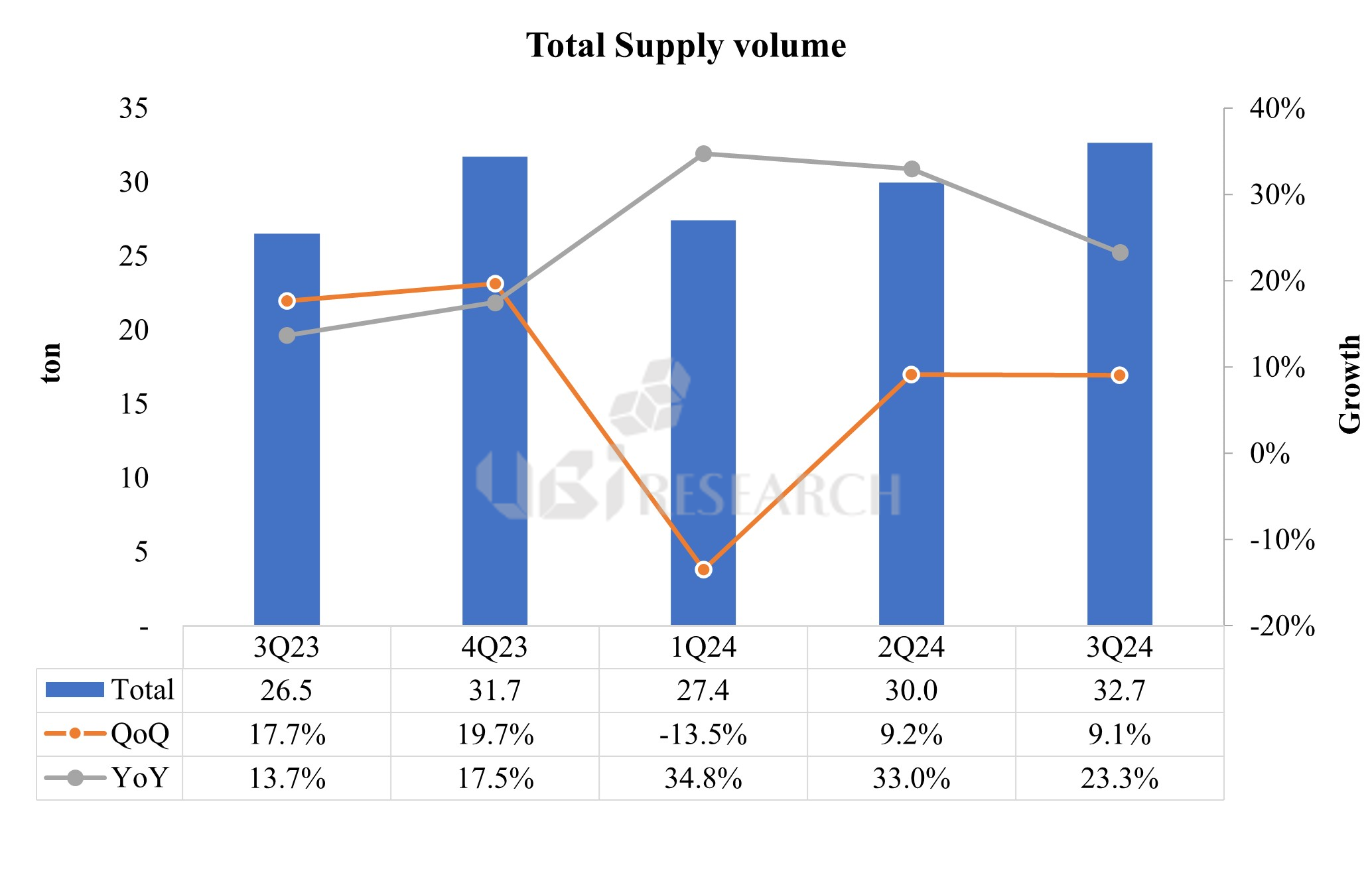

The purchase volume of OLED emitting materials in the third quarter of 2024 is expected to reach 32.7 tons, the highest ever purchase volume of emitting materials in 2024

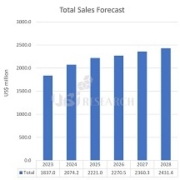

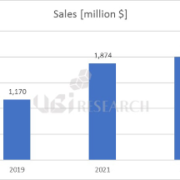

According to UBI Research’s ‘4Q24_Quarterly OLED Emitting Material Market Tracker’, the purchase volume of emitting materials in the third quarter of 2024 was calculated to be 32.7 tons. Previously, material purchases were highest in 2021, when the market expanded due to COVID-19, but the all-time high was renewed in the third quarter of 2024. Considering the characteristics of OLED emitting materials, which show the highest usage in the fourth quarter of every year, it is expected that 2024 will see the highest usage ever.

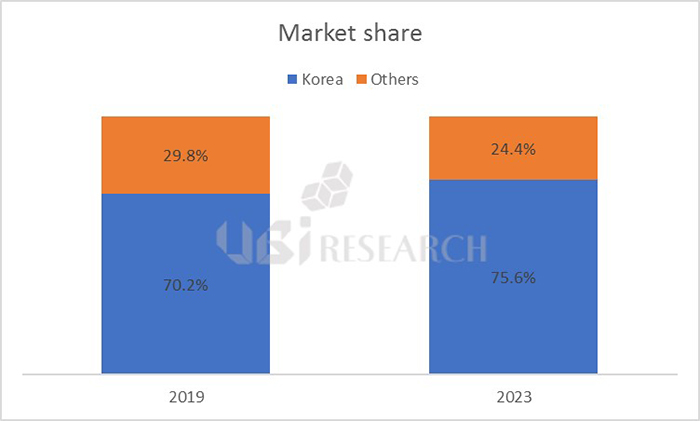

Looking at each company, Samsung Display consistently holds the highest market share. Samsung Display had a 41.4% share in the entire OLED emitting material market based on purchase volume, followed by LG Display with 20.5%, BOE with 11.6%, and Visionox with 8.3%.

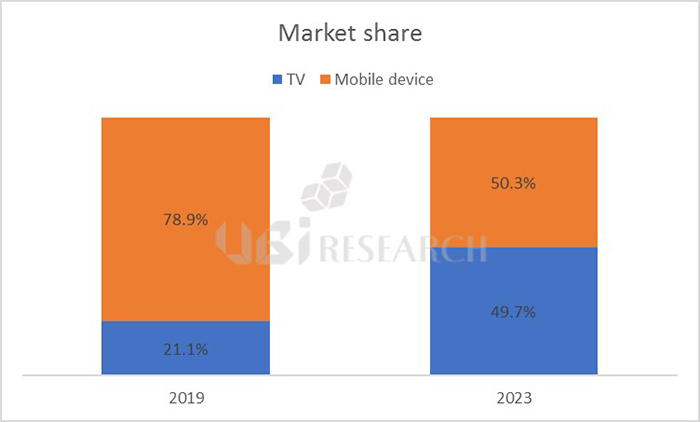

By substrate, RGB OLED still maintains the 80% level with a market share of 83.7% based on purchase volume, and as 8.6G lines begin to operate in earnest, RGB OLED’s market share is expected to gradually decline. WRGB-OLED’s market share was 11.3%, similar to the second quarter, and QD-OLED’s market share was 2.8%.

The market share of RGB 2 stack tandem OLED once rose to 6.4% in the second quarter due to a surge in iPad Pro OLED shipments but fell to the 2.2% range in the third quarter due to low demand. Compared to panel shipments, IT devices that use 2-stack tandem OLED for smartphone OLED, which uses single stack OLED, have large panel areas and have two light-emitting layers, so material purchase volume accounted for a higher share than shipment volume.

However, as BOE’s 8.6G line was confirmed to supply OLED for smartphones first, the growth of the 2 stack tandem OLED market was in the hands of Samsung Display. Starting in 2026, when OLED is expected to be applied to MacBook Pro, the purchase amount of light emitting materials applied to 2 stack tandem OLED is expected to more than double compared to 2024. The 2-stack tandem OLED panel supplied to MacBook Pro is expected to be supplied first by Samsung Display.

Junho Kim, UBI Research analyst(alertriot@ubiresearch.com)

OLED Emitting Material Market Track Sample

OLED Emitting Material Market Track Sample