LG Display Announces Q3 2019 Results, Revenue 5,817.2 Billion won, Operating Loss 436.7 Billion won

LG Display announced on the 23rd that it recorded sales of 5,827.1 billion won and operating loss of 436.7 billion won in the third quarter of 2019 according to K-IFRS.

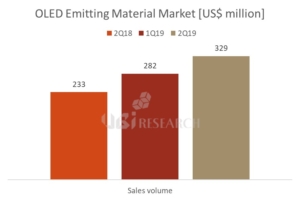

Revenue increased 9% QoQ (5.35 trillion won) due to the full-fledged sales of plastic OLED business and the expansion of mobile panel sales.

On the other hand, 3Q operating loss fell last quarter due to a sharp drop in LCD TV panel prices that exceeded market expectations, reduced utilization of related fabs, and increased depreciation expenses associated with the operation of new plastic OLED plants. The operating loss recorded 436.7 billion won.

Net loss was 442.2 billion won and EBITDA was 611.8 billion won (EBITDA margin of 10.5%).

Revenue breakdown in the third quarter of 2019 recorded 32%, a 9% QoQ decline for TV panels due to a decline in shipments due to adjustments in LCD TV fab utilization. Mobile panels recorded 28%, up 9% p QoQ, due to full-scale production of plastic OLED panels. Notebook and tablet panels accounted for 21 percent and monitor panels 18 percent.

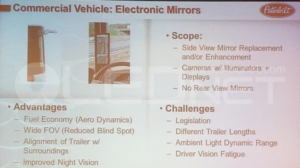

Dong-hee Seo, Executive Vice President of LG Display CFO, said, “LG Display is innovating its business structure to reinforce its fundamental competitiveness and have a differentiated competitive edge.” In addition, the company plans to find ways to secure competitiveness from a more fundamental and long-term perspective, while at the same time strengthening its IT, commercial (auto) and auto (business) business capabilities that can differentiate in the existing LCD sector. Large OLEDs will accelerate the market trend utilizing the inherent value of products and continue to stabilize the business of plastic OLEDs for smartphones. ”

In addition, “We will communicate with the market by establishing a long-term vision centering on technologies and product lines that can quickly complete the ongoing LCD structure improvement activities and provide differentiated value.”