Chinese panel makers BOE and Tianma started small and medium sized AMOLED production, acceleratedly chasing Samsung.

It is the first time for China to produce Gen6 flexible AMOLED; it is expected that BOE’s mass production not significantly affected by yield due to the tremendous support from the Chinese government will cause such impact on the small and medium-sized AMOLED market where Samsung has monopolized so far.

B7 line, which was built in May 2015 with the investment of approx. 465 yuan, is expectedly used in high-end mobile display in China, with 48K- large monthly capacity based on Gen6. In Dec last year, 45K investment was confirmed in Mianyang’s Gen6 flexible AMOLED production line B11 and mass production is expected to operate in 2019.

<5.5 inch FHDfoldable AMOLED launched at CIDC 2016>

In addition, Tianma successfully lighted up the rigid AMOLED panel manufactured in Gen6 LTPS AMOLED production line in Wuhan for the first time in China on April 20th. Tianma has first built the Gen 4.5 AMOLED pilot line in China as well as Gen 5.5 AMOLED production line in Shanghai for mass producing small-medium AMOLED display.

Also CSOT aims to mass-produce in the fourth quarter of 2018 as the investment in Gen6 rigid and flexible AMOLED production lines at Wuhan’s T4 plant has been proceeding. Visionox plans to additionally expand Kunshan’s Gen5.5 line (V1, presently 4K) phase1 11K and Phase2 15K investment is being proceeded. ROYOLE also invested in the Gen 5.5 flexible AMOLED mass production line, and LOI of the SFA deposition equipment was announced last January. The expected capacity is 15K.

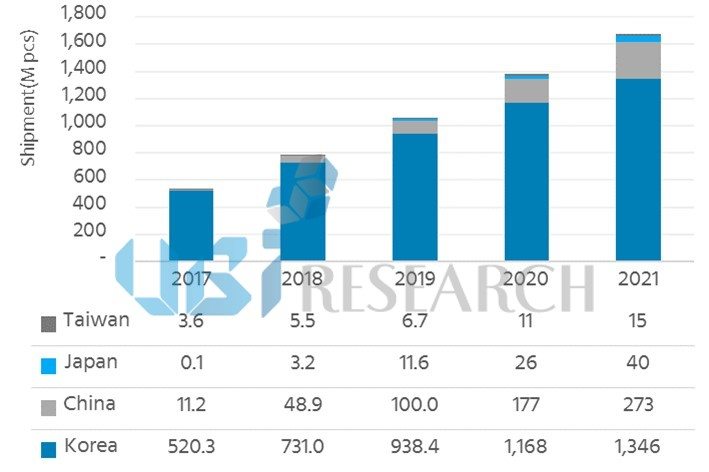

In the Korea-dominated AMOLED market, Chinese panel makers are taking up the market share rapidly through the Chinese government support and their huge domestic market. Lee Choong-hoon (chief analyst) at UBI Research specialized in AMOLED market predicts that by 2021, Chinese AMOLED panel makers will record their second largest shipment volume with approx. 16% of the entire market share via full-fledged shipment from 2018, followed by Korea by 2021 “.

<forecast of AMOLED panel shipment by country>