[Press Release] OLED production capacity will increase to double in 2023.

UBI Research has published [2019 OLED Equipment Report] that forecasts the OLED equipment market. According to the report, the total substrate area of display companies in 2019 will be 34.9 million square meters, which will be 68.5 million square meters in 2023 and double after four years.

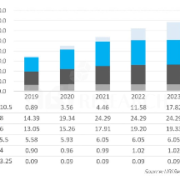

OLED substrate area growth is attributable to investments made by OLED lines for TVs driven by Samsung Display and LG Display. Currently, OLED manufacturing lines for TVs are 8G lines optimized for 55-inch panel production. However, the demand for premium TVs is shifting from 55-inch OLED TVs to 65-inch TVs. By 2021, the 65-inch OLED TV market will account for more than 40%. In response to these market conditions, LG Display is preparing to invest 10.5G lines in the most efficient production of 65-inch panels. In 2023, the substrate area of a large OLED line is expected to occupy 42% of the total substrate area.

<OLED production capacity by generation>

The substrate area of the 6G line is expected to grow to 13 million square meters this year and to 19.3 million square meters in 2023. Most of this is due to investment by Chinese panel makers. In China, the smartphone market accounts for about 40% of the global market, so Chinese smartphone makers have a very high market share based on the domestic market. Huawei has recently become the world’s second-largest shipper based on its domestic market. Chinese panel makers are boldly adding a 6G flexible OLED line to Chinese smartphone makers, with the Chinese government’s huge support.

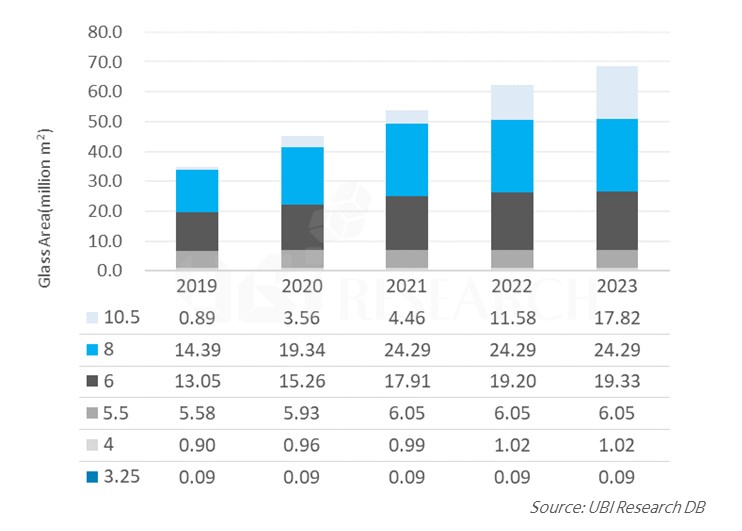

<OLED production capacity by country>

In 2019, Korea’s OLED production capacity (substrate area) will total 27.9 million square meters, accounting for 80% of its total production capacity and expanding to 54.8 million square meters by 2023. The market share will remain at 80% and lead the OLED industry.

Chinese panel makers are expected to stay at around 20% as they are investing only in OLED production lines for mobile device.

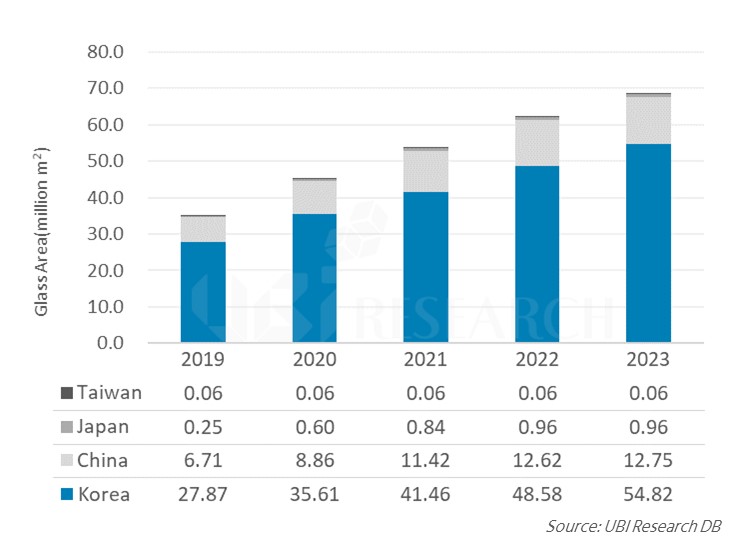

The OLED manufacturing equipment market (excluding logistics equipment) is estimated at $ 28.4 billion for four years from 2019 to 2022 due to investment by Korean and Chinese panel makers. Among them, the sixth-generation equipment market is expected to account for 61% of the total equipment market, at $ 17.2 billion.

<Equipment Market Forecast by Generation (2019 ~ 2022)>