Samsung Display advances mass production of 8.6G OLED line, Chinese panel companies are catching up

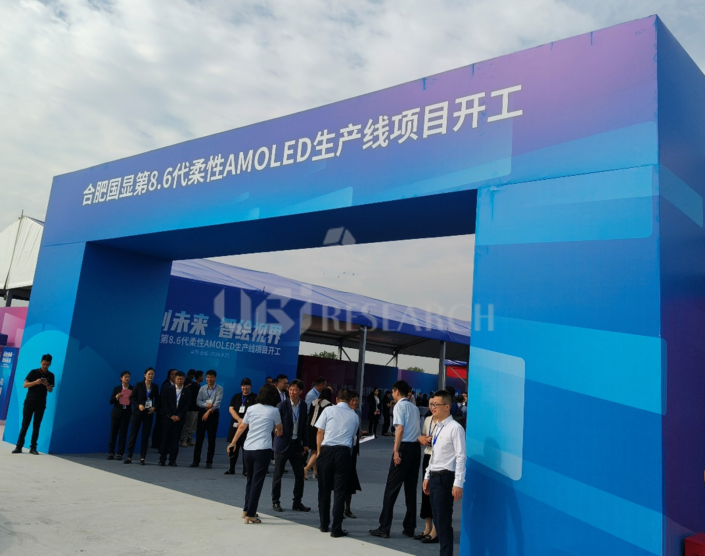

Hefei Visionox V5 groundbreaking ceremony held last September

Recently, there is news that Samsung Display is moving up the mass production of the A6 8.6G OLED line to the end of 2025. Following Samsung Display, Chinese panel companies are also rapidly investing.

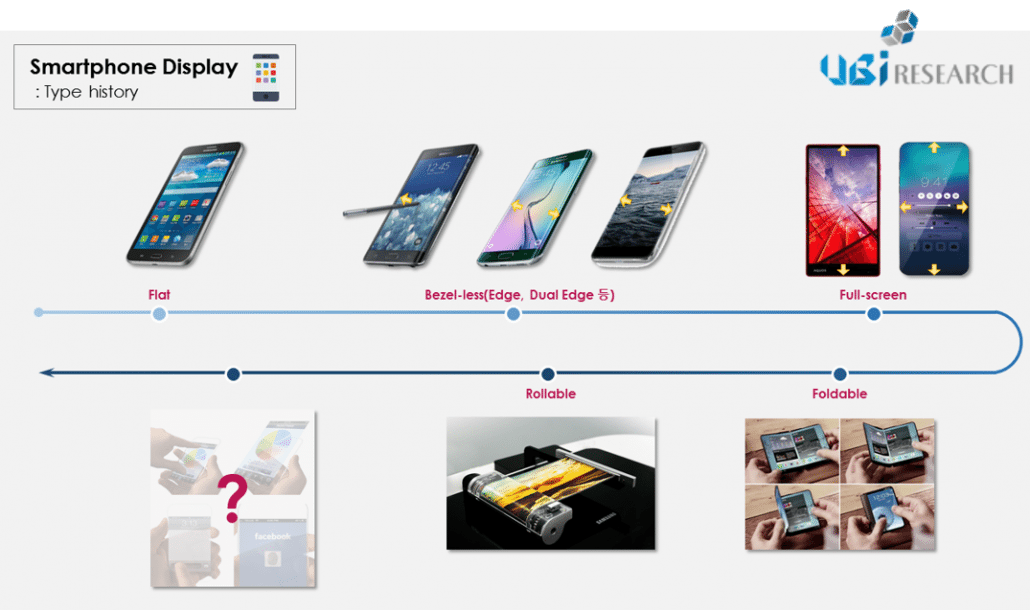

The biggest reason why OLED panel companies are rushing to invest in the 8.6G OLED line is the chamfer rate. Initially, OLED began to be applied to small and medium-sized products first, and when producing small and medium-sized products of 10 inches or less, a sufficient chamfering rate could be achieved even with the size of a 6G substrate. However, as OLED began to be applied to IT products with large panel areas, unlike small and medium-sized products, the unusable and discarded area in the 6G line increased, and to solve this, a line using a larger substrate was needed.

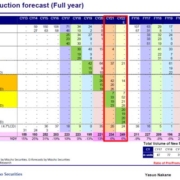

Samsung Display, the leader in the 8.6G OLED line, began building a production line early this year and plans to begin mass production at the end of 2025. Samsung Display invested in the 8.6G line to mass-produce 2-stack tandem OLED for Apple’s MacBook Pro, but mass-produced it earlier than originally planned, gaining time before mass-producing panels for MacBook Pro. Before mass producing panels to be supplied to Apple, Samsung Display is expected to first mass produce tandem OLEDs to be supplied to laptop set makers such as Samsung Electronics, Dell, HP, and Lenovo.

BOE, a latecomer, also began investing in the 8.6G line. BOE is expected to bring in two deposition machines from Sunic Systems in 2025 and begin mass production in the third quarter of 2026. BOE’s 8.6G line mass production period is from the third quarter of 2026, but like the iPhone, it is expected to be difficult to supply IT OLED panels to Apple in the early stages. Like other 6G lines, it is expected to initially mass produce panels for the Chinese domestic market and improve product quality to supply products to Apple. BOE is currently investing in module lines sequentially, and a total of 18 module lines are scheduled to be invested in Phase 1. Unlike Samsung Display, BOE is simultaneously investing in modules for smartphones and small and medium-sized OLEDs as well as IT OLEDs in the 8.6G line.

Following BOE’s lead, Visionox also invested in 8.6G. Last September, a groundbreaking ceremony was held for Visionox’s 8.6G OLED line, V5, in Hefei, and when Chinese President Xi Jinping visited Hefei’s V5 line in October, it received positive reviews. Additionally, it is understood that Visionox officials visited Korean equipment companies and held meetings this month. Visionox plans to attract government investment based on ViP (Visionox intelligent Pixelization), but due to technical difficulties in vertical deposition, it is likely to be used only as a pilot line.

It was discovered that TCL CSOT is also preparing to invest in an 8.6G line based on inkjet technology. There is a high possibility that an investment announcement will be made at the end of the year. The location is Guangzhou City, and the line capacity is 16K for the inkjet method and 16K for the FMM method, with a total investment of 32K likely to be made.

In addition to the companies mentioned above, Tianma also has the possibility of investing in the 8.6G line, and HKC is considering new investments in 6G OLED. Now that Chinese panel companies are following in the footsteps of Samsung Display, which made its first investment, attention is being paid to how Samsung Display will widen the technology gap.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

China Trend Report Inquiry

China Trend Report Inquiry