Choong Hoon Yi, Chief Analyst, UBI Research

BOE is intending to carry out a large amount of investment in order to operate Gen10.5 LCD line from 2018. Meanwhile, key set makers including Apple, Samsung Electronics, LG Electronics, and Panasonic are devising strategy to move from LCD to OLED for smartphone and premium TV displays. As such, it is becoming more likely for the LCD industry to be in slump from 2018.

At present, the area where LCD industry can create profit is LTPS-LCD for smartphone. The forecast smartphone market for this year is approximately 15 billion units. Of this, Samsung Electronics and Apple are occupying 20% and 15% of the market respectively. OLED equipped units are less than 2 billion.

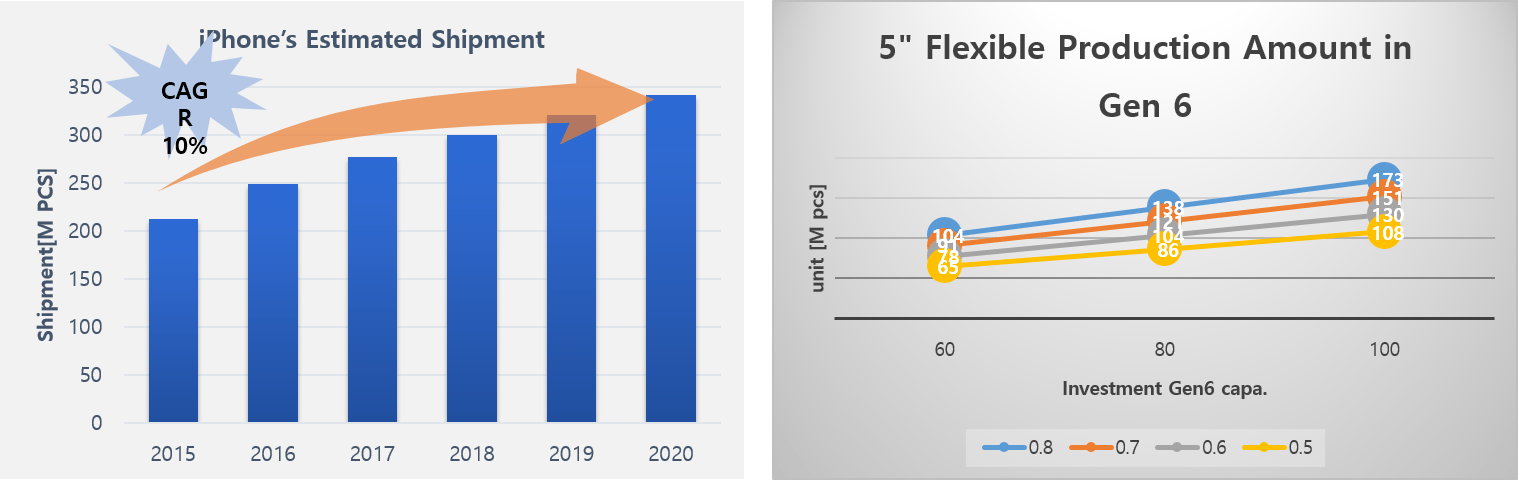

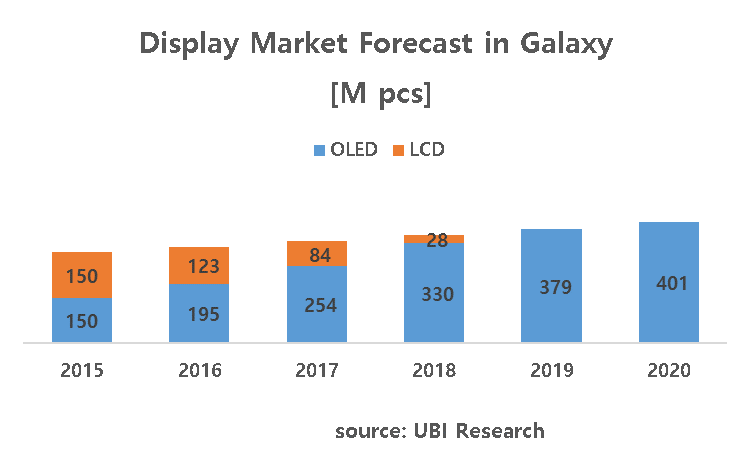

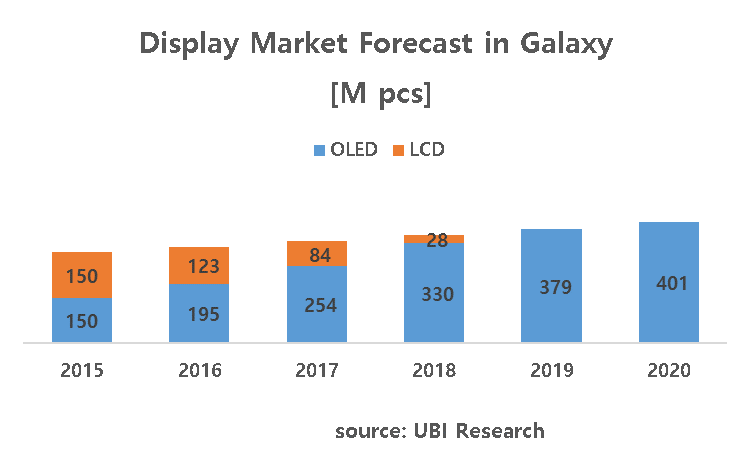

However, from 2018 the conditions change greatly. Firstly, Apple, which has been using LCD panel only, is estimated to change approximately 40% of the display to OLED from 2017 earliest and 2018 latest. Apple is testing flexible OLED panels of JDI, LG Display, and Samsung Display, and recommending them to invest so flexible OLED can be applied to iPhone from 2017. The total capa. Is 60K at Gen6. As new investments for Gen6 line of Samsung Display and LG Display are expected to be carried out from 2016, supply is theoretically possible from 2017.

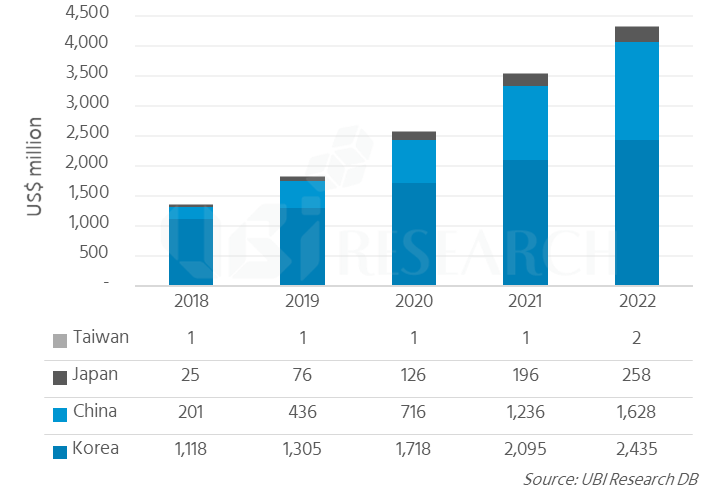

Source: UBI Research Database

If 5inch flexible OLED is produced from Gen6 line, under the assumption of 50% yield at 60K capa. 65 million units can be produced annually, and approximately 1 billion units if the yield is 80%. If Apple’s iPhone shipment in 2017 is estimated to be around 2.7 billion units, within the 50-60% yield range approximately 25% of the display is changed to OLED from LCD, and if yield reaches 80% around 40% will change. The companies that are supplying Apple with LCD for smartphone, LG Display, JDI, and Sharp, are expected to show considerable fall in sales and business. These 3 companies could be reduced to deficit financial structure just from Apple’s display change

Furthermore, as Apple is not producing low-priced phones, under the assumption that future iPhone could all have OLED display, Apple could cause the mobile device LCD industry to stumble after 3 years.

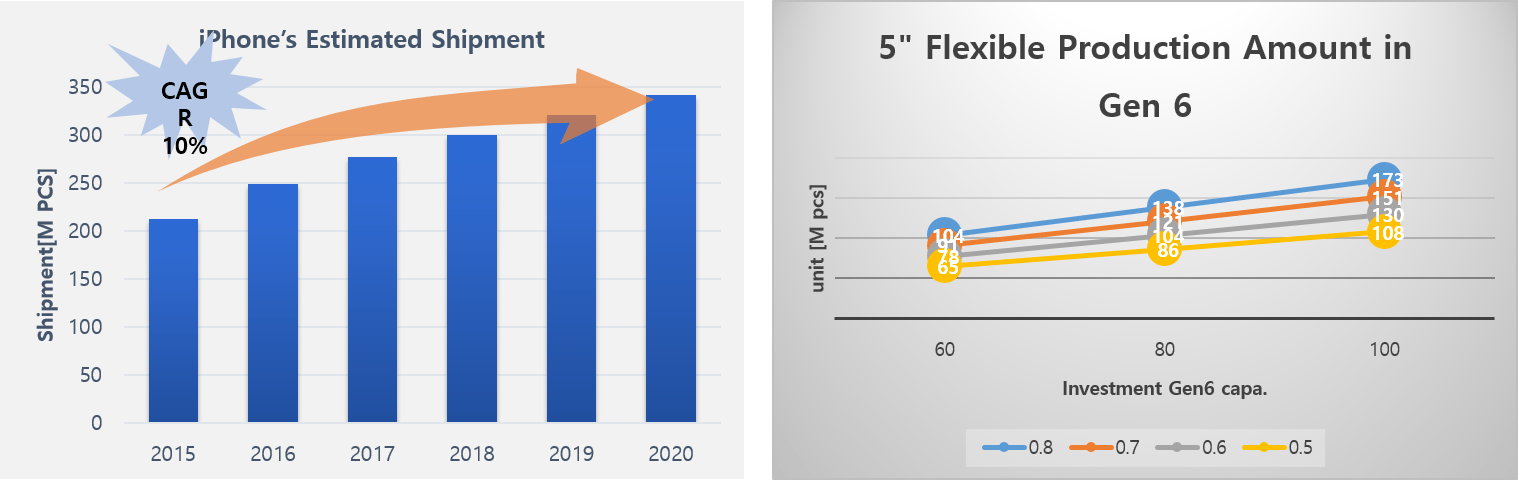

Samsung Electronics also is gradually changing Galaxy series display to OLED from LCD. Of the forecast 2015 shipment of 3 billion units, 50%, 1.5 billion units, has OLED display, but Samsung Electronics is expected to increase flexible OLED and rigid OLED equipped products in future. Particularly, as Apple is pushing for flexible OLED application from 2017, Samsung Electronics, whose utilizing OLED as the main force, is estimated to increase flexible OLED usage more than Apple. It is estimated that all Galaxy series product displays will be changed to OLED from 2019.

Under these assumptions, of the estimated smartphone market in 2020 of approximately 20 billion units, Samsung Electronics and Apple’s forecast markets’ 7 billion could be considered to use OLED.

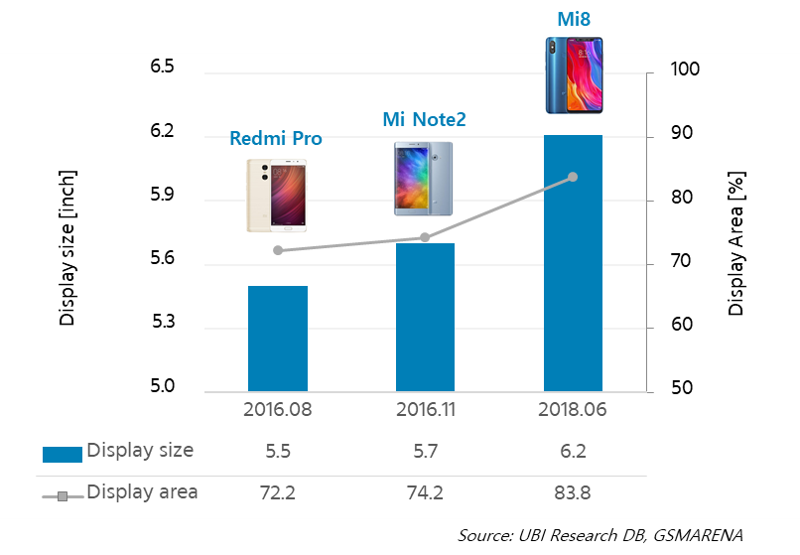

Samsung Display is strengthening supply chain of set companies using their OLED panels. Samsung Display is supplying OLED panels to diverse companies such as Motorola and Huawei as well as Samsung Electronics, and also expected to supply rapidly rising Xiaomi from 2016. If smartphone display is swiftly changed to OLED from LCD from 2017, Chinese display companies that are currently expanding TFT-LCD lines are to be adversely affected.

Additionally, in the premium TV market, LG Electronics mentioned that they will focus on OLED TV industry at this year’s IFA2015. As a part of this, LG Display is planning to expand the current Gen8 34K to 60K by the end of next year. Furthermore, in order to respond to the 65inch market, Gen9.5 line investment is in consideration. In the early 2015, Panasonic commented that they were to withdraw from TV business but changed strategy with new plans of placing OLED TV on the market in Japan and Europe from next year.

As Samsung can no longer be disconnected from the OLED TV business, there are reports of investment for Gen8 OLED for TV line in 2016. Although OLED TV market is estimated to be approximately 350 thousand units this year, in 2016, when Panasonic joins in, it is expected to expand to 1.2 million units. The OLED TV’s market share in ≥55inch TV market is estimated to be only 4% but in premium TV market it is estimated to be significant value of ≥10%.

If Samsung Display invests in Gen8 OLED for TV line in 2016, from H2 2017 supply to Samsung Electronics is possible. As OLED Gen8 line’s minimum investment has to be over 60K to break even, it can be estimated that Samsung Display will invest at least 60K continuously in future.

Under these conditions, LCD industry can only be in crisis. Firstly, it becomes difficult for Sharp to last. Sharp, which is supplying TFT-LCD for Apple’s iPhones and LCD for Samsung Electronics’ TV, will lose key customers. Secondly, BOE, AUO, and JDI, the companies selling LCD panels to these companies, are not ready to produce OLED and therefore damage is inevitable.

BOE is carrying out aggressive investment with plans to lead the display industry in future with operation of Gen10.5 LCD line. Therefore, from 2018, as the main cash cow items disappear, administration pressure could increase.

China Trend Report Inquiry

China Trend Report Inquiry