[China OLED Trends] Will US-China Trade Dispute Accelerate Chinese Large-Size OLED Market?

Recently, due to the trade dispute between the US and China, a large portion of the budget planned by the Chinese government is flowing into the display industry while the semiconductor industry, which is one of intensive investment promotion industries, foreshadows difficulties. In the display industry, the focus is on OLED, which is a cutting-edge technology, and most of the investment is in the 6G line, a mobile product production line. This year has already been made at Visionox and Tianma on the 6G line, and BOE and CSOT will be invested further this year.

The Chinese government is actively investing in the display sector, which is relatively uncontained due to trade disputes between the United States and China, and it is reported that the mobile OLED production line as well as the large OLED line, 8.5G and 10.5G lines, are being reviewed ahead of time.

Large OLED lines are currently being mass-produced only by LG Display, and are being produced using oxide TFT and white OLED deposition. Samsung Display is also considering mass production by adding QD structures to oxide TFT and blue-based OLED deposition.

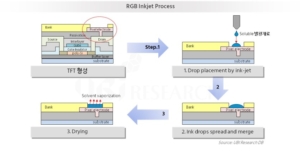

Samsung and LG are preparing to mass-produce or mass-produce by applying heat deposition method to organic materials, but Chinese OLED panel makers are oriented to mass production line of RGB Inkjet method (Solution Process OLED). However, as the investment has accelerated recently, experts are concerned about the investment of RGB inkjet method which has not been mass-proven.

This is because LG Display’s white OLED deposition method has already been mass-proven and Samsung Display is also planning to invest in the same deposition method with only the different structure. Indeed, it is necessary to see whether Chinese OLED panel makers will move beyond the second-place strategy to adopt the RGB Inkjet method or change their direction to the deposition method, a proven technology.