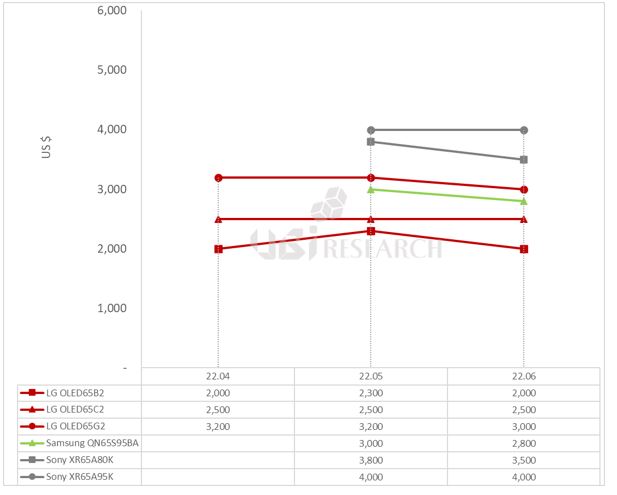

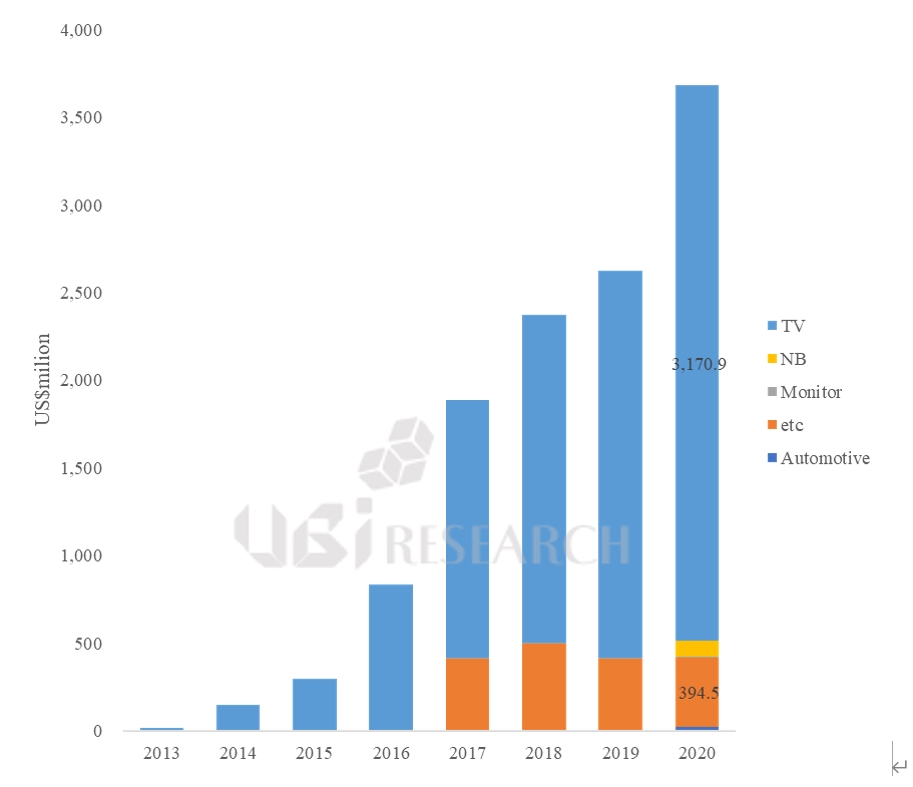

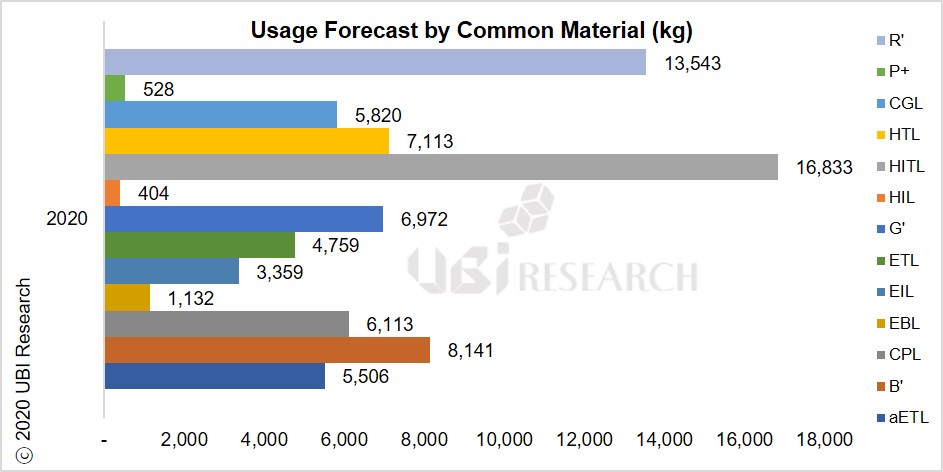

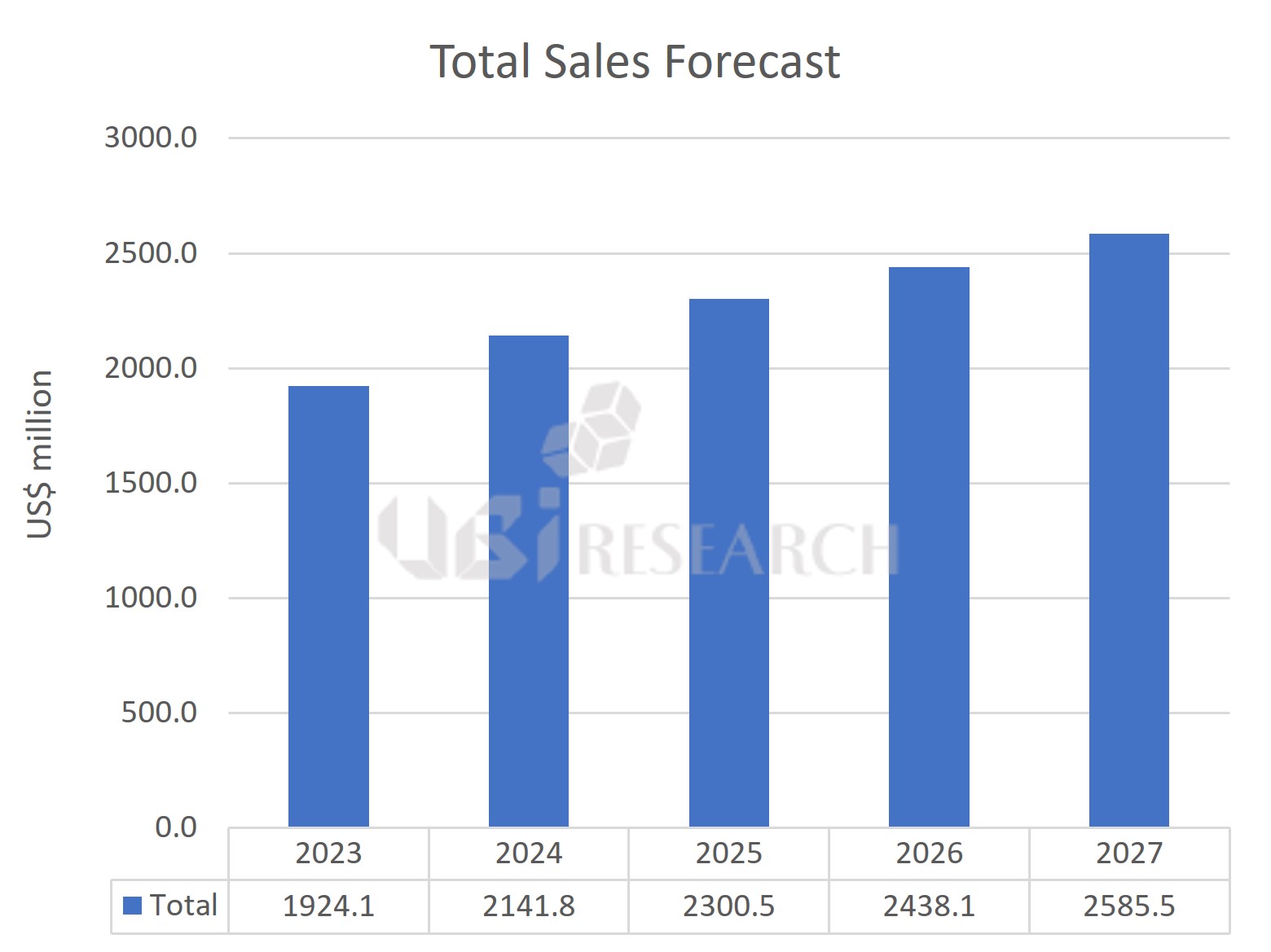

OLED emitting materials market in 2027 expected to reach US$ 2.59 billion with an average annual growth rate of 7.7%

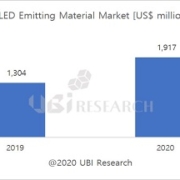

According to the ‘2023 OLED Emitting Material Report’ recently published by UBI Research, the total emitting material market is expected to reach US$ 2.59 billion in 2027 with an average annual growth rate of 7.7% from US$ 1.92 billion in 2023.

total emitting material market

Analyst Yoon Daejeong of UBI Research said, “The small OLED material market is expected to grow at an average annual growth rate of 2.5% from 2023 to US$ 1.61 billion in 2027. And in 2027, Samsung Display’s purchase of small OLED materials is expected to be US$ 560 million, BOE US$ 430 million, and LG Display US$ 200 million.” and “the small OLED material market will change depending on how much the foldable OLED market replaces the sharp decline in rigid OLED shipments for smartphones.

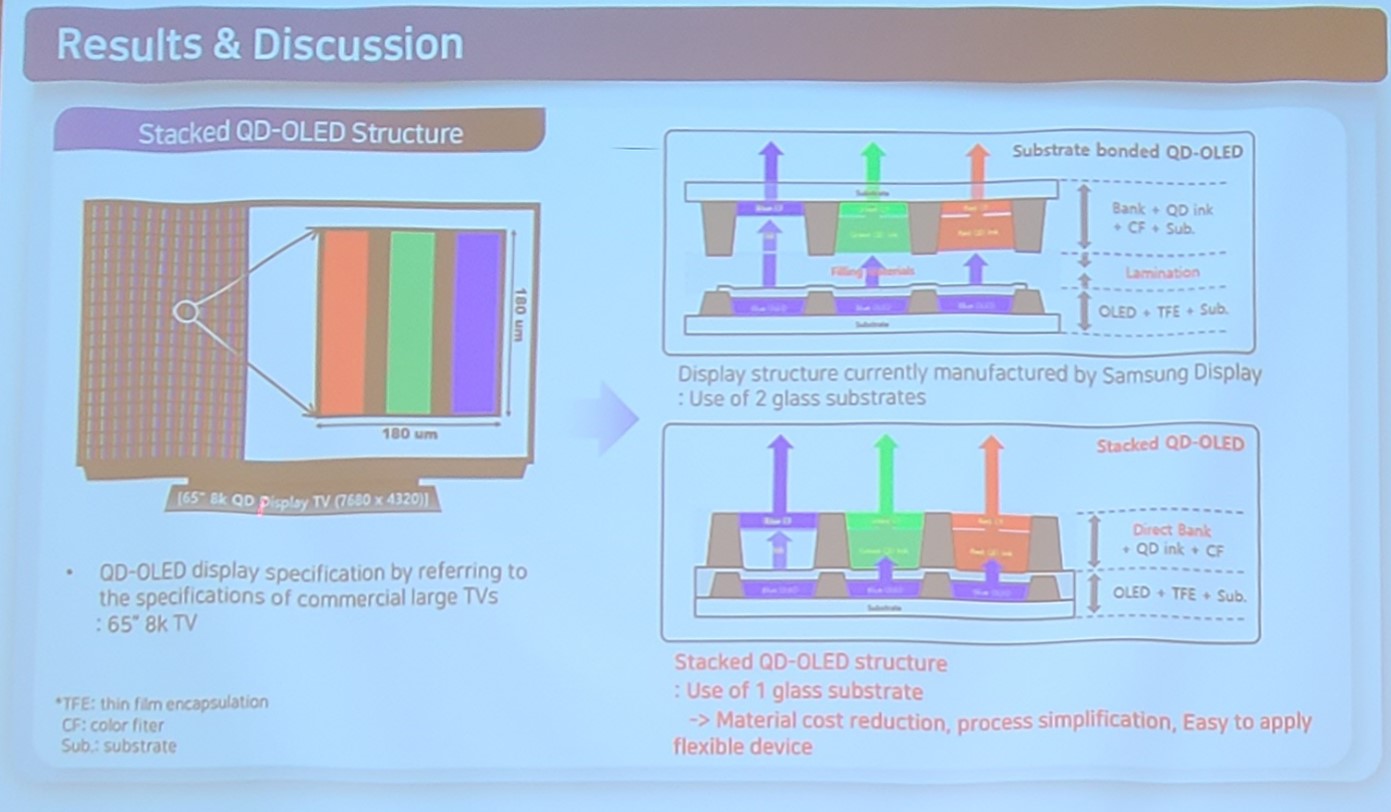

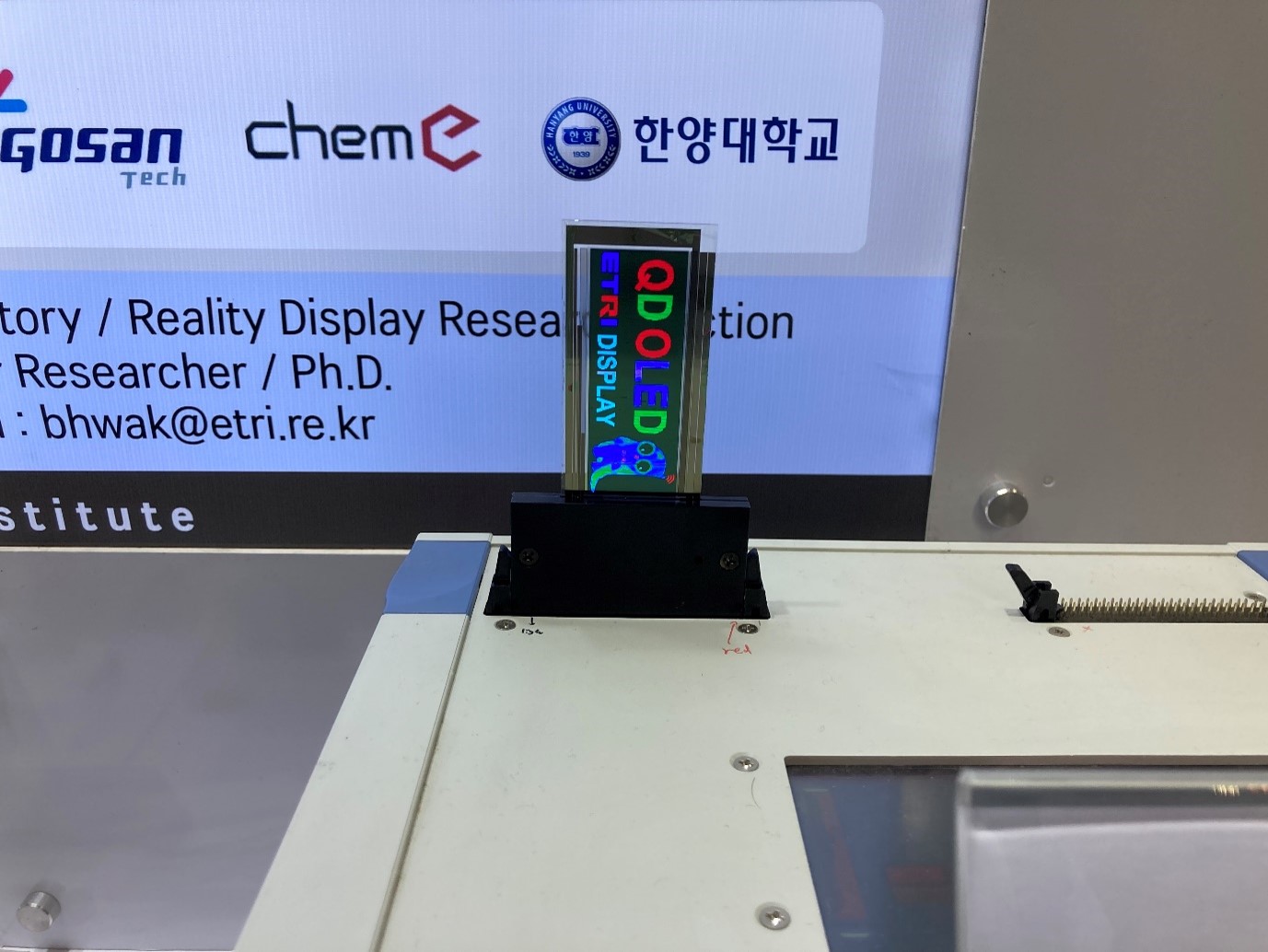

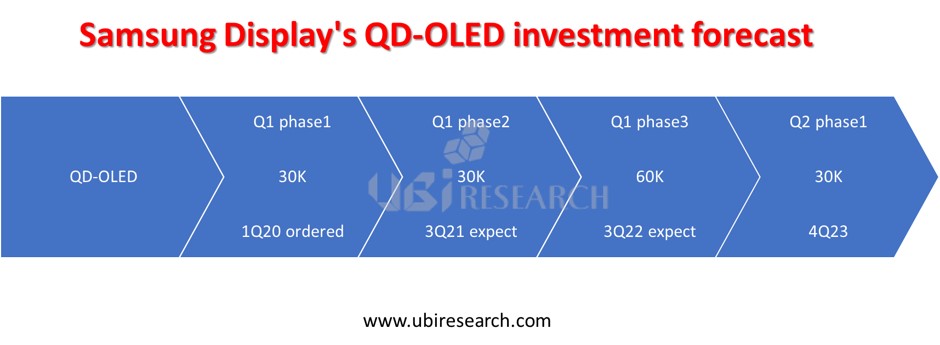

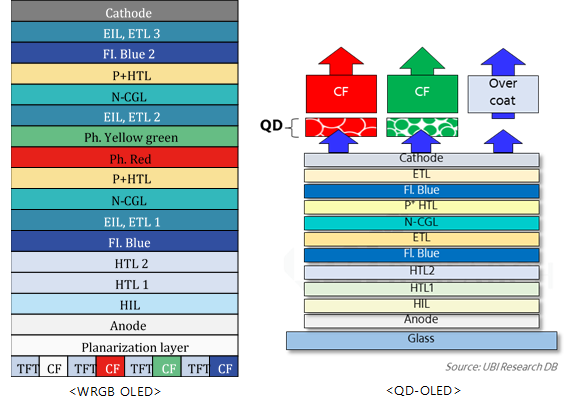

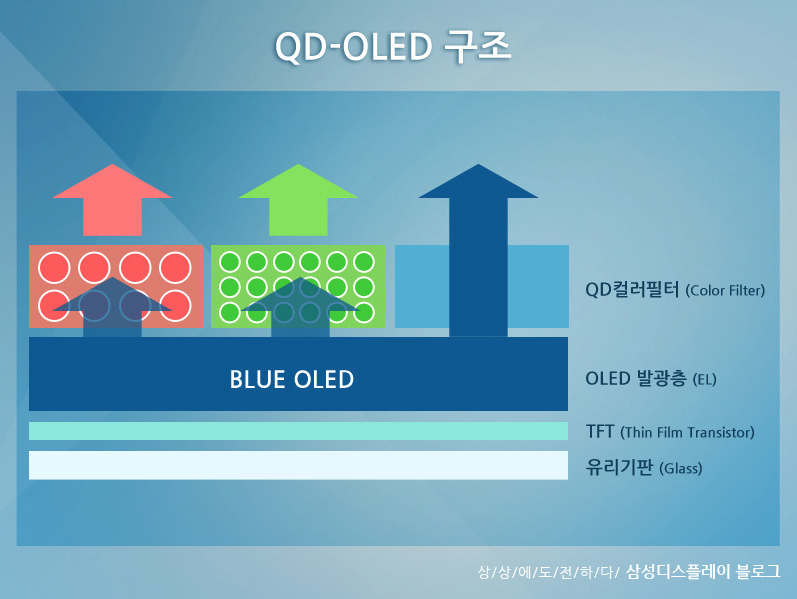

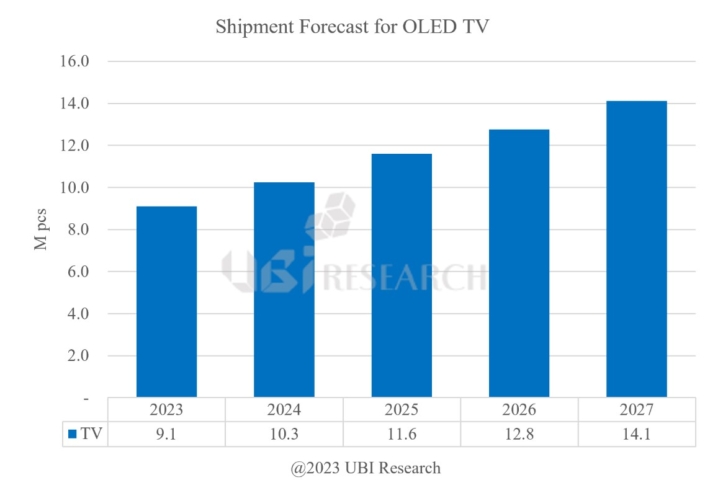

Analyst Yoon continued, “As the shipments of LG Display’s WOLED and Samsung Display’s QD-OLED are expected to be 12 million units and 3 million units, respectively, in the large OLED material market in 2027, the purchase amount of emitting materials is also expected to be US$ 430 million and US$ 140 million, respectively”

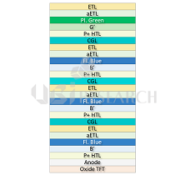

Meanwhile, the report predicted that by OLED method in 2027, RGB OLED would occupy the largest share at 66.6%, followed by WOLED at 16.5%, RGB 2stack OLED at 11.4%, and QD-OLED at 5.5%.

2023 OLED Emitting Material Report Sample Download

2023 OLED Emitting Material Report Sample Download

UBI Research website

UBI Research website