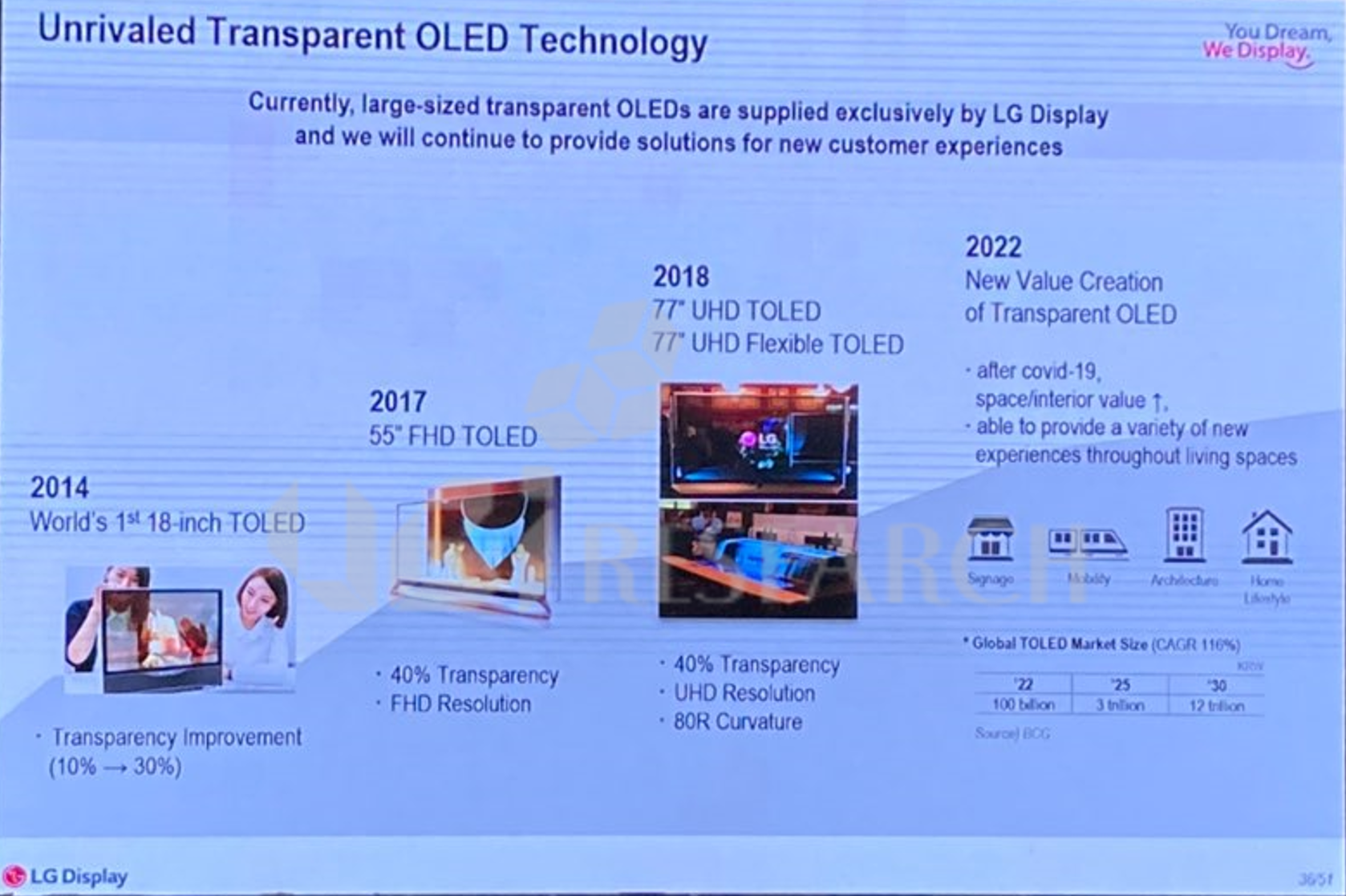

At ‘K-Display 2022’ held from August 10 to 12, LG Display exhibited various transparent OLED products such as wall type and TV type. The transparent OLED exhibited this time had a transmittance of 45% and a resolution of FHD level.

LG Display’s transparent OLED exhibited at K-Display 2022

At the ‘Display BUSINESS Forum 2022’ held on the 11th, Kang Won-seok, managing director of LG Display, said that the use of transparent OLEDs is increasing due to improved transmittance and reduced weight.

Director Kang mentioned that LG Display has been developing transparent OLED since 2014, and announced that he would increase the value of transparent OLED in line with internal activities that have been increasing since COVID-19.

LG Display Transparent OLED Roadmap

Currently, LG Display is mass-producing transparent OLED on a limited basis in its E3 line. Currently, only 55-inch transparent OLEDs are being mass-produced, but from the second half of this year, they plan to expand the lineup to 77 inches.

LG Display’s transparent OLED is mainly used for museums and signage in China. As demand is expected to increase in the future, LG Display is expected to respond to the market by lowering panel prices and introducing production lines other than E3.

UTG market outlook source : UBI Research

At the ‘K-display 2022 Business Forum’ held at COEX from August 11th to 12th, CEO Il-jae Lee of Coses GT presented ‘Cover Window for Foldable and UTG Manufacturing Method’.

Regarding the foldable phone market, CEO Lee said, “According to UBI Research data, the size of the foldable market is expected to grow to 1 trillion won by 2025. Recently, not only Korea, but also China and the United States are actively engaged in foldable-related businesses. We are concentrating on securing competitiveness in UTG and hinge technology to catch up with Samsung Electronics such as Apple in the US and Huawei, Oppo and Honor in China.”

Next, explaining the characteristics of UTG products, “OCA and PET films are attached on the UTG products that are actually used and hard coating and anti-finger coating are made. If you do a pen-drop test on the 30um thick UTG of CosesGT, the panel breaks at 2.5cm. If PET film is applied over UTG, it can withstand up to 25cm in the pen-drop test, but the unique properties of UTG are greatly damaged. We are thinking about how to proceed with UTG alone without any special process on top of UTG.”

Regarding product mass production, “Actually, the Galaxy flip or fold-sized panel developed by CosesGT can be mass-produced with a thickness of 50 to 70um. Samples can be made with the same thickness as flip and fold for a 17-inch or larger medium-large panel such as a laptop, but considering mass production, it can be produced with a thickness of 70-100um.”

According to the announcement, the actual folding radius of the panel developed by CosesGT achieved a radius of 0.9R at 6.8 inches, 1.2R at 8.2 inches, and 4R at 17 inches. The folding test passed 170,000 times for 96 hours at 60°C and 170,000 times for 96 hours at -20°C, a total of 340,000 folding tests.

Finally, when asked about the most difficult aspect of UTG development by Chinese UTG processing companies, he said, “Recently, Chinese panel makers’ UTG demand is increasing, but Chinese processing makers have not yet entered the UTG business. The hinge technology of Chinese processors is also a problem, but the development of foldable phones is still being delayed because the proportion of foldable phones in the smartphone market is still small. Also, UTG processing companies in China seem to think that early UTG and glass are the same material and can be easily developed.”

CosesGT’s UTG for laptop/tablet

CosesGT exhibited UTG for 6.1-inch iPhone13 Pro and UTG for 13.3, 13.9, 15, and 17.8-inch notebooks/tablets at K-display 2022. Currently, CosesGT receives a glass ledger from NEG, a Japanese glass producer, and processes it, and samples are being evaluated by several companies.

Samsung Display’s Vice President Seon Ho

At the ‘K-display 2022 Business Forum’ held at COEX in Samseong-dong from Aug 11 to 12, Samsung Display’s Vice President Seon Ho and Marketing Team Manager Shah Chirag gave a keynote speech, ‘QD-OLED: Redefining Your Visual Experience’.

Vice President Seon Ho said, “As the COVID-19 situation has passed, online communication has become more active, and the era has come when daily life is done through displays.” He continued, “If the focus has been on increasing the size of the display so far, the display in the future will pursue better picture quality. Samsung Display is aiming for a display that has excellent color volume and purity, expands HDR, and does not change color depending on the viewing angle. QD-OLED will be the new standard for displays in pursuit of better picture quality.”

Marketing Team Manager Shah Chirag

Shah Chirag presented, “QD-OLED is currently the display that can display the color closest to nature.” Samsung Display’s QD-OLED supports more than 125% of DCI-P3 and more than 90% of BT2020 color gamut due to the characteristics of quantum dots.

Shah Chirag also mentioned the excellent viewing angle characteristics of QD-OLED. He further explained, “Unlike general displays that have different colors or brightness depending on the viewing position, QD-OLED shows 50% improved luminance and color characteristics compared to conventional displays at a viewing angle of 60 degrees.”

excellent viewing angle characteristics of QD-OLED

Lastly, Vice President Seon Ho concluded with, “It has been half a year since QD-OLED TV came out as a set, and Samsung Electronics and Sony are selling them. Next year, we will continue to strive to create brighter and clearer displays so that more products can be launched in Korea. I hope the display industry develops in a better direction.”

Samsung Display mainly exhibited QD-OLED TVs at K-display 2022. Samsung Display has mass-produced QD-OLED panels since the end of last year. The production capacity is 30,000 sheets per month and the products produced are 55- and 65-inch TV panels and 34-inch monitor panels.

The structure of the OLED panel is composed of various components and materials.

Also, there are differences in the structure according to Flexible OLED, Foldable OLED, and W-OLED.

In this video, I talked about the major small, medium and large OLED shipments along with the major components and materials market forecasts.

If you have any questions or comments, please feel free to leave them.

Thanks for watching.

※ This video was produced based on UBI Research’s ‘2022 OLED Components and Materials Report’ and ‘OLED Components and Materials Market Track’

▶ Download Report sample

https://ubiresearch.com/en/product/2022-oled-component-and-material-report/

▶ Download Market Track sample

https://ubiresearch.com/en/market-track/market-component/

▶ UBI Research Homepage

https://ubiresearch.com/en/

▶ Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶ If you want to know the latest news related to OLED?

https://en.olednet.com/

This is the LG Display booth exhibited at K-Display 2022.

LG Display exhibited OLED.EX, transparent OLED, and various concept OLED products.

I hope it will be of some help to those who could not attend K-Display 2022.

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶If you are curious about the latest news related to OLED?

https://en.olednet.com/

This is LG Display’s new transparent OLED display.

It was amazing to actually see the technology we saw in sci-fi movies when we were young.

How can LG Display’s transparent OLED be applied to our lives?

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶If you are curious about the latest news related to OLED?

https://en.olednet.com/

This is Samsung Display’s Flex OLED lineup.

We were able to see the Flex S, which was made after the first letter S of Samsung, and the Flex G, which folds three times.

It was disappointing that I could not see the demonstration of the screens of Slidable products being stretched.

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶If you are curious about the latest news related to OLED?

https://en.olednet.com/

Samsung Display unveiled QD-OLED for the first time in Korea.

It is unfortunate that the camera cannot capture the advantages of QD-OLED, but I hope you enjoy it.

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

▶If you are curious about the latest news related to OLED?

https://en.olednet.com/

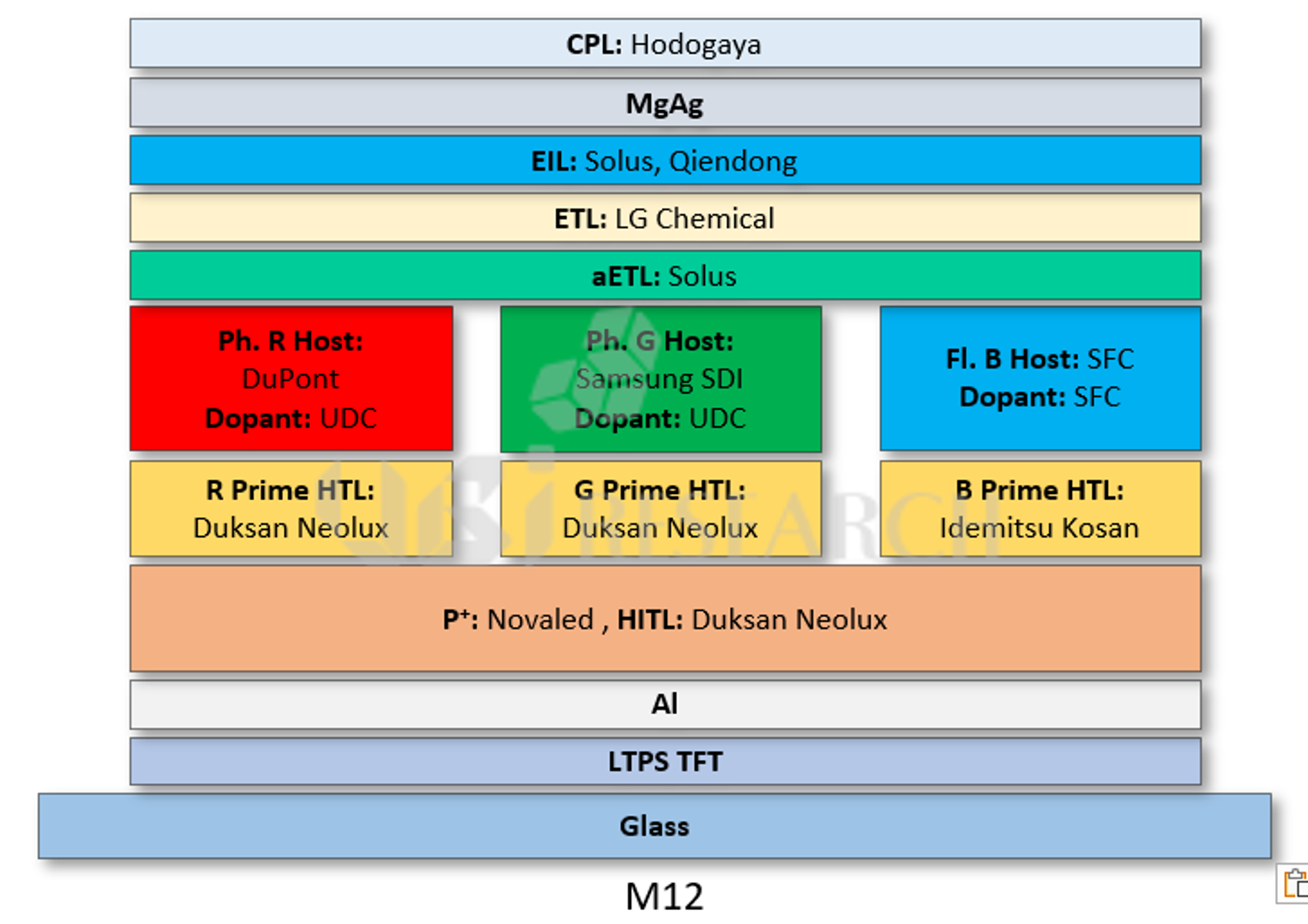

Supply Chain of M12 Structure Applied to iPhone14

Samsung Display will apply the new material structure M12 only to the top two Pro models of Apple’s iPhone 14 series, scheduled to be released in the second half of the year. For the lower two models, the M11 structure applied to the iPhone13 is used as it is.

Samsung Display supplies OLED to all four iPhone14 series. Samsung Display uses the same M11 structure applied to iPhone13 as it is for iPhone14 and 14 Max, the two lower models to which LTPS TFT is applied. Samsung Display applies a new structure, M12 structure, to 14 Pro and Pro Max to which LTPO TFT is applied.

The reason why Samsung Display applies a material structure differently to the iPhone series seems to be Apple’s cost-saving measure. In Samsung Electronics’ Galaxy S22 series released in the first half of the year, M11 was applied to Ultra and Plus models and M10 was applied to regular models.

Samsung Display’s new material structure M12 is applied to Apple’s iPhone14 series and Samsung Electronics’ foldable phones Z Fold4 and Z Flip4.

Have you ever used a VR device?

In VR, immersion and sense of presence are very important.

For clear picture quality, Micro-OLED is essential in VR equipment.

Can VR replace monitors and TVs in the near future?

I expect that Korean companies can play an important role in the micro display market as well.

Thank you for watching today.

※ This video was produced based on UBI Research’s special report ‘2022 Micro-Display Technology Report’.

▶Download the 2022 Micro-Display Technology Report Sample

https://ubiresearch.com/en/product/2022-micro-display-technology-report/

▶ UBI Research official website

https://ubiresearch.com/en/

▶Business, display report inquiry

marketing@ubiresearch.com

+82-2-577-4391

The ‘2022 OLED Components and Materials Report’ recently published by UBI Research (www.ubiresearch.com), a company specializing in OLED market research, summarizes Samsung Display’s pol-less technology development status and future roadmap.

Pol-less technology applies black pixel define layer (BPDL) and color filter instead of polarizer. It is called ‘On-Cell Film’ (OCF) at Samsung Display and ‘Color filter On Encapsulation’ (COE) at BOE and Visionox.

Pol-less technology was applied to ‘Galaxy Z Fold 3’ for the first time. Samsung Display announced that it can reduce panel power consumption by up to 25% even at the same brightness by increasing the light transmittance by 33% by applying pol-less technology.

Comparison of power consumption of OLED with polarizer applied and OLED with polarizer removed, Source: news.samsungdisplay.com

According to UBI Research, Samsung Electronics’ ‘Galaxy Z Fold 4’ to be released in the second half of this year will apply RGB resist in color filters as a low reflective material instead of pol-less technology.

Samsung Display’s pol-less technology requires two photo processes for TFT and five photo processes for color filter. In the future, it is expected that the process time and cost will be shortened by reducing the photo process 3 to 4 times by applying new materials.

Samsung Display is expected to further develop pol-less technology and apply it not only to smartphones but also to IT devices.

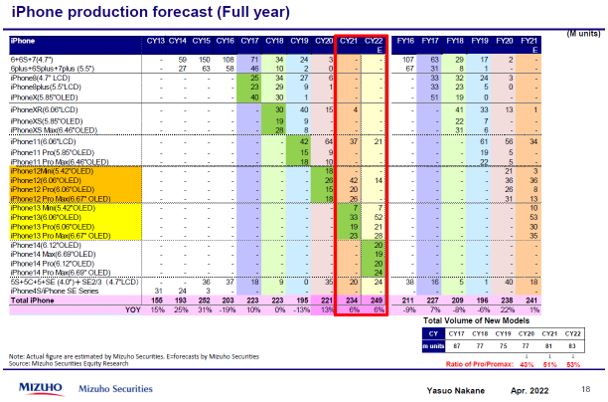

In this video, Apple’s OLED product roadmap, a company that accompanies innovation, was covered. OLEDs for Apple products are supplied by Samsung Display and LG Display. Apple’s presence in the display industry is great. The image of Apple’s foldable laptop that UBI Research predicts is shown in the video. What other innovative products is Apple preparing?

※ This video was produced based on UBI Research’s special report ‘2022 Micro-Display Technology Report’.

▶Download the 2022 Micro-Display Technology Report Sample

▶ UBI Research official website https://ubiresearch.com/en/

▶Business, display report inquiry marketing@ubiresearch.com +82-2-577-4391

▶If you are curious about the latest news related to OLED? https://en.olednet.com/

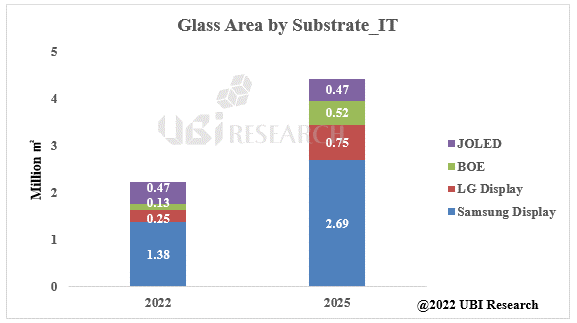

According to the ‘2022 OLED Components and Materials Report’ recently published by UBI Research (www.ubiresearch.com), a company specialized in OLED market research, the substrate area of the total OLED mass production capacity in 2022 is expected to be 47.3milion ㎡. In 2022, the LTPO TFT line and EDO’s 6th-generation rigid OLED line, which Samsung Display invested in to supplement the idle capacity of the A3 line, are scheduled to be operated. In 2023, LG Display’s E6-4 line and BOE’s B12-3 line Line, Samsung Display’s 8.5G IT line are expected to be put into operation in 2024.

As for the substrate area of small OLED for smart watch and smartphone, the line capacity for rigid OLED in 2022 is 5.29 million ㎡, accounting for 24.8% of the market share. Rigid OLED investment is not expected in the future. In 2022, the capacity for flexible OLED is 15.3 million ㎡, accounting for 71.5% of the total. From 2024, part of Samsung Display’s A3 line will be converted to an IT line, and the mass production capacity is expected to decrease. The line capacity for foldable OLED is expected to reach 0.79 million ㎡ in 2022 and 1.52 million ㎡ from 2023.

Samsung Display’s IT line capacity is expected to expand to 2.69 million ㎡ by 2025 as part of the A3 line is converted to an IT line in the first half of 2024. A new 8.5G line is expected to be operated in 2024. From the second half of 2023, LG Display’s capacity is expected to be 0.75 and 0.52 million ㎡, respectively, with the E6-4 line operating and BOE’s B12-3 line operating.

OLED line capacity for TV is not expected to change until 2026 unless additional investment is made. From 2022, LG Display’s mass production capacity is 20.3 million ㎡, accounting for 85.5% of the total. Capacity is expected to increase further depending on whether additional customers are secured in the future. Samsung Display’s capacity is 3.3 million ㎡ and BOE’s is 0.13 million ㎡, accounting for 13.9% and 0.6% of market share, respectively.

Meanwhile, the ‘2022 OLED Components and Materials Report’ published this time dealt with the latest OLED industry issues analysis, development of components and materials for foldable devices, industry status, analysis of mass production capacity of OLED panel companies, and major component and material market forecasts. It is expected to help parts and materials companies to understand related technologies and predict future technology directions and markets.

Recently, there is a movement to manufacture display-related materials, materials, and equipment exclusively in China. According to the ‘2022 OLED Components and Materials Report’ recently published by UBI Research (www.ubiresearch.com), China National Development and Reform Commission(国家发展和改革委员会) or Ministry of Industry and Information Technology of the People’s Republic of China(中华人民共和国工业和信息化部) are providing investment funds to Chinese OLED display-related developers and are rapidly moving towards domestic demand.

The Ministry of Industry and Information Technology of China is planning a large-scale support project for display-related materials, equipment, and parts for domestic demand in China. The companies selected for the project will receive unprecedented subsidies from the Chinese government. Recently, the Ministry of Public Information and Security is believed to have supported FMM and related evaporators and other equipment. In addition, the items promoted by the National Development and Development Committee of China for domestic demand will be developed and mass-produced within three years, and all domestic production will be carried out within five years.

In addition to government projects, companies are also active in domestic demand. BOE, China’s largest display maker, has already made significant investments for domestic demand. In March, BOE CEO Gao Wenbao, who felt the pressures due to volume and cost, ordered a special policy directly for purchase planning. In the process of diversifying business partners for cost reduction, BOE reviewed only domestic companies, excluding overseas companies. Of BOE’s investment in materials, materials and equipment for domestic demand, about 70% of the capital has already been invested. The investment is expected to be completed by 2023.

The Chinese government has included display in the national high-tech strategic industry early on and has provided unprecedented support to display companies such as BOE and TCL CSOT. In addition, the Chinese government is raising import tariffs on materials and parts that can be produced in China and is meeting the needs of domestic demand.

In order to widen the gap with China, which is closely chasing Korea from LCD to OLED, the Korean government must take active measures. The Korean government will designate display as a national high-tech strategic technology in the ‘Special Act on National Advanced Strategic Industries’, which will be enforced on the 4th of next month and will provide tax support and various benefits to display companies.

<Display technology strategy announced by TCL CSOT at DTC 2021>

According to the China Trend Report published by UBI Research, the schedules of TCL CSOT’s 8.5G LCD line T9 and 6G LCD line T5 are expected to be delayed.

In early July, the T9-1 was put into operation, but overall equipment orders for the ph-2 were delayed. According to the report, the schedule is expected to be delayed by about six months.

The schedule of the T5 line is expected to be postponed indefinitely. The T5 line was expected to begin mass production in the second half of 2023, but the schedule is indefinitely postponed and the mass production schedule is also uncertain.

Accordingly, TCL Chairman Li Dong Sheng, who is scheduled to visit Korea at the end of July, is expected to seek the understanding of Korean equipment makers due to the delay of schedules for LCD lines as well as consultations due to Samsung Electronics’ decrease in TV panel volume.

After visiting Korea, he is expected to visit JOLED in Japan to check inkjet technology. According to this visit, it is expected that the outline of whether the T8 line will be applied with inkjet process or deposition technology will be revealed in the future.

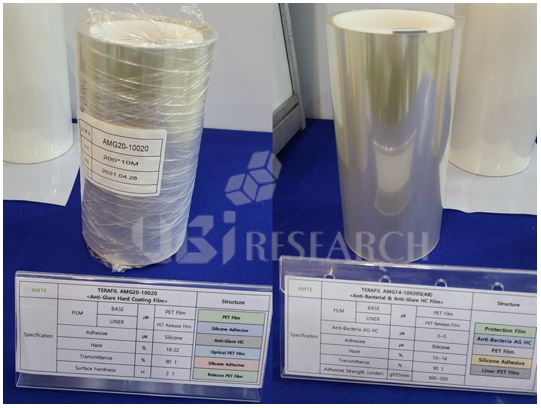

From July 6th to the 8th, NANO Korea 2022 Exhibition was held at the Kintex 1st Exhibition Hall Ilsan. The exhibition consisted of 604 booths from 343 companies. The International Nanotechnology Convergence Exhibition, the International Adhesive Coating Film Convergence Material Exhibition, the International Laser Technology Exhibition, the International Advanced Ceramics Exhibition, and the International Smart Sensor Technology Exhibition were just a few represented at this exhibition.

One display company, AMOGREENTECH, a company based on nanomaterials, exhibited thermally conductive adhesive sheets and thermally conductive pastes as heat dissipation solutions with low dielectric constant and high thermal conductivity. The products exhibited by AMOGREENTECH showed a simple process structure and high heat resistance and transfer characteristics.

CollTech booth

CollTech, an adhesive solution company established in 2013, is converting its adhesive business from film to liquid to reduce the display bezel of automotive displays. An official from Coll tech stated, “Since it is difficult to develop a liquid adhesive from the beginning, we are developing it in advance for films. Recently, companies have been requesting a lot of liquid type adhesives or sealing agents containing black pigments during UV curing.”

Films exhibited by AMTE

AMTE, which produces functional coating materials and films, exhibited high-hardness antifouling coatings used for OLED and LCD, high-brightness anti-glare coatings, transparent antistatic coatings, and blue light cut coatings.

French laser company Amplitude exhibited laser equipment used for display repair, panel shape cut, and camera hole cut. Recently, Amplitude mentioned that he is testing a ‘giga burst’ technology that improves machinability by splitting laser pulses into 200-800 pieces.

In addition, laser companies such as Coherent and Trumpf exhibited their laser equipment, and various display-related companies such as Evident Korea, Nanosolution, Profinecam, and Iotechnics exhibited their products.

VR devices have been on the rise since 2016 and were expected to be an important factor in IT business, but have not yet made a big impact. At CES 2016, Intel exhibited applications that enable creative activities such as education and art. In 2017, Samsung presented games and movies that can be felt with the body in 4D form at the IFA VR experiment zone.

VR features excellent immersion and presence. A 1-inch display can look like a 60-inch display. The display that provides information uses micro-display, but LCoS (liquid crystal on silicon) has a slow response speed, poor color, and low contrast ratio. So the trend is changing to OLEDoS (OLED on silicon). Sony is making its own micro OLED and Panasonic is working with US Kopin to make VR.

Recently, VR devices are preparing to replace monitors. If it is made in high resolution, about 10 screens can be displayed on each VR monitor screen. In the future, the monitor market will change to the VR market. VR can emerge as the best dark horse in the IT market. VR may possibly also replace TVs. A head speaker with a much better three-dimensional effect is essential. There may also be changes in the movie theaters as a VR device might provide a 60-inch screen and provide a high sense of immersion into the film for movie-goers.

Micro OLED composition consists of TFT designed on a silicon wafer and OLED is formed on it. LGD’s WOLED method is used for OLED. The RGB method requires a fine metal mask, but the AP system is preparing a mask capable of 2000ppi or more using a laser. Because WOLED uses a color filter, there is a loss of about 10%. RGB may be more advantageous in terms of luminance, but for commercialization, WOLED resolution can be much higher. Since it has been developed for a long time, WOLED is expected to be applied. Applications include military, medical, industrial, viewfinder, smart glasses, and the like.

Recently, Apple requested LG Display and Samsung Display to prepare Micro OLED. LG Display placed an order for the Sunic System evaporator in June and is moving quickly.

Samsung Electronics also has a request for VR. In 2025, it can be seen that LG Display and Samsung Display can produce many types of Micro OLED. We expect to see Apple’s VR devices around 2024.

Related Report : 2022 Micro-display REPORT

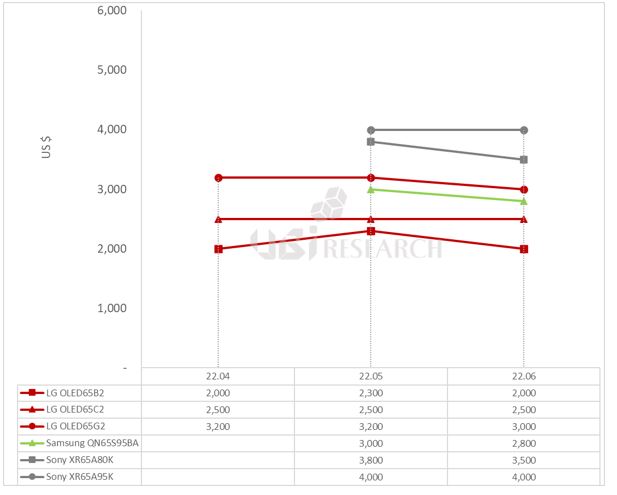

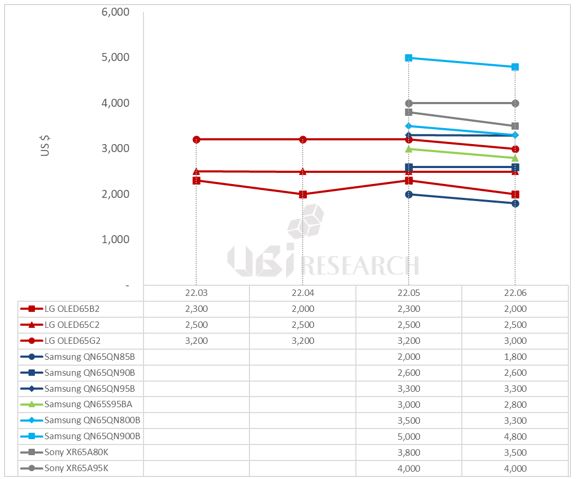

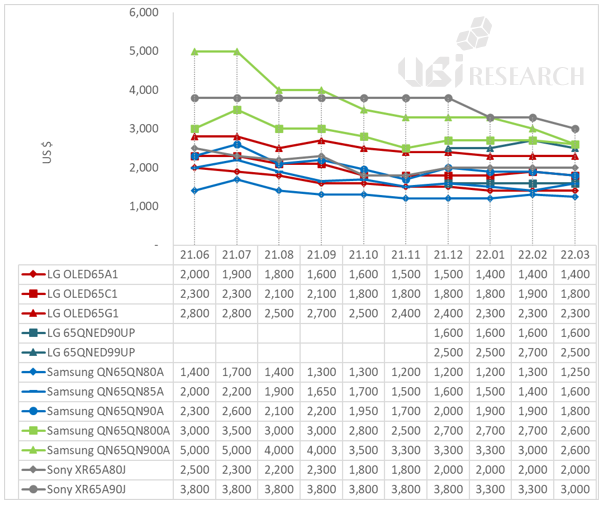

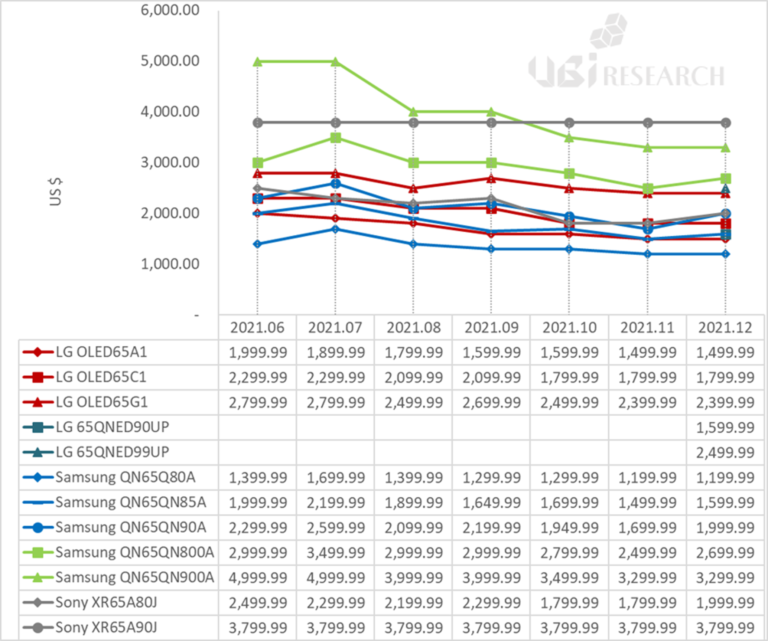

We experienced fierce price competition in the first half of 2022 among premium TVs with a launch price of $2,000 or more. It will be interesting to see how the Amazon Prime Day event scheduled for July will affect TV prices.

2022 OLED TV prices until June 2022 was analyzed based on 65 inch TVs. The standard was the selling price on Bestbuy.com and Sony’s QD-OLED TV selling price on their official website.

LG Electronics’ WOLED TVs B2, C2, and G2 released in March were $2,300, $2,500, and $3,200, respectively. Samsung Electronics’ QD-OLED TV S95B was $3,000. Sony’s WOLED TV A80K was priced at $3,800 and QD-OLED TV A95K was priced at $4,000.

In June, the price of LG Electronics’ G2 model fell by $200, forming a price difference of $500 for each series. Samsung Electronics’ S95B model continues to maintain a price difference of $200 lower than LG Electronics’ high-end model G2. Sony lowered the price of the WOLED TV A80K by $300, while maintaining the price of QD-OLED TV A95K.

Samsung Electronics’ S95B and LG Electronics’ high-end OLED TV G2 are in heavy price competition. Sony is setting the price of QD-OLED TV higher than WOLED TV.

The price competition is also fierce between OLED TVs from each set makers and Neo QLED TVs with Samsung Electronics’ mini-LED technology.

As of June, the prices of Samsung Electronics’ 4K Neo QLED TVs, QN85B, QN90B, and QN95B, are $1,800, $2,600, and $3,300, respectively. The 8K Neo QLED TVs QN800B and QN900B are $3,300 and $4,800.

The prices of Samsung Electronics’ 4K Neo QLED TV series and LG Electronics’ 4K OLED TV series are similar. Within Samsung Electronics’ entire TV series, QD-OLED TV is located between 4K Neo QLED and 8K Neo QLED. Sony’s OLED TV series, which is highly evaluated in terms of picture quality, is competing in price with Samsung Electronics’ 8K Neo QLED TV series.

Although this price trend is expected to continue this year, aggressive marketing following the Amazon Prime event in the second half of the year and the Qatar World Cup is expected to be strong variables. Attention should be paid to how LG Electronics’ OLED TV with micro lens array technology, which is expected to be released next year, will affect the premium TV market in the future.

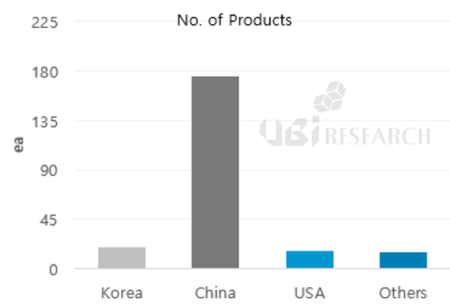

The number of OLED smartphone launches, which had steadily increased from 2019 to 2021 reached only 110 units in the first half of 2022. 137 units had been released in 2019, 166 units in 2020, and 225 units in 2021. If this industry trend continues in 2022, OLED smartphones expected release will only be similar to 2021 or even slightly fewer than it had been last year.

Most of the smartphones released in the first half of 2022 were made in China. 98 products from China accounted for 89% of market share, followed by 9 products from Korea, 2 from Japan, and 1 from India.

By size, 6.6-inch products were the most with 34 types, followed by 6.4-inch products with 31 types and 6.7-inch products with 21 types. The largest sized product was Vivo’s ‘X Fold’, which was an 8.03-inch foldable. Not including the foldables, Vivo’s ‘X Note’ was the largest at 7.0 inches. The smallest product was Sony’s ‘Xperia 10 IV’, which was 6.0 inches.

By design, 102 types of punch hole models were released, with 4 narrow bezel types, 2 notch types, and 2 UPC types. There were two types of smartphones with UPC (Under Panel Camera) applied: ZTE’s Axon 40 Ultra and Nubia Red Magic 7 Pro.

By resolution, 51 products with 300ppi range, 50 products with 400ppi range, and 9 products with 500ppi or higher were released. No products under 300ppi were released. The product with the highest resolution was Sony’s ‘Xpeia 1 IV’, which had a resolution of 643ppi.

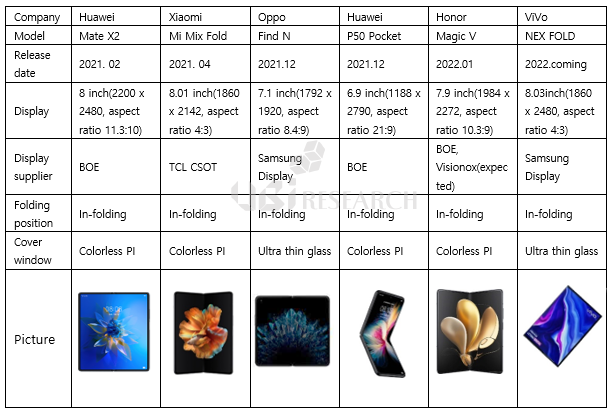

There were three foldable phones released in the first half of the year: Vivo’s ‘X Fold’, Honor’s ‘Magic V’, and Huawei’s ‘Mate Xs2’. All three types of foldable phones have a punch-hole design. The resolution of ‘Mate Xs2’ was 424ppi, which is 10ppi higher than the average OLED smartphones released in the first half of the year. Whereas ‘X Fold’ and ‘Magic V’ were two products with the lowest resolution among OLED smartphones released in the first half of the year.

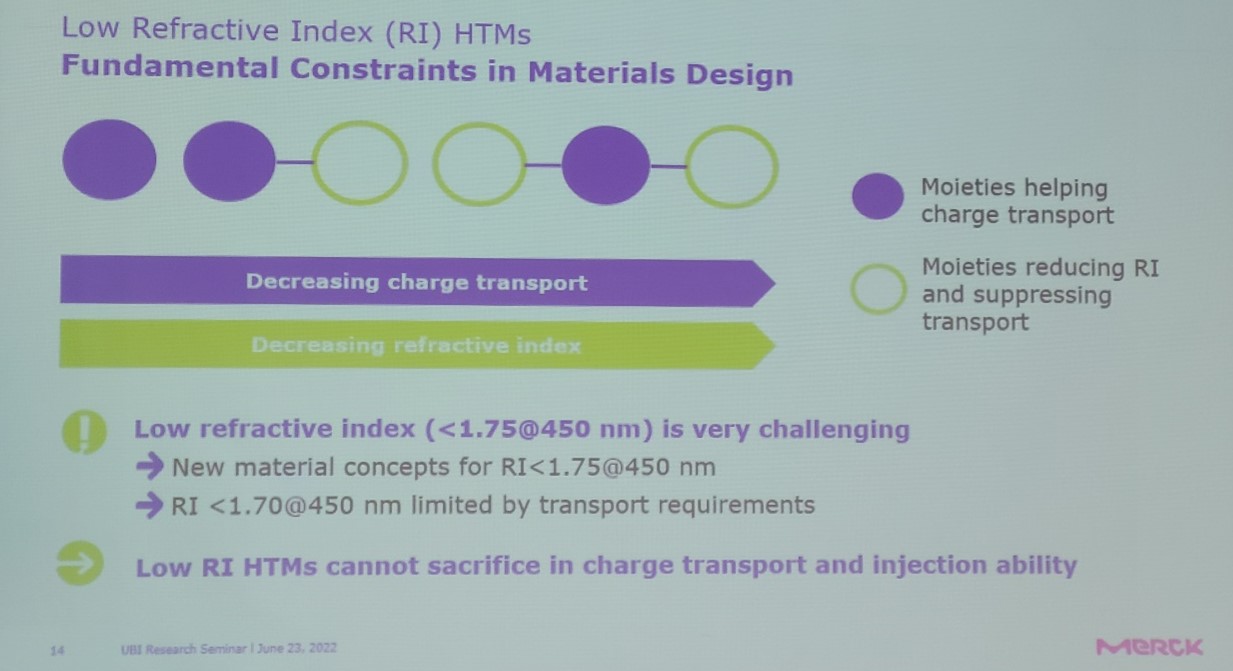

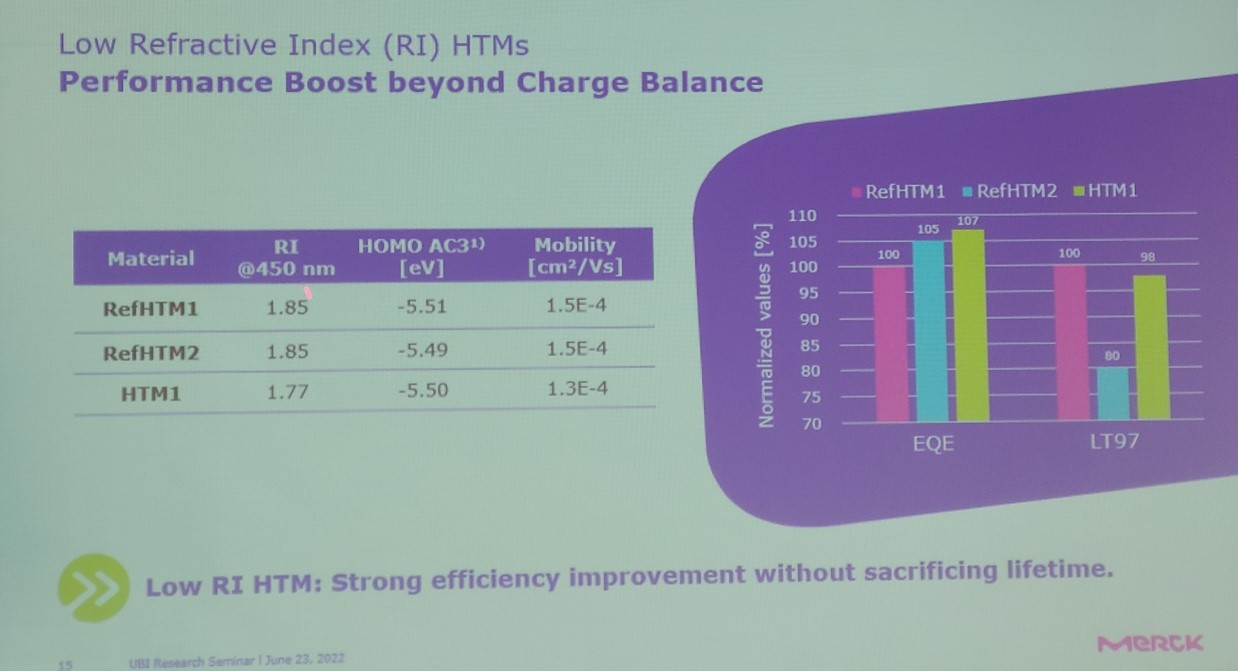

At the ‘OLED settlement seminar for the first half of 2022’ held at COEX on June 23, Merck’s Kim Jun-ho, head of research institute, said, “The concept of the refractive index of the emitting layer is often applied to the capping layer on the cathode, but now it is also required for HTL” and mentioned that the light extraction efficiency can be improved through the optimized refractive index design of HTL.

Next, Kim said, “Because the refractive index of HTL has a trade-off relationship with the hole transport capacity, it is difficult to adjust the refractive index,” and “Even though it was lowered to 1.77 from 1.85, the light extraction efficiency could be improved by 7% without an increase in the driving voltage or a decrease in electron mobility.”

Recently, panel makers are continuously developing the OLED light extraction efficiency. This is because by increasing the light extraction efficiency, as a result, the battery life can be increased. Representative examples include a high-refractive capping layer and micro lens array, and an on-cell film that removes the polarizer and uses a color filter.

The concept of the refractive index of the light emitting, which had been concentrated on the capping layer, is extended to the common layer, and it is expected that panel makers will intensify technological competition, and that there will be many changes in the supply chain of emitting materials of panel makers in the future.

Although there is still a gap in display technology between Korea and China, it has been argued that Korean display companies should have price competitiveness as soon as possible.

On the 23rd, at the ‘OLED Settlement Seminar for the first half of 2022’ held at COEX in Samsung-dong, Seoul, UBI Research CEO Choong-Hoon Yi made a presentation on ‘Forecast of the small OLED market, which China is chasing fiercely’.

CEO Yi announced, “Currently, the media reports that the technological gap between Korea and China has almost narrowed, but making and displaying products and mass-producing products are two different things, and the technological gap between Korea and China is still significant.” He continued, “Samsung Display is planning various products such as slideable and Z-folding based on technological competitiveness. However, it will be difficult to commercialize it immediately because the slideable phone invades the existing foldable phone market.”

CEO Yi said, “It is very important not only to develop technological competitiveness, but also to increase price competitiveness. The reason Korean companies closed the LCD business is not because of the good technology of Chinese companies, but because they were pushed back in price competitiveness.”, and “As the technology advances, the performance difference felt by ordinary consumers becomes insignificant, so products with good price competitiveness are inevitable in the market,” he analyzed.

Finally, “China’s OLED industry is growing under the enormous support from the government. In order not to lose the lead in the OLED market like LCD to China, it is essential for domestic companies to prepare for price competitiveness and the government’s support policy,” he concluded.

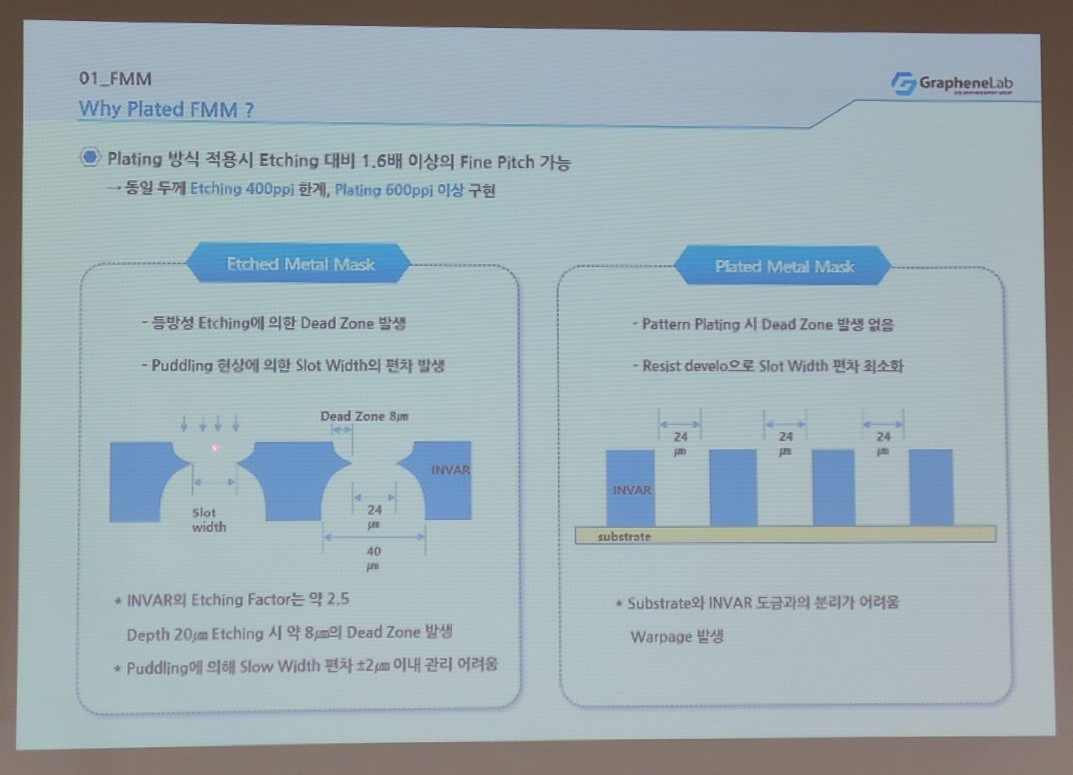

GrapheneLab, a graphene commercialization technology company, announced that it is possible to manufacture FMMs over 800ppi using graphene.

At the ‘UBI Research First Half 2022 OLED Settlement Seminar’ held at COEX in Samseong-dong, Seoul on the 23rd, GrapheneLab CEO Yong-duk Kwon said, “In the early 2000s, FMM technology, which started in the early 2000s, was not interested in the plating method. It is changing,”, and “After 2013, many patents related to the plating method FMM manufacturing technology have been applied, and it is easier to apply the plating method than the currently used etching method in order to go to high resolution.”

Next, CEO Kwon said, “We moved away from the existing limiting etching method FMM and applied the plating method FMM. Compared to the etching method, where 400ppi was the limit at the same thickness, the plating method realized more than 600ppi.”, “Etched metal mask has a dead zone of 8um in length due to the INVAR structure that becomes sharp like a dot when etching at a depth of 20um, whereas there is no dead zone during pattern plating of the plated metal mask.”

Lastly, CEO Kwon said, “For the MSAP electroforming technology, a low coefficient of thermal expansion with a thin thickness is required. As a result of measuring the coefficient of thermal expansion using TMA on the plated sample, it was measured up to 3.1ppm, and it went down to 2.5ppm without heat treatment.”

iPhone13/Apple

It seems that BOE has started line operations for iPhone 13.

Back in March, most of the iPhone 13 shipments were canceled due to an issue with Apple. BOE will now resume production. With this new development, BOE’s forecast for iPhone 13 production this year is expected to increase after being adjusted down in March.

BOE has a total of 20 iPhone module lines at its B11 (Mianyang) plant. BOE’s production of the iPhone 13 is believed to have begun in early June and production of the iPhone 14 is expected to begin as well. The B11 factory has iPhone 13 line to produce iPhone 12 and 13 and iPhone 14 module line exclusively for iPhone 14, as the process is quite different from iPhone 13 line.

Details of BOE’s iPhone 13 and 14 production volume, panel unit price, and module line by product can be found in UBI Research’s ‘China Trend Report’. UBI Research’s ‘China Trend Report’ can be inquired on the UBI Research website.

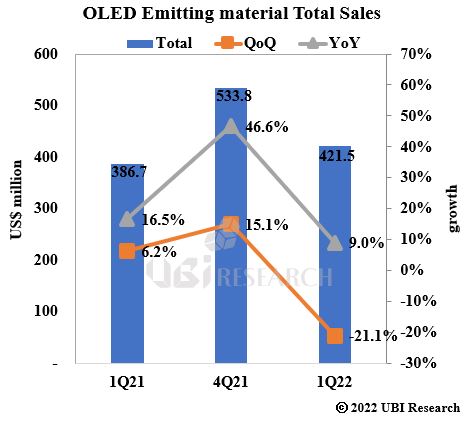

According to “2Q22 OLED Emitting Material Market Track”, a quarterly report published by UBI Research, the sales of emitting materials in the first quarter were $421 million, down 21.1% (QoQ) from $533 million in the previous quarter but was an increase by 9% (YoY)when compared to $386 million in the first quarter of 2021.

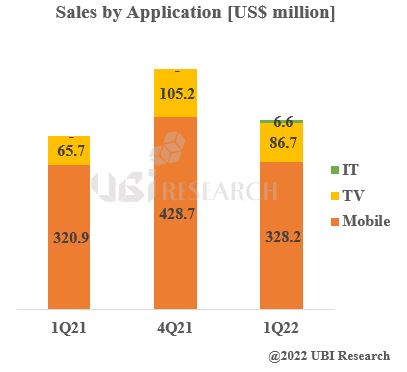

Although sales of emitting materials for TV and mobile devices decreased compared to the previous quarter, IT sales recorded a meaningful figure of $6.6 million. Although sales fluctuate depending on seasonal demand for applied products, if the sales of emitting materials are analyzed by application product, TV use is gradually increasing.

The top 3 companies in 1Q sales were UDC($86.6 million), DuPont($41.3 million), and Duksan($37.5 million). Duksan became the number one company in sales as a Korean company. The overall sales of luminescent materials in the first quarter decreased compared to the previous quarter but only UDC’s sales increased. Sales decreased to $421.5 million in 1Q22 from $533.8 million in 4Q21. However, UDC’s 1Q22 sales increased to $86.6 million from 4Q21’s sales of $85.5 million. It is estimated that this is due to the rise in the price of rare earth metals, a key material for manufacturing dopant.

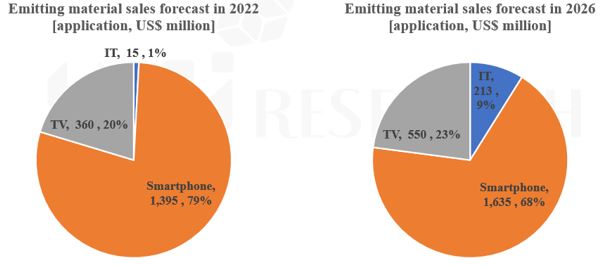

Estimated sales of emitting materials in 2022 are $1.77 billion and are expected to grow to $2.4 billion in 2026.

By application product, the projected sales of emitting materials for smartphones this year are $1.4 billion, accounting for 79% of the total.

Of the projected sales in 2026, emitting materials for TV are expected to reach $550 million, which is expected to increase by 23%. In addition, emitting materials for IT are expected to account for 9% of $210 million.

“OLED Emitting Material Market Track” surveys and analyzes the market for quarterly OLED emitting materials. The total market of light emitting materials was identified by examining sales by light emitting layer and common layer. Performance analysis was categorized by country, panel maker, application product, layer, and OLED method (RGB, WRGB, QD-OLED). In addition, OLED market information for the next five years (up to 2026) was forecasted by predicting the amount of emitting material usage and sales by company. The quarterly market track provides necessary information to industry professionals who lead the OLED industry.

<Honor 70 With Panels Supplied by Visionox>

Chinese panel makers such as Visionox and BOE are expected to face losses due to cost pressures.

The operation rate of Visionox was analyzed to be high. This is because Visionox is exclusively producing 70-80% of Honor, a large Chinese smartphone manufacturer.

However, despite the high operation rate, Visionox’s business status is precarious at best. Through cooperative efforts, Visionox was allocated most of Honor’s panel production quantity, but it is known that Honor has requested additional panel price reduction. According to some sources, Visionox is currently facing a loss of about 200 million yuan per month due to the reduced panel price.

BOE, the largest panel maker in China is also facing trouble. BOE along with Visionox had previously been in charge of panel production for Honor but received almost no allocation of production volume from Honor. Earlier this year, BOE faced tremendous difficulty due to the cancellation of existing iPhone 13 shipments to Apple. In April, BOE’s CEO Gao Wenbao felt a sense of crisis due to pressure on OLED and LCD volume and price and gave direct orders on cost reduction. Currently, BOE’s OLED line operation rate is less than 40% and it is estimated that the OLED business unit may incur a loss of about 10 billion yuan this year.

LCD, which is one of the main businesses of Chinese panel makers, is continuously falling in prices and the supply and demand of panels from smartphone set makers are sluggish. If an appropriate countermeasure is not found, Chinese panel makers will continue to experience a growing deficit in the display business.

□ OLED supporting 240Hz, installed in new MSI notebooks

□ Emerging as a ‘game changer’ in the gaming laptop market with high refresh rate OLED

<World’s first 240Hz OLED laptop from MSI featuring Samsung Display OLED delivers game changing lifelike immersiveness>

<World’s first 240Hz OLED laptop from MSI featuring Samsung Display OLED delivers game changing lifelike immersiveness>

Samsung Display today announced the start of mass production of the world’s first OLED displays for laptops with high refresh rate of 240Hz. The new panel will make its debut in MSI’s latest 15.6-inch gaming laptop, Raider GE67 HX, upping the ante in the fiercely competitive gaming market for high-performance displays.

Samsung Display’s OLED exceptional advantages of wide color gamut, high contrast ratio, true black and low blue light are not only recognized by smartphone users but by discerning laptop users as well. Beyond visual elements, specifications that affect actual gameplay such as response time and refresh rate, are more critical to gaming laptop users and the reason many players are opting for OLED products.

Refresh rate, or the number of times a display can update its image in one second, is a key factor in display performance. The higher the refresh rate, the smoother the movements on a screen without afterimages. As displays featuring higher refresh rates present better image transitions, they are the tools of choice among first-person shooter (FPS) players who need to perceive fast-changing game situations as quickly as possible.

“OLED with high refresh rate is the perfect combination for a premium gaming experience, with super-low response time, super-wide color gamut, and super-high contrast ratio. In addition, it balances well between high resolution and high refresh rate performance,” said Clark Peng, Vice President of MSI Notebook Product Management Division. “Therefore, the latest 240Hz OLED display is suitable for high-performance enthusiasts and content creators as well as for gamers enjoying premium games,” he added.

“Our new 240Hz refresh rate OLED meets and exceeds the demand of consumers who have long been waiting for a laptop with a high refresh rate OLED panel,” said Jeeho Baek, Executive Vice President and Head of Samsung Display Strategic Marketing for Small and Medium Business. “The clear advantages offered by high refresh rate OLED panels compared to LCDs will be a game changer for the gaming industry.”

To introduce Raider GE67 HX to the world, MSI will hold a new product launching event on its YouTube channel on June 7, 2022, 10:00 a.m. PDT under the theme “MSIology: Ahead of the Curve.

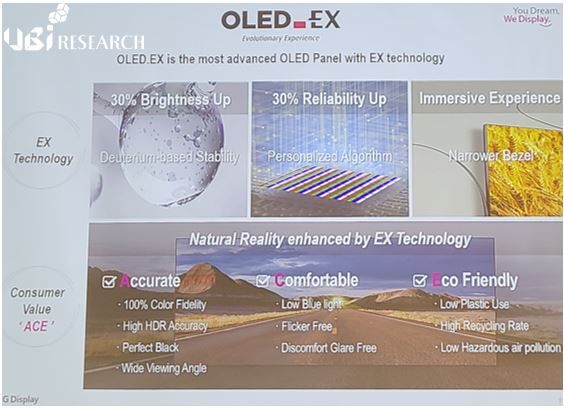

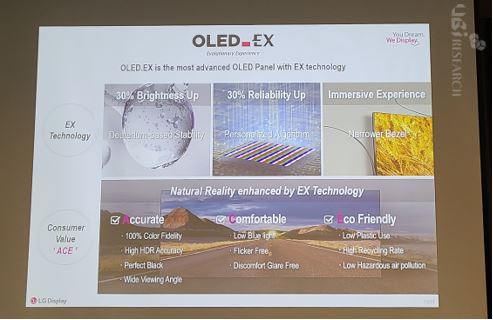

2As Samsung Display’s QD-OLED begins to be applied to TVs and monitors in earnest in 2022, technological changes are being detected for LG Display’s WRGB OLED, which has been leading the large OLED market.

LG Display’s WRGB OLED has produced a WBC structure consisting of two blue layers and one red+yellow green layer in Paju by the end of 2021, and a WBE structure consisting of two blue layers and one red+green+yellow green layer in Guangzhou. Deuterium substitution technology was applied to the blue of the WBE structure.

Since 2022, LG Display has stopped producing WBC panels from its Paju line and has been producing ‘OLED.EX’ panels with deuterium substitution technology applied additionally to green of WBE produced in Guangzhou.

<Photo of OLED.EX presented by LG Display at the 2022 OLED Korea Conference>

At SID 2022, LG Display also exhibited a large OLED panel with micro lens array technology. Micro lens array technology was applied to Samsung Electronics’ ‘Galaxy S Ultra’ series, and it is the first technology applied to large OLEDs. LG Display is known to expect a 20% improvement in luminance compared to the previous one by applying micro lens array technology. Panels which micro lens array technology is applied are expected to be produced in Paju from the second half of this year.

Lastly, it is known that LG Display is developing a structure in which yellow green is removed from WRGB OLED. By eliminating yellow green, material and processing costs can be saved, and color gamut is expected to be improved.

Attention is paid to how LG Display’s WRGB OLED will evolve to compete against QD-OLED.

<OLED panel with micro lens array technology exhibited by LG Display at SID 2022>

Rollable 8” Display

300 ppi color and black and white

Resolution (pixel) : QHD (2560 x RGB x 1440)

Pixel Density : 202PPI

Brightness :1,000 cm/m²

Contrast Ratio : 1,000,000 : 1

Color Gamut : 100% NTSC

Pixel Configuration : Color Conversion

Viewing Angle : 179° / 179° / 179° / 179°

LED Size : 30um

Resolution : 1920(H) * RGB * 1080 (V)

Frame Rate : 60Hz

Active Area(mm) : 309.12(H) X 173.88(V)

Color Gamut : DCI-P3 → 99%

Color Temperature : 6500K

Brightness : 200nits

Contrast Ratio : 1,000,000 : 1

Crimp Radius : R20mm

Crimp Life : 100,000 times

Resolution 2592 x 2176

Sliding Reel Radius 4.5mm

Machine Thickness 12.4mm

Sliding Distance 34mm

BOE, the largest display maker in China, produces UPC (Under Panel Camera) panels with transparent PI substrates.

UPC is a technology that makes a full screen of a smartphone possible by placing the front camera under the screen. The UPC technology that is currently commercialized is a method of patterning the cathode electrode and changing the resolution near the camera. However, this time it is expected that a transparent PI substrate will be additionally applied to the UPC panel supplied by BOE to Oppo.

Existing transparent PI substrates had difficulties in mass production due to the high process temperature of LTPS TFT. Yet, the recent test results of the panels with the transparent PI substrate produced by BOE reached most conditions of satisfactory levels even at the LTPS TFT process temperature.

The UPC OLED panel with the transparent PI substrate developed by BOE is expected to be installed in Oppo’s upcoming products.

<Apple iPhone 14 Series Specifications>

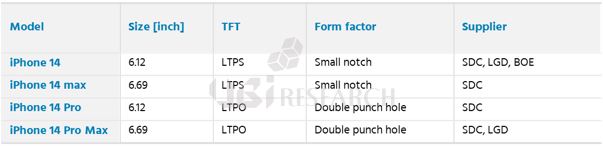

Samsung Display, LG Display, and BOE are expected to supply panels to Apple’s new iPhone 14 series in 2022. It is expected that Samsung Display will supply panels to all models in addition to iPhone 13 series. LG Display will supply 6.12-inch LTPS models and 6.69-inch LTPO models. BOE will supply panels only to 6.12-inch LTPS models.

The existing 5.4-inch mini model has been removed from the iPhone 14 series and a 6.69-inch Max model has been added. The size and resolution of iPhone 14 Max are the same as iPhone 14 Pro Max and LTPS TFT is applied instead of LTPO TFT.

In terms of design, the iPhone14 Pro and 14 Pro Max will have a punch hole design instead of the conventional notch. Apple’s punch hole design is expected to be applied as a double punch hole design due to various sensors and cameras.

Meanwhile, the total OLED panel supply to Apple in 2022 is expected to be about 215 million units, with Samsung Display expected to supply 135 million units, LG Display 55 million units, and BOE 25 million units. However, shipments are expected to be organically controlled due to market conditions and Apple’s policies.

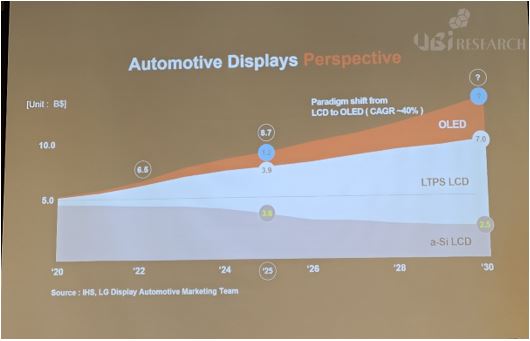

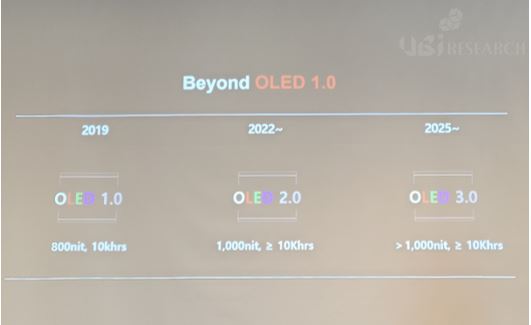

At the keynote session of UBI Research’s ‘2022 OLED Korea Conference’ held from April 6th to 8th, Sang-Hyun Ahn, Managing Director of LG Display, announced, ‘The Present and Future of Automotive OLED Display: LG Display’s Future Outlook’.