Shipments of Medium and Large OLEDs Over 10 inches Will Expand to 69.5 Million Units by 2027

According to the “4Q22 Medium & Large OLED Display Market Track,” which combines the performance and prospects of OLEDs over 10 inches at UBI Research, medium and large OLEDs are expected to expand from 26.1 million in 2022 to 69.5 million in 2027.

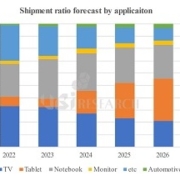

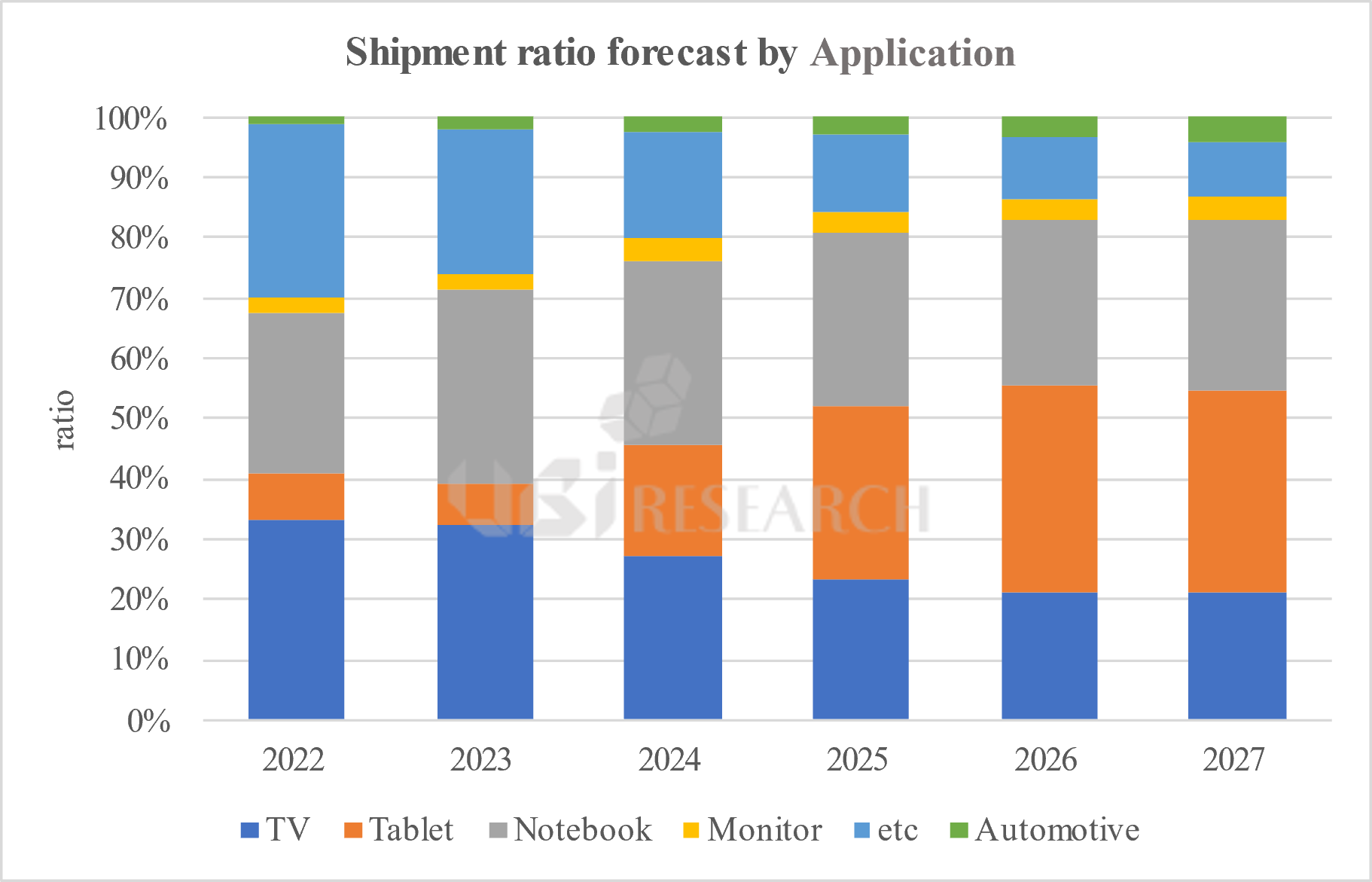

It is predicted that OLED for TVs will lead the mid- to large-sized OLED market based on sales by 2027. Due to the global economic downturn, expected shipments in the future decreased from the previous quarter, but a total of 14.8 million units are expected to be shipped in 2027 at an annual average growth rate of 11.2%, recording sales of $9.18 billion. This is 62.8% of the total sales of medium and large OLEDs in 2027.

It is expected that OLED markets for IT such as laptop, tablet PC, and monitor will gradually bloom from 2024. The OLED market for IT is expected to be led by OLED for laptop, and 19.7 million units are expected to be shipped by 2027 with an annual average growth rate of 22.9%. In 2024, Apple’s OLED for iPads will be released in full-scale, and OLED markets for tablet PCs will expand. Although OLED shipments for tablet PCs are expected to be 2 million units in 2023, they are expected to be 7.2 million units in 2024 and 23.3 million units in 2027. The average annual growth rate from 2023 is 85.7%.

OLED for vehicles is also expected to grow at an annual average rate of 54.7% from 2022, and the market is expected to continue to expand.

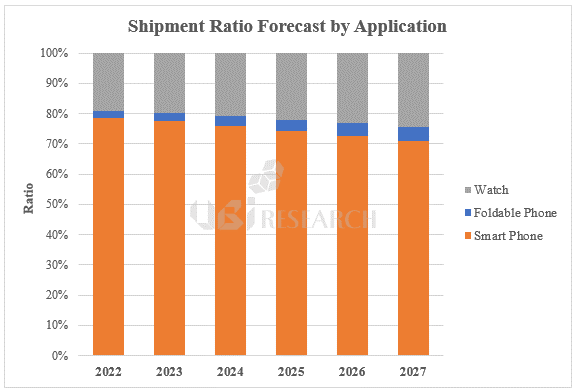

Shipment ratio forecast by application