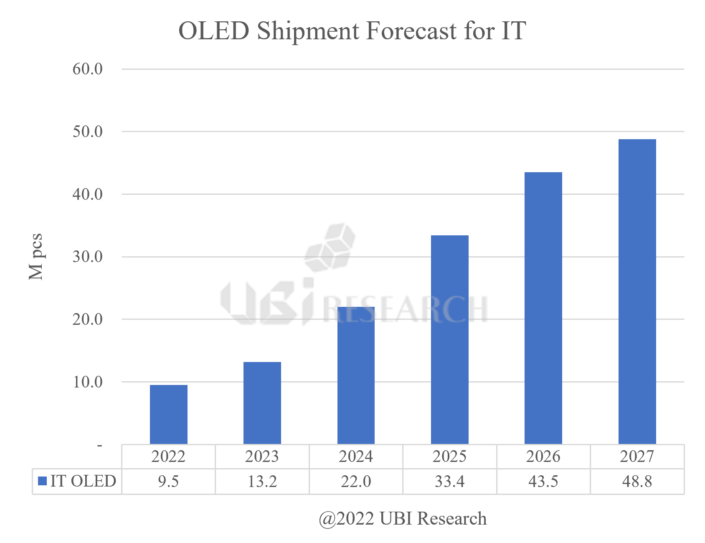

OLED for IT, Will Ship 48.8 million Units by 2027 With an Annual Average Growth Rate of 39%

According to the “2022 Mid-Large OLED Display Semi-Annual Report” recently published by UBI Research, shipments of OLED for IT such as tablet PCs, monitors, and laptops are expected to reach 48.8 million units by 2027 with an annual average growth rate of 39% from 9.5 million units in 2022.

According to the report, the OLED market for IT is expected to be led by laptops by 2024 and OLED for tablet PCs and laptops are expected to lead the market from 2025, as OLED for tablet PCs begin mass production in 2024.

OLED Shipment Forecast for IT Source : 2022 Mid-Large OLED Display Semi-Annual Report

In addition, as Apple plans to adopt OLEDs for some iPad series, Korean and Chinese panel companies are expected to invest in OLED lines for IT. Samsung Display, LG Display, and BOE are planning to invest in new 8.7th generation lines and Visionox recently ordered vertical vapor deposition machines for R&D on the V3 line, which is the sixth generation line.

Samsung Display and LG Display are expected to invest faster in the 8.7th generation line than Chinese panel makers, while BOE and Visionox are expected to invest after Korean companies’ investment.