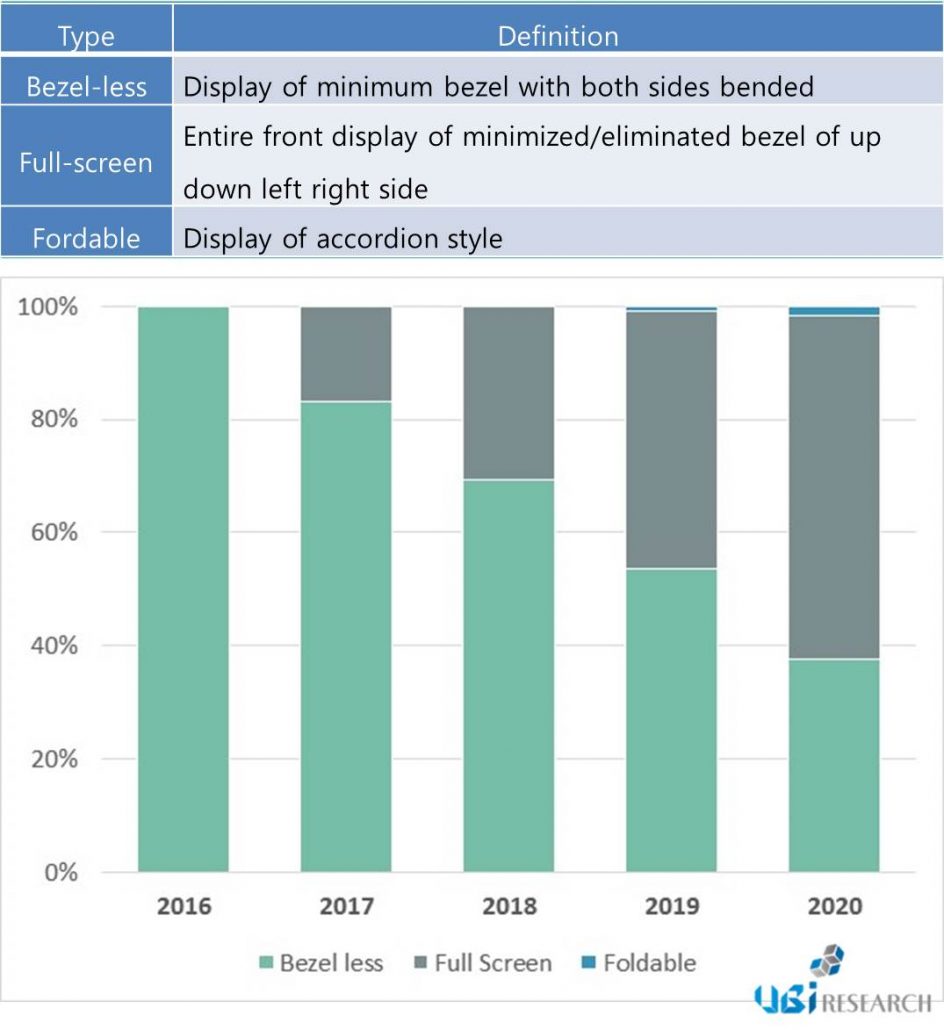

Foldable OLED shipments will expand to 61 million units in 2027, and the UTG market will also grow more than three times

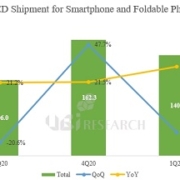

According to the ‘2023 OLED Components and Materials Report’ recently published by UBI Research (www.ubiresearch.com), a company specializing in OLED market research, In 2023, foldable OLED shipments are expected to record 22 million units, and expand to 61 million units in 2027 at an average annual growth rate of 29%.

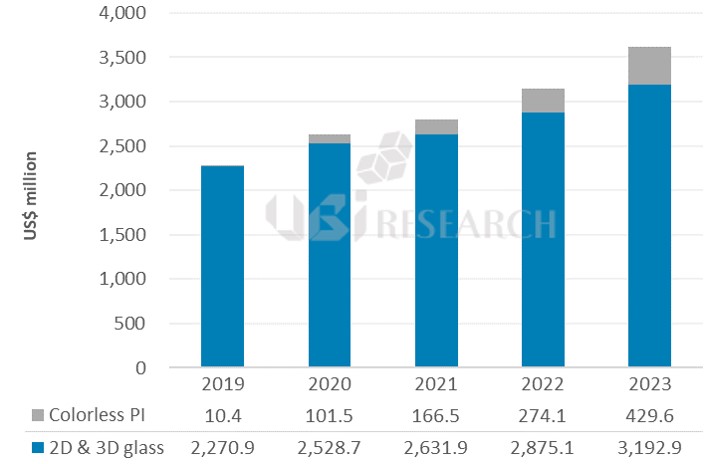

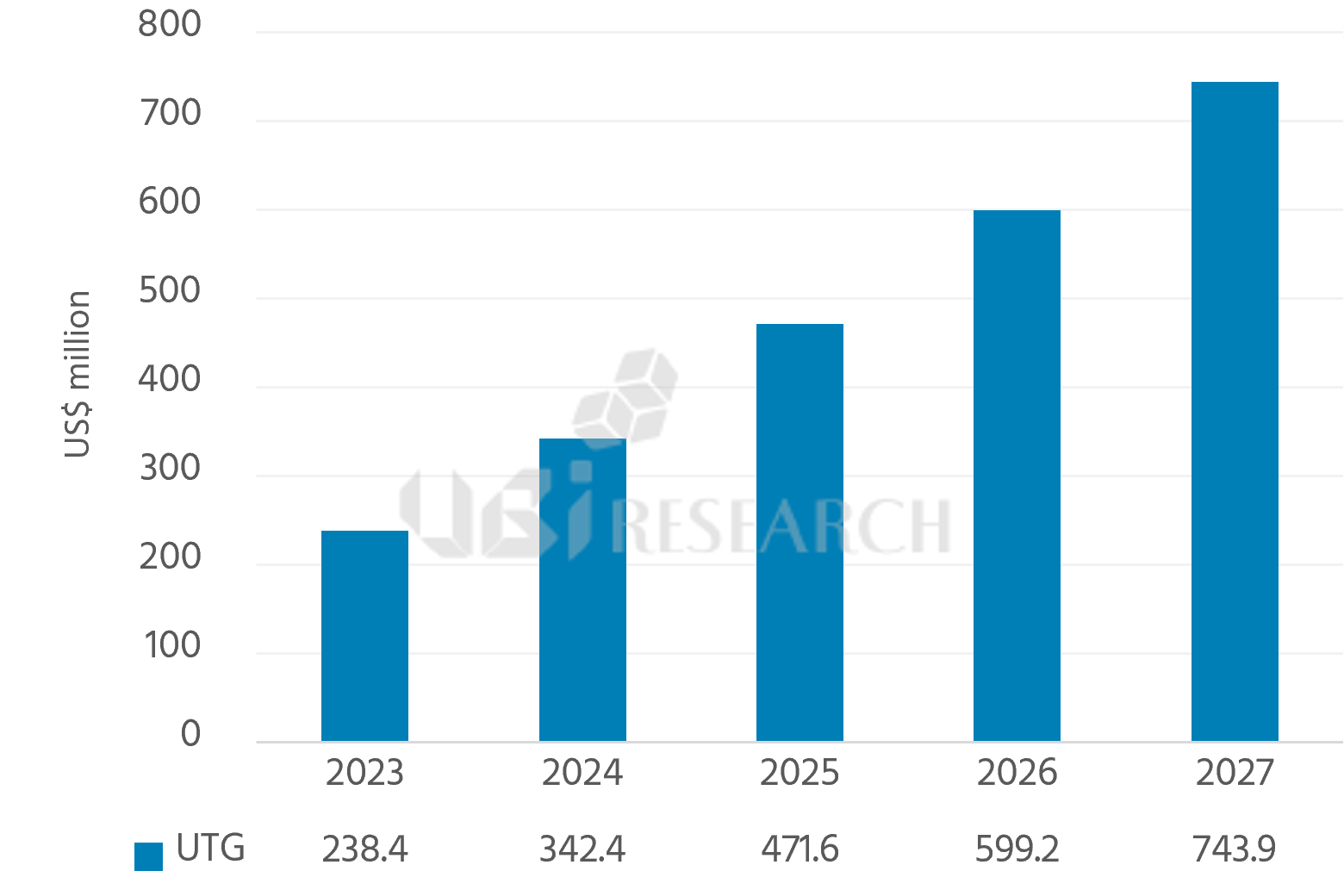

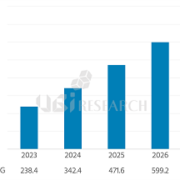

Ultra Thin Glass market forecast

As the foldable market expands, the market for foldable cover windows is also expected to expand. The market for foldable cover windows is expected to expand from $410 million in 2023 to $840 million in 2027.

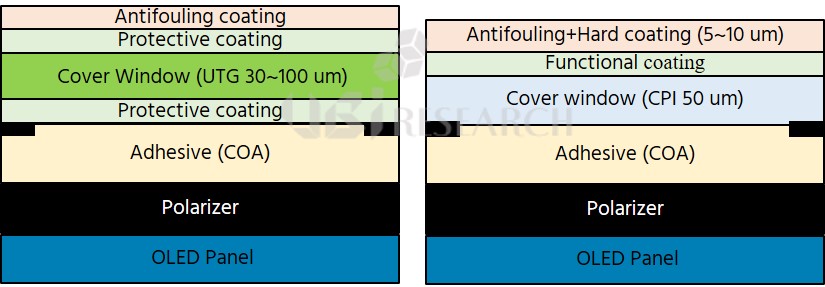

However, since Samsung Display plans to mass-produce foldable OLEDs only with UTG in the future, and BOE, TCL CSOT, and Visionox are also developing foldable OLEDs with UTG applied, the cover window market for foldable phones is expected to be led by UTG (UItra thin glass) in the future, and the share of colorless PI will continue to decline.

The UTG market is expected to grow from $240 million in 2023 to $740 million in 2027, and the colorless PI market is expected to shrink from $170 million in 2023 to $95 million in 2027.

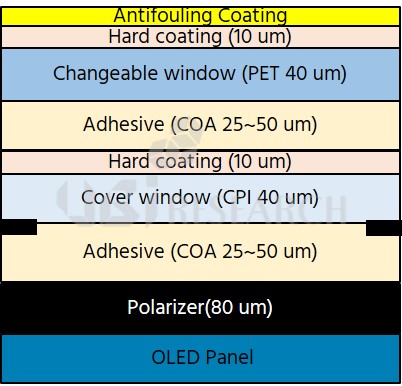

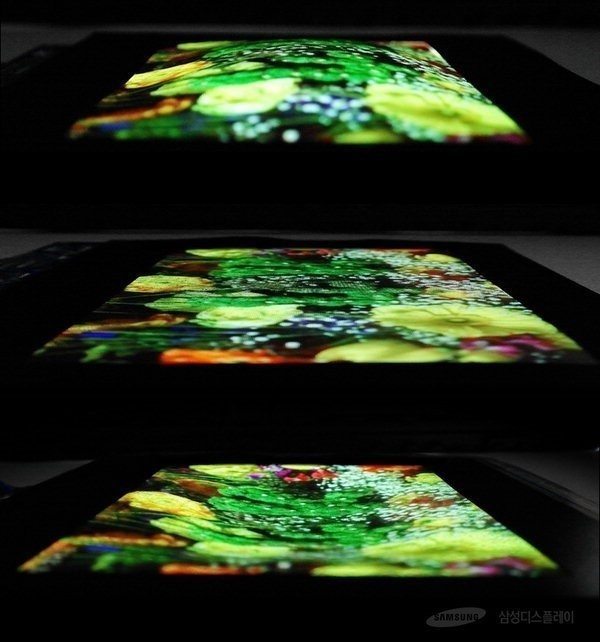

Samsung Electronics, a leader in foldable phones, has applied UTG (Ultra thin glass) for cover windows to all foldable phones released since the ‘Galaxy Z Fold2’. Samsung Electronics processes and uses Corning’s glass, and Samsung Display is supplied with Schott’s glass.

Recently, Chinese companies that have adopted colorless PI as a cover window due to lack of technology are also increasing the use of UTG.

Motorola released clam-shell type ‘Razr 40’ and ‘Razr 40 Ultra’ in June. The panel supplier for both products is TCL CSOT, and Schott’s UTG is processed and supplied by SEED(赛德) for the cover window. Among them, the ‘Razr 40 Ultra’ has a larger external display of 3.6 inches compared to the existing foldable phone, similar to the ‘Galaxy Z Flip 5’ to be released by Samsung Electronics.

Oppo is preparing to release a 6.8-inch clam-shell type and an 8.1-inch book type foldable phone. All of Oppo’s new foldable OLED panels will be supplied by BOE, and TOKEN will process and supply Schott’s UTG.

Huawei released the successor to the Mate series, the Mate X3, in April. The foldable OLED panel of ‘Mate X3’ is supplied by BOE and Visionox, and the cover window is supplied with KOLON’s colorless PI coated by DNP. Huawei was developing UTG for cover windows, but adopted colorless PI due to performance issues.

The ‘2023 OLED Components and Materials Report’ published this time analyzes the development and business status of foldable/rollable OLED by set and panel companies, the latest OLED development status such as MLA (Micro lens array), QD materials, oxide TFT, and encapsulation technology, OLED Analysis of panel makers’ mass production capa and market outlook for major parts and materials were discussed.

2023 OLED Components and Materials Report Sample Download

2023 OLED Components and Materials Report Sample Download