Small OLED shipments in the third quarter increased by 7.8% compared to the previous quarter, and LG Display’s shipments surged

‘4Q24 Small OLED Display Market Track’

The small OLED market in the third quarter rose 7.8% compared to the previous quarter. Most panel companies recorded panel shipments at a similar level to the second quarter, but overall shipments increased as shipments from LG Display and China’s Everdisplay surged.

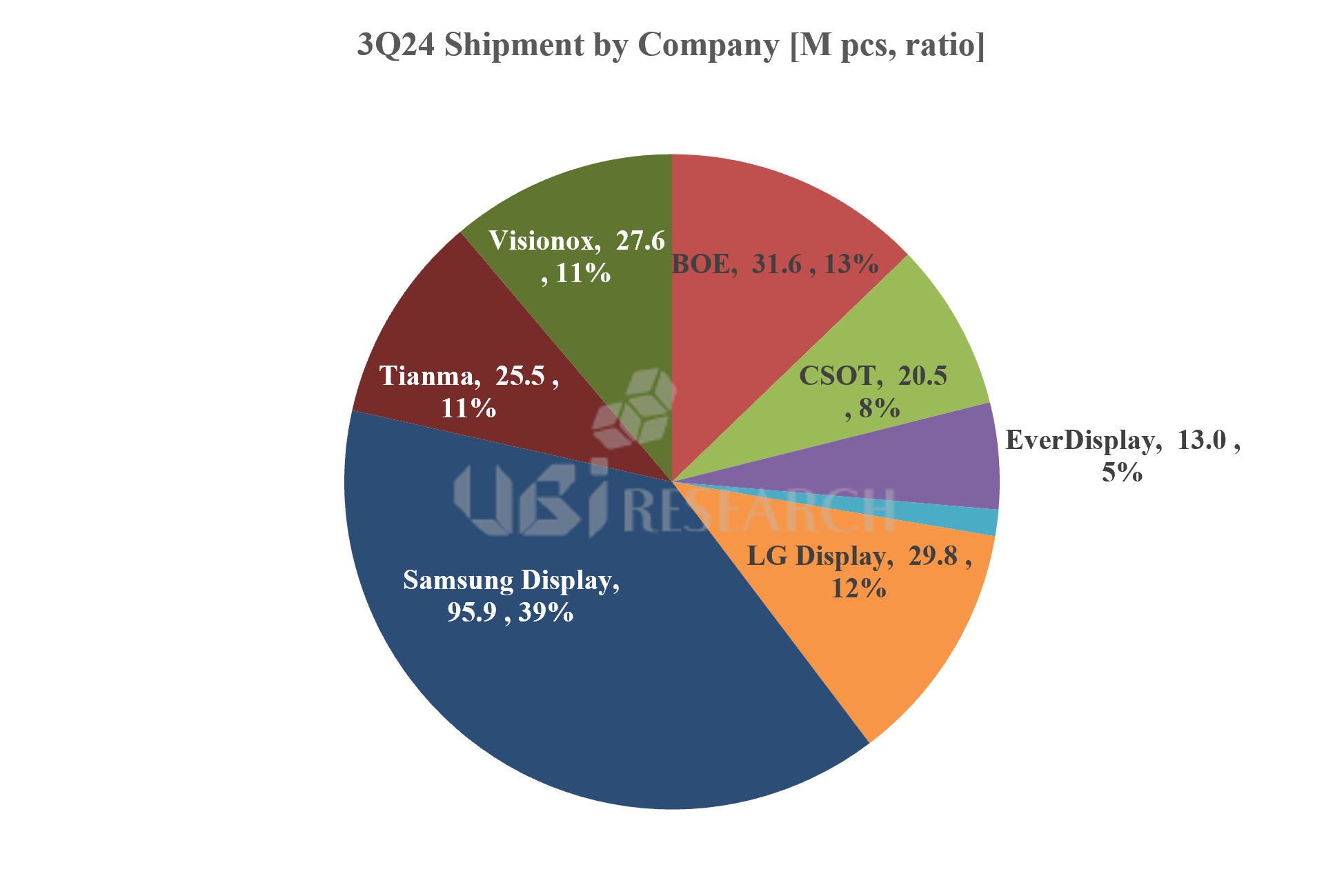

According to the ‘4Q24 Small OLED Display Market Track’ recently published by UBI Research, small OLED shipments in the third quarter of 2024 were 247 million units, up 7.8% compared to the previous quarter and 32.6% compared to the same quarter of the previous year. The shipments of Chinese panel companies, including Samsung Display and BOE, were similar to or slightly lower than the previous quarter, but as the shipments of LG Display and China’s Everdisplay surged, overall shipments increased.

Based on the iPhone 16 series, which began full-scale production, LG Display shipped 17.6 million iPhone panels, a 64% increase from the previous quarter, and smartwatch shipments increased 147% to 12.2 million units. Due to the impact of increased shipments, LG Display’s sales increased by 74% compared to the previous quarter and by 115% compared to the same quarter of the previous year.

LG Display’s shipments are expected to continue to increase next year following the fourth quarter. As LTPO TFT begins to be applied to the iPhone 17 series scheduled to be released in 2025, there are predictions that BOE’s initial panel supply will actually be difficult, and as BOE is unable to supply panels, the supply may be transferred to LG Display. However, since LG Display is currently producing panels close to full capacity, line expansion is necessary to produce more panels. There is an analysis that it is realistic to expand 6G lines because it is realistically difficult to quickly start investing in 8.6G.

Among Chinese panel companies, shipments of Everdisplay and Tianma increased. Tianma’s shipments increased, but only slightly, and Everdisplay’s shipments more than doubled to 13 million units compared to the previous quarter.

Samsung Display’s shipments decreased somewhat, but sales were similar to the second quarter, and BOE’s shipments were similar to the second quarter, but sales increased by 15%. In the fourth quarter, shipments from not only LG Display but also Samsung Display and BOE are expected to increase, and considering the characteristics of the OLED market with the highest shipment volume in the fourth quarter, global OLED shipments for smartphones are expected to exceed 800 million units in 2024.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

Small OLED Display Quarterly Market Track Sample

Small OLED Display Quarterly Market Track Sample