UBI Research Lowers Forecast of OLED Market for ≥ 55 inch TV by Approx. 20-30%

55inch LG OLED TV

55inch LG OLED TV

OLED Smartphone Galaxy Note7(Source = Samsung)

Hyunjoo Kang / jjoo@olednet.com

OLED smartphone market is growing prominently in the global market. Q2 2016 global 4~6 inch OLED panel shipment increased by 72% compared to the same period in 2015.

According to investigation by UBI Research, the shipment of OLED panel for smartphone in Q2 2016 is 88 million units, an increase of 72% compared to 51.2 million units in Q2 2015. This rapid growth of 4~6 inch OLED panel is led by key smartphone companies in Korea and China.

Samsung Electronics, a leading representative of OLED smartphone market, is expanding OLED smartphone products. The company recently announced flexible OLED panel equipped Galaxy Note 7, a first for a Galaxy Note series.

Not only Samsung, but Chinese companies are leading the market growth expanding the OLED application. In particular, Huawei’s smartphone business growth is significantly affecting OLED market. According to a market research company IDC, the global smartphone sales of the same period is only 3%. However, the sales of Huawei, possessing numerous OLED smartphone products, increased by 25% in H1 compared to the same period in 2015.

According to UBI Research, the total revenue of Q2 2016 global smartphone OLED panel market is USD 3,160 million, approximately 27% increase compared to the same period in 2015.

Flexible OLED Equipped Smartphone Galaxy note 7

Hyunjoo Kang / jjoo@olednet.com

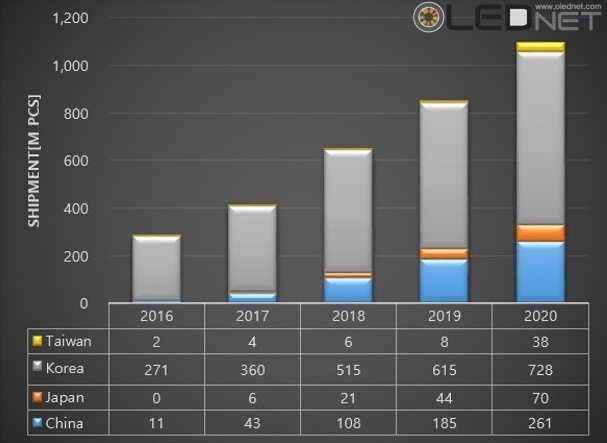

Global smartphone OLED panel shipment is expected to exceed 300 million units for the first time in 2016, and exceed 1,000 million units in 2019.

On 16 August, UBI Research forecast that the global shipment for 4-6 inch OLED panel for smart phone is expected to be 318.8 million units, approximately 27% increase from 2015.

From then on, 2017 is estimated to record 505.3 million units, 902.5 million units in 2018, 1,170.2 million units in 2019, and 1,379 million units in 2020.

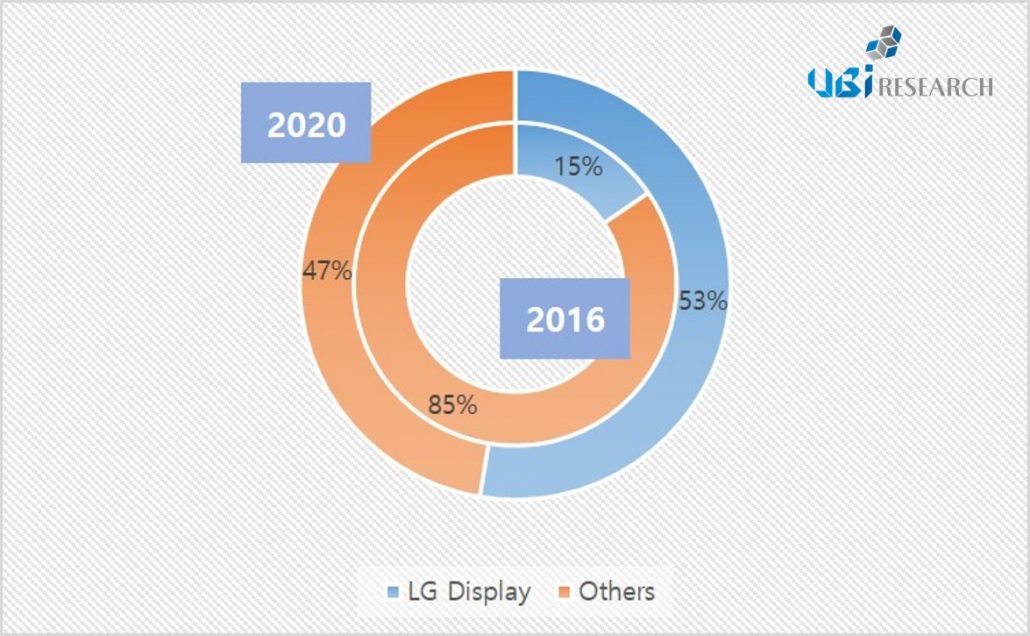

UBI Research forecast that rapid growth of flexible OLED for smart phone in particular will lead the total smart phone OLED shipment increase. According to UBI Research’s investigation, rigid type of smart phone OLED shipment is expected to dominate the total smartphone OLED shipment in 2016 with 78%.

However, in 2018, flexible OLED panel is estimated to record 56% and exceed rigid. The market share of flexible is expected to increase to 62.3% in 2019, and 67% in 2020; it is forecast to be the main force within the smartphone OLED market.

IHS, another market research company, also forecast that the smart phone OLED panel shipment will exceed 300 million units for the first time in 2016. IHS estimated the smartphone OLED shipment to be 366.88 million units in 2016 and 663.66 million in 2019, and showed some difference from UBI Research.

eMagin`s Microdisplay (Source = eMagin)

Hyunjoo Kang / jjoo@olednet.com

eMagin, an OLED microdisplay company which is a technology that is needed for VR device, AR device, medical device, etc., showed 3.8% fall in H1 2016 sales compared to the same period last year with net loss of USD 2.404 million.

According to eMagin’s Q2 2016 performance results announced on 11 August, the company recorded sales of USD 5.5 million in sales, a decrease of approximately 11% compared to the same period in 2015.

As such, eMagin’s total sales in H1 is USD 12.534 million, approximately 3.8% less than H1 2015. While the product sales did not significantly differ, the government contracts suffered compared to the same period last year. However, the company recorded profit of USD 1 million in licensing revenue which did not occur in H1 2015. eMagin holds VR headset related intellectual property rights.

eMagin recorded a net loss of USD 2.164 million in Q2 2016, and a net loss of USD 2.15 million in H1 2016. Compared to the net profit of USD 0.254 million in the same period last year, this is a fall of USD 2.404 million. Andrew G. Sculley, CEO of eMagin, explained that the government contract volume was low and there were some manufacturing equipment downtime. He emphasized that eMagin is the only company that can satisfy the resolution and luminance demanded by the expanding VR and AR market.

Source = JDI

Hyunjoo Kang / jjoo@olednet.com

Japan Display, which recently drew attention when it became known that they sought financial help from the government, recorded JPY 10,600 million operating loss in H1 2016.

This company recently announced that in Q1 2016, a fiscal year that ended on 30 June, they recorded JPY 174,300 million in sales, a decrease of 29.2% compared to the same period last year, and operating loss of JPY 3,400 million, a fall of 5,600 million compared to the same period in 2015.

As such in H1 2016, JDI showed JPY 350,600 million in sales and JPY 10,700 million operating loss. It explained that the shipment in the last quarter fell short of expectations, and operating profit was poor due to China’s ASP fall, etc. In particular, it is analyzed that the poor sales of Apple’s iPhone, which has been occupying 50% of JDI sales, affected JDI’s business.

On 10 August, Japanese media reported that Mitsuru Honma, CEO of JDI, revealed that INCJ promised support. The financial support is analyzed to be for the smooth installation of OLED mass production line as well as the loss recovery.

JDI is carrying out mobile OLED mass production line and anticipated to be one of the strong candidates as OLED panel suppliers for Apple’s future new iPhone. Through this performance announcement, JDI emphasized they are planning to mass produce OLED from H1 2018.

The company forecast that they will show JPY 210,000 million in sales and JPY 1,000 million operating profit in Q2 2016 in fiscal year that ends in 30 September.

Galaxy Note 7 Records High Peak Brightness of 1,048 nit

Hyunjoo Kang / jjoo@olednet.com

DisplayMate Technologies, the leading evaluator of video screens, announced the results of a new series of comprehensive lab tests on the Galaxy Note 7 ’s display.

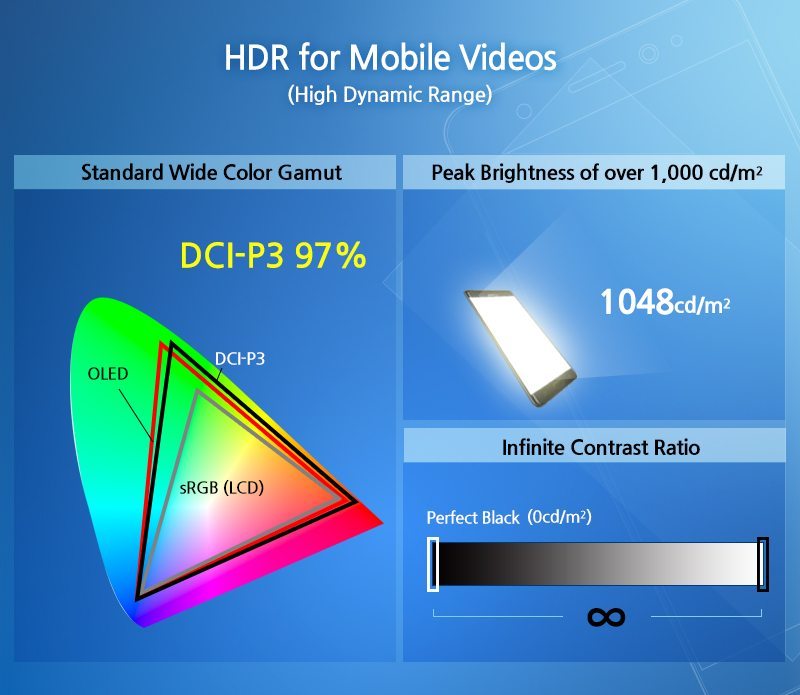

As the first smartphone to incorporate High Dynamic Range(HDR) technology for mobile video streaming, the Galaxy Note7 provides a cinema-like viewing experience. HDR, the newest performance enhancement feature developed for the latest 4K Ultra HDTVs, expands the color, contrast and brightness of video content through special image processing.

To display the latest high-end video content, the Galaxy Note7 was equipped with the newest standard Wide Color Gamut called DCI-P3 for Digital Cinema Initiative. The measured color gamut of the AMOLED Cinema screen mode is a very accurate 97 percent of the standard DCI-P3 color gamut. It also received a very accurate Absolute Color Accuracy measurement of 2.8 JNCD.

The Galaxy Note7 boasts a record high peak brightness (automatic brightness) of 1,048 nits in high ambient light conditions and a screen reflectance level of 4.6 percent. This means that the screen of the Galaxy Note7 can easily be viewed or read, even under relatively high ambient lighting, such as bright sunlight, which washes out the image color saturation and contrast, decreasing picture quality.

In line with its automatic brightness improvements, the Galaxy Note7 received praise from DisplayMate for being the first of its kind to incorporate a second, rear ambient light sensor. This sensor measures surrounding ambient light and then uses the measured value, along with that of the front ambient light sensor, to alter the display brightness accordingly. The additional sensor helps the device to obtain an accurate reading of the true ambient light level, even when the phone is held in the user’s shadow.

DisplayMate also made note of the Galaxy Note7’s new Blue Light Filter that allows the user to adjust and reduce the amount of blue light from the display for better night viewing, “which some recent research indicates can affect how well users sleep afterwards.”

Featuring curved screen OLED display, the Galaxy Note7 will be available for purchase starting August 19.

bungee jump with Gear VR (Source = Samsung)

Hyunjoo Kang / jjoo@olednet.com

Unlike the same period last year, H1 2016 showed quiet smartwatch sector while VR (virtual reality) device and smartband became popular.

According to UBI Research, of OLED wearable device revealed in H1 2016, 6 are VR devices (OLED display is either directly equipped to the device or OLED smartphone can be connected) and 4 are smartbands. In H1 2015, there were 5 OLED smartwatches and 3 OLED smartbands. The difference between almost no smartwatches in H1 2016 is evident.

In VR sector, Oculus began the announcements with Samsung Display’s OLED equipped Oculus Rift in January. Following this, other companies such as Sony, HTC, and DeePoon revealed new products in international exhibitions. Samsung Electronics recently showed Gear VR that can be paired with Galaxy Note 7 in New York, and VR is expected to maintain its popularity in Q3.

In H1 2016, smartband stimulated the market with Samsung Electronics’ Gear Fit 2, Xiaomi’s Mi Band 2, and Fitbit’s Alta.

However, the only new OLED smartwatch product announced in H1 2016 was China’s GEAK’s GEAK Watch 3, and it was not even released in the market. The reason for the slump in the smartwatch market has been noted to be short battery life, and lack of useful applications. However, as Samsung Electronics and Apple are expected to announce new smartwatch products in Q3, renewed enthusiasm is anticipated.

Samsung’s Gear 3 is expected to be revealed in IFA 2016 in Berlin in September. Apple is also rumored to be announcing Apple Watch in September. Apple has already revealed smartwatch operating system Watch OS3 with improved speed and function in June.

With the Forecast of Continued growth of OLED Lighting Panel Market, Automotive Lighting Market is Rapidly Growing ( Picture Source = Novaled )

Global lighting OLED panel revenue market share (Source = UBI Research 2016 OLED Lighting Annual Report)

Hyunjoo Kang / jjoo@olednet.com

Source = UDC

Hyunjoo Kang / jjoo@olednet.com

Universal Display Corporation( UDC ), enabling energy-efficient displays and lighting with its UniversalPHOLED technology and materials, today announced the signing of an OLED Technology License Agreement and Supplemental Material Purchase Agreement with Tianma Micro-electronics Co. Ltd., a leading Chinese small-and medium-size display panel manufacturer. The agreements run for five years.

Tianma is a leading player in AM-OLED technology and series production capacity in domestic China . In late May, Tianma demonstrated its latest OLED advances with a number of display prototypes at Display Week 2016 International Symposium, Seminar and Exhibition. Tianma has a Gen 5.5 AM -OLED line in Shanghai , which started producing AM-OLED modules for intelligent mobile terminals to brand clients this year. Tianma is also increasing its OLED investments to ramp up capacity for commercial mass production.

“We are very pleased to enter into these license and supply agreements with Tianma Micro-electronics, an early OLED developer and key Chinese display maker,” said Steven V. Abramson , President and Chief Executive Officer of Universal Display . “Tianma has been at the forefront of OLED R&D in China for a number of years, and we look forward to working with Tianma to advance their commercial OLED product pipeline with our proprietary OLED technologies and materials. Around the world, we believe that OLED research, development and investment activities are gaining tremendous ground, as consumer demand for cutting-edge, fast-response, thin, energy-efficient displays continues to rise, in products such as smartphones, wearables, tablets and automotive.”

Under the license agreement, Universal Display , through its wholly-owned subsidiary UDC Ireland Limited , has granted Tianma Micro-electronics non-exclusive license rights under various patents owned or controlled by Universal Display to manufacture and sell OLED display products. Additionally, Universal Display will supply phosphorescent OLED materials to Tianma Micro-electronics for use in its licensed products.

Source = UDC

Hyunjoo Kang / jjoo@olednet.com

Universal Display Corporation( UDC ), enabling energy-efficient displays and lighting with its Universal PHOLED technology and materials, today reported financial results for the second quarter ended June 30, 2016.

For the second quarter of 2016, the Company reported net income of $21.8 million, or $0.46 per diluted share, on revenues of $64.4 million. This includes $1.8 million of currency exchange loss related to the BASF OLED patent acquisition. For the second quarter of 2015, the Company reported a net loss of $11.8 million, or $0.25 per diluted share, on revenues of $58.1 million. The 2015 net loss reflected a $33.0 million write-down of inventory, primarily of an existing host material and associated work-in-process. Excluding this item and its associated $1.9 million reduction of income tax expense, adjusted net income for the second quarter of 2015 was $19.4 million, or $0.41 per diluted share (see “reconciliation of non-GAAP Measures” below for further discussion of the non-GAAP measures included in this release).

“Our second quarter 2016 revenues and net income increased year-over-year, and we maintained our strong margin profile. We are confident that the underlying growth fundamentals of our long-term outlook remain robust, but near-term, we expect our revenue growth will be delayed by about six months,” said Sidney D. Rosenblatt, Executive Vice President and Chief Financial Officer of Universal Display.

Rosenblatt continued, “We expect strong revenue growth in 2017. At that time, new OLED production from the multi-year capital expenditure cycle is slated to start contributing to our revenues. Ahead of this wave of high-volume capacity, we have been working to expand and broaden our team and core competencies to advance our strategic initiatives and increase our competitive edge. We expect these initiatives, along with new OLED capacity, coupled with our pipeline of new materials, new technologies and new agreements, to bolster our long-term growth plan.”

Financial Highlights for the Second Quarter of 2016

The Company reported revenues of $64.4 million, compared to revenues of $58.1 million for the same quarter of 2015, an increase of 10.8%. Material sales were $22.3 million, down 8.3% compared to the second quarter of 2015, primarily due to a $2.0 million decline in host material sales. Royalty and license fees were $42.0 million, up from $33.7 million in the second quarter of 2015. The Company recognized $37.5 million in Samsung Display Co., Ltd. (SDC) licensing revenue in the second quarter of 2016, up from $30.0 million in the same quarter of 2015.

The Company reported operating income of $34.0 million in the second quarter of 2016, compared to an operating loss of $4.8 million for the second quarter of 2015. Excluding the inventory write-down of $33.0 million, adjusted operating income was $28.2 million for the second quarter of 2015. Operating expenses were $30.4 million, compared to $62.9 million in the second quarter of 2015 and cost of materials was $5.7 million, compared to $39.1 million in the second quarter of 2015, both of which included the inventory write-down of $33.0 million in the second quarter of 2015.

The Company’s balance sheet remained strong, with cash and cash equivalents and investments of $332.0 million as of June 30, 2016. During the second quarter, the Company added $96.0 million in intangible assets in the form of intellectual property purchases and certain other assets from BASF, increasing the portfolio to more than 4,100 issued and pending patents worldwide. During the second quarter, the Company generated $36.2 million in operating cash flow.

Financial Highlights for the First Six Months of 2016

The Company reported revenues of $94.1 million, compared to revenues of $89.3 million for the first half of 2015, or an increase of 5.4%. Material sales were $46.6 million, down 8.8% compared to $51.1 million in the first half of 2015, primarily due to a $7.0 million decline in host sales. Royalty and license fees were $47.4 million, up from $38.1 million in the first half of 2015.

The Company reported operating income of $36.7 million in the first half of 2016, compared to an operating loss of $3.1 million for the first half of 2015. Excluding the inventory write-down of $33.0 million, adjusted operating income was $30.0 million for 2015. For the first half of 2016, we reported net income of $23.8 million, or $0.51 per diluted share, compared to a net loss of $10.5 million, or $0.23 per diluted share, for the same period of 2015. Excluding the inventory write-down and the associated $1.9 million reduction of income tax expense, adjusted net income was $20.7 million, or $0.45 per diluted share, for the first half of 2015.

Operating cash flow for the first half of 2016 was $36.2 million, a decrease of 51.8% compared to $75.2 million for the first half of 2015 which included an upfront $42.0 million license and royalty payment.

2016 Guidance

While the OLED industry is still at a stage where many variables can have a material impact on its growth, based upon the most recent and best information on hand, the Company believes it is prudent to revise its 2016 revenues guidance. The Company now expects 2016 revenues to be in the range of $190 million to $200 million.

LG`s 77 inch OLED TV Picture Source = LG Elec.

Taiwanese panel industry in recorded decreased small to medium size LCD panel shipment and increased shipment of 9 inch or bigger large size LCD panel. (Picture Source = AUO)

Hyunjoo Kang / jjoo@olednet.com

In Q2 2016, Taiwanese panel industry recorded decreased small to medium size LCD panel shipment and increased shipment of 9 inch or bigger large size panel.

According to DigiTimes, Taiwanese TFT-LCD panel companies shipped 58.38 million units of ≥ 9 inch panels in Q2 2016, an increase of 18.1% QoQ, and 0.8% increase YoY. The small to medium size panel shipment was 269.249 million units, a decrease of 0.5% QoQ, and 6.3% decrease YoY.

In terms of small to medium size, ≤ 9 inch, Chunghwa Picture Tubes (CPT) led the shipment volume with 100.56 million units, and HannStar Display followed with 67.892 million units in Q2. For LCD panels ≥ 9 inch, AUO led the Taiwanese market with Q2 shipment of 27.11 million units. Of these 7.176 million units are for TV, and the rest are for notebook, monitor, and tablet. Following AUO, Innolux recorded 27.09 million units of shipment. Of these 10.72 million units are for TV, and the rest are for notebook, monitor, and tablet.

According to companies’ recent Q2 performance announcement, key Taiwanese LCD companies, including AUO and Innolux, reported decreased business profit. AUO reported TWD 80,000 million in Q2 sales, a 13% fall YoY, and TWD 116 million in business profit, approximately 98% decrease YoY. Innolux showed TWD 66,800 million in Q2 sales, decrease of approximately 29%, and business loss of TWD 3,039 million.

Samsung Elec. unveils Galaxy Note 7

Hyunjoo Kang / jjoo@olednet.com

Samsung Electronics continues to drive the smartphone market with the Galaxy Note7 by building on the company’s category-defining leadership with innovative features that set a new standard for large-screen devices. With refined craftsmanship, premium materials and a unique, symmetrical edge design, the Galaxy Note7 features:

The Galaxy Note7 strikes a balance between work and play, enabling people to achieve more than what they thought possible on a smartphone.

“The Galaxy Note7 combines productivity and entertainment, and strong security features. Powering a robust ecosystem, it is the ideal device for those who want to achieve more in life,” said DJ Koh, President of Mobile Communications Business, Samsung Electronics. “Life moves faster than ever now so we created the Galaxy Note7 to move with users – helping them get things done more easily wherever, whenever.”

Source = LG Elec.

Hyunjoo Kang / jjoo@olednet.com

Source = Samsung

Samsung Electronics today announced financial results for the second quarter ended June 30, 2016. Samsung’s revenue for the quarter was KRW 50.94 trillion, an increase of KRW 2.40 trillion YOY, while operating profit for the quarter was KRW 8.14 trillion, an increase of KRW 1.24 trillion YOY.

The second quarter saw significant earnings growth led by strong performance both in the set and component businesses. Overall earnings of the set business improved YOY as well as QOQ due to the continuous sales increase of premium products.

The IT & Mobile Communications (IM) Division saw substantial earnings improvement led by expanded sales of flagship products such as the Galaxy S7 and S7 edge. A streamlined mid-to low-end smartphone lineup also contributed to improved profitability. Operating profit for the IM Division was KRW 4.32 trillion.

The Consumer Electronics (CE) Division achieved significant earnings growth YOY led by strong sales of its premium lineup such as SUHD TVs, Chef Collection Refrigerator, AddWash washer and newly launched air conditioner.

The component business achieved solid performance although overall earnings decreased YOY due to ASP declines in the industry. Earnings for the Display Panel segment improved QOQ led by increased OLED capacity utilization and stabilized LCD panel yields. Demand for semiconductors for mobile and SSD increased and the company achieved solid growth with a competitive edge in differentiated products, including 20-nanometer DRAM, V-NAND and 14-nanometer mobile AP.

The company estimated that the stronger Korean won against major currencies in the second quarter negatively impacted operating profit by approximately KRW 0.3 trillion, reflected mainly in the component business earnings.

Looking ahead to the second half of 2016, the company expects its solid performance to continue compared to the first half, mainly driven by earnings increase in the component business due to sales growth in high value-added products and stable demand and supply conditions. The set business is expected to continue its stable earnings while the IM Division expects marketing expenditure to increase.

In the third quarter, the company expects the component business to maintain its solid performance due to improved demand and supply conditions for memory chips and LCD panels and stable earnings for OLED and System LSI. For the set business, the company forecasts marketing expenditure for the IM business to increase mainly due to a new flagship product launch and fierce competition in the industry. Meanwhile, weak seasonality is likely to impact the CE business.

Capital expenditure (CAPEX) for the second quarter was KRW 4.2 trillion, which includes KRW 2 trillion for the Semiconductor business and KRW 1.6 trillion for the Display Panel business. The accumulated total CAPEX for the first half was KRW 8.8 trillion.

The annual plan for CAPEX has not yet been confirmed but is projected to increase slightly compared to last year. This year’s CAPEX will be concentrated on OLED and V-NAND capacity as the company sees strong market demand for OLED panels for smartphones and V-NAND SSD.

The Semiconductor business posted KRW 12 trillion in consolidated revenue and KRW 2.64 trillion in operating profit for the quarter.

The memory business enjoyed solid growth in demand in the second quarter. Orders for high-density NAND and DRAM products contributed to solid earnings QOQ. This was coupled by a reduction in cost from continuous process migration.

In NAND, shipments of SSD remained strong in the quarter, as enterprise companies increasingly made the transition from HDD to SSD so as to reduce total cost of ownership (TCO). Orders for high-density mobile storage products over 32GB also helped drive sales, mainly due to the expanded adoption by Chinese companies. Samsung actively responded to orders for high-density mobile products over 64GB and enterprise SSD over 4TB and increased supply of the industry’s first 48-layer V-NAND.

In DRAM, demand climbed QOQ as smartphone manufacturers bought more high-density mobile DRAM and demand for high-density products increased following the launch of a new server platform.

A supply imbalance of some applications led to greater demand for Samsung’s 20-nanometer high-density, high value-added mobile and server products.

Looking ahead, for NAND, increased adoption of high-density products and strong seasonality will further drive demand growth in the second half. Growth in high-density, premium SSD products will continue, and the launch of new products by smartphone manufacturers is expected to raise demand for mobile storage. However, supply and demand will be tighter in the second half, due to soft industry supply growth.

For DRAM, the launch of new smartphones and the increasing adoption of 6GB memory chips in high-end smartphones will spur shipments of mobile DRAM in the second half. Shipments of high-density server products will be strong, as more data centers make the transition to a new server platform.

The System LSI business saw gains QOQ, thanks to stronger demand for 14-nanometer mobile AP in premium smartphones and increased sales of high megapixel image sensors. In the second half, increased sales of mid- to low-end mobile AP and LSI products are expected to provide a stable revenue stream.

The Display Panel segment posted KRW 6.42 trillion in consolidated revenue and KRW 0.14 trillion in operating profit for the quarter driven by increased shipments of OLED panels and enhanced yields for new LCD TV panel production technology.

For the OLED business, second quarter earnings improved QOQ due to healthy sales of flagship smartphones and increased demand for flexible panels. High fab utilization rates with the help of an expanded mid to low-end product portfolio also contributed to improved earnings.

For the LCD business, the second quarter saw a continuation of QOQ growth under a gradual recovery in the supply-demand balance. The company was able to achieve growth thanks to improved yields for new TV panel production technology as well as expanded TV sales particularly for large-sized UHD panels.

Looking ahead to the second half, the OLED business, Samsung expects demand for OLED panels to rise despite a likely slowdown in the smartphone market. To remain competitive, the company plans to actively address customer demand and reinforce profitability by expanding the proportion of high value-added products such as flexible and high-resolution displays. Samsung will also seek to secure supply capacity according to market demand while expanding its customer base and new applications.

As for the second-half outlook for the LCD industry, Samsung expects supply and demand to improve thanks to increased demand under strong seasonality as well as continuous UHD TV market growth and size migration towards larger screens. In response, the company will focus on enhancing profitability by improving cost competitiveness and expanding its portfolio to high value-added products including ultra-large size, high-resolution and curved panels.

The IM Division posted KRW 26.56 trillion in consolidated revenue and KRW 4.32 trillion in operating profit for the quarter.

Samsung’s earnings improved QOQ thanks to strong sales of its flagship Galaxy S7 and S7 edge smartphones. Additionally the company achieved growth in the second quarter by maintaining the profitability of mid- to low-end models, such as the Galaxy A and J series, and improving the product mix by raising the sales proportion of the Galaxy S7 edge to over 50 percent.

Demand for smartphones and tablets in the second half is forecast to increase, however, market competition is expected to strengthen as other companies release new mobile devices. Despite this outlook, Samsung will focus on YOY earnings increase by strengthening its high-end line-up and maintaining solid profitability of mid to low-end products.

Looking into the third quarter, the release of a new large-screen flagship smartphone will help to maintain solid sales of high-end smartphones led by the Galaxy S7 and S7 edge. Samsung will also focus on expanding smartphone sales including this year’s new Galaxy A and J series and the debut of the Galaxy C series exclusively for the China market.

Samsung will focus on increasing smartphone sales under strong seasonality with the launch of a new model, while expecting marketing expenses to increase QOQ due to seasonality.

As for the Networks business, earnings improved due to increased LTE investment of major carriers in the second quarter.

The Consumer Electronics Division – encompassing the Visual Display (VD), Digital Appliances (DA), Printing Solutions and Health & Medical Equipment (HME) businesses – posted KRW 11.55 trillion in consolidated revenue and KRW 1.03 trillion in operating profit for the quarter.

In the second quarter, global TV demand remained flat YOY due to sluggish economic conditions in major emerging markets that offset the growth experienced in developed markets. Amid these challenging conditions, Samsung achieved solid YOY earnings by successfully launching new products, including SUHD TVs, and increasing sales of premium products on the back of global sporting events.

For the appliances business in the second quarter, although growth momentum continued in North America, global demand declined YOY due to slower growth in China and the impact from the economic slowdown in emerging markets. Despite these circumstances, earnings improved from the same period of the previous year thanks to increased sales of premium products such as the Chef Collection refrigerator and the AddWash and activ dualwash™ washing machines.

Looking ahead to the second half, TV demand is expected to decline YOY due to weakened demand in Europe and a prolonged economic slowdown in emerging markets. In response, Samsung will focus on improving profitability and increasing sales through collaborations with local channel partners and through region-specific promotions. To reinforce its leadership in the premium TV segment, the company will also seek to grow sales of its premium SUHD TV line-up, particularly products featuring its Quantum Dot technology.

Concerning the outlook for appliances in the second half, market growth is expected to be limited due to the aforementioned concerns in Europe and emerging markets. Despite these conditions, Samsung will actively seek opportunities to counter the challenging market dynamics by launching innovative products that offer superior consumer experiences. The company also plans to achieve further growth by enhancing its B2B business in this sector, particularly for built-in kitchens and system air conditioners.

Source = LGD

Hyunjoo Kang / jjoo@olednet.com

LG Display ( LGD ) reported today unaudited earnings results based on consolidated K-IFRS (International Financial Reporting Standards) for the three-month period ending June 30, 2016.

LGD announced its seventeenth straight quarterly operating profit at KRW 44 billion, which resulted from a thorough and profit-focused management based on differentiated technologies in response to difficult market conditions caused by continuing falls in panel prices and the aggressive expansion of LCD production capacity by Chinese panel makers.

To deal with the difficult market situation, LGD increased profitability by expanding the production share devoted to large-size panels of 60-inches and above as well as premium TV panels embedded with HDR(High Dynamic Range) technology, while continuously leading the Ultra HD TV panel market for 40-inches and above based on its differentiated M+ technology. The company also maximized production efficiency over all its business areas by improving the manufacturing process and producing profit-focused products.

Panels for TVs accounted for 39% of the revenue in the second quarter of 2016, tablets and notebook PCs for 18%, mobile devices for 27%, and desktop monitors for 16%.

With 83% in the liability-to-equity ratio, 145% in the current ratio, and 19.6% in the net debt-to-equity ratio as of March 31, 2016, the financial structure of the company remains stable.

LG Display will continue to make efforts to improve profitability by focusing on premium products including large-size Ultra HD TV displays based on its M+ technology and IPS In-Touch displays in the second half of the year, while driving expansion of the OLED market and its customer base.

As for large-size OLED TV panel, the company will increase cost competitiveness through further stabilizing production and improving the manufacturing process of Ultra HD products, while continuing promotion with customers to strengthen the premium positioning of OLED TV. It will also establish a competitive edge through timely investments in cutting-edge technologies for the future including flexible OLED displays.

Mr. Don Kim, CFO of LG Display, said “Display area shipments in the third quarter are expected to increase by a mid-single digit percentage compared to the second quarter due to seasonal factors and the growing trends towards large-size panels. Overall profitability in the second half of the year is expected to further improve due to stabilized panel prices.” He also added, “LG Display will put its best efforts to create differentiated value in terms of profitability, while preparing for future growth even under difficult market conditions.”

LGD will invest KRW 1.99trillion in 6G flexible OLED line. (Source = LGD)

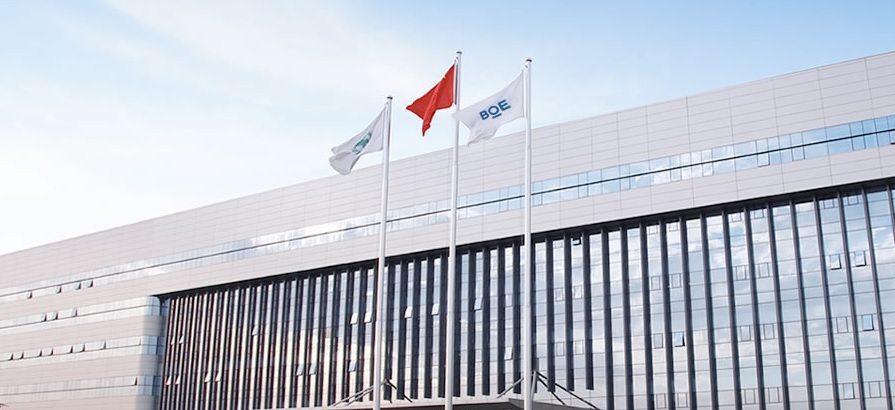

Chinese and Taiwanese Gen8 line is higher than Korea’s Gen8 LCD capa. (Source = BOE)

Hyunjoo Kang / jjoo@olednet.com

In order to respond to the outpouring Chinese large area LCD, it is analyzed that carrying out investment to turn large area LCD line into OLED is the most reliable method.

According to 2016 OLED Manufacturing Equipment Annual Report, recently published by UBI Research, Chinese and Taiwanese panel companies’ Gen8 or higher LCD mass production line is 690K in total as of Q1 2016. This is higher than Korea’s Gen8 LCD capa.

Even now, China is showing active movements in additional establishment of large area LCD mass production line. UBI Research forecasts that in 3 years, China and Taiwan’s new large area LCD mass production line will reach up to 80% of the Korea’s current mass production capa. The report emphasizes that to fight against this great supply volume from Great China region, Korean panel companies should change the large area LCD line to OLED.

In case of Gen8 line, unlike small-to-medium size line, the LCD line can be cost effectively transformed to OLED line. As such, it is considered to be the main object for the complementary investment.

Particularly, if oxide TFT, which has few photomask processes, and WRGB+CF technologies are applied, existing large area a-Si LCD line’s manufacturing equipment can continue to be used.

UBI Research explained that an advantage of complementary investment is the fact a-Si LCD line’s backplane equipment and color filter equipment can continue to be used. He further added that in order to maximize a-Si line’s capa., development of TFT process with few photomask processes is a necessity.

Picture Source = SDC

Hyunjoo Kang / jjoo@olednet.com

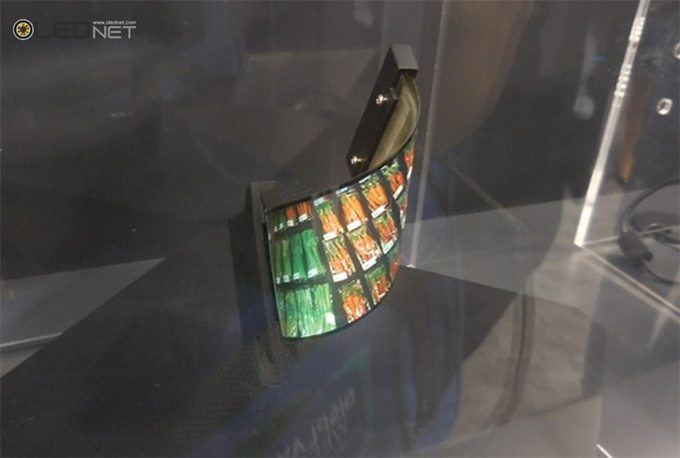

In order to respond to rapidly increasing OLED smartphone demand, Samsung Display( SDC ) is analyzed to require additional installation of Gen5.5 rigid OLED line and V1 line move.

At present, China’s smartphone OLED demand is explosive. According to UBI Research’s investigation, China needs up to 200 million units of mobile OLED until next year. Therefore, for Samsung Display to produce more OLED panels in A2 factory, V1 line that produces transparent OLED needs to be moved to L8 which is a Gen8 LCD factory.

OLED use V1 line has been using Gen8 manufacturing equipment produced TFT substrate cut into 6. As such, moving the V1 line to Gen8 factory is analyzed to be advisable in terms of panel production and distribution management.

The president of UBI Research, Choong Hoon Yi explained that China’s future mobile OLED demand volume is difficult for China’s key panel companies such as BOE, and even for mobile OLED leader Samsung Display it is not easy to supply sufficient amount with existing mass production line. He estimated that Samsung Display, to meet the demand, will require additional installation of at least 20-30K OLED mass production line to Gen5.5 A2 line.

2016-2020, global Gen8 complementary investment ( LCD → OLED ) is expected to be total USD 6,674 million.

Hyunjoo Kang / jjoo@olednet.com

For the next 5 years, 2016-2020, global Gen8 (8G) complementary investment ( LCD → OLED ) is expected to be total USD 6,674 million.

According to 2016 OLED Manufacturing Equipment Annual Report, recently published by UBI Research, Korea’s 8G complementary investment in 2016-2020 is estimated to be USD 5,400 million, 81% of the global USD 6,674 million. Particularly, complementary investment for large area LCD line to OLED is expected to be actively carried out centering around LG Display.

China is estimated to actively operate new large are LCD lines from 2016. To respond to this move, Korean panel companies are expected to transform 8G a-Si LCD lines located in Korea to OLED line from 2016.

To respond with LCD, China’s supply offensive and price competitiveness are too strong. As such, the situation calls for concentrated efforts in OLED.

Gen8 LCD line became the object of complementary investment as it can be easily converted to OLED compared to small-to-medium size LCD line. 8G LCD line’s a-Si TFT can be turned into oxide TFT used in Gen8 OLED line cost effectively.

Source = Cynora

Hyunjoo Kang / jjoo@olednet.com

CYNORA, a leader in blue TADF (thermally activated delayed fluorescence) materials, has appointed Dr. Andreas Haldi as its Chief Marketing Officer.

With his strong technical and business experience, Andreas Haldi will reinforce CYNORA in the forthcoming commercialization of its high performance blue OLED materials.

CYNORA is preparing the commercialization of its emitting materials for OLEDs. The company is hiring Andreas Haldi to further enhance its already good relationships with the major display makers and to now prepare with them the implementation of its materials in their products.

Andreas Haldi has close to 15 years of experience in the OLED materials field and profound knowledge of the Asian display market. Prior to joining CYNORA, Haldi held manager positions in R&D and sales at Novaled GmbH. For the last five years he was headquartered in Seoul, Korea, as Novaled’s representative in front of the major AMOLED display makers in Asia.

“I am very happy to get Andreas on board” says Gildas Sorin, CYNORA’s CEO. “We are preparing ourselves intensively for the commercialization of our blue emitters. Thanks to his proven skills on OLED and his experience in Asia, Andreas will help us to build up our success as a leading supplier for TADF materials.”

“I am looking forward to joining CYNORA” says Andreas Haldi, “CYNORA has shown its expertise and its impressive capability to progress rapidly during the last 8 months. CYNORA has a great potential to become key player in the OLED material industry.”

The appointment of the new CMO is a significant signal of CYNORA’s further development and its forthcoming market entry. Blue TADF-based emitters will enable a significant reduction of power consumption in OLED devices and will allow higher display resolution. CYNORA owns a broad IP portfolio with over 100 patent families and is aiming for over 600 patents.

LGD`s 65“ OLED TV Panel

Source = BOE ( China )

Hyunjoo Kang / jjoo@olednet.com

China is expected to possess 80% worth of new large size LCD line of current Korean large size LCD mass production line after 3 years.

According to 2016 OLED Manufacturing Equipment Annual Report, recently published by UBI Research, the total monthly production capa. of large area LCD mass production line that has been confirmed or being considered for investment in China and Taiwan until the end of 2018 is 525K. This is based on the results of UBI Research’s investigation on Q3 2016 – Q4 2018 investment plans of Chinese and Taiwanese companies including BOE, HCK, CEC Panda, CSOT, AUO, and Innolux.

If the plan is carried out without any issues, the order is expected to be completed by Q4 2018, and after equipment installation, the lines are to be ready to operate in 2019.

The monthly capa. of 525K is 80% of the current total LCD mass production line of Korea. Once 525K new lines begin to operate, oversupply of large size LCD panel is expected to actively occur.

UBI Research estimated that if China and Taiwan’s large area LCD investment is carried out according to plan, it will be difficult for Korean and Japanese large size LCD panel to compete against Chinese panel.

Source = AUO

Hyunjoo Kang / jjoo@olednet.com

LCD shipment of AU Optronics (AUO) in Q2 2016 increased but revenue decreased.

AUO recently announced that they recorded revenue of NTD 80.09 billion (approx. USD 2,478 million) in Q2 2016. This is an increase of 12.6% from the previous quarter but down 13.2% from Q2 2015.

AUO’s panel shipment in Q2 was 70.96 million units with 28.46 million units of 10-inch and above panels, and 42.5 million units of 10-inch and below panels. The large size panels increased by 16.5% QoQ, and by 14.3% YoY. The small to medium size panels increased by 12.6% QoQ, and by 11.5% YoY.

Basically, this company sold more and earned less demonstrating that LCD price fall aftermath continued into Q2.

The H1 2016 revenue of Novatek, Taiwan’s LCD driver IC company, fell by 10.9% compared to H1 2015. LCD surface mount company TSMT’s Q2 revenue fell by 10.1 compared to Q2 2015.

Intel, LG Display, Dolby Laboratories, Audi and more slated to preset at the OLEDs World Summit 2016

Join top OLED display, lighting and material developers at the 18th annual OLEDs World Summit, taking place September 20-22 at the Paradise Point Resort & Spa in San Diego, CA. For nearly two-decades, the OLEDs World Summit has served as a homecoming for the display and lighting industries and provided a platform for them to highlight successes, address challenges and network. This year you can expect a complete overview of the industry.

The OLEDs World Summit 2016 will kick off by examining flexible display applications including wearable devices, smart phone applications and more. Over the course of the event, attendees will also explore chemicals and tools for OLEDs, new applications, challenges for OLED materials in displays and much more. As an attendee you can expect to hear discussions such as:

In addition to the presentations and dynamic discussions, there are four keynote presentations by some of the biggest names in the industry. You’ll hear from:

Register today!

Your colleagues from Eastman Kodak, Acuity Brands Lighting, Universal Display, LG Display and more have already reserved their delegate tickets. Book your ticket today for the low price of $1199. Hurry, the price goes up after July 13th!

Questions?

Contact the Graphene World Summit Team:

Agenda Questions-DeAna Morgan at dmorgan@smithers.com

Media Questions-Katie Oster at koster@smithers.com

Sponsorship Questions-Emily Murray at emurray@smithers.com

QLED is Becoming an issue (Picture Source = Samsung Elec.)

UBI Research Chief Analyst Choong Hoon Yi

As the next generation TV technology, QLED is becoming an issue in media. This is because Samsung Electronics selected QLED TV as the next product after the currently selling SUHD TV. However, if QLED TV display is the product that uses electroluminescence quantum dot, this shows they do not know display at all.

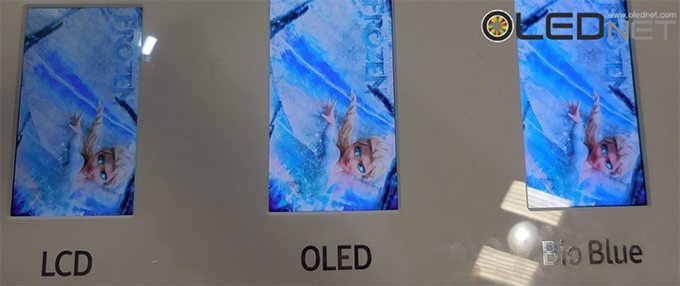

Quantum dot technology display can be divided into 2 types depending on the light-emitting technology. Photoluminescence quantum dot technology uses mechanism where the materials stimulated by external light emits light again, and this QD technology is currently applied to LCD TV. The TV has quantum dot sheet attached to the backlight’s blue light to be used as the backlight unit, and Samsung Electronics’ SUHD TV is such a product.

As photoluminescence quantum dot has wide color gamut, this can actualize over 110% of NTSC standards and there is no doubt that this is the best LCD TV product. Furthermore, another photoluminescence quantum dot technology, where colors are actualized by dispersing quantum dot materials on color filter, is in development.

In comparison, electroluminescence quantum dot technology is self-emitting when electricity is applied, and similar to OLED. Only the light emitting materials are inorganic and the structure is comparable to OLED. For OLED, hole is introduced from electrode through HIL layer, and this hole reaches emitting materials through HTL layer to produce light.

When the electron reaches emitting materials through EIL and ETL layers, the emitting materials with rapidly increased energy level due to electron and hole, produces light to release the energy. HIL, HTL, EIL, and ETL layers are needed in OLED to control the energy levels needed for electron and hole to reach emitting materials.

Therefore, for electroluminescence quantum dot to emitting light, HIL, HTL, EIL, and ETL layers are required same as OLED. Scientists developing electroluminescence quantum dot technology are using OLED HIL, HTL, EIL, and ETL materials. As the exclusive materials have not been developed, the technology is still in early stages.

This still belongs in science category rather than technology. Furthermore, electroluminescence quantum dot is dispersed to solution to print, and as such ink-jet or similar equipment development is necessary. HIL, HTL, EIL, and ETL also have to be dispersed using solution.

What is curious is whether Samsung Electronics’ QLED TV is existing QD technology that uses photoluminescence quantum dot or technology that uses electroluminescence quantum dot. Generally, QLED signifies electroluminescence quantum dot.

Therefore, if Samsung Electronics can really sell electroluminescence quantum dot using QLED within a few years, this will place Samsung Electronics as the world’s most innovative company establishing new scientific records.

However, OLED emitting materials developing companies are dismissing this claim as ridiculous. Solution process produced OLED emitting materials, HIL, HTL, EIL, and ETL materials have not yet been suitably developed, and require 5 more years before commercialization. As such, companies believe that actualizing QLED in a few years is impossible.

The fact is QLED exclusive HIL, HTL, EIL, and ETL materials are not being developed yet. Printing equipment also have not yet been commercialized. Electroluminescence quantum dot developing academia also points out that only the potential has been glimpsed so far.

Several stages have to be passed through for QLED to be realized. For solution process using QLED to be commercialized, it could only happen after solution process OLED appears first. Looking at the history of OLED commercialization, this is minimum 10 years.

For Samsung Electronics that cannot produce OLED TV to have mentioned that they will produce QLED TV within 3 years makes the writer wonder whether to exclaim, “only Samsung” in awe or ask “what is Samsung doing?”

Source = LG

(Unit: KRW bn)

These figures are the tentative consolidated earnings based on K-IFRS. This tentative earnings is provided as a service to investors prior to LG Electronics’ final earnings results including net profit and details regarding each division which will be announced officially later this month.

Hyunjoo Kang / jjoo@olednet.com

Samsung Elec. announced its earnings guidance for the second quarter of 2016.

Samsung Elec. estimates that consolidated sales came to approximately KRW 50 trillion, and consolidated operating profit of approximately KRW 8.1 trillion.

The above figures are estimates of consolidated earnings based on K-IFRS. Korean disclosure regulations do not allow earnings estimates to be provided as a range. Therefore, the above figures are based on the median of the earnings estimate range, as given below.

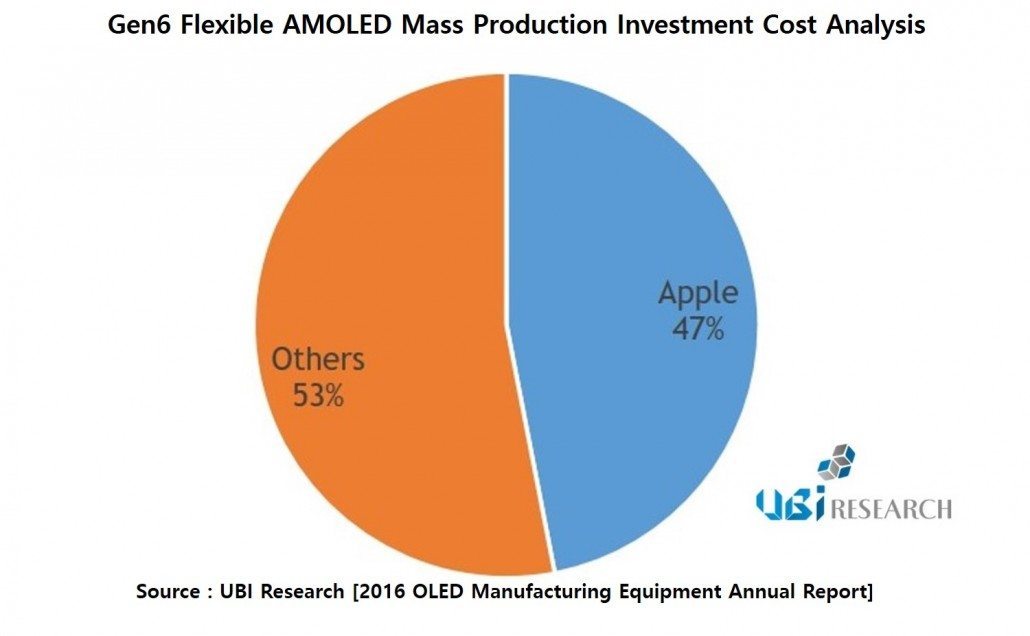

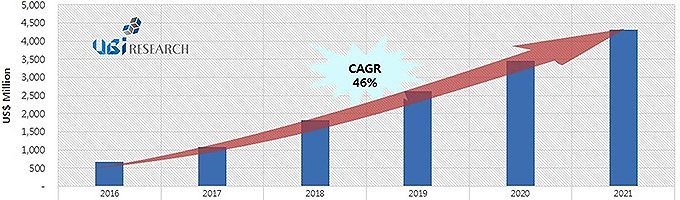

Source = UBI Research [2016 OLED Manufacturing Equipment Annual Report]

AMOLED manufacturing equipment market for Apple’s use for 5 years, 2016-2020, is expected to reach USD 13,000 million.

According to 2016 OLED Manufacturing Equipment Annual Report, published on 7 July by UBI Research, the global Gen6 flexible AMOLED manufacturing equipment market is expected to record USD 28,411 million in 2016-2020. 47% of this is for Apple’s use with USD 13,000 million. The figure is if Apple applies flexible panel to some new models of iPhone to be released in 2017, and all new models to be released in 2018.

Apple occupies approximately 15% of the total smartphone sales with over 200 million units per year. As such, it is expected to have great impact on future exible panel market expansion.

In 2021, global flexible AMOLED panel shipment is estimated to exceed 1,000 million units. UBI Research forecasts Apple iPhone’s flexible panel will occupy 20% of the total flexible AMOLED shipment in 2017, and exceed 50% in 2021. UBI Research explains that in order to meet Apple’s flexible AMOLED panel demand, the required panel production capa. is analyzed to be 30K per month in 2017, and total 300K per month in 2021.

Furthermore, panel companies’ mass production line is expanding accordingly, and Samsung Display in particular is expected to invest 30K per year directed to Apple.

UBI Research’s latest report forecasts that the total OLED manufacturing equipment market to record approximately USD 43,927 million in 2016-2020.

출처 = Applied Materials

Hyunjoo Kang / jjoo@olednet.com

Applied Materials is expected to show Q2 display manufacturing equipment sales increased by almost 6 times bolstered by OLED market growth.

Digitimes recently quoted Applied Materials’ greater China account general manager Kuo Yi-tze and reported that the company’s Q2 2016 order value for the display manufacturing equipment is estimated at USD 700 million. This is a 5.8 times increase compared to USD 120 million in Q2 2015.

Particularly, the demand by Korean panel companies, including Samsung Display and LG Display, is rapidly increasing. Furthermore, Chinese panel companies are also actively taking action to catch up to Korean panel companies’ technology and production ability.

Applied Materials estimates that the global shipment of mobile device OLED panel for smartphone, smartwatch, etc. will increase from 2016’s 353 million to 2020’s 799 million units. Furthermore, automotive OLED panel shipment is expected to increase from 2016’s 134 million to 2020’s 176 million units.

Applied Materials has seen orders for OLED equipment increasing, especially from South Korea-based panel makers, and its second-quarter 2016 order value for the display equipment segment is estimated at US$700 million, 5.8 times the US$120 million recorded for second-quarter 2015, according to Applied Materials’ greater China account general manager Kuo Yi-tze for AKT Display Business Unit.

South Korea-based panel makers take significantly lead in OLED technology and production and China-based fellow makers are making efforts to catch up, Kuo said.

Demand for OLED panels mainly comes from growing application to smartphones and smart watches, with global shipments of OLED panels used in mobile devices to increase from 353 million units in 2016 to 799 million units in 2020, Kuo indicated.

In addition, global shipments of OLED panels used in automotive displays will increase from 134 million units in 2016 to 176 million units in 2020, with a CAGR of 9% in unit shipments and 12% in area shipments during 2016-2020 Kuo noted.

Source = Japan Display

Hyunjoo Kang / jjoo@olednet.com

Japanese media reported that Japan Display (JDI) is expected to sell small-to-medium sized LCD module factory located in south China to Chinese panel company Jiangxi Holitech. The sales price is USD 16.15 million.

The factory is attached to Morningstar Optronics Zhuhai (MOZ), Taiwan’s LCD module company Star World Technology’s subsidiary company. Taiwan Display is the major shareholder, and JDI owns the entirety of Taiwan Display. Through the sales of MOZ factory, Taiwan Display is to own 100% of Star World Technology stakes.

JDI used to own 3 LCD module production subsidiary companies, JDI Device and JDI Electronics in Suzhou, and Shenzhen JDI in Shenzhen, to supply touch panel for Chinese smartphone companies.

According to Japanese media, JDI is expected to confirm detailed plans regarding the sales of these three subsidiary companies.

Source = innolux

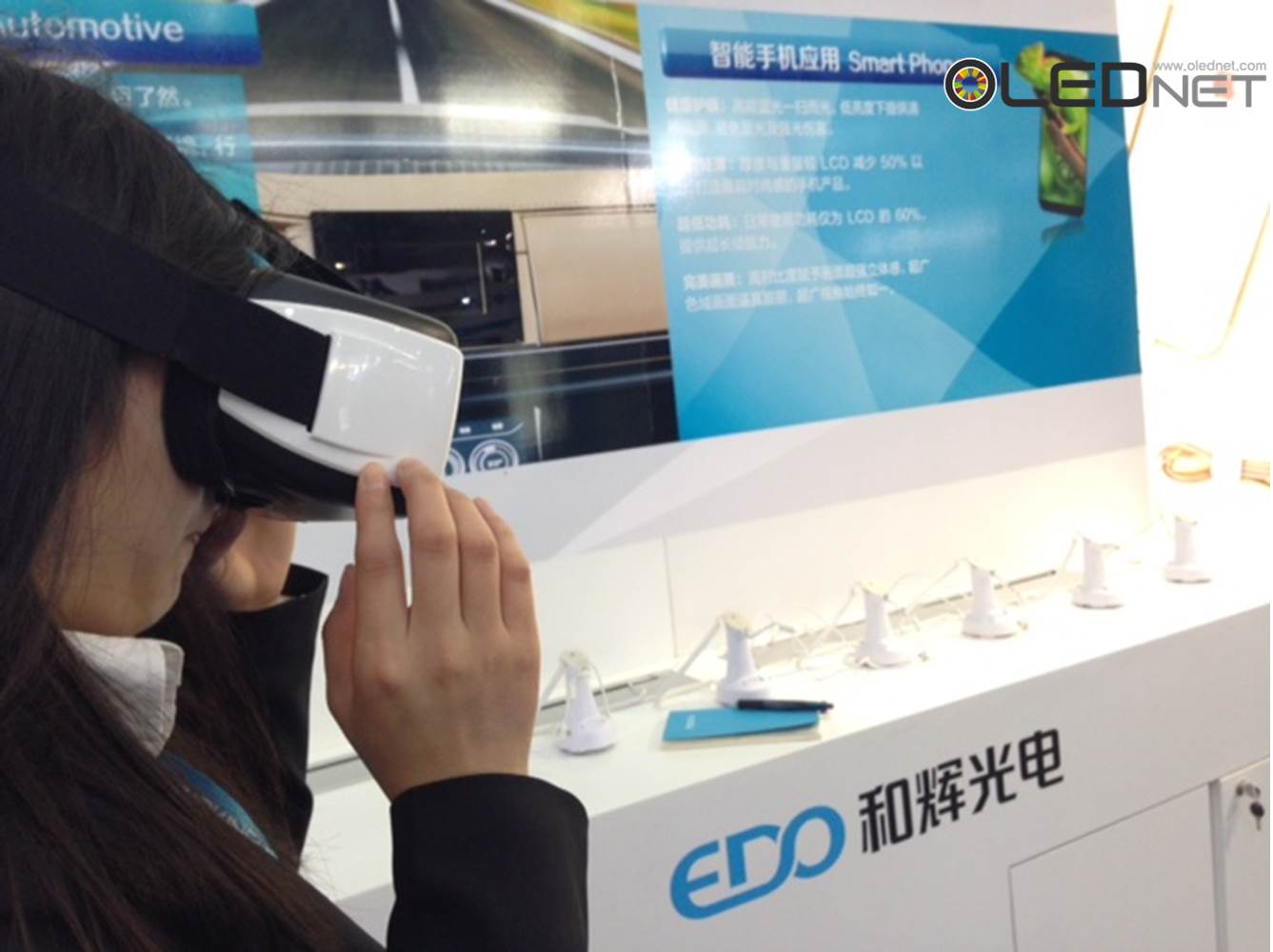

Artcraft booth visitor is experiencing virtual reality using VR device and joystick

Manufacturing World Show Director Takeshi Fujiwara

At the exhibition, Takeshi Fujiwara, the event’s show director, told OLEDNET that they have been expecting VR’s vitalization in manufacturing industry, hosting IVR for 24 years, and the proportion of it increased by a groundbreaking number. Until now, it has been mostly handled in academia such as research labs, but as VR is nearing the general public through construction, game, amusement, etc., Fujiwara explained that he sees this year to be VR’s year of vitalization.

Hyunjoo Kang / jjoo@olednet.com

UDC announced today that it has entered into an agreement to acquire Adesis, Inc. Adesis is a privately held contract research organization (CRO) with 43 employees specializing in organic and organometallic synthetic research, development, and commercialization. Adesis is a critical technology vendor to companies in the pharmaceutical, fine chemical, biomaterials, and catalyst industries, and has worked with Universal Display over the last few years to help advance and accelerate a number of Universal Display’s product offerings.

“This acquisition is part of our strategic growth plan. We believe that it will provide additional highly-skilled resources to further advance our initiatives for the development and delivery of next-generation proprietary emissive material systems in the rapidly evolving OLED industry,” said Steven V. Abramson, President and Chief Executive Officer of Universal Display. “Moreover, we expect it to enable us to leverage our twenty-plus years of experience in developing and commercializing cutting-edge chemistry technologies to help expand Adesis’ businesses across its end-markets including pharma, biotech and catalysis. We are delighted to welcome Dr. Andrew Cottone, President of Adesis, Dr. Ving Lee, Chief Scientific Officer, and the vastly experienced Adesis team to UDC.”

“We are very excited to become part of UDC and build additional synergies between both companies, and further enhance the growth of UDC’s OLED leadership,” said Andrew Cottone, President of Adesis, Inc. “In addition, we anticipate that Adesis will benefit from UDC’s financial and business acumen to better support our clients with world-class technology and expertise, and reinforce our positioning for continued growth as a specialty chemical CRO.”

Under the terms of the agreement, Universal Display will acquire all outstanding shares of Adesis, Inc. in a merger for approximately $36 million in cash. The transaction is expected to close in the third quarter of 2016, subject to customary closing conditions. Following the closing, Adesis will operate as a wholly-owned subsidiary of Universal Display Corporation. Andrew Cottone will continue as the President of Adesis, and Steve Abramson will become the Chairman of the Board of Adesis.

Informatix’s GyroEye, VR Software at Manufacturing World Japan 2016

Tokyo = Hyunjoo Kang / jjoo@olednet.com

Plenty of VR related contents and software products were exhibited in Manufacturing World Japan 2016 (22-25 June).

Transmedia presented Drop in VR which is a platform which allows users to create, manage and publish VR contents. The user-created 3D modelled contents can be uploaded to the Drop in VR server, and edited by adding music, clips, and other functions.

The produced contents can be downloaded and enjoyed through a VR device. At the exhibition, Transmedia demonstrated VR contents that allows comic books to be viewed in 360°, edited by Drop in VR. The company explained to the OLEDNET that they will begin testing in September and begin Drop in VR service by the end of the year.

Informatix revealed a 3D viewer software GyroEye that can be used in housing or office design. Using GyroEye, hypothetical space can be compared before construction and after construction in 360° through VR. Informatix explained that in August, GyroEye and Germany’s Zeiss’ VR device VR one+ will be released together.

ZENKEI began VR platform Stereo 6 for viewing scenery in 22 June. Stereo 6 is a comprehensive system that allows clips from 6 cameras to be transformed into 360° contents and experienced through VR.

Dynamo Amusement, showed their VR contents Megalodon, and used Samsung Electronics’ Gear VR and Galaxy S6 for demonstration. The company explained that Megalodon, a 5-minute CG produced contents showing deep sea underwater world, will be released in the summer.

Dynamo Amusement demonstrated 4D VR contents using Gear VR

Tokyo = Hyunjoo Kang / jjoo@olednet.com

At Manufacturing World Japan (22-25 June, Tokyo Big Sight), 4D movie was demonstrated through Gear VR.

Dynamo Amusement, a contents company, showed their VR contents Megalodon, and used Samsung Electronics’ Gear VR and Galaxy S6 for demonstration. The company explained that they used these devices as they were popular although the content is not exclusive to these products.

For the demonstration, visitors could sit in chairs installed in the Dynamo Amusement booth wearing Galaxy S6 equipped Gear VR. The focus could be controlled using the wheel on Gear VR.

Megalodon is a clip that shows the deep sea underwater world using CG technology. The moving chairs and air jets are not different from existing 4D contents, but the VR screen provided realistic experience, much more vivid, including the scene where the viewer is swallowed by a giant shark.

However, the picture quality remains an issue. Despite using the wheel to focus, the clear picture was not produced. This is dependent on the resolution of the smartphone connected to the VR device, the Galaxy S6 used in the demonstration has AMOLED panel of 577 ppi, 2560 x 1440. Nonetheless, with Samsung’s recent reveal of 806 ppi AMOLED for VR at 5 inch mark, future picture quality improvement is anticipated.

Additionally, despite the vividness directly ahead, concentration was difficult due to the not insignificant weight of the device. A total weight of 518 g, Gear VR’s 380 g and Galaxy S6’s 138 g, can be heavy to be placed on the head for a long period of time. For longer uses, the weight has to be reduced.

Dynamo Amusement’s Megalodon has the running time of 5 minutes, to be released this summer.

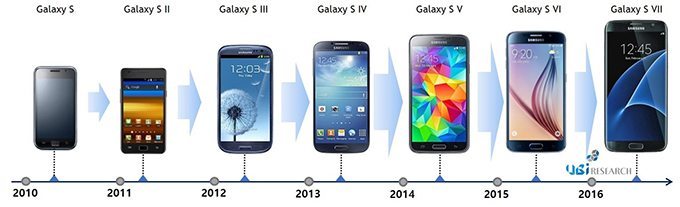

Galaxy S Series`s Blue Materials Luminance Needs to be Improved by 3.7 Times (Source = UBI Research)

Hyunjoo Kang / jjoo@olednet.com

If the Galaxy S Series luminance increase trend continues, it is estimated that the luminance will reach 754 nits within 2-3 years. In order to produce Galaxy S with 754 nits, the luminance of blue emitting materials, that will be used for the product’s AMOLED, is analyzed to require improvement by approx. 3.7 times.

According to AMOLED Characteristics Analysis Report of Galaxy S Series, published by UBI Research, the analysis of luminance increase trend of Galaxy products from S4 released in 2013 shows Galaxy S series with full white luminance of 430 nits and peak white of 754 nits is expected to be produced within 2-3 years. The Galaxy S4 luminance is 338 nits (peak white), and the luminance increased to S7’s 505 nits via S5 and S6’s 400 nits mark. Calculating based on this trend, the future product is analyzed to have 754 nits of luminance.

The report reveals that for Galaxy S7, the luminance of red materials is 142 nits, green 338 nits, and blue 26 nits. To actualize 754 nits screen, the red materials have to improve luminance by approximately 1.5 times, green 1.2 times, and blue 3.7 times. UBI Research explained that for high resolution screen with limited size, emitting materials performance improvement is a must and that technology development should be focused on blue emitting materials.

* Luminance figures (nits) quoted in the article have been measured by UBI Research, with Auto Brightness function switched off. Future luminance forecast is also without this function.

Barry Young Suggested “Don`t Believe the Garbage about QLED in 2019” (Source = Samsung)

Hyunjoo Kang / jjoo@olednet.com

An article by Barry Young, the managing director of the OLED Association, in Display Daily created much excitement in Korean display industry when domestic media picked up the story on 14 June. The article includes Young’s suggestion, “don’t believe the garbage about QLEDs in 2019”.

Clarifying this comment, experts unpack this to mean Young’s pessimistic outlook for QLED mass production in 2019 forecast rather than for QLED itself.

Barry Young discussed QD in an article titled Drinking the QD Kool-Aid in Display Daily. It is estimated that the comment is aimed at the recent speculation that Samsung Electronics will mass produce QLED TV as the next generation product in 2019 rather than OLED TV. While Samsung Electronics has not announced their official position regarding QLED TV mass production timing, some sectors within the market believe it will be possible by 2019. However, many have differing opinions.

QLED is a display that uses quantum dot for emitting layers’ host and dopant while maintaining the common layers used in the existing OLED. Quantum dot, emitting layer materials used in QLED, utilizes inorganic materials and can lower the production cost in comparison to OLED’s emitting layer materials. That the process does not require evaporation as it can be carried out through ink jet printing is another advantage, and some also believe that QLED color purity is superior to OLED.

Despite these, some experts point out that it is difficult for QLED to become the main force of the premium TV market, surpassing OLED, in a short time. QLED has to solve several technological issues including lifetime and emitting efficiency. When mass producing QLED, pin holes occur and reduce device lifetime, and as the hole and electron are not balanced the emitting efficiency falls. Furthermore, as even research has not been carried out regarding QLED lifetime and degradation, whether it will be commercialized by 2019 is also in question.

Meanwhile, Young refuted the argument that QD-LCD’s picture quality is superior to OLED. He proclaimed that QD Vision and Nanosys are making “very questionable statements” about how “OLED TVs were outperformed by LCD’s with QD enhanced LED backlights” without considering merits of OLED such as contrast ratio, viewing angle, response time, color accuracy, and form factor as well as luminance and color area.

Manufacturing World Japan(Source=REED)

Hyunjoo Kang / jjoo@olednet.com

Reed Exhibitions Japan Ltd., the largest trade show organiser in Japan, announced that Manufacturing World Japan 2016, Japan’s leading trade show for the manufacturing industry, is coming back at Tokyo Big Sight from June 22 – 24, 2016 with the largest scale in its history.

According to the huge supports from manufacturing industry of Japan and Asia, the number of exhibitors in 2016 is expected to reach 2,350 exhibitors from all around the world. This figure is the largest ever in the history of Manufacturing World Japan and 5% increasing from last year.

The number of visitors is expected to be 83,500 and they will pack the show floor during 3 days show period. From the survey of visitor pre-registration, motivation of visitors for purchasing from exhibitors is extremely high.

The number of international exhibitors of 2016 show is expected to be 365 and this figure is 14% increasing from last year. This is the largest number in Manufacturing World’s history. “This fact means that this event is evolved to be the global trade show and there is a huge demand from international exhibitors to develop the new business with Japanese manufacturers,” said Takeshi Fujiwara, Show Director of Manufacturing World. “We hope there will be great number of good meetings between international exhibitors and Japanese visitors at Manufacturing World Japan 2016 and it leads to the innovations which can make the greater cars, consumer electronics, trains, airplanes etc.”

Requirements for quality from Japanese manufacturers being well known as extremely high, all exhibitors will exhibit their latest products/technologies/solution with all their skills. Though this show has been recognized as the place where the world’s highest quality products/technologies/solution are gathered for these years, Show Management is sure that the 2016 show should be the most exciting show in its history gathering 2,350 exhibitors. If you would like to see the finest skills of metal processing/micro fabrication by the craftsman’s effort and history, you should come and visit Manufacturing World Japan 2016. If you have a trouble on your product which you have been struggled for a long term, you should not miss Manufacturing World Japan 2016.

For free entry to Manufacturing World Japan 2016, visitors need to apply for the visitor registration through the official website. Now visitor registration is open at the official website. Access to the following URL and complete the registration form for Exhibition Ticket.

VIP Exhibition Ticket Registration (Only visitors above manager level): http://www.japan-mfg.jp/en/vip/

Exhibition Ticket Registration: http://www.japan-mfg.jp/en/inv/

Group Visit Application (The group with more than 6 people): http://www.japan-mfg.jp/en/To-Visit_Tokyo/Group-Visit/

Shows held inside Manufacturing World Japan 2016

· 20th Mechanical Components & Materials Technology Expo [M-Tech]

· 27th Design Engineering & Manufacturing Solutions Expo [DMS]

· 7th Medical Device Development Expo [MEDIX]

· 24th 3D & Virtual Reality Expo [IVR]

Manufacturing World Japan 2016: http://www.japan-mfg.jp/en/

Samsung OLED Equipped HP Spectre 360 (Source = HP)

Hyunjoo Kang / jjoo@olednet.com

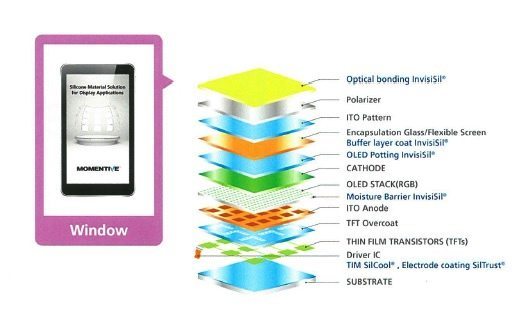

With diverse merits, OLED application is increasing to include notebook, tablet, monitor, etc. Accordingly, Samsung Display’s OLED panel is being actively expanding to this market.

HP recently began shipping Spectre 360, a notebook equipped with Samsung Display’s 13.3 inch OLED with resolution of 2560 x 1600. Previously, in CES 2016 (6-9 Jan) Samsung Electronics revealed Samsung Display’s 12 inch OLED equipped Galaxy Tab Pro S, and HP and Dell also presented Samsung Display’s 13 inch mark OLED equipped labtop.

In SID 2016 (22-27 May), Samsung Display presented 2560 x 1440 resolution 13.3 inch and 14 inch OLED for notebook and actively targeted the notebook market. Following this, a Korean press reported that Samsung Display will stop production of TN panel, low resolution LCD panel for notebook and monitor. That Samsung Display is actively targeting the notebook market is analyzed to be a strategy to create premium market advocating diverse advantages of OLED.

Due to superior contrast ratio, OLED’s picture quality is clearer in comparison to LCD, and easy to create premium market as the weight can be lighter than LCD. Burn in effect, considered one of OLED’s drawbacks, is also known to have been much improved.

As the price of OLED is higher than LCD at present, specialist market, such as medical, should be targeted first. However, when the price competitiveness improves in future, popularization of OLED is anticipated. Accordingly, Samsung Display is actively taking action in notebook and tablet OLED market expansion. UBI Research reported that 2016 Q1 OLED panel shipment for tablet increased by more than 10 times compared to the same period in 2015.

According to UBI Research’s 2016 OLED Display Annual Report, the 11 inch – 13 inch, notebook and monitor use, OLED panel shipment is expected to record 100,000 units this year, and this is expected to increase by 10 times in 2020.

SDC`s 806 ppi OLED Panel for VR

Hyunjoo Kang / jjoo@olednet.com

Samsung Display’s recently revealed 5.5 inch 806 ppi AMOLED is expected to contribute to the expansion of the global VR (virtual reality) market as well as providing synergy for both Samsung Electronics’ future VR and smartphone business.

In SID 2016 (22-27 May), Samsung Display revealed 5.5 inch AMOLED with resolution of 806 ppi. This 4K UHD display has the highest resolution for 5 inch mark AMOLED in industry.

The response speed of AMOLED is approximately 1,000 times faster than LCD and can actualize much superior picture quality due to exceptional contrast ratio. The reduced amount of harmful blue light is also another merit of AMOLED, and it is becoming the general trend for display for VR display.

Even at the same resolution, the visual effects for smartphone and VR device are different. For example, 577 ppi QHD resolution applied to Galaxy S7 can actualize quite clear picture quality for smartphone. However, when the display is directly in front of the eyes, in cases of VR, aliasing effects, when what is on the screen looks jagged, occurs. In order to produce clear picture quality with almost no aliasing effects in VR, expert believe that 1,500 ppi is required at minimum. However, the current VR AMOLED only can actualize up to high 500 mark ppi.

That Samsung Display displayed AMOLED with resolution of over 800 ppi for the first time should be noted. With this resolution, aliasing in VR can be significantly improved even if not perfectly. Furthermore, this AMOLED has the same brightness as the Samsung’s Galaxy S7. Considering the production yield improvement, this display could be used for Galaxy S8 (TBA) that is expected to be released in 2017. For VR device connected to smartphone, smartphone’s resolution is directly related to the VR’s picture quality. This means that the Samsung’s 806 ppi 5.5 inch AMOLED allows for UHD smartphone production as well as the introduction of VR with upgraded picture quality.

UBI Research explained that while some believe that ultra-high resolution is not necessary in small screen such as smartphone, the 4K UHD 5.5 inch AMOLED is significant in that smartphone is linked with VR which market is being opened. He added that the 806 ppi AMOLED recently revealed in SID 2016 by Samsung will contribute to the expansion of the global VR market as well as providing synergy for both Samsung Electronics’ future VR and smartphone business.

Hyunjoo Kang / jjoo@olednet.com

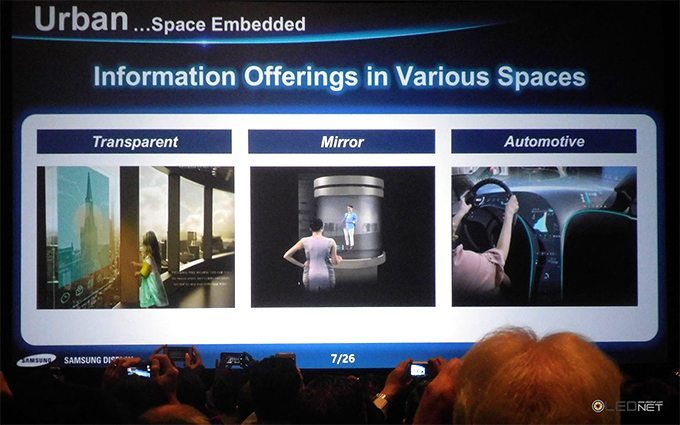

Samsung Electronics, will showcase the latest additions to its industry-leading digital signage and visual display solutions portfolio at the InfoComm 2016 tradeshow. Scheduled to take place June 4-10, 2016, at the Las Vegas Convention Center, InfoComm is the largest annual global conference for the professional AV industry and is expected to welcome more than 40,000 attendees from nearly 110 countries.

Under the theme “Collaborate. Attract. Engage.”, Samsung’s booth (#C-6319) will include a variety of next-generation technologies designed to promote more efficient content delivery and display management in corporate, hospitality, public, retail and at-home environments (among others). Highlighted by the integration of the Tizen operating system into many of its newest digital signage technologies, Samsung’s diverse line-up will demonstrate how booth visitors can drive greater engagement, and related sales, through clear, cost-effective message presentation.

“As the world’s leading total digital signage solutions provider, we strive to discover new avenues that help our partners deliver captivating content and a differentiated experience at every stage of the customer journey,” said Seog-gi Kim, Senior Vice President, Visual Display Business at Samsung Electronics. “We are excited to introduce the latest expansion of our cutting-edge visual display lineup at InfoComm 2016, and showcase how these new technologies solve prominent challenges and drive growth in today’s fast-paced business environments.”

Beginning in 2016, Samsung’s new P Series digital signage technologies will feature the enhanced fourth generation Samsung SMART Signage Platform (SSSP 4.0) powered by the Tizen operating system. With Tizen, SSSP will deliver more powerful graphic performance and seamless content playback to expand users’ visual display possibilities while creating a more vivid and memorable experience for their audiences.

The Tizen-powered, fourth-generation SSSP features an upgraded graphics engine to drive faster response time, interactions and loading speeds. The platform additionally enables users to manage display content more rapidly through an optional PC-less all-in-one screen.

The refined SSSP 4.0 platform allows users to build and launch web-based applications by offering HTML5 support and a comprehensive toolset, including Web Simulator and Tizen Emulator. The new platform’s versatility expands users’ content development capabilities while reducing activation time.

A key component of the improved SSSP 4.0 platform, Samsung’s MagicInfo Server 4.0 program enables users to manage their entire display network from any location through a centralized server. Reliable and easy to use, MagicInfo Server 4.0 integrates a dedicated Backup Player and DataLink content streaming functionalities to reduce the manual work required to share essential information.

The enhanced MagicInfo Server 4.0 program additionally offers enterprise users a more capable set of content creation, scheduling and deployment tools. Content managers can leverage an intuitive interface, including drag-and-drop content scheduling, to rapidly identify and implement updates. MagicInfo Server 4.0 further makes content programming easy through a design that does not require JavaScript or additional plug-ins to operate, reducing steps to save valuable time.

Samsung’s new standalone displays (PHF and PMF Series) provide a slim, strong and simple signage solution for environments facing tight or irregular space limitations. Featuring a slim-depth design (29.9mm) and narrow bezel (6.9mm), the PHF and PMF displays are among the thinnest on the market and can accommodate a range of business settings. The Tizen-supported standalone displays are designed for uninterrupted 24/7 content delivery, and an integrated centralized infrared receiver (IR) further ensures continued performance in any environment.

A host of additional design features further enable the PHF and PMF Series displays to deliver clear, brilliant content regardless of location. A non-glare frontal panel reduces natural and ambient light reflection to ensure continuous readability.

InfoComm attendees also will get the first look at Samsung’s new large-format OHF Series outdoor displays. Billed as industry’s leading large-sized outdoor signage, the OHF Series is available in a variety of sizes (46-, 55-, 75- and 85-inch models), with each boasting a slim-depth design for more impactful content delivery.

The OHF Series displays are equipped with SSSP 4.0 and powered by the Tizen operating system, ensuring faster and more reliable content development and delivery. An embedded power box condenses operational components to a single system, conserving space while streamlining management. Engineered for any outdoor environment, the OHF Series displays can withstand temperatures ranging from -30-50oC without impeding content delivery. OHF Series viewers additionally benefit from external magic glass, 2,500nit brightness and a 5,000:1 contrast ratio that ensure messages can be seen clearly at any time and place.

Optimized for a range of indoor retail, corporate and public-viewing applications, Samsung’s narrow bezel (1.7mm bezel-to-bezel) UHF-E video walls combine advanced color management capabilities with the visual enhancements of large-format signage to deliver clear and consistent content. The ultra-slim design eliminates distractions and keeps viewers focused on the display’s content rather than the display itself. Equipped with the same durability and color presentation components as its predecessors, the UHF-E video walls represent a sleek, stylish alternative capable of delivering uninterrupted content in any indoor setting.

Designed for corporate, control room and customer-facing environments, Samsung’s indoor SMART LED displays deliver compelling content and inspire collaboration at a lower total cost of ownership. These displays feature top-tier diodes and customizable pixel pitch compositions ranging from 1.5-2.5mm, providing seamless visibility while simultaneously accommodating users’ specific operational and branding needs. Combined with design elements that produce the same deep contrast, realistic picture quality and color consistency viewers expect from Samsung’s latest televisions, the LED signage portfolio offers users an extra edge to stand out within often-crowded indoor environments.

ZTE`s Smartphone (출처=GSMARENA)

Hyunjoo Kang / jjoo@olednet.com

Recently, DigiTimes reported that Chinese smartphone companies are discussing supply with Taiwanese panel companies due to panel shortage. According to the report, executives of Chinese smartphone companies such as ZTE, Vivo, GiONEE, etc. and Chinese panel companies including Truly recently met with Taiwanese panel companies, AUO, Innolux, Chunghwa Pictures Tubes, etc.

The reason that Chinese smartphone companies are experiencing the panel shortage is known to be because their panel suppliers reduced smartphone panel production due to too low prices. However, DigiTimes reported that Huawei is receiving relatively sufficient amount of panels from BOE, Tianma, etc.