LG Display invited about 200 people of Chinese set makers, distributors and related experts and had ‘OLED Partner’s Day’ to share the status of premium TV market and OLED TV business development at Renaissance Capital Hotel in Beijing, China on September 12.

<Source : LG Display>

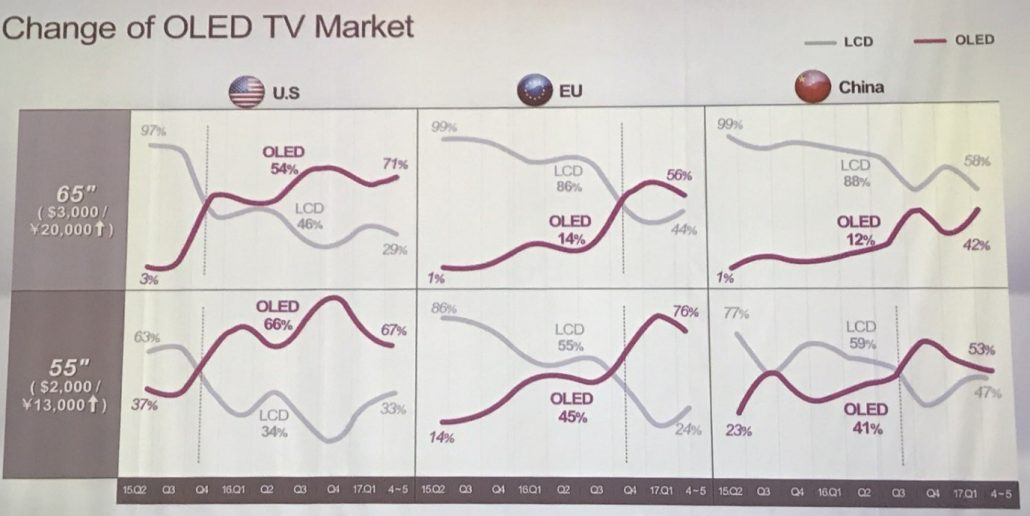

In the expert forum on the day, key executives from distribution and set makers such as LG Electronics, Sony, Philips, Skyworth, Suning and related organizations such as electronic committee and awards association participated and agreed that OLED will lead the TV market in the future. Forum participants, Liu Tangz(刘棠枝), CEO of Skyworth, said “The Chinese TV industry is currently in a state of saturation, but OLED TV, which can offer new value, will be a breakthrough in the display industry,” and commented “OLED TV will help increase brand awareness and market share.”

Yeo Sang-Deog, LG Display CMO, said, “OLED TV has already become the market trend” and emphasized “We will lead the market with OLED TV, a true future display that can deliver value beyond TV.”

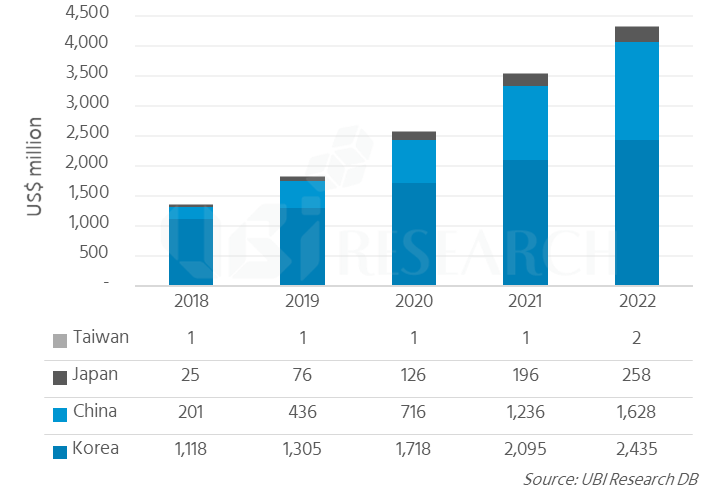

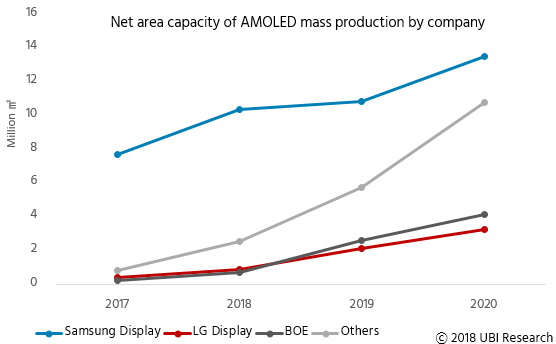

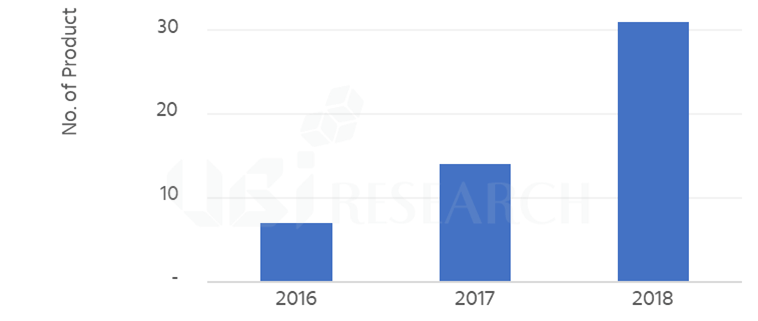

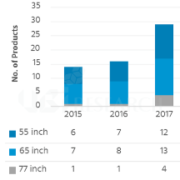

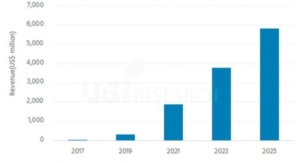

Since LG Display began mass production of OLED TV panels in 2013, it has expanded its customer base to 13 major companies in Europe, Japan and China, starting with LG Electronics. World TV set makers such as LG Electronics, Skyworth, Concha, Philips and Panasonic have set OLED TV products on the front at the IFA (International Consumer Electronics Show) 2017 in Berlin in early September.

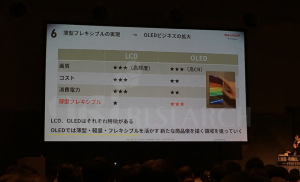

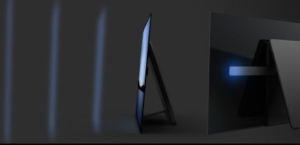

OLED TV’s market competitiveness is getting higher as major set makers in the world recognized the value of OLED TV, which has various advantages such as image quality, thickness, design, viewing angle and power consumption and aggressively launch products.

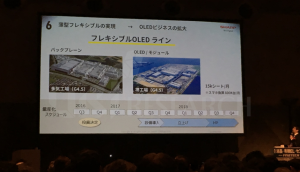

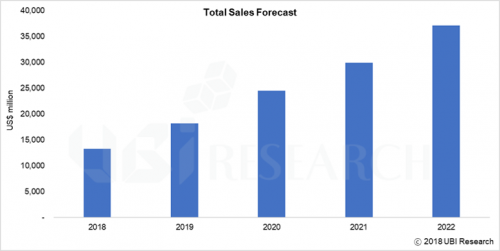

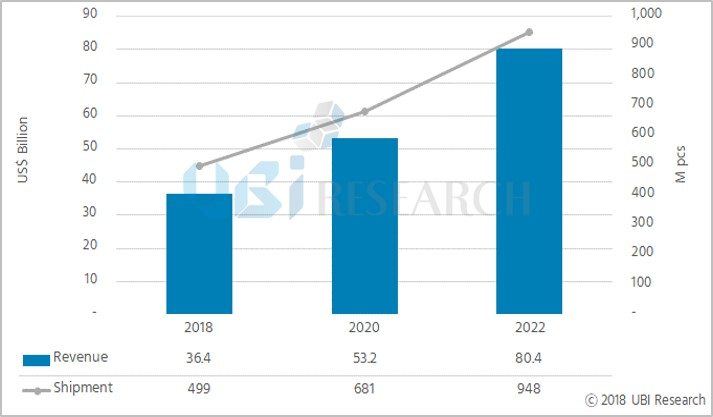

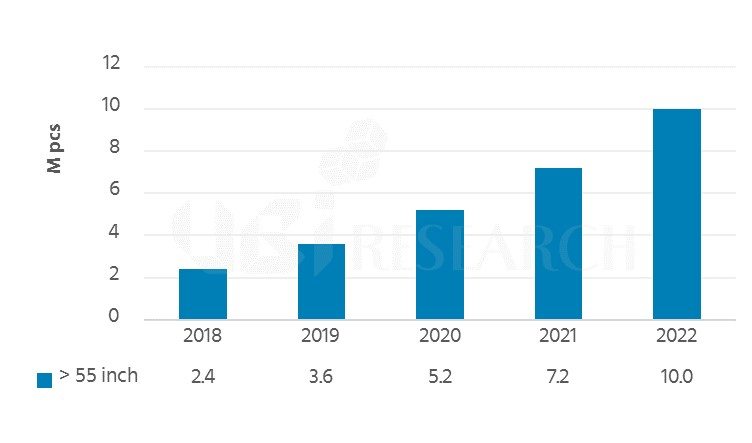

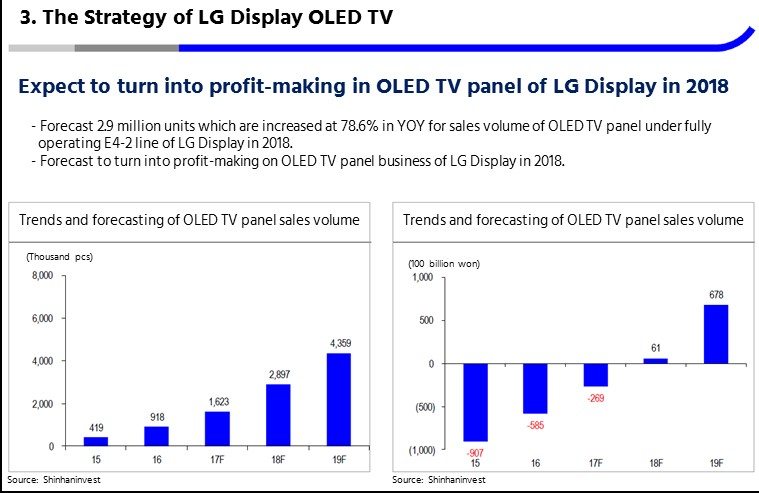

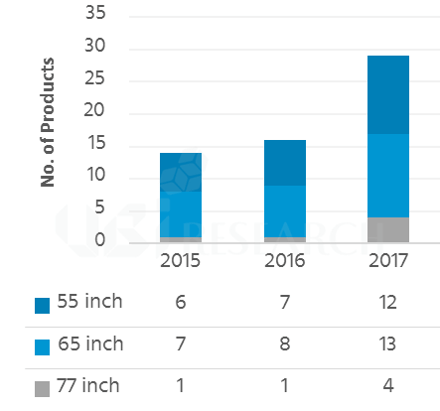

Yeo Sang-Deog CMO emphasized the confidence in quality, he added, “In addition to securing stable yields, we will increase the output to 1.7 ~ 1.8 million units in 2017 and 2.5 million units in 2018.” and explained that they finished all the preparations that OLED TV can influence in terms of production.

<Source : LG Display>

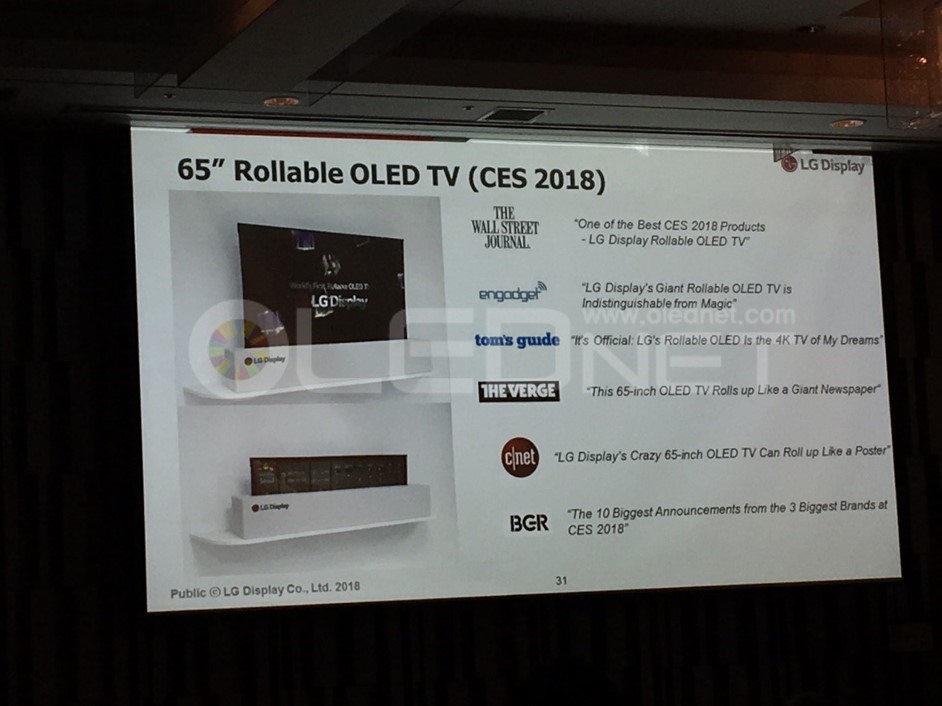

OLED TV has been rated as one of the best products by the world’s leading professional rating agencies such as ‘Consumer Report’, a nonprofit consumer organization in the US.

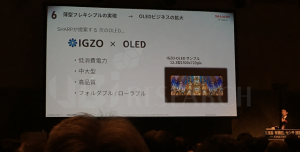

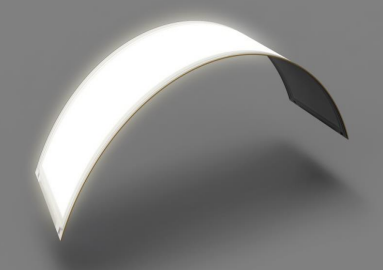

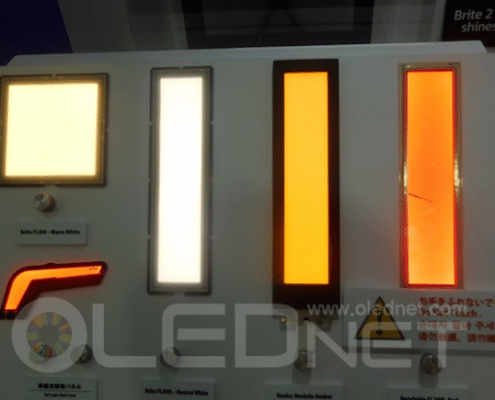

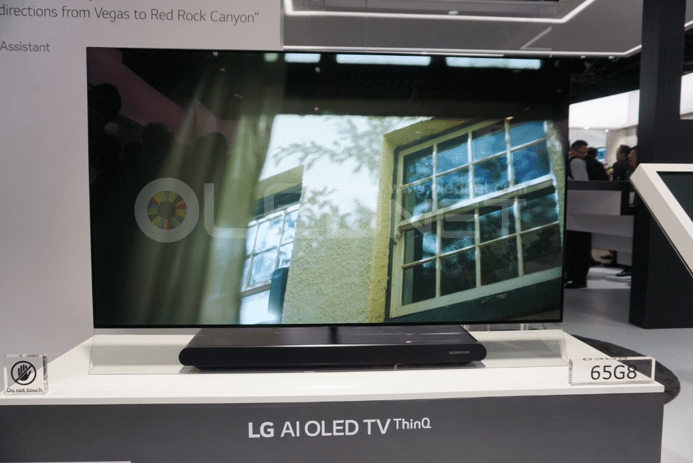

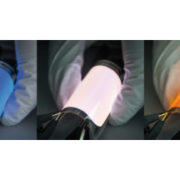

OLED TV can be used for interior decoration that displays pictures and photos even when not watching TV, and easy to apply on various AI platforms so that there is no limit to the range of applications. LG Display expects OLED TVs with infinite scalability to change the lifestyle of consumers.

“OLED is a true future display that can deliver new value to the TV market,” said Yeo Sang-Deog CMO and “LG Display plans to carry out a variety of promotional activities to enable more consumers to know and experience the value of OLED.”

LG Display plans to build an OLED landmark in Guangzhou Tower while operating an OLED experience center in the core city of China.

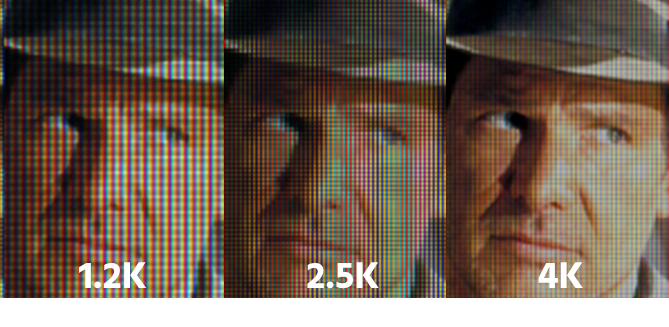

Meanwhile, Vincent Teoh, editor-in-chief and image quality expert at HDTV Test, explained that the TV picture quality test conducted recently proved the overwhelming superiority of OLED TV in all aspects such as contrast and color accuracy, famous Chinese photographer Tungmeong (童梦) shared the experience of use from the user perspective that OLED is the best display to realize the natural color.

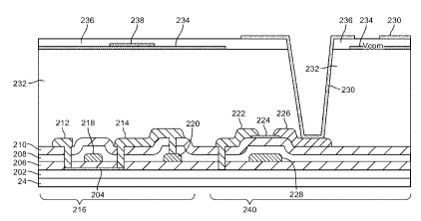

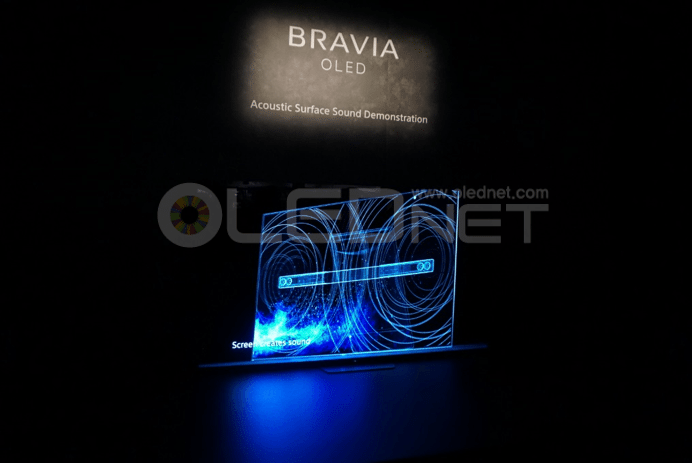

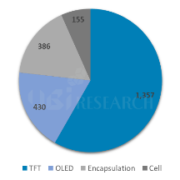

On the he other side of the event hall, there prepared the experience zone that can compare structure and image quality of OLED, gallery that can be observed high-end products such as CSO and wallpapers TV and products released by customers allowing attendees to directly experience the benefits of OLED TV.