Apple adopts LTPO TFT to extend battery life time to Apple Watch Series 4

Reporter & Analyst : Daejeong Yoon

Apple released its Apple Watch Series 4 with enhanced healthcare features on a larger screen than before, in the Steve Jobs Theater at Apple Park in California, USA on September 12.

<Apple Watch Series 4, Source: Apple.com>

In this announcement, Apple brought Apple watch series 4 with a new technology called LTPO to improve power efficiency.

LTPO stands for low temperature polycrystalline oxide. It is a kind of TFT using only the advantages of poly-Si with good charge mobility and IGZO with low power driving. LTPO TFTs have low leakage current and good on / off characteristics, which lowers power consumption and increases battery life.

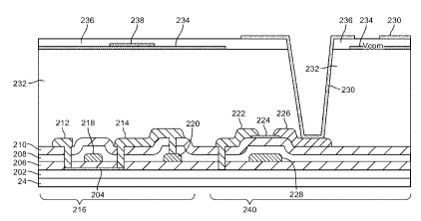

<Apple’s LTPO TFT patent>

In addition, Apple increased the size of its Apple Watch 4 to 40mm and 44mm. The edge-to-edge screen is 35% and 32% larger than previous models by narrowing the bezel compared to previous models. The screen resolution was 368×448 pixels for the 44mm model and 324×394 pixels for the 40mm model. The display of Apple Watch4 is a plastic OLED made by LG Display with a maximum brightness of 1,000 nit. The Apple Watch Series 4 starts at US$399 for GPS model, while the cellular model starts at US$499. The Apple Watch Series 4 is available for pre-order from Septmber14 in the U.S. with the availability beginning September 21.