<Source :LG Display Unveils Next-Generation Market Leading Technologies at CES>

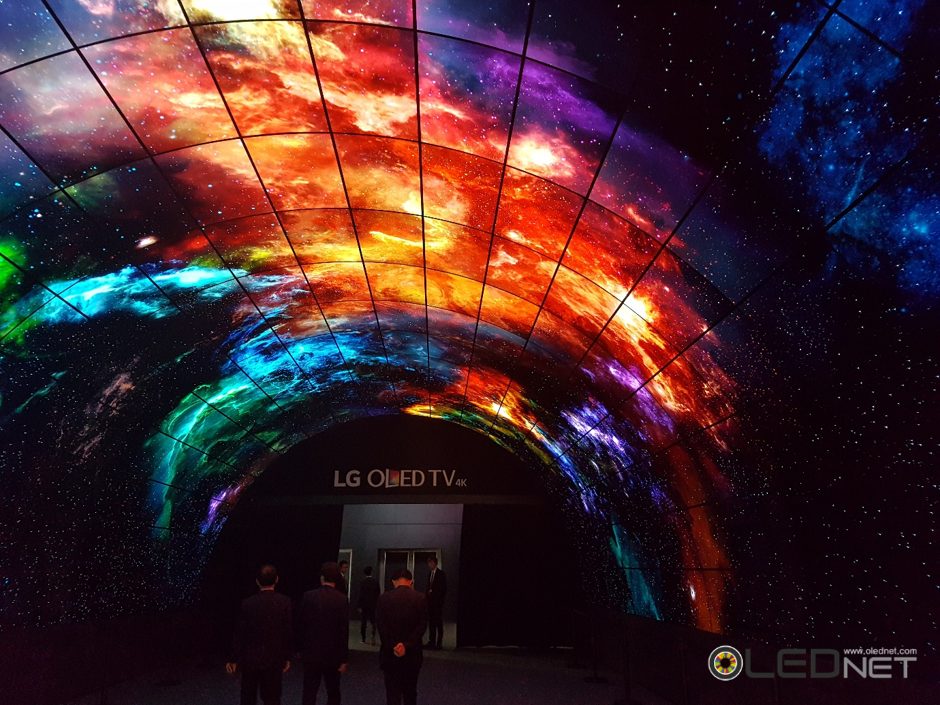

LG Display is actively participating in the ‘CES (Consumer Electronics Show) 2017’ to be held in Las Vegas, the U.S., from January 5 to 8 to show more diverse products and next-level differentiated technologies.

LG Display plans to convey its purpose to achieve consumer innovation together with LG Display’s differentiated technologies under the slogan of ‘Our Technology, Your Innovation’, at its private showroom for clients in the Las Vegas Convention Center, from January 4 to 8.

Especially, LG Display will showcase new products that basically has superior picture quality and fulfill OLED’s next-level design and potential, as well as a variety of products that provide new future to customers with its own differentiated technologies.

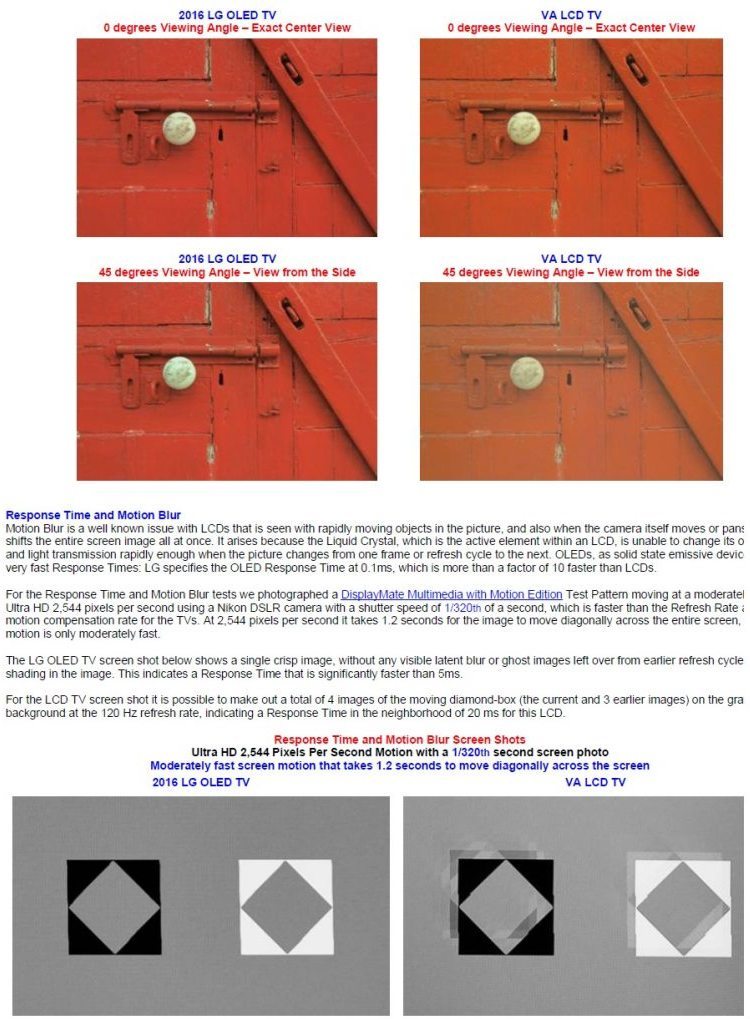

■ Unveil the New OLED TV with Superior Picture Quality, and Extreme Design

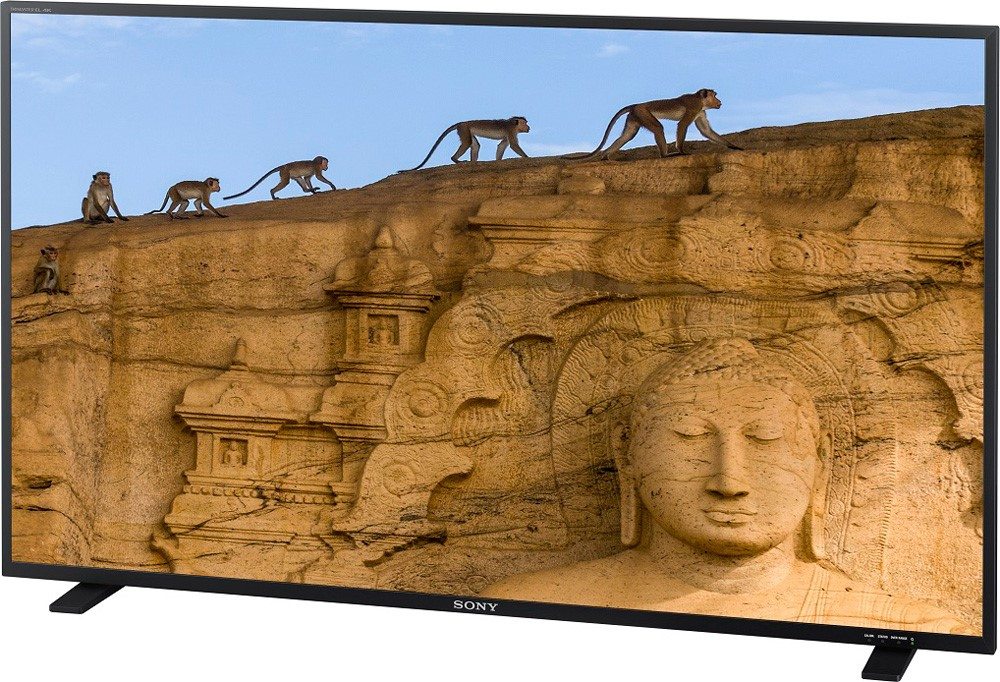

LG Display will release its differentiated OLED TVs with unsurpassed picture quality and potential application and design.

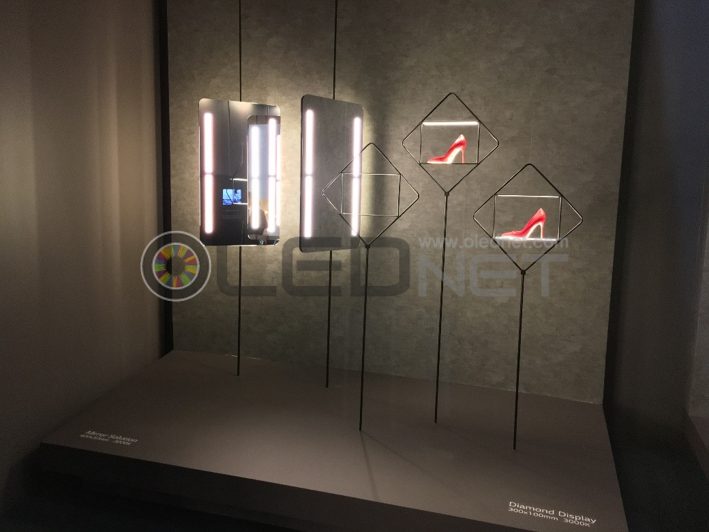

During CES, it will also introduce a 55-inch transparent FHD display featuring the improved colors and more natural and transparent screen.

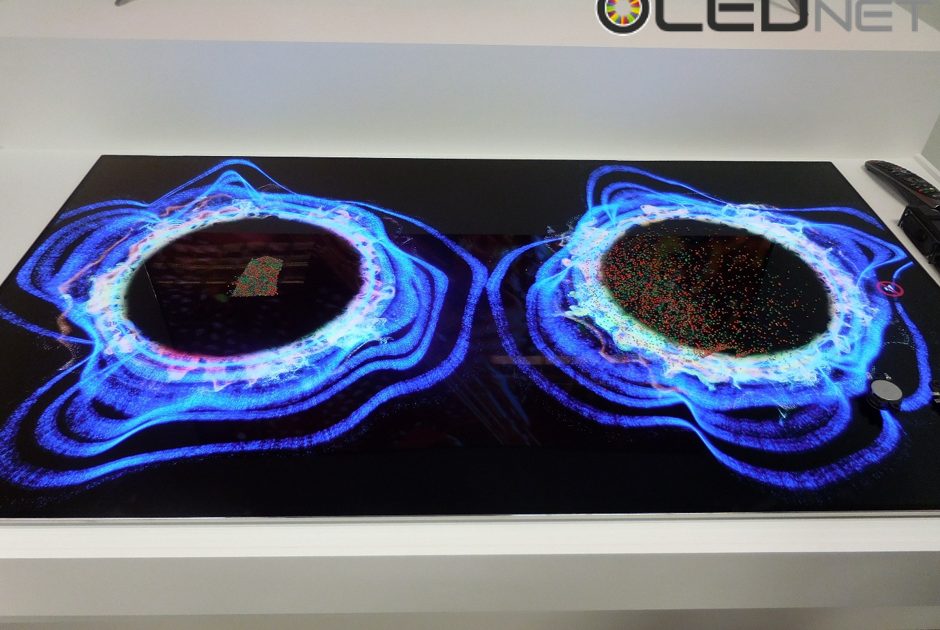

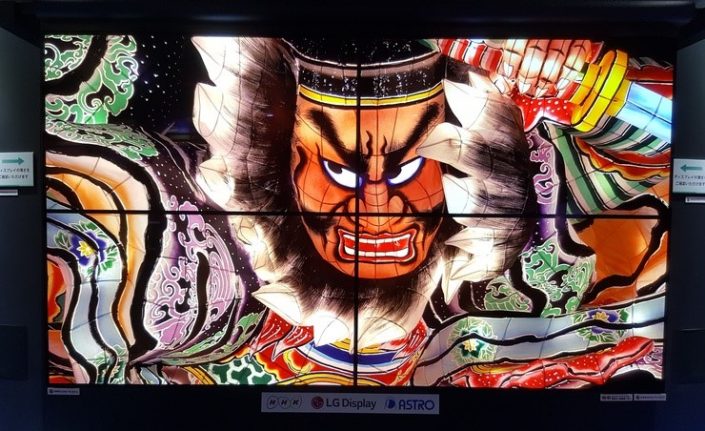

LG Display will showcase 65-inch and 77-inch UHD Wall Paper TV line-up with ultra thin and innovative design. It will also show off futuristic displays, including a 77-inch double-sided UHD display and 77-inch six rollable UHD commercial displays, which will open various possibilities of OLED with surpassed picture quality.

■ Constantly evolving IPS, Innovative LCD Technology

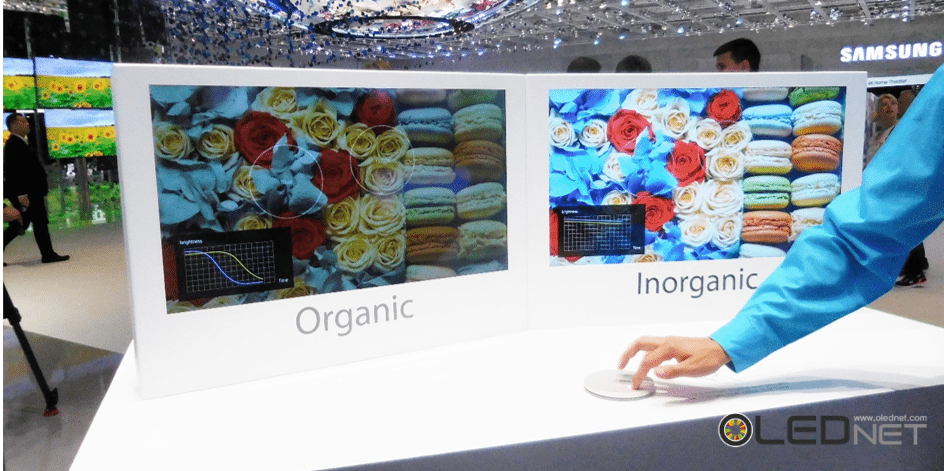

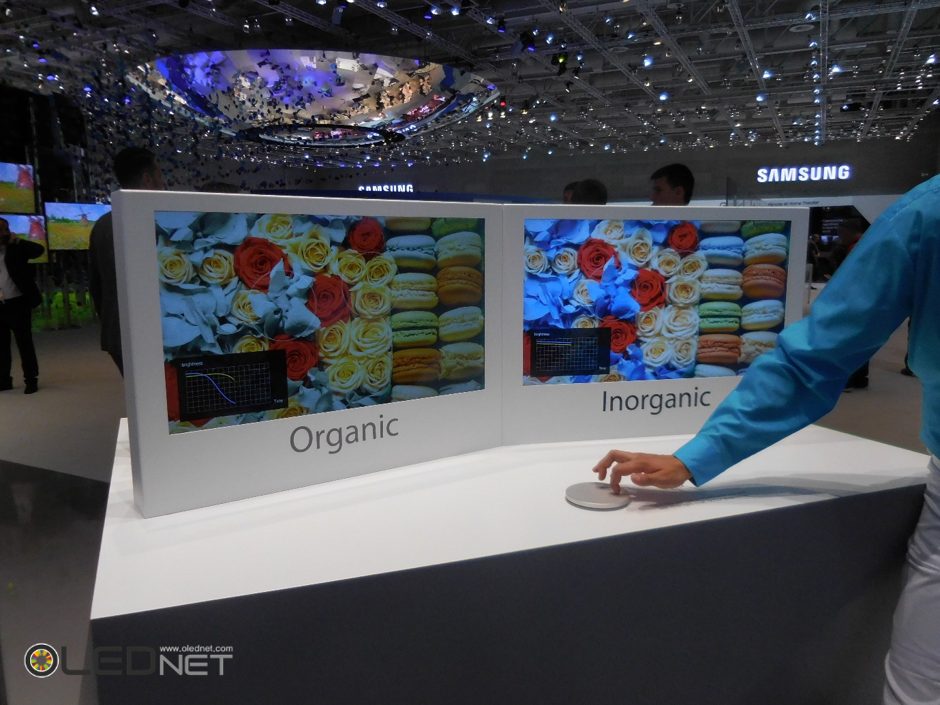

LG Display’s OLED(Organic Light-Emitting Diode) and a high-resolution technology IPS evolve further.

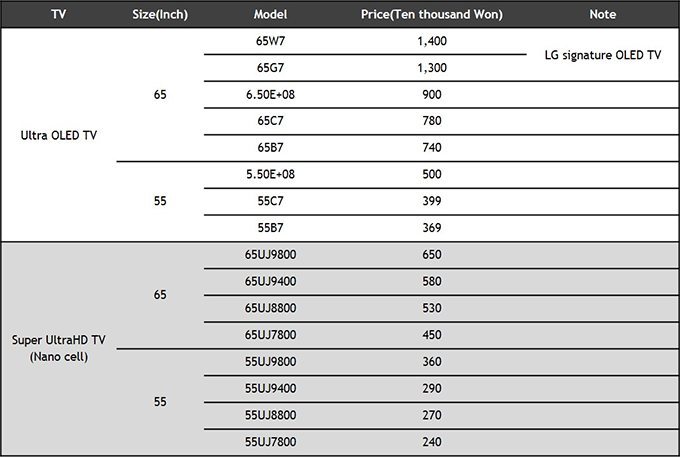

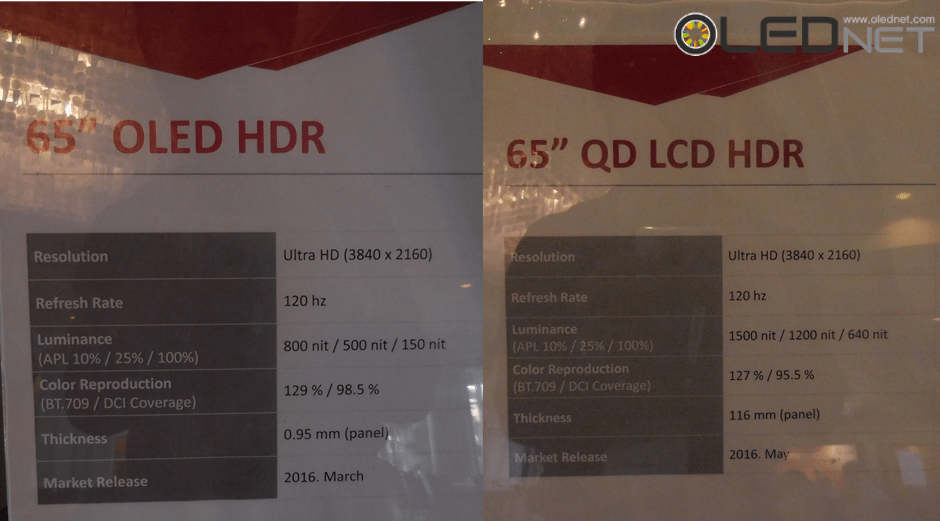

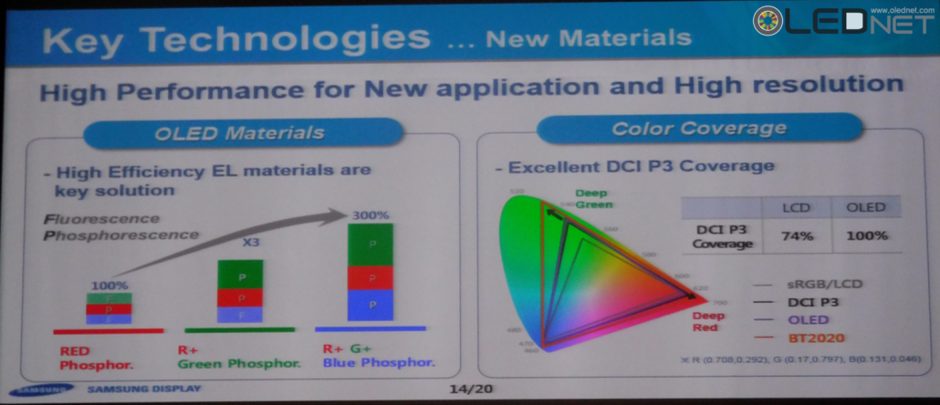

LG Display will show off IPS products with improved picture quality and price competitiveness by using WCG(Wide Color Gamut, a technology to provide a greater range of colors), HDR(High Dynamic Range, a technique to reproduce a greater dynamic range of luminosity), and high-resolution technical solutions.

Especially, IPS Nano Color at this show is LG Display’s own WCG technology that can express more accurate and vivid colors, using nano-sized wide color gamut.

It is increased with the addition of the strength of IPS OLED to offer high color accuracy. This show will apply it to a 65-inch UHD product.

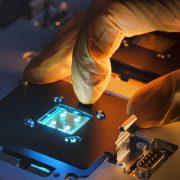

■ User’s Expanded Touch Experience through in–TOUCH, Improved-quality Display

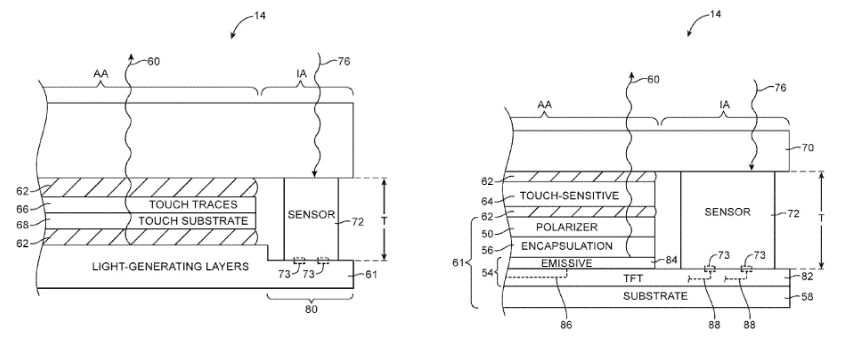

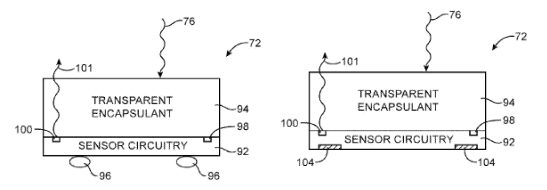

LG Display will expand in-TOUCH technology of touch sensor-embedded panel to 24-inch monitors, while showing off the key advantages of design to offer differentiated values to IT market through its high-resolution product strategy.

in-TOUCH technology offers a thinner and lighter product since there is no Touch Cover Glass.

In addition, Active Pen Solution is applied to a 13.3-inch in-TOUCH panel, so that it features higher touch accuracy outside the screen, faster touch response, and more precise calibration of the touch point, compared to conventional Add-on(touch sensor-added panel).

LG will also show not only the world’s largest 38-inch curve monitor suitable for such offices as stock trading, movie-watching, and immersive gaming but also 32-inch 8K monitor with ultra high resolution and HDR monitor panel for broadcasting and video editing experts.

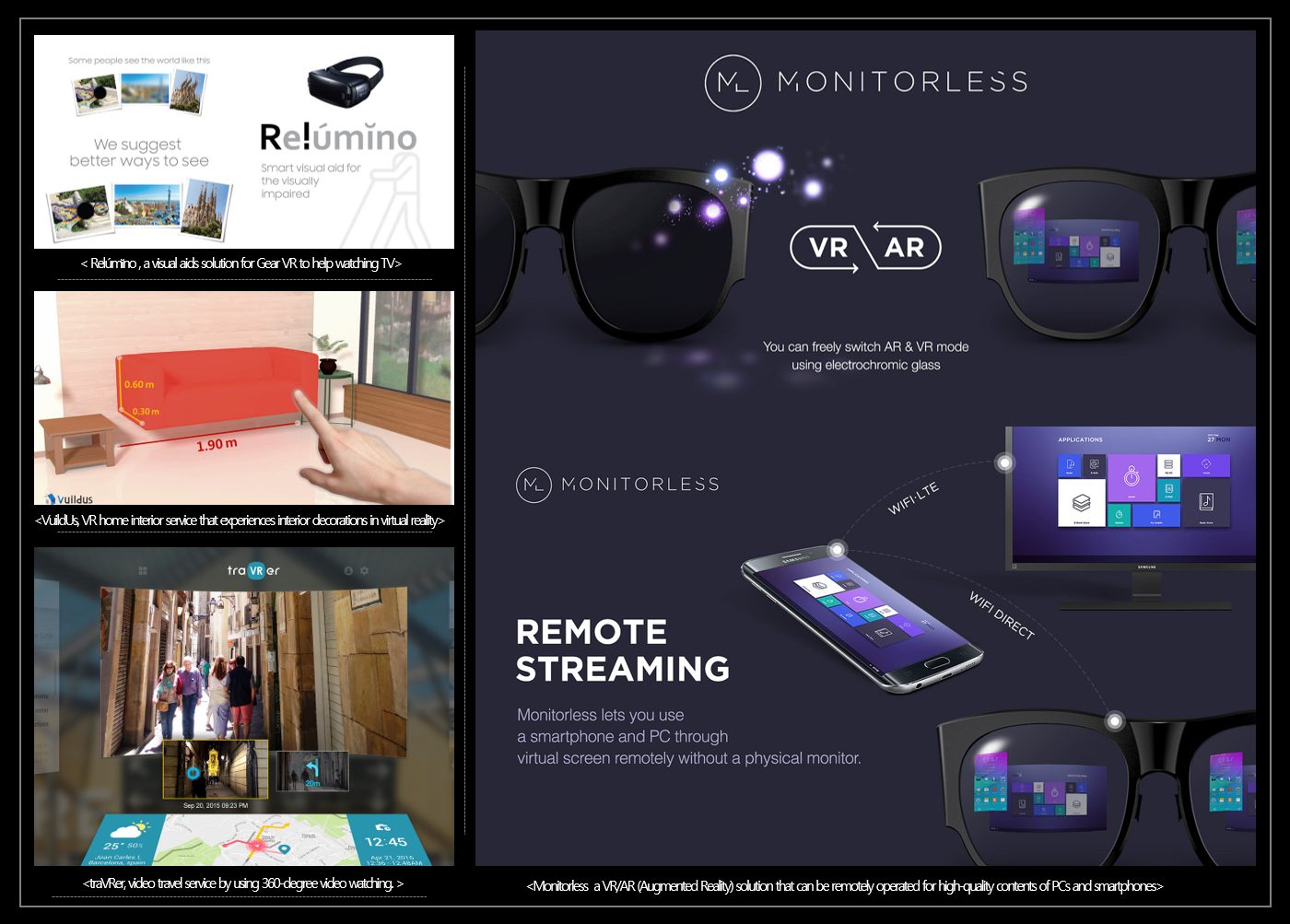

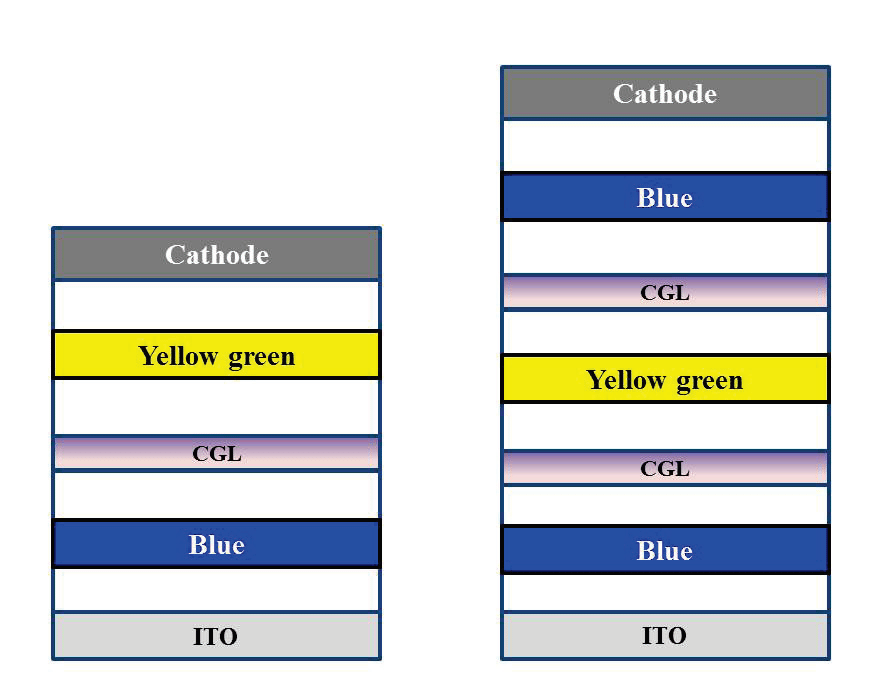

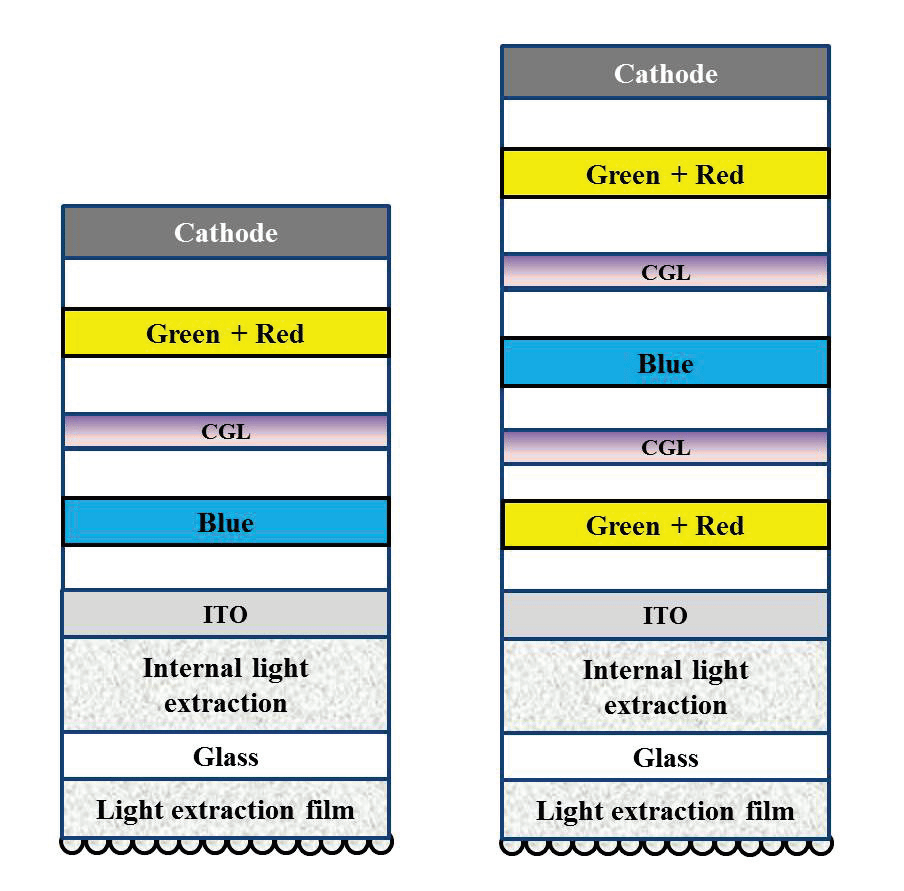

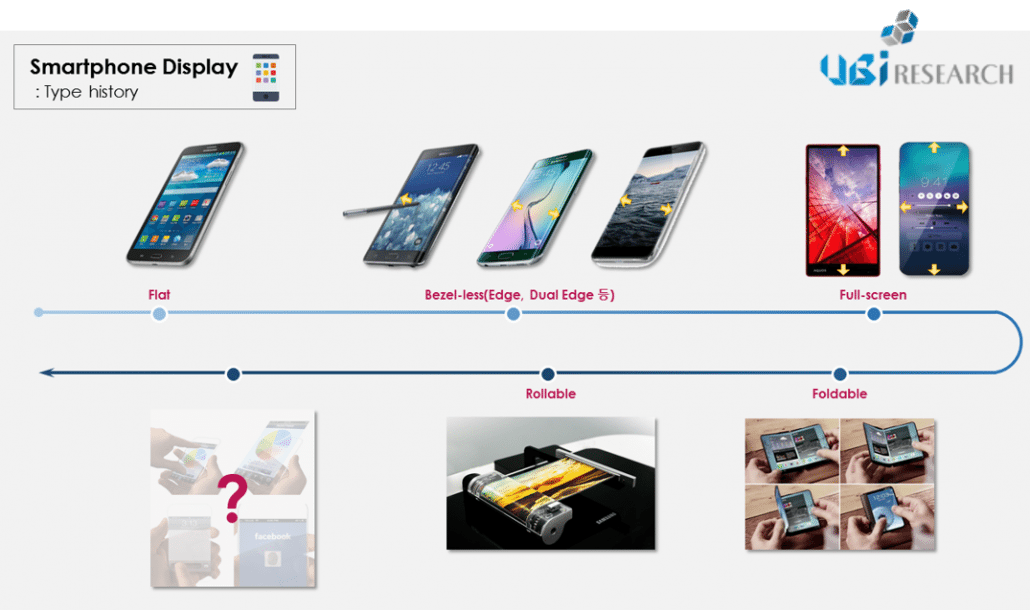

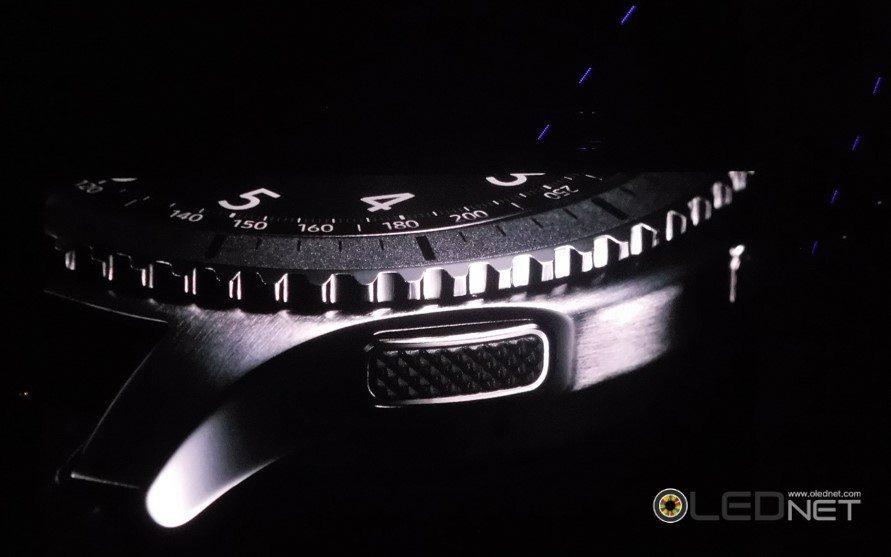

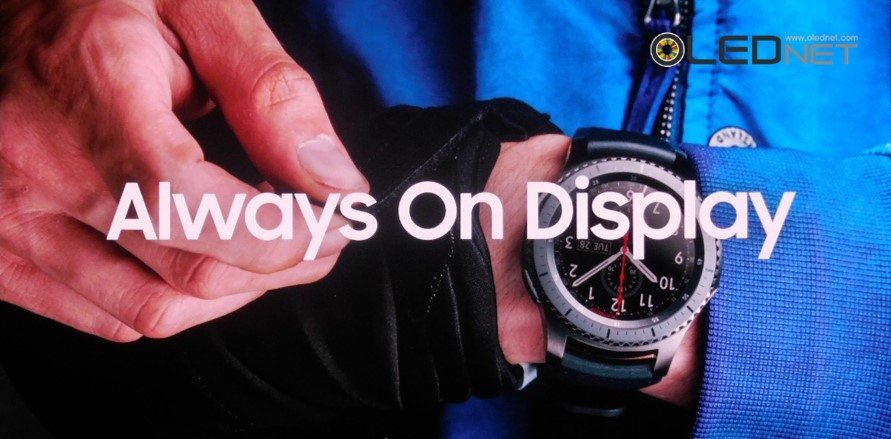

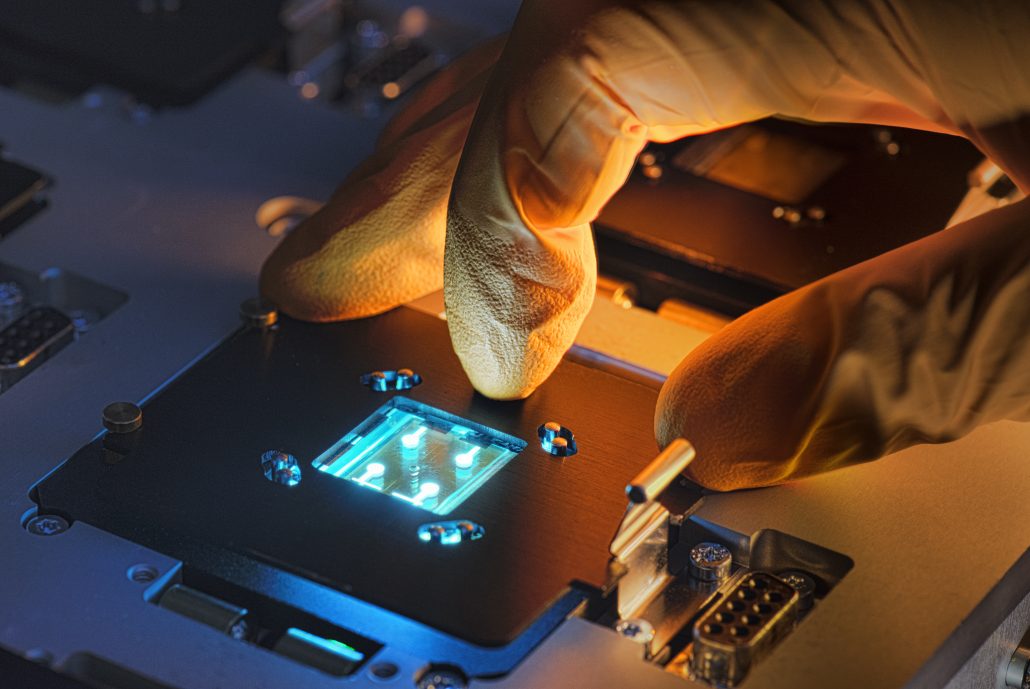

■ Providing Future Vision through its P-OLED with Excellent Picture Quality and Design Freedom

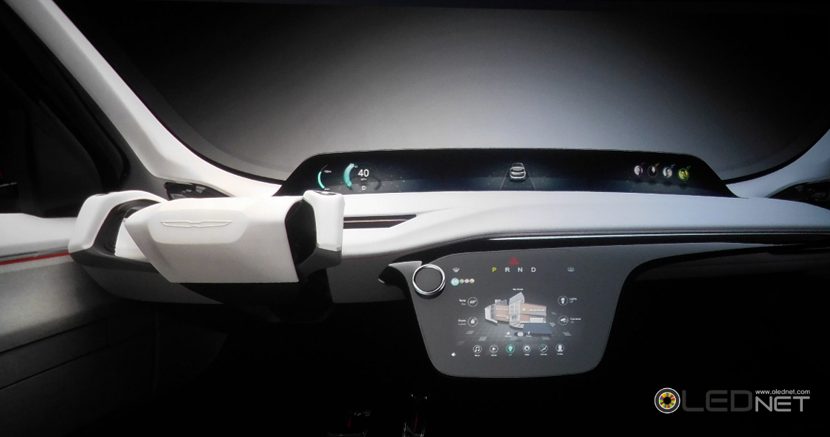

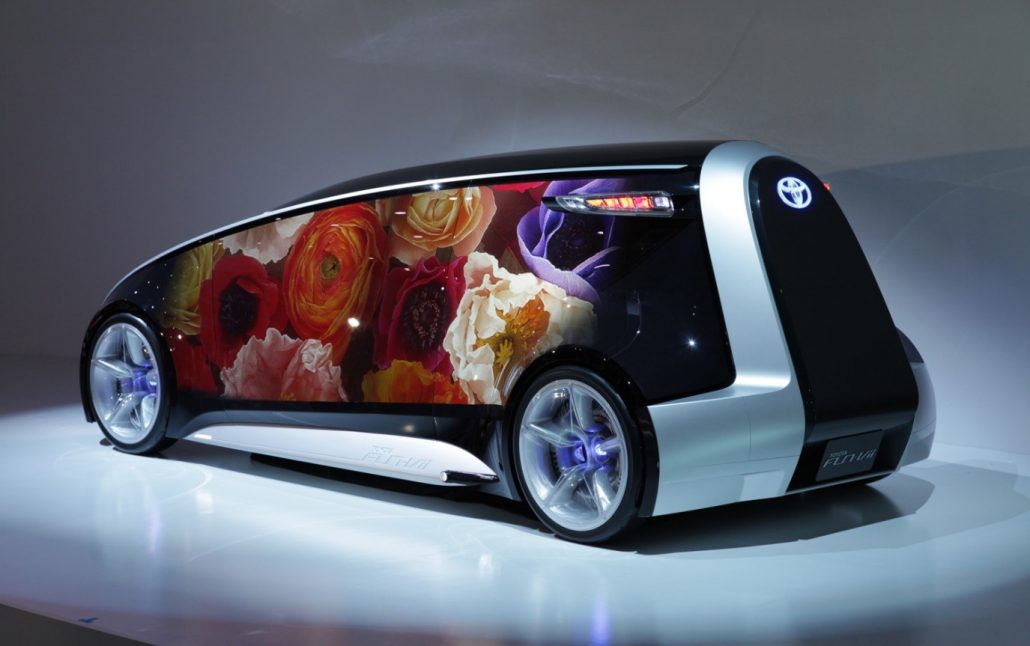

LG Display will provide next-gen futuristic automotive display products through P-OLED(Plastic OLED) with superior picture quality and design freedom.

P-OLED featuring wide screen, perfect expression of black, and high design flexibility is an optimized technology to provide new vision to automotive interior in harmony with the curved surfaces of vehicles.

LG Display plans to have a showroom for visitors to experience futuristic concept products in a real situation, including Cluster that will provide better safety and convenience, Center Information Display, passenger seat display, large transparent OLED, and mirror-type OLED.

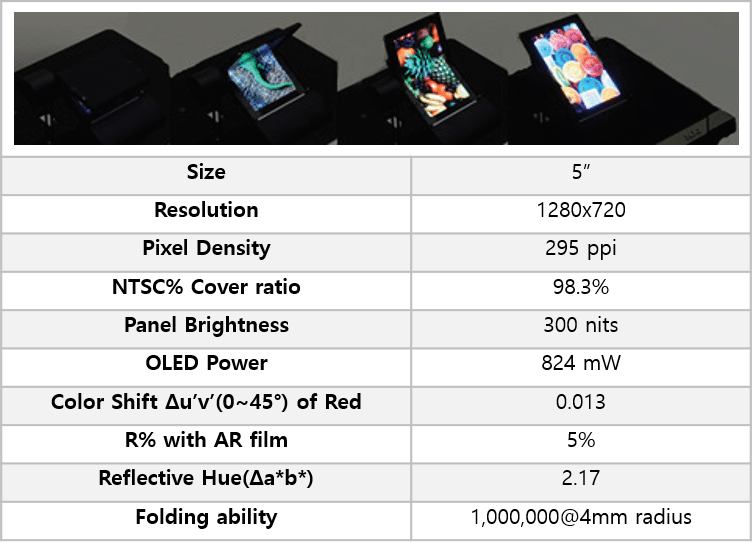

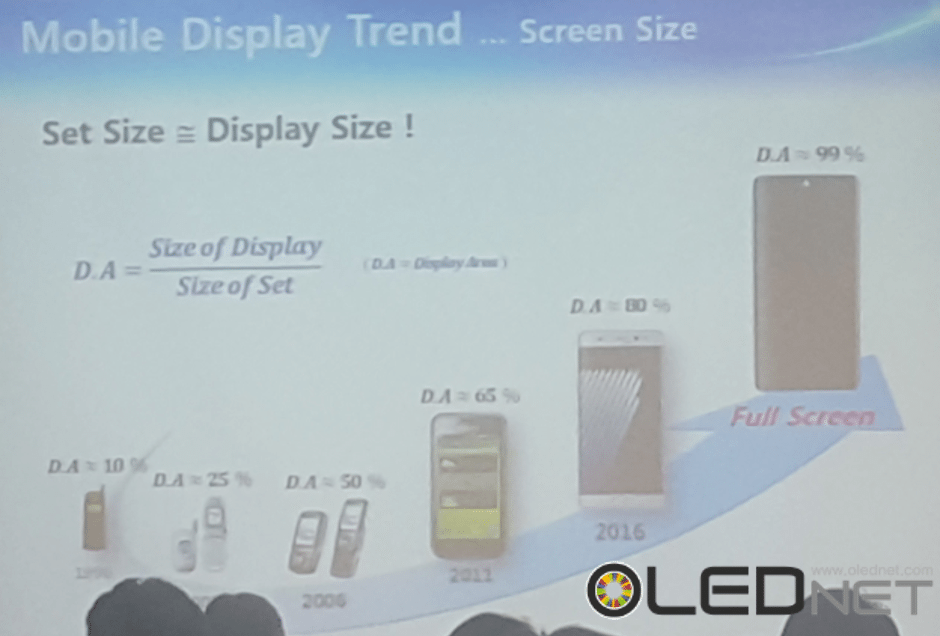

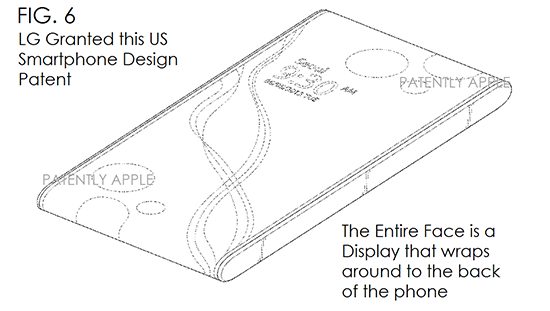

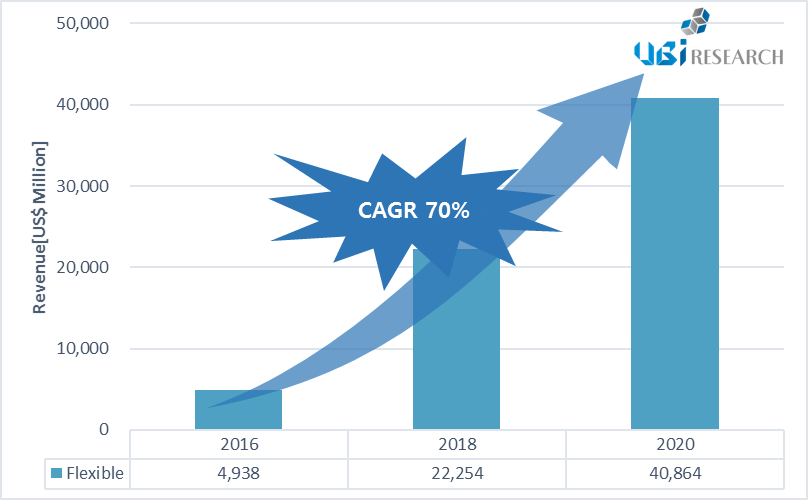

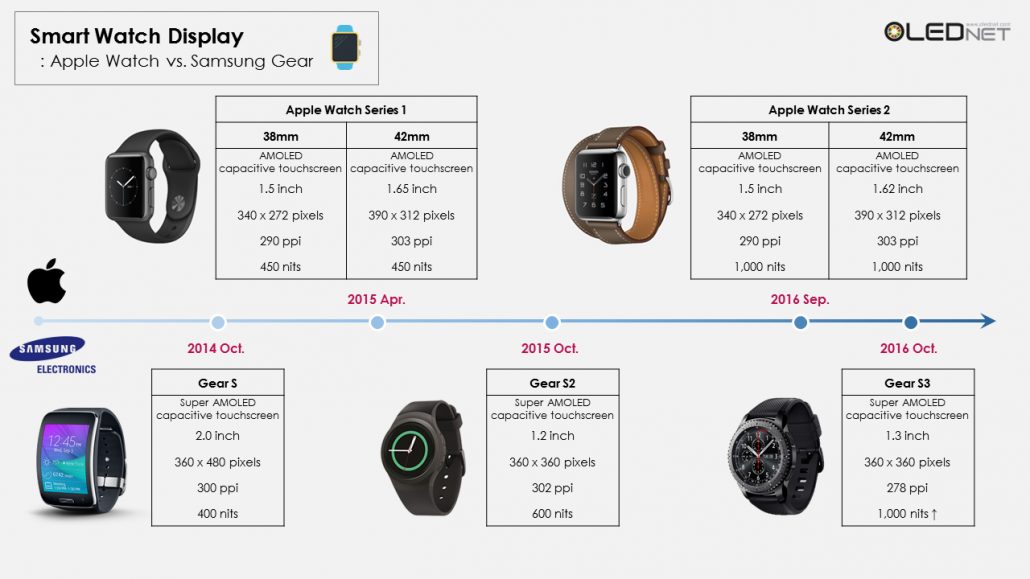

Besides, LG Display is aiming to enter the middle and small-sized OLED market through 5.5-inch QHD P-OLED. In addition, it will introduce the P-OLED for Smartwatches with diverse designs, including circular or square pattern.

LG Display Vice Chairman, Han Sang-beom announced “LG Display has offered leading products that can provide new values beyond the expectation of the market, with its differentiated technologies.” “It will proactively respond to the market through its next-generation display OECD and new innovative technologies, and consolidate its position as a leading company”.

BY HYUNJUN JANG, HANA OH