[K-Display Business Forum 2022] Sumitomo Chemical Material Performance Disclosure

At the ‘Display Business Forum 2022’ held at COEX, Seoul from August 10 to 12, 2022, Sumitomo Chemical unveiled the performance of inkjet materials developed until recently.

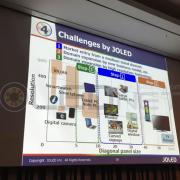

Inkjet printing technology is attracting attention as a technology that can reduce the process time and increase material usage of 3-stack OLED or 4-stack OLED, which are mainly used for medium and large-sized devices. JOLED is mass-producing panels for monitors, and TCL CSOT also are considering investing.

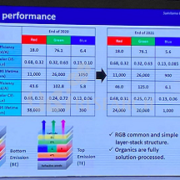

Sumitomo Chemical first disclosed the RGB performance of the top-emitting OLED and the bottom-emitting OLED produced by spin coating. Although there was no significant difference in the OLED of the bottom emission type from the previous year, it was confirmed that the performance of the material was improved in the OLED of the top emission type, and in particular, both the efficiency and performance of the blue material were improved.

Sumitomo Chemical’s Material Performance

Sumitomo Chemical also mentioned impurity management, ink formation, curing process, and jetting mechanism as core tasks of inkjet printing technology. In order to secure the process time, yield, and performance of inkjet printing, the aforementioned four factors must be overcome.

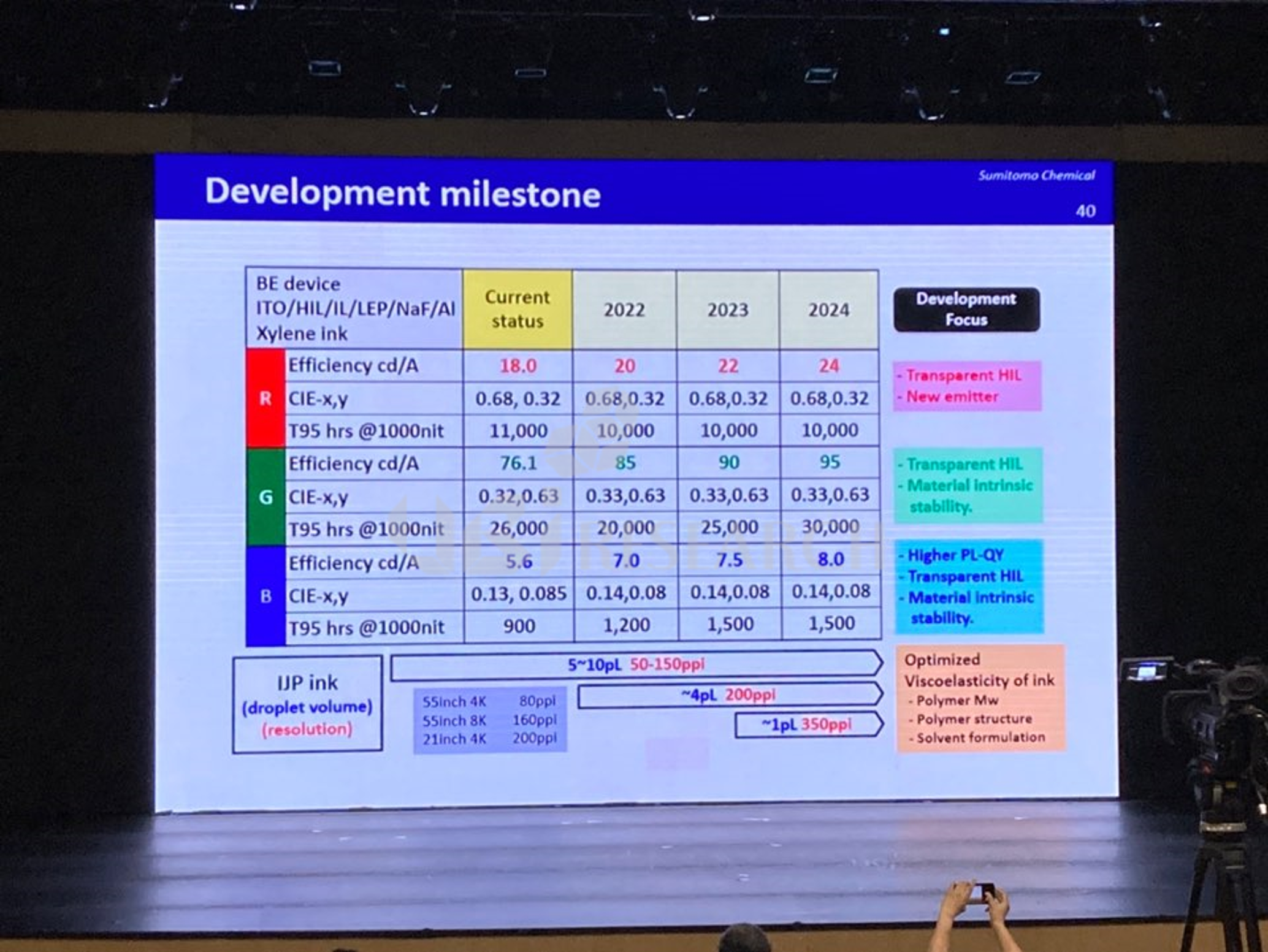

Lastly, Sumitomo Chemical announced the performance of RGB inkjet materials developed so far, and concluded the presentation by mentioning the target efficiency and lifetime of future materials.

Sumitomo Chemical Development Milestone

2022 OLED Emitting Material Report Sample Download

2022 OLED Emitting Material Report Sample Download