CES 2025 becomes a competition hall for panoramic HUDs

We will introduce the contents of the “2025 Automotive Display Technology and Industry Trends Analysis Report” published by UBI Research in February 2025 as a series. As the first series, we will introduce Panoramic-HUD, which is included in the report.

Samsung Display's First Micro LED Watch

CES 2025 in Las Vegas set the stage for Samsung Display's private booth at the Encore Hotel. Among its cutting-edge OLED technologies, the highlight was the rare appearance of Micro LED. After years of quiet development, Samsung Display debuted its Micro LED for watches for the first time

LG Electronics' Transparent OLED T

The TV showcased at LG Electronics' booth at CES 2025 was the transparent OLED-based 'OLED T.

LG Electronics showcased its innovative transparent OLED displays, capturing attention at CES.

At CES 2025, LG Electronics showcased its flagship transparent OLED technology by creating a circular display installation. The setup featured 24 individual 77-inch transparent OLED panels seamlessly connected using a cordless design, highlighting the innovation in large-format transparent display solutions.

Samsung Display's QD-OLED: Key Highlights at CES 2025

Samsung Display unveiled the winning keywords to strengthen its QD-OLED business at CES 2025: 'Brightness, Highest, Fastest.

The purchase volume of OLED emitting materials in the third quarter of 2024 is expected to reach 32.7 tons, the highest ever purchase volume of emitting materials in 2024

According to UBI Research’s ‘4Q24_Quarterly OLED Emitting Material Market Tracker’, the purchase volume of emitting materials in the third quarter of 2024 was calculated to be 32.7 tons. This is the highest figure since 2021, when the market expanded due to COVID-19. Considering the characteristics of OLED emitting materials, which show the highest usage in the fourth quarter every year, it is expected that usage will be higher in the fourth quarter than in the third quarter.

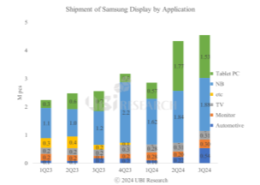

Samsung Display's Auto OLED shipments surge, sales remain strong even as tablet PC panel shipments decrease

Samsung Display's mid- to large-sized OLED shipments and sales in the third quarter were similar to those in the second quarter. Due to low sales of iPad Pro OLED, OLED shipments for tablet PCs decreased, but shipments increased in other applications and sales remained at a similar level. Samsung Display supplies mid- to large-sized OLED products for a variety of applications, including not only tablet PCs but also notebooks, monitors, and automotive OLEDs.

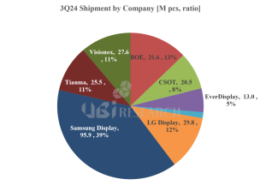

Small OLED shipments in the third quarter increased by 7.8% compared to the previous quarter, and LG Display’s shipments surged

The small OLED market in the third quarter rose 7.8% compared to the previous quarter. Most panel companies recorded panel shipments at a similar level to the second quarter, but overall shipments increased as shipments from LG Display and China's Everdisplay surged.

iPhone 17 series to be released in 2025, panels supplied by Samsung and LG Display, BOE still unknown

It is expected that only two companies, Samsung Display and LG Display, will supply panels for the iPhone 17 series to be released next year. It is unclear whether BOE will be able to supply the new model, but it is expected that it will be difficult to obtain panel approval within 2025.

Samsung Display advances mass production of 8.6G OLED line, Chinese panel companies are catching up

Recently, there is news that Samsung Display is moving up the mass production of the A6 8.6G OLED line to the end of 2025. Following Samsung Display, Chinese panel companies are also rapidly investing.

The adoption of Tandem OLED in the iPad Pro and MatePad Pro is boosting the IT OLED market, increasing shipments, and intensifying competition among panel manufacturers.

With the release of APPLE's iPad Pro and HUAWEI's MatePad Pro featuring Tandem OLED, the adoption of OLED in IT products is gaining momentum. OLED, known for its low power consumption and ability to accommodate larger batteries, is also well-suited for power-hungry on-device AI laptops, suggesting that more IT products will incorporate OLED in the future.

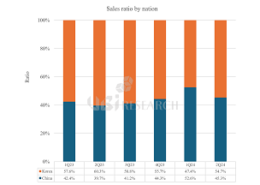

Korean OLED Panel Makers' Emitting Material Purchases Reach 51.2% in H1, with a Modest Recovery Expected in H2

According to UBI Research's recently published "3Q24 OLED Emitting Materials Market Track," the purchase of emitting materials by Korean OLED panel manufacturers in the first half of 2024 totaled $495 million, representing 51.2% of the market share—a 7.8% decrease compared to the same period last year. This is a notable shift. Meanwhile, Chinese companies held 48.8% of the market share, up 7.8% year-on-year, with purchases amounting to $471 million.

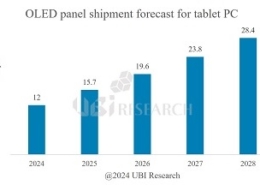

Due to the OLED iPad Pro for Tablet PC, shipments are rapidly increasing, and shipments are expected to increase by more than 6 times in 2024 compared to the previous year.

According to the "3Q24 Medium-Large OLED Display Market Track" published by UBI Research, more than 12 million OLEDs for tablet PCs are expected to be shipped in 2024 thanks to Apple's entry into the OLED market for tablet PCs.

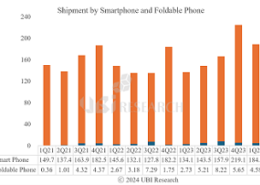

Foldable OLED shipments in 2Q reached 9.9 million units, doubling from 1Q and setting a new record.

According to the "3Q24 Small OLED Display Market Track" published by UBI Research, OLED shipments for foldable phones in the second quarter of 2024 are expected to reach 9.94 million units, more than doubling compared to the first quarter.

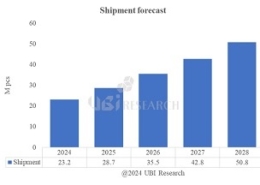

OLED emitting material demand expected to grow to 177 tons by 2028

According to the ‘2024 OLED Emitting Materials Report’ recently published by UBI Research, the total demand for emitting materials in 2024 is expected to be 131 tons, and the demand for emitting materials is expected to be 177 tons by 2028 with an average annual growth rate of 7.9%.

OLED market for Tablet PCs to grow 6-7 times by 2024 due to Apple’s entry

According to the ‘2024 Mid-Large OLED Display Annual Report’ recently published by UBI Research, shipments of OLED panels for tablet PCs are expected to grow from 12 million units in 2024 to 28.4 million units in 2028, with an average annual growth rate of 24.1%.

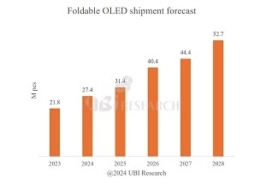

Samsung Display continues to dominate the OLED market for foldable phones

According to the ‘2024 Small OLED Display Annual Report’ recently published by UBI Research, OLED shipments for foldable phones are expected to increase from 27.4 million units in 2024 to 52.7 million units in 2028.

International Business Conference: 2024 OLED Korea & 2024 eXtended Reality Korea will be held in parallel!

UBI Research, a display specialist research company, will hold the international business conferences OLED Korea and eXtended Reality Korea in parallel at The-K Hotel in Yangjae, Seoul from March 27 to 29, 2024. This event is expected to be an opportunity for people from companies, academia, and research institutes related to the display industry around the world to attend, exchange the best information, and form a global network.

Aren’t you curious about the future of OLED and micro displays? OLED Korea and eXtended Reality Korea will provide the answer!

Korea maintains a leading position in the IT product and display markets. OLED Korea is an International Business Conference created to serve as a bridge between the global OLED industry so that OLED can replace LCD. This conference, with the participation of approximately 150 to 200 industry experts, has established itself as a key location to gauge the direction of the global OLED industry along with Korea's OLED.

Foldable and slidable OLEDs are replacing LCDs in IT

Foldable OLED technology, which started in the smartphone market, is also sprouting up in the notebook market. Foldable OLED technology has the advantage that the entire front of a smartphone or notebook can be configured as a screen, and since the screen can be folded, it is a product that enhances portability. Therefore, it will become an essential product in the increasingly sophisticated information age.

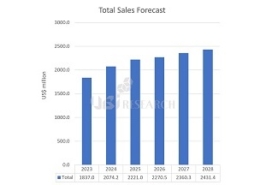

In 2028, the OLED emitting material market is expected to reach $2.43 billion with an average annual growth rate of 5.8%

According to the ‘4Q23_Quarterly OLED Emitting Material Market Tracker’ recently published by UBI Research, the market for emitting materials used in OLED is forecasted to grow from $1.84 billion in 2023 to $2.43 billion in 2028, with an average annual growth rate of 5.8%.