Samsung Display continues to dominate the OLED market for foldable phones

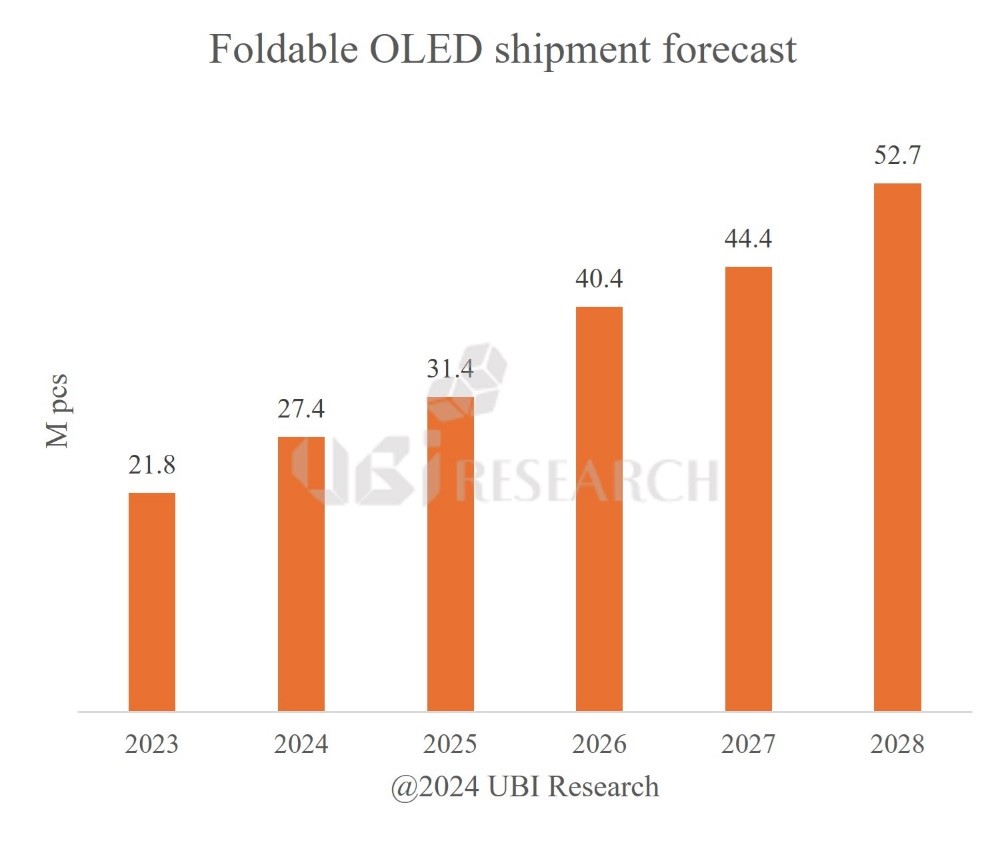

Foldable OLED shipment forecast

According to the ‘2024 Small OLED Display Annual Report’ recently published by UBI Research, OLED shipments for foldable phones are expected to increase from 27.4 million units in 2024 to 52.7 million units in 2028.

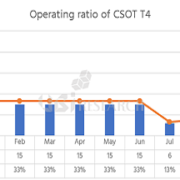

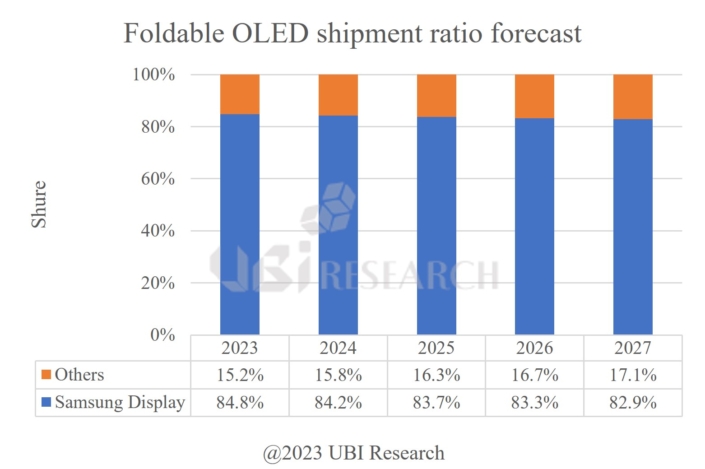

According to the report, Samsung Display’s OLED shipments for foldable phones in 2023 will be 13.4 million units, a 6.3% increase from 12.6 million units in 2022. Also, among Chinese panel makers, BOE shipped 6.2 million units of OLED for foldable phones, more than three times the 1.9 million units in 2022, while TCL CSOT and Visionox each shipped 1.1 million units of OLED for foldable phones.

Although there is fierce pursuit by Chinese companies, Samsung Display is expected to still take the lead in the foldable phone market. Samsung Electronics, to which Samsung Display supplies panels, is expected to expand the models of the Galaxy Fold series scheduled to be released this year, and Samsung Display’s foldable phone panels are expected to be applied first to Apple’s foldable iPhone to be released in the future. Based on such technological prowess and competitiveness, Samsung Display’s dominance in the foldable phone market is expected to continue for the time being.

2024 Small OLED Display Annual Report Sample Download

2024 Small OLED Display Annual Report Sample Download

2023 OLED KOREA

2023 OLED KOREA