As autonomous driving technology advances, the adoption rate of OLED will increase

At UBI Research’s ‘OLED Settlement Seminar in the second half of 2021’ held on the 19th, Park Seon-hong, head of the Korea Automobile Research Institute, gave a presentation on ‘the status and outlook of future automotive display development’.

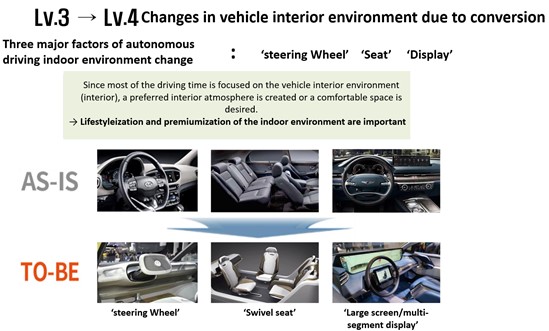

Responsible Park said, “If the autonomous driving technology is advanced, the number or time of driving will decrease, and the change of the interior space is essential because the driver pays attention to the interior environment of the vehicle. Through the change of the vehicle display, the change of the steering wheel to secure space, and the change of the seat, the efficiency of the space that can utilize the interior space can be increased.”

Among the changes resulting from the development of autonomous driving technology, Responsible Park said, “With the change of the display inside and outside the vehicle, the degree of freedom of space within the vehicle can be improved as buttons, switches, and gear knobs inside the vehicle are applied to the display.” In keeping with, the display mounted on the vehicle is also changing to a large-screen, large-area curved display.”

Responsible Park said, “Displays that secure the reliability of autonomous driving by communicating with the outside such as pedestrians and two-wheeled vehicles through external communication as well as the inside of the vehicle are gaining prominence. By displaying information about the vehicle’s condition (acceleration or deceleration, whether it is stopped, etc.), safety issues can be controlled.”

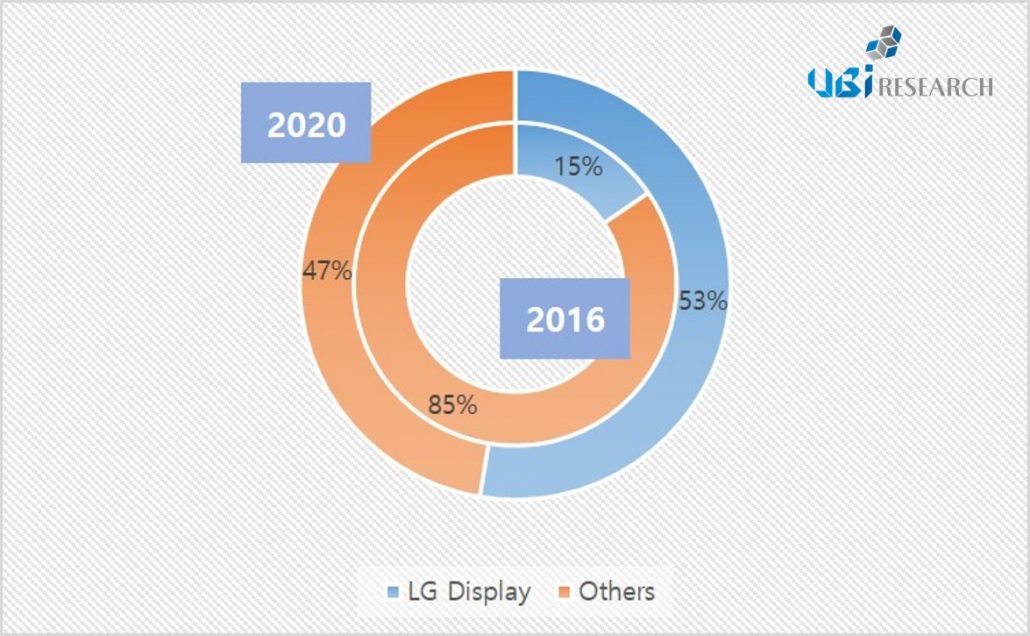

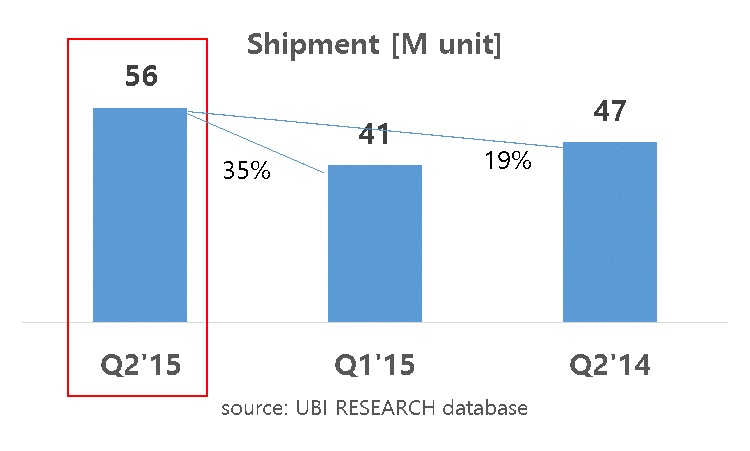

Currently, automotive displays have a high adoption rate of LCD, but OLED can realize flexible displays, and its thin thickness, high contrast ratio, fast response speed, and wide viewing angles make it possible to apply it in complex and diverse spaces inside automobiles in line with the era of autonomous driving. expected to increase. LG Display is already mass-producing POLED for automobiles, and Samsung Display and Chinese panel makers are also preparing for mass-production of OLED for automobiles.

As autonomous driving technology develops, automobiles are emerging as a new concept of ‘rest and comfort’ out of a means of transportation. While the evolution of in-vehicle displays is essential in such a leisure space, expectations are being raised on how much influence OLED will have on the market as a display for automobiles in the future.