[UBI Research China Trend Report] Will BOE Provide UPC Panel with Transparent PI Substrate to Oppo?

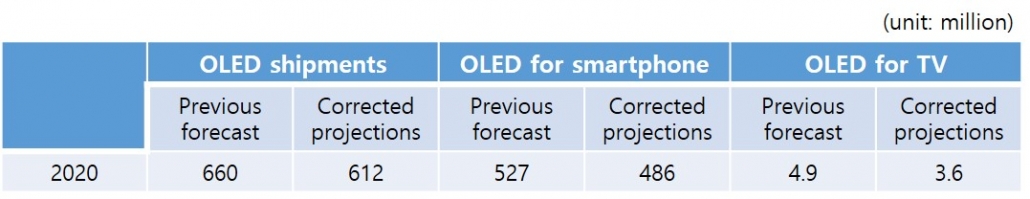

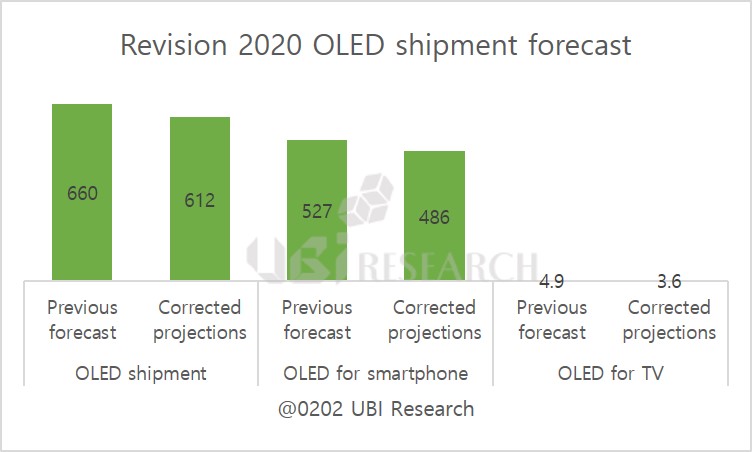

According to UBI Research’s report on changes in the OLED market caused by coronavirus, the forecast for the 2020 OLED modification market is $ 36.7 billion in sales and 612 million units. This is a decrease of 4.8% and 7.6%, respectively, from the expected sales of $ 38.5 billion and shipments of 6.6 million units at the beginning of the year.

As a result of UBI Research’s analysis of the effect of coronavirus on the OLED market for two months, the global smartphone market is expected to drop by 20% and the TV market is expected to decrease by 15%. However, the impact on the overall OLED industry was judged to be only 5-8%. OLED panels for smartphones, TVs and watches are expected to decrease, but the market for OLEDs for monitors is expected to increase.

The expected OLED shipment for smartphones was 527 million units at the beginning of the year, but the forecast for correction is 486 million units, a decrease of only 7.8%. Although the market for Galaxy and iPhone is analyzed to be higher than the average decrease rate, Chinese smartphone makers are expected to reduce LCD smartphones and increase production of OLED smartphones significantly.

Chinese smartphone makers’ use of OLED seems to follow Apple’s business direction. Flagship models of Chinese smartphone makers have used Pro and Pro Plus. Pro is the model grade name used by Apple and Plus is the model grade name used by Samsung. However, flagship models of Chinese smartphone makers that are launching this year are using both Pro and Pro Max as well as Apple. All of these models, like Apple, plan to use flexible OLEDs.

The OLED TV market was found to be greatly affected by coronavirus. Estimated shipments at the beginning of the year were 4.9 million units, but the forecast for correction was 3.6 million units, down by 1.3 million units. A 26.5% reduction is expected. This is 300,000 units more than 2019 shipments. This is because the production schedule of the Guangzhou factory has been postponed since the third quarter due to the coronavirus, and TV sales are plunging due to the spread of coronavirus in Japan and Europe, the main markets for OLED TV. In fact, Japan’s TV performance in the second quarter was below 50% in 2019.

However, the demand for the OLED panel business for monitors that Samsung Display has been promoting since the second half of last year is expected to increase due to the game industry, telecommuting, telemedicine, and remote classes due to the aftermath of the coronavirus.