[2022 Vehicle Displays] BOE

#BOE #automotive #display

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#BOE #automotive #display

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

Growing into the mainstream of OLED growth by expanding large OLED, differentiated products and supply

■ Small and Medium-sized POLED, strengthening fundamental business capacity and preparing future products such as Foldable

■ Develop commercial and automotive products, new technologies / new markets and develop into first-class business

LG Display is one of the world’s largest electronics exhibitors, and will hold a press conference at the Las Vegas Convention Center (LVCC) in Las Vegas on June 7, the day before the opening of the Consumer Electronics Show (CES) with Han vice chairman, executive vice president Kang In-Byoung, Strategy and Marketing Group Director Song Young-kwon, and other executives.

At the meeting, Han Sang-bum said, “Although there were many difficulties due to excessive supply and enormous investment due to intensified global competition last year, large-sized OLED business turned to surplus and stable profit was generated mainly in high value-added products. “This year, LG Display will focus on OLED investments, accelerating OLED growth, and focus on commercial and automotive businesses. By 2020, LGD will account for more than 50% of total OLED and growth businesses. “He said.

To this end, LG Display plans to expand its large-size OLED market, strengthen its fundamental business capabilities in small- and mid-sized P-OLED (plastic OLED) businesses, and develop new markets with differentiated commercial and automotive products.

■ Large OLED, differentiated products and supply expansion

Since LG Display first supplied OLED TV panels in 2013, LG Display has continued to develop its technology. And last year, it sold nearly 3 million units and developed into a strong player in the premium TV market. This year, the company plans to expand its TV product lineup from the existing 4K resolution to 8K, and to further enhance its competitiveness by further enhancing performance such as luminance and response time. In addition, the company will expand its market by expanding differentiated products such as wall paper, CSO (Crystal Sound OLED), rollable and transparent display. LG Display will complete the G8.5 OLED panel factory in Guangzhou, China in the first half of this year, and mass-produce OLED from the third quarter. Through this, the company plans to expand its sales volume from 2.9 million units in 2018 to 4 million units this year, and to achieve more than 10 million units in 2021.

In addition, LGD will expand sales areas for existing customers, strengthen collaboration with strategic customers, and increase sales of premium products such as ultra-large size panel.

■ Small and mid-sized P-OLED, strengthening fundamental business capacity and preparing future products.

LG Display is targeting the small- and mid-sized OLED market through P-OLED.

This year, it is a great challenge to develop core technologies and products for strategic customers in a timely to raise market share of small- and medium-sized panel.

In addition, LGD plans to increase the production capacity of the Gen 6 Gumi factory, which has a capacity of 15,000 sheets per month, and to expand the P-OLED production capacity by early stabilizing the Gen 6 factory in Paju.

In addition, LGD plans to steadily prepare related technologies and infrastructure so that future products such as Foldable can be released on time.

■ Commercial and automotive displays, Fostering first-class business

LG Display nurtures the rapidly growing commercial and automotive businesses to first-class business.

In the commercial market, LGD plans to pursue differentiated products such as 98 and 86 inches, ultra-slim products such as in-touch, bezel of 0.44 mm, transparent and gaming.

For automobiles, LTPS-based high-resolution LCDs and P-OLEDs are expected to focus on 8-inch and larger screens and high-resolution products. In addition, LGD will prepare its production infrastructure to expand its business in a timely manner and further strengthen its cost competitiveness, thereby achieving the first place in the fast growing auto market.

This year LGD plans to complete investment in preparation for the future, which began in 2017. LGD Han Sang-Bum, vice chairman of LG Display, said, “LG Display will be able to lead the global display market once again with OLED.

LG Display spoke that they plan to change the sales structure by focusing on the OLED sales at the conference call in Q2, 2017 which was held on 26 July, and they expected that the OLED sales portion among the total sales would be from 10% in this year to 40% in 2020.

Sang-don, Kim, the CFO of LG Display said that they will invest about 15 trillion won of production line for the Gen10.5 OLED and the Gen6 POLED(Plastic OLED) at Paju P10 factory against 4 years. He said that “The investment of Paju P10 is a leading task for the mass production and the improvement of efficiency because the demand of OLED TV is rapidly increasing by the forecasting of 2.5 million units in 2018 and 6 million units in 2020. We will take the P10 factory as an OLED hub.”

The CFO also said that “We plan to order and install the necessary equipment from July 2017 to January 2019 for the Gen10.5 OLED line in Paju P10 factory, and through test period for 6~12 months, the 1st target will be to mass-produce the OLED of 30,000 units per month based on single unit. 5 trillion won will be invested to the P10 factory to install new lines of the Gen6 POLED with 30,000 units per month and it would be started to produce it in 2019.”

Accordingly, LG Display announced that E5 in Gumi, which was previously invested, plans to mass-produce the Gen6 POLED with monthly 15,000 units of scale in this year, E6 in Paju plans to mass-produce the Gen6 POLED with monthly 15,000 units of scale in Q2 2018. In addition, they mentioned that at the OLED new line in Guangzhou, China, will mass-produce the Gen8.5 OLED with monthly 60,000 units of scale from the first half of 2019 by the investment of the 5 trillion won. For concerns on the technology leakages about the investment of the Gen8.5 OLED in Guangzhou, the CFO, Sang-don, Kim, said “There was no cases of technology leakages in the LCD line of Guangzhou until now from last 2013 since the OLED is complicated technology to copy, and there would be much benefit by the localized equipment and all investment instead of it.”

Meanwhile, the sales of LG Display for the Q2 this year were reduced QOQ 6% (7,620 billion won) as 6,629 billion won, but, increased 13% versus same quarter of last year (5,855 billion won). The portions by the products are following: 46% for TV panels (QOQ +3%p), 22% for Mobile panels (QOQ -4%p), 17% for Monitor panels (QOQ +2%p), 15% for Laptop/Tablet panels (QOQ -1%p). LG Display explained that the performance in first half declined due to the seasonality impact, but the shipments in second half considered as high-season, will be increased versus first half.

LG Display announced that it will concentrate 70% of CAPEX(investment cost for future profits) on large-sized OLED and POLED, and among them, the proportion of POLED will be higher than that of large OLED through the 2017 Q1 conference call held on April 26.

Kim, Sang Don, CFO of LG Display said “The specific size and timing of the investment is under review, but investing more than 70% of the investment in OLED remains unchanged.” Also revealed LG Display’s future investment direction by adding “Since OLED investment costs are high, we will deeply examine the confidence of our customers and the certainty of market demand, and will invest in a conservative position.”

LG Display said it will continue to secure LTPS-LCD competitiveness. Kim, Sang Don, CFO said ”We plan to switch the Gumi E5 line to POLED instead of LTPS-LCD in the second half of this year, but we think there still is demand for LTPS-LCD and opportunity for high-resolution smartphone manufacturing.”

For the LG Display’s plan for OLED Lighting business and OLED panel shipment, mentioned “OLED lighting will be produced about 15,000 sheets in the second half of 2017, and POLED will be mass-produced in Gumi E5 at the end of 2Q 2017.

For a plan for OLED TV production expansion, said “The reaction for OLED wall paper TV and Crystal Sound OLED released at CES 2017 in January this year, is better than expected in the TV market.” and mentioned “We expect OLED TV shipments to reach 300,000 units in 1Q and 500,000 units level in each quarter of the second half of this year.”

The forecast for ultra-large TV market in 2017, it is forecasted “LG OLED TV occupies an overwhelming share in ultra-large OLED TVs of 60 inches and above, and the ultra-large TV market is expected to grow continuously and record more than 30% of growth rate in the future.”

For the LG Display’s counterplan forward for the Chinese panel makers’ LCD technology, mentioned “Until 2020, it is concerned that the Chinese LCD panel makers are expected to improve their LCD technology and invest in Gen 10, however, LG Display’s IPS technology, consistent quality of mass production and stable supply chain are enough to overcome.”

Meanwhile, said that the sale proportion by product based on LG Display’s sales amount in Q1 this year were 43% for TV panels, 26% for mobile panels, 16% for notebooks and tablets, and 15% for monitors. Also, quarterly operating profit reached a record profit of 1.269 trillion won through continuous overall price increase trend of panel and the mix operation of profit-oriented products of high-resolution, high-end IT products and etc.

During the 3Q performance conference call on 26th, LG Display mentioned that their investment ratio in OLED was 50% this year, and plans to increase its ratio to at least 70% next year.

Small and medium sized mobile display market will quickly change from LCD to POLED, and plans to strengthen business cooperation in 1Q of next year, such as mass production of 6th generation E5 line and technological competitiveness, in order to make the basis of OLED extension. It means they started to concentrate on small and medium sized OLED business starting next year.

They also revealed their production plan and future strategies of POLED production line. Gumi E5-1 line and E5-2 line are productions lines with monthly production capacity of 7500 sheets each, where they are proceeding POLED investments after converting existing LTPS facility, and also Paju E6 line is in process of investment to increase the monthly capacity of 15,000 sheets. It seems they will be capable for mass production by 2H 2018.

OLED TV market indicated that they will continue to put effort in cost reduction from improvements in rate, process, and production. They mentioned to establish OLED market more firmly in 1H of next year after successfully increasing the mass production capacity to 25,000 sheets. Among the entire TV panel, OLED sales took up 10%, and among OLED TV panel, 55-inch screen took up 70%, and they forecasted 65-inch market ratio will increase.

They noted they have high expectations of market growth in large screen HD field in large LCD. China is catching up in the market very fast but, they emphasized they will be able to easily acquire profitability by concentrating in high-end LCD such as OLED.

The biggest reason that they choice OLED as their next generation business is because there are possibilities in extension in automobile and commercial other than existing TV•monitor IT devices, and in case of automobiles, they said they are currently in cooperation with many other companies, and also informed many companies are interested in currently ongoing topic, VR, where they plan to adopt plastic OLED products.

In case of commercial products, they are proceeding developments with their customers in various fields such as medical and broadcasting other than public signage. They also mentioned that they are planning to proceed OLED light business after collecting many applications in one place.

From price increase of large LCD panel and extension of large-scale trend of all products, LG Display continued their profit relay for 18 consecutive quarters by resulting 3rd quarter sales of 6,723,800 million KRW and profit of 323,200 million KRW. Sales increased by 15% (5,855,100 million) compared to past quarter, operating profit increased by 634% compared to past quarter (44,400 million KRW) due to improvements in high-valued products such as ASP, UHD, and IPS.

On the other hand, according to Yubi industry research, LG Display forecasted to ship out 900 thousand large OLED panel in 2016, and 1,500 thousand in next year.

In OLED summit 2016 held in San Diego, USA on 21st(local time), general manager of LG Display Joosu Im gave presentation on “Going forward with pOLED & future challenges” which is about 5 core technology that must-be developed in pOLED and the next pOLED.

As 5 types of core technology of pOLED, dream picture quality, design freedom, process simplication, cost innovation, a diversity of pOLED products were selected.

The presentation focused on topics such as, in dream picture quality, HDR and BT-2020 are applied in high resolution, and in design freedom, new TSP sensor development such as low stress TFT and metal mesh, and durability improvement of flexible window cover.

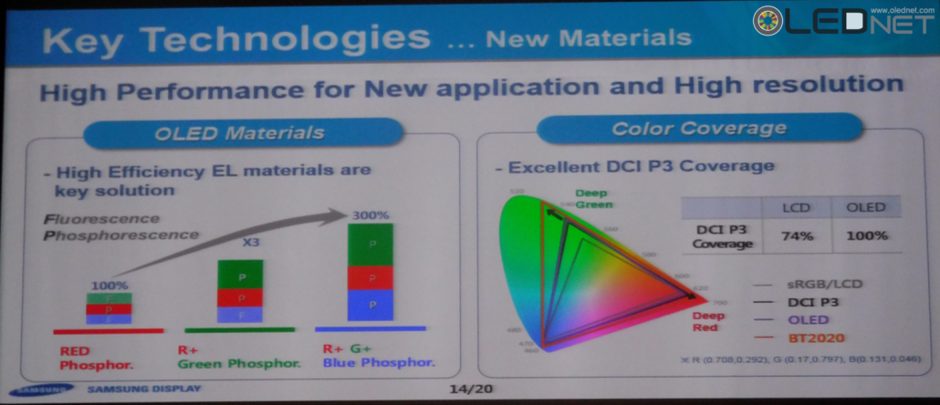

Also, he emphasized the process development for reducing the panel layer such as low temperature process and touch integration for process simplification, and the need for cost innovation through it. Lastly, he suggested material development (such as phosphorescence, TADF blue) in low power for diversity of pOLED products such as monitor for VR and PC, and automobile diversity of pOLED products, and also suggested changes of pixel design for enhancing the open ratio.

As a new opportunity for pOLED, he pointed out applications on foldable, automotive, and VR devices, and mentioned transparent display as the next pOLED.

This LG Display presentation is very much similar to Samsung’s previous presentation about Samsung Display in IMID 2016, and it looks like the development process and roadmap of the two companies are identical in pOLED (flexible OLED).

Especially, seeing that BT2020 application in AMOLED panel for mobile is previously mentioned by Samsung Display early this year, and now also mentioned by LG Display, it is expected that BT2020 application will become another main issue.

< LG Display general manager Joosu Im >

< Samsung Display presentation contents, IMID 2016 >

UBI RESEARCH / CEO:Choong Hoon Yi / Business License Registration Number 220-87-44660

ADDRESS: A-1901, Samho Moolsan Bldg, 83, Nonhyeon-ro, Seocho-gu, Seoul, Republic of Korea (Zip) 06775 TEL:+82-2-577-4390 / E-MAIL:marketing@ubiresearch.com