Foldable Phones Predicted to Exceed 100 Million Units by 2026

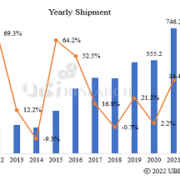

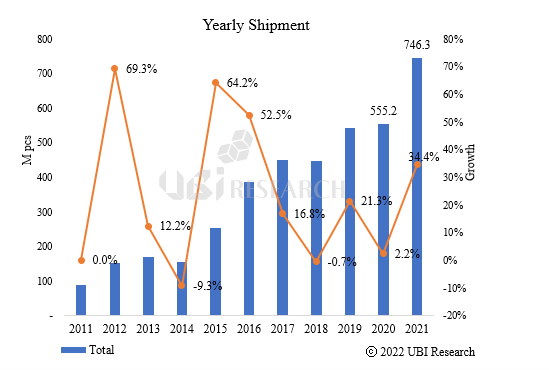

According to UBI Research’s “1Q22 Small OLED Display Market Track” Small OLED Display (10-inches or smaller watch, smartphone, foldable phone, etc.) shipment in 2021 was 746 million, a 34.4% increase from the previous year’s 555 million. The reason for the increase in shipments compared to 2020 can be attributed to the increased sales of iPhone 12, iPhone13, and the unexpectedly strong sales of Galaxy Z’s Fold 3 and Flip 3.

Compared to the previous year, Small OLED sales in 2021 was up from $26.5 billion to $38.1 billion, a 43.9% increase.

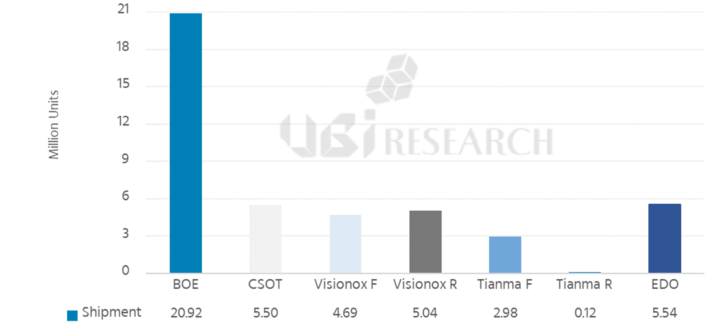

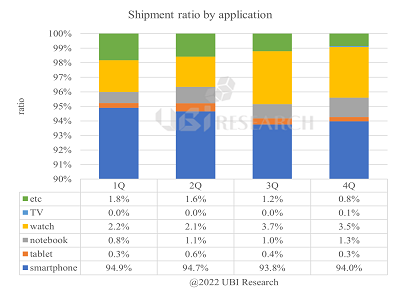

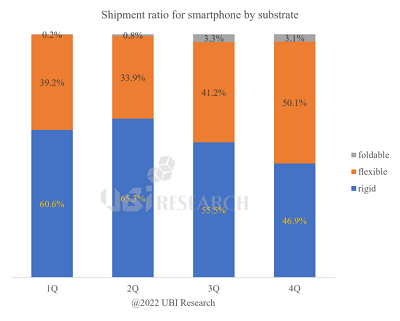

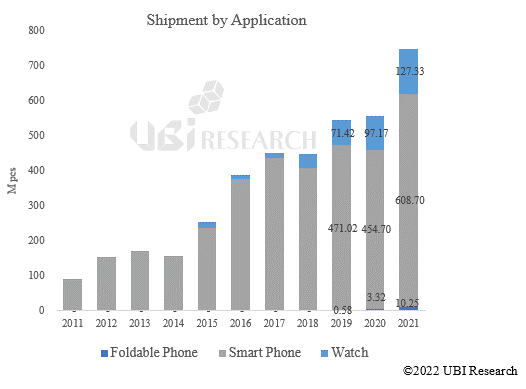

Graphs are categorized by application product; Watch, Smartphone, Foldable Phone.

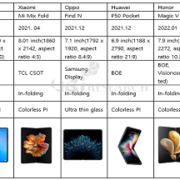

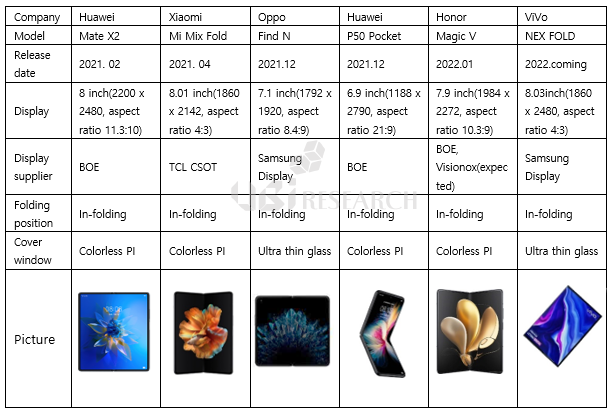

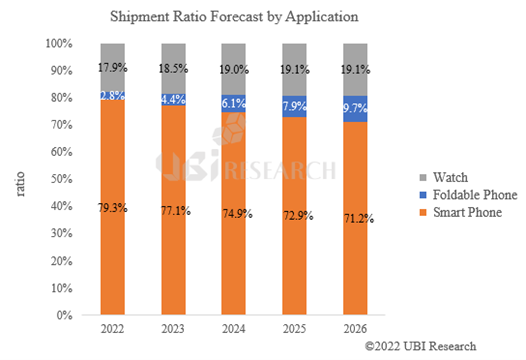

Since 2019, foldable phones have been on an upward trend. The market for foldable phones in 2021 exceeded 10 million units, accounting for 1.4% of all small displays. It is predicted that foldable phones’ yearly upward trend will result in exceeding 100 million units by 2026, accounting for 9.7% of all small displays.

“1Q 2022, Small OLED Display Market Track” analyzes the production capacity for 10-inches or smaller OLED Displays. Quarterly sales market and shipment market were investigated by these categories; major panel makers, country, generation, substrate, TFT technology (LTPO and LTPS), and by application products (watch, smartphone, foldable phone).

An analysis of ASP and OLED supply/demand by application is also provided. Small OLED Display market forecast data is predicted until 2026 on Excel.