Apple, to Use OLED More than Samsung Elec. from 2021 – UBI

UBI Research’s Yi is Analyzing Market related to Apple’s OLED Selection

Hyunjoo Kang / jjoo@olednet.com

A forecast that Apple will apply more OLED than Samsung Electronics from 2021 has been suggested.

On 13 May, UBI Research hosted OLED Investment Analysis Seminar titled The Effects that Apple will have on Display Industry in Seoul, Korea. At this event, UBI Research’s Choong Hoon Yi estimated future flexible OLED smartphone market share.

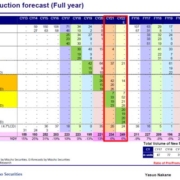

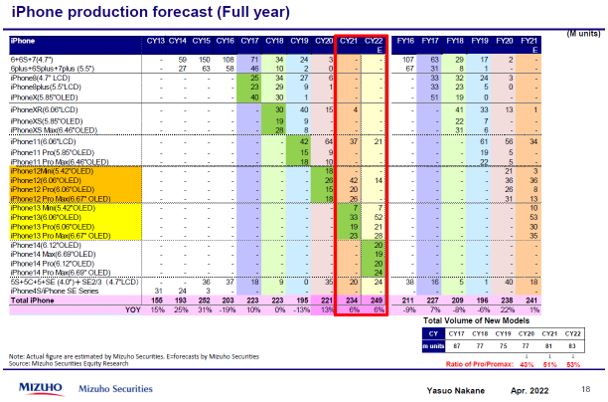

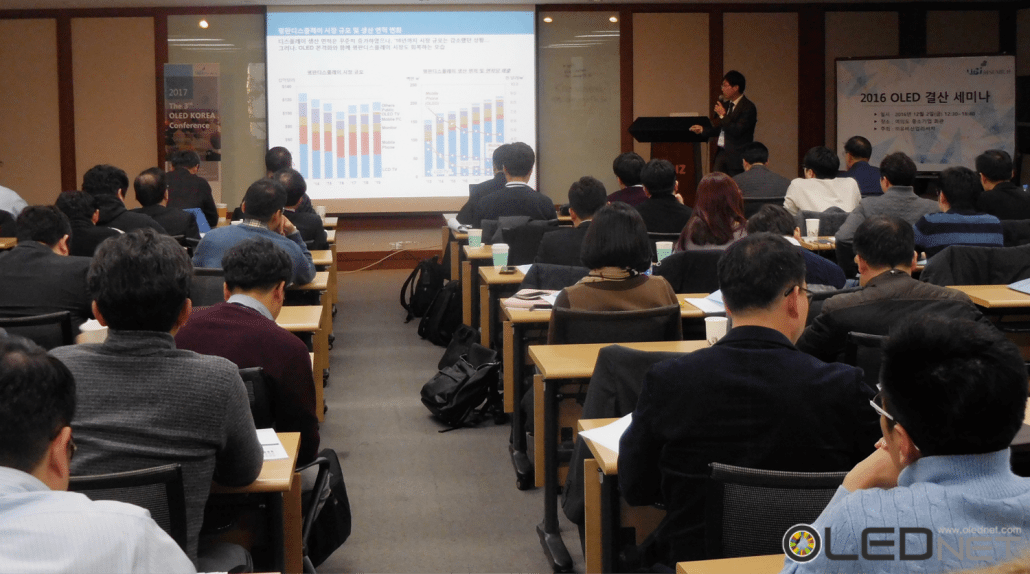

According to Yi, Apple is to begin releasing flexible OLED iPhone from 2017, and occupy 8% of the global flexible OLED smartphone market in that year. Following this, Yi analyzed that Apple will continue to increase market share each year to record 32% in 2020, same as Samsung Elec., and exceed Samsung Elec.’s 27% with 37% in 2021.

For 2015 and 2016, with the market share of over 70% of the global flexible OLED smartphone market, Samsung Elec. is dominating the market. However, Apple is expected to release OLED iPhone from next year, and iPhone market share is increasing within the smartphone market. Yi believes that Apple’s OLED usage will exceed that of Samsung Elec.’s.

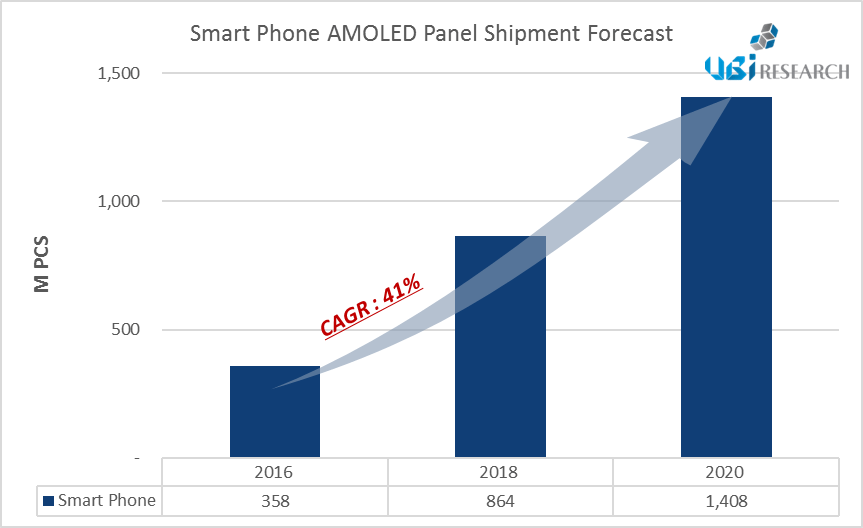

UBI Research estimates that the smartphone market will grow at CAGR of 6% in 2016-2021, and overall shipment will increase. Of these, Samsung Elec. has been outdistancing Apple and greatly increasing the market share until 2013. However, since 2014, Samsung Elec.’s market share has been gradually decreasing while Apple’s is increasing.

At the seminar, Yi told the attendees that Apple is selling approximately 220 million units of iPhone per year, but the number is expected to increase to 300-million-unit mark and of 30% of that, 1,00-million-unit mark, are estimated to be OLED equipped products. He added that this will grow to 4,00-million-unit mark in 2020, and 80% of that is estimated to be OLED.

With Apple’s section of OLED, the competition for the product supply between global display companies is expected to be fierce. Yi forecast that Samsung Display will supply 60% of the demand, the second supplier 30%, and the rest 10%.

LG Display and Japan Display were likely to be the second and third suppliers. However, Apple’s steadfast partner, Foxconn took over Sharp and became a strong candidate for this position. Hence, 4 companies could end up supplying to Apple. Yi added that one company of JDI and Foxconn could be pushed out.

Panel companies’ mass production establishment investment for product supply for Apple is also being carried out. Samsung Display is expected to execute 45-60K investment in flexible AMOLED line this year. LG Display is carrying out Gen6 7.5K investment in Gumi, with prospect of additional 7.5K order this year.

JDI also announced smartphone AMOLED panel mass production in January 2016 aiming for mass production in 2018. There is a possibility of investment for AMOLED supply for iPhone. Yi also estimated that Apple will conclude OLED emitting materials company selection by this August or September.

Furthermore, Yi explained that a human eye is more sensitive to contrast compared to brightness. He emphasized that OLED, with its contrast ratio of 1,000,000:1 is a more human friendly display than LCD and its 3,000:1.

At the seminar, LG Economic Research Institute’s Senior Consultant Wookeun Lee also analyzed the market with the theme of The Effects that Apple’s OLED Selection will have on Korea and China’s Display Industry.

China Trend Report Inquiry

China Trend Report Inquiry