OLED is also worried about oversupply…” China factory size, twice that of Korea.” (YONHAP NEWS)

OLED is also worried about oversupply…” China factory size, twice that of Korea.” (YONHAP NEWS)

(Full text of articles: https://www.yna.co.kr/view/AKR20190419148900003?input=1195m)

Following LCD panels, there are predictions that oversupply can become a reality for OLED panels.

Concerns are growing as South Korean companies plan to grow OLEDs into new “cash cow” instead of LCDs that China has taken the lead.

According to a recent report released by Hana Financial Management Research Institute on 21th, the number of OLED panel factories currently under construction in China is 419,000 sheets per month, about twice the amount of 225,000 sheets per month, which is the size of South Korea’s expansion.

According to the report, China’s BOE, which ranks first in LCD panel market, is going to increase its size to 144,000 panels. In addition, Chinese panel manufacturers such as CSOT, Visionox, and TCL are also scrambling to expand their facilities on a large scale.

Among South Korean companies, LG Display is set to operate its 90,000-unit monthly plant in Guangzhou, China, and it is expected that there will be a total of 45,000 panels per month in Paju.

Industries predict that size of OLED plant that will be built by Samsung Display in Tangjeong, South Chungcheong Province, will reach 90,000 sheets per month.

“As speed of expansion of OLEDs in South Korea and China is much faster than rate of increase in demands, there is a high possibility that oversupply will worsen.” said Joo-wan Lee, a researcher.

The screen shield that caused controversy over faulty Galaxy folds…Why do I need it? (Yonhap news)

The screen shield that caused controversy over faulty Galaxy folds…Why do I need it? (Yonhap news)

(Full text of articles: https://www.yna.co.kr/view/AKR20190421010700017?input=1195m)

Samsung Electronics’ first foldable Smartphone was embroiled in controversy over its screen defects even before it was released. Samsung Electronics explains that this happened because early users removed “screen protection film,” which can be misunderstood as screen protection film.

<Samsung Electronics [Samsung Electronics Co., Ltd.]>

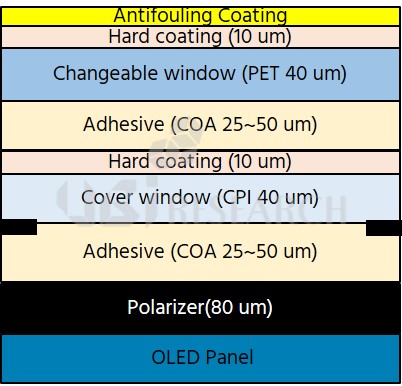

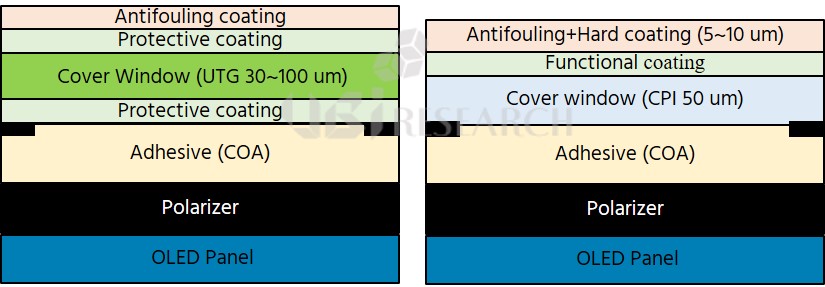

According to industries on the 21st, current Smartphones are going to protect displays by attaching cover windows with reinforced glass material on top of OLED display panels.

OLED panels themselves are very thin like vinyl and are weak against external shocks. Plastic OLED (Plastic OLED) that is used for foldable Smartphones is more vulnerable to scratch. However, it can’t put glass, which is a material that doesn’t fold, so it is finished by applying film of plastic material.

“Although screen protection films that we already know are additional products that prevent scratching, protective films that are used for flexible displays are very important for displays.” said Professor Hak-seon Kim of UNIST, who is a former vice president of Samsung Display. Ok-hyun Jeong, an electronic engineering professor at Sogang University, also said, “The fact that we took out a protective film from PLED is tantamount to ripping off the display parts themselves.”

OLEDs emit light as organic materials, and due to their characteristics, they are very susceptible to oxygen and moisture components. When a thin panel itself is subjected to strong pressure during a screen’s opening, it can cause the screen itself to become indigestion due to moisture in an empty space.

Plastic has a weaker hardness than glass, making it easier to scratch the surface.

In addition to screen glitches, the media that received Galaxy Folders for review such as Bloomberg and Derverge points out that the protective film is easily dented or scratched. One reviewer said, “I tapped the screen with my fingernails, but there are still permanent marks.”

Some point out that there is a gap between the protective film and the display, which makes it easier for dust and others to get rid of it. One reviewer suggested a photo showing the gap between the screen’s protective screen and bezel, suggesting that it could be misleading.

Due to this reason, Samsung Electronics explained that its screen shield is for ‘replacement’. Since there is a higher chance of damage such as scratch than conventional glass, they were made so that they could be replaced at that time. However, users should not replace them directly and go through a service center.

Experts point out that such precautions should be sufficiently notified to consumers before the launch, and that early users also need to follow basic precautions as they use first-generation products.

Jeong said, “Samsung Electronics seems to have lacked notice of screen protection. “We need to strengthen advance notice when it is officially released.” said a person who dropped it from the company, which is about 100 grams more than normal Smartphones, risks further damage when it is dropped from the same location. This part also requires the user to pay attention,” he pointed out.

“Since the film itself is a plastic material, even if it is attached with protective film, it can be pierced and torn if exposed to sharp needles, unlike glass,” Professor Kim said. “In fact, these precautions should be properly introduced when selling it.”

SK is investing in OLED business? (etoday)

SK is investing in OLED business? (etoday)

(Full text of articles: http://www.etoday.co.kr/news/section/newsview.php?idxno=1747027)

SK Corp. is considering investing into OLED material business. As OLED markets are rapidly growing, industries that are made of OLED materials are also increasing.

According to mid- and long-term management plan data that SK Corp. held a corporate briefing for analysts of securities companies on Wednesday, SK Corp. is also reportedly considering investing in OLED materials to expand its material business.

SK Corp. has set a mid- and long-term strategy for its material business to expand its high-growth area by utilizing its current material platform.

For OLED materials, LG Display is planning to develop its own technologies by linking current SK Trichem’s technologies such as precursors and others while also considering investing in them.

Industries predict that SK Corp. will be able to expand its business through investments as it is an investment-type holding company.

For battery materials, which are planning to enter markets with high-entry barrier materials through partner companies’ cooperation and investment in technology holding companies, it has quickly entered the market by investing 270 billion won into shares of related companies.

SK Corp. previously acquired the stake in Watson, China’s No. 1 company that manufactures the second-order essential part of the battery, in November last year.

A reason why SK is showing interest in OLED markets is because OLED markets are growing rapidly.

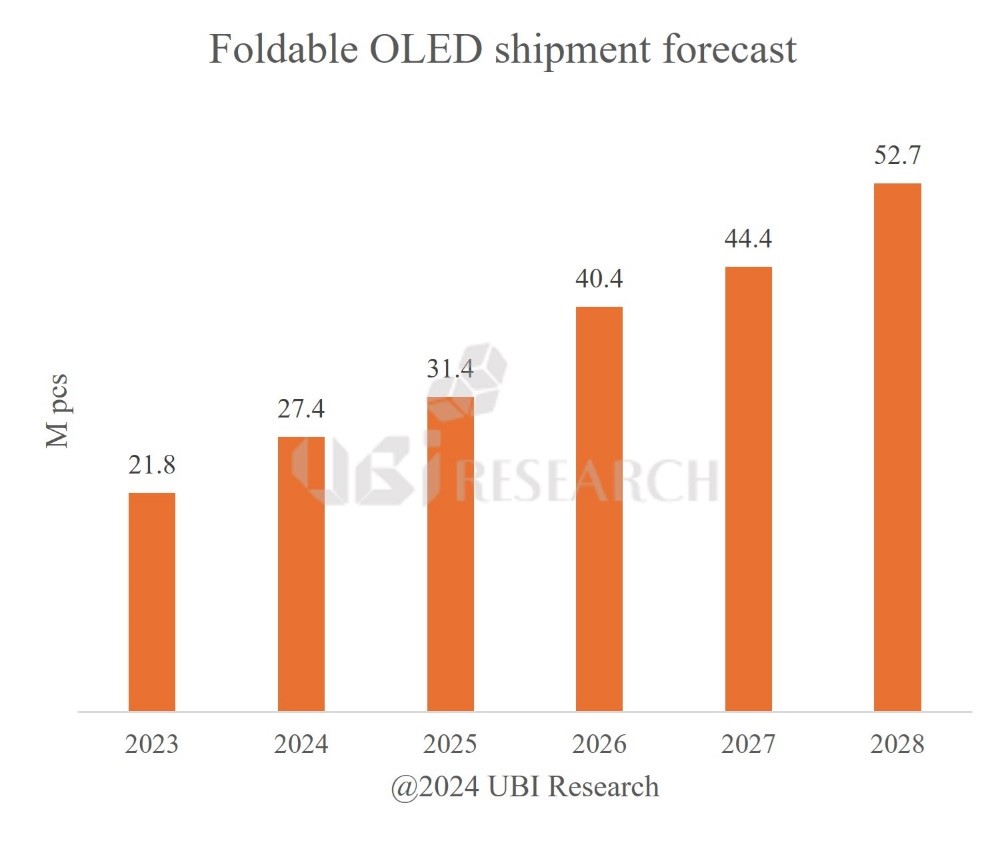

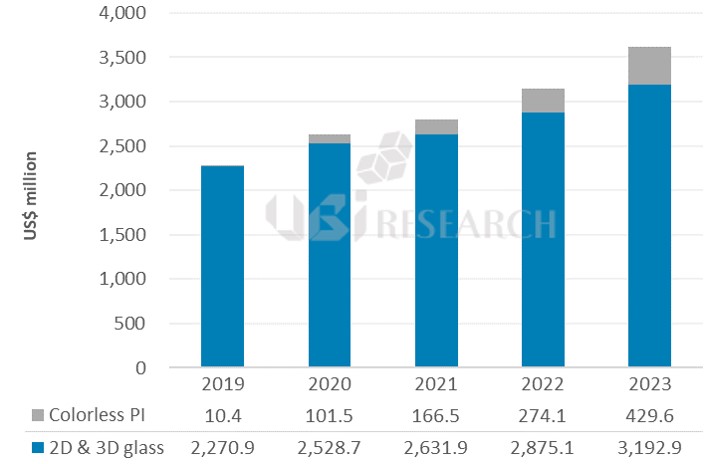

According to a market research company called Ubi Research, size of OLED display market was estimated to be $28.31 billion (31.9568 trillion KRW) last year, which is a 7.1% increase year-on-year and is expected to grow to $32.3 billion (36.457 trillion KRW) this year.

It is expected to grow to $59.5 billion by 2023.

As a result, many other companies are working on OLED materials. Earlier this month, LG Chem stepped up its related business by acquiring material technology for “Solid Organic Light Emitting Diodes,” a key platform for next-generation displays, from DuPont in the U.S.

Doosan also established a new company through division of its business sector to strengthen its material businesses such as OLED.

“We have no specific plan to invest in OLED materials yet.” said a representative for SK Corp.

2024 Small OLED Display Annual Report Sample Download

2024 Small OLED Display Annual Report Sample Download

OLED is also worried about oversupply…” China factory size, twice that of Korea.” (YONHAP NEWS)

OLED is also worried about oversupply…” China factory size, twice that of Korea.” (YONHAP NEWS)