Chinese Government’s Aggressive Movement Toward Domestic Product Exclusivity. What Next for Korean Companies?

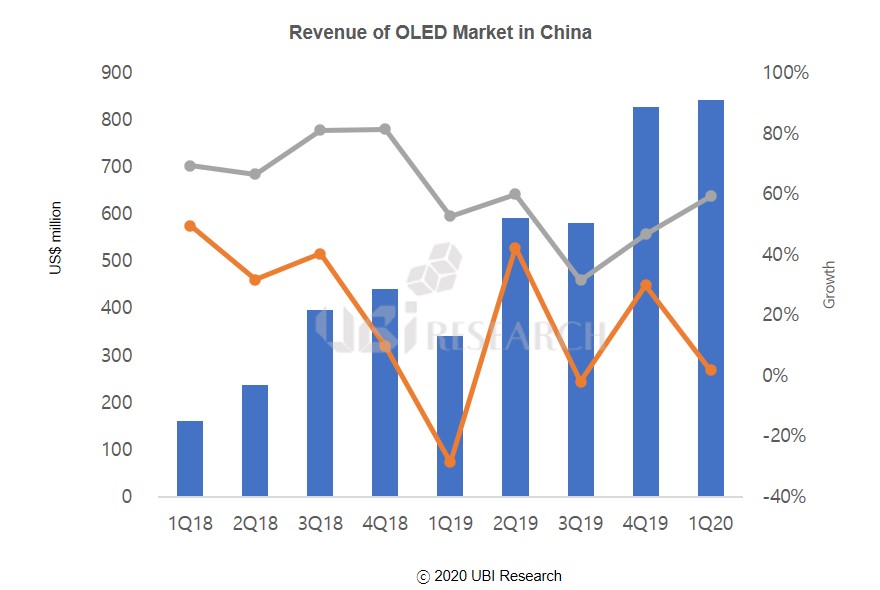

Recently, there is a movement to manufacture display-related materials, materials, and equipment exclusively in China. According to the ‘2022 OLED Components and Materials Report’ recently published by UBI Research (www.ubiresearch.com), China National Development and Reform Commission(国家发展和改革委员会) or Ministry of Industry and Information Technology of the People’s Republic of China(中华人民共和国工业和信息化部) are providing investment funds to Chinese OLED display-related developers and are rapidly moving towards domestic demand.

The Ministry of Industry and Information Technology of China is planning a large-scale support project for display-related materials, equipment, and parts for domestic demand in China. The companies selected for the project will receive unprecedented subsidies from the Chinese government. Recently, the Ministry of Public Information and Security is believed to have supported FMM and related evaporators and other equipment. In addition, the items promoted by the National Development and Development Committee of China for domestic demand will be developed and mass-produced within three years, and all domestic production will be carried out within five years.

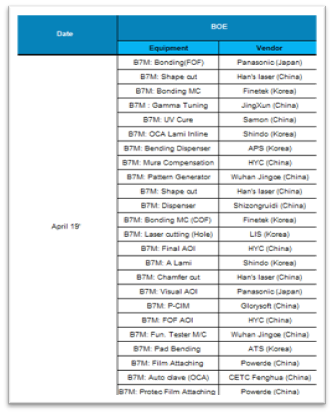

In addition to government projects, companies are also active in domestic demand. BOE, China’s largest display maker, has already made significant investments for domestic demand. In March, BOE CEO Gao Wenbao, who felt the pressures due to volume and cost, ordered a special policy directly for purchase planning. In the process of diversifying business partners for cost reduction, BOE reviewed only domestic companies, excluding overseas companies. Of BOE’s investment in materials, materials and equipment for domestic demand, about 70% of the capital has already been invested. The investment is expected to be completed by 2023.

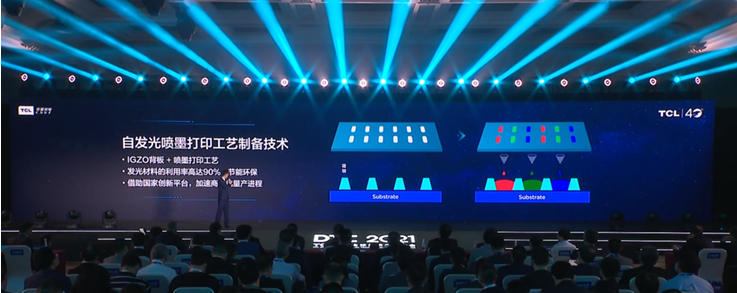

The Chinese government has included display in the national high-tech strategic industry early on and has provided unprecedented support to display companies such as BOE and TCL CSOT. In addition, the Chinese government is raising import tariffs on materials and parts that can be produced in China and is meeting the needs of domestic demand.

In order to widen the gap with China, which is closely chasing Korea from LCD to OLED, the Korean government must take active measures. The Korean government will designate display as a national high-tech strategic technology in the ‘Special Act on National Advanced Strategic Industries’, which will be enforced on the 4th of next month and will provide tax support and various benefits to display companies.