2020 OLED annual performance analysis

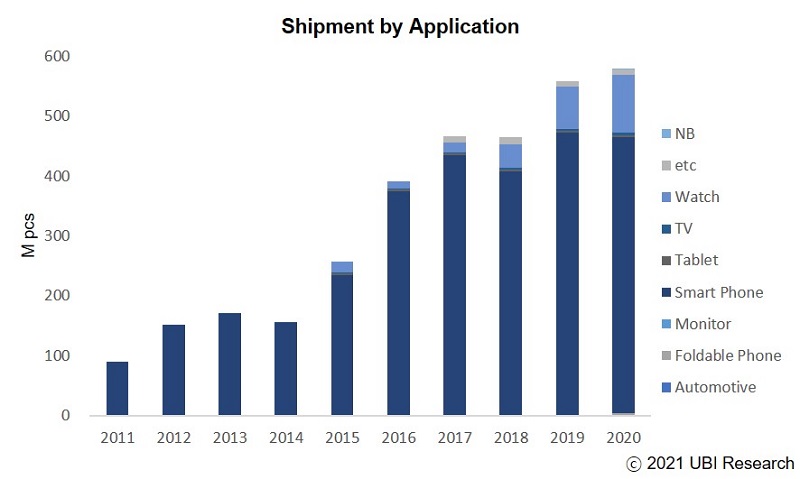

Total shipments of AMOLED in 2020 were aggregated to 575.78 million units. This is an increase of 20.41 million units compared to the 557.46 million units shipped in 2019.

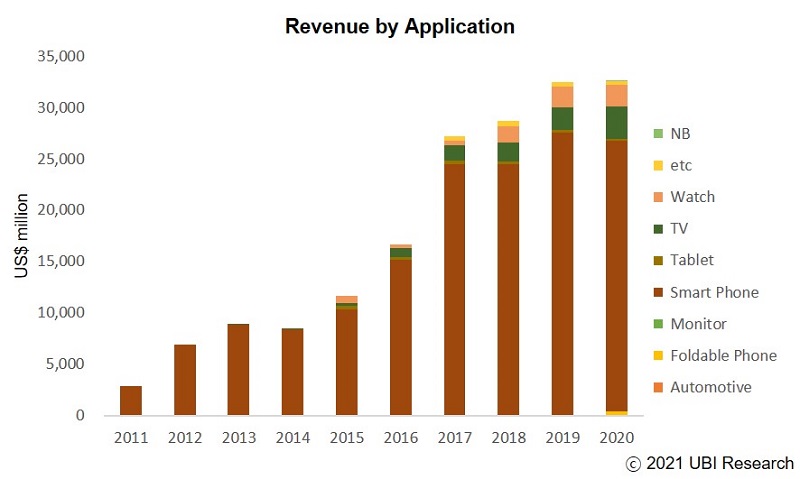

The first OLED application products released in 2020 are for automobiles and for notebooks. Analysis by application product shows that the market has increased for foldable OLED, TV WRGB OLED, and watch OLED, and the decline is for smartphone and tablet PC.

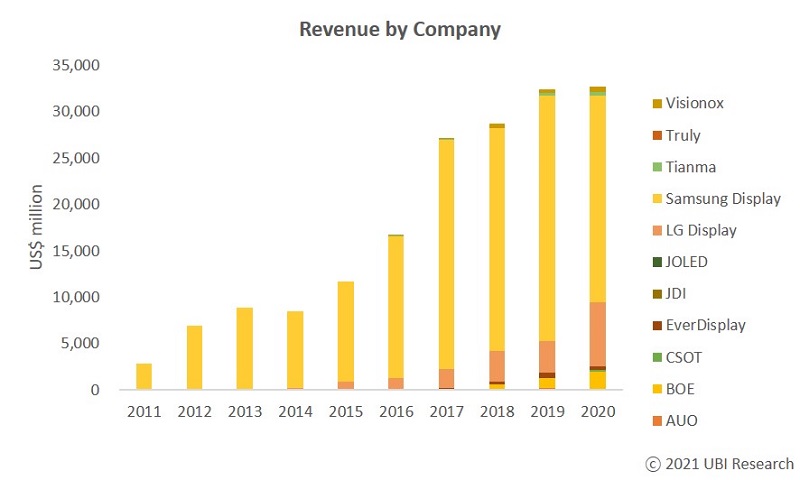

Sales in 2020 were $32.68 billion, an increase of $2.3 billion from $32.45 billion in 2019. The insignificant increase in sales compared to the increase in shipments in 2020 is due to the decline in OLED unit prices for smartphones. This is because the OLED unit prices of iPhone and Galaxy S20, which are supporting the OLED market for smartphones, have decreased compared to 2019, and OLED shipments by Chinese panel makers have led to a decrease in OLED unit prices of Samsung Display.

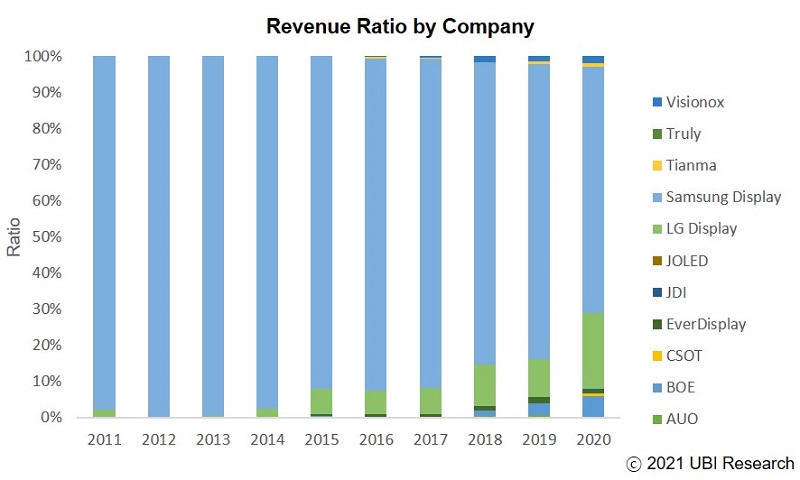

In terms of sales by company, Samsung Display was found to be $22.3 billion, a decrease of $4.2 billion from $26.5 billion in 2019. Samsung Display’s smartphone OLED shipments amounted to 390 million units, a decrease of 40 million units compared to 430 million units in 2019, and sales decreased due to a drop in selling prices. As a result, Samsung Display’s market share in 2020 dropped sharply to 68.2%.

On the other hand, LG Display’s OLED sales reached $68.7 billion, and its market share surged to 21%. LG Display’s sales increase is due to increased shipments of POLEDs for iPhone and OLED panels for TVs.

BOE’s 2020 sales were $1.86 billion, up $7.5 billion compared to 2019. The market share was 5.7%, ranking third.

Korea’s market share in 2019 was 89.3%, falling below 90% for the first time.