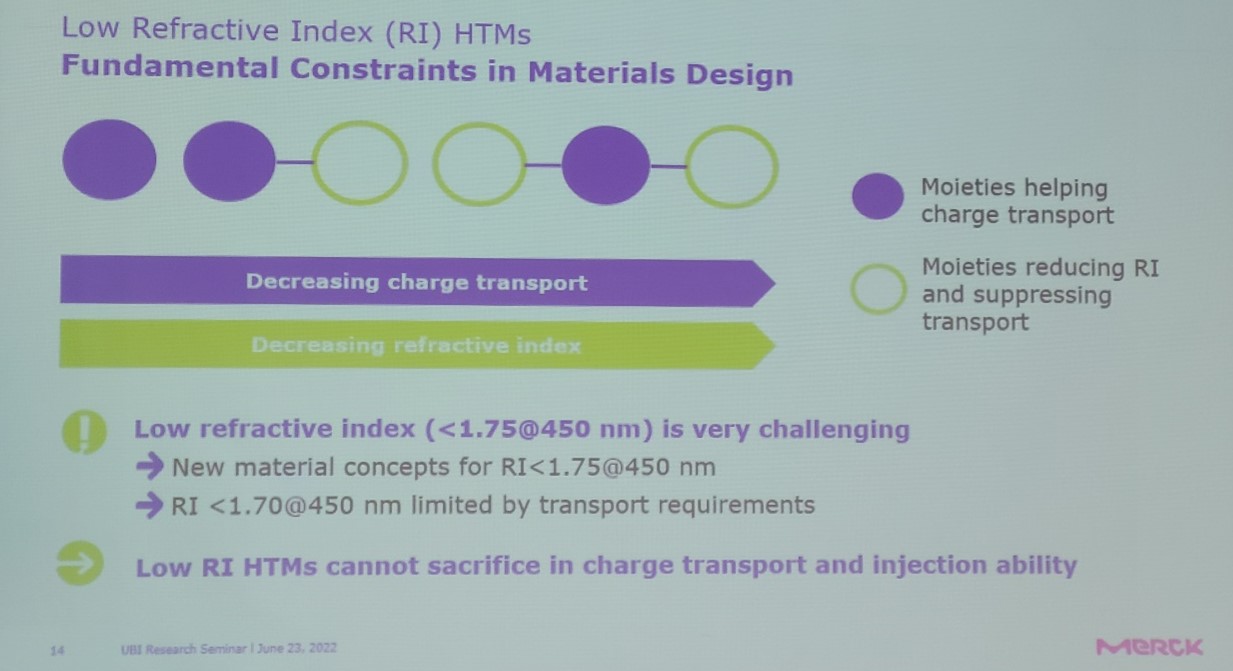

Merck, now it is time to consider the refractive index of common layer materials.

At the ‘OLED settlement seminar for the first half of 2022’ held at COEX on June 23, Merck’s Kim Jun-ho, head of research institute, said, “The concept of the refractive index of the emitting layer is often applied to the capping layer on the cathode, but now it is also required for HTL” and mentioned that the light extraction efficiency can be improved through the optimized refractive index design of HTL.

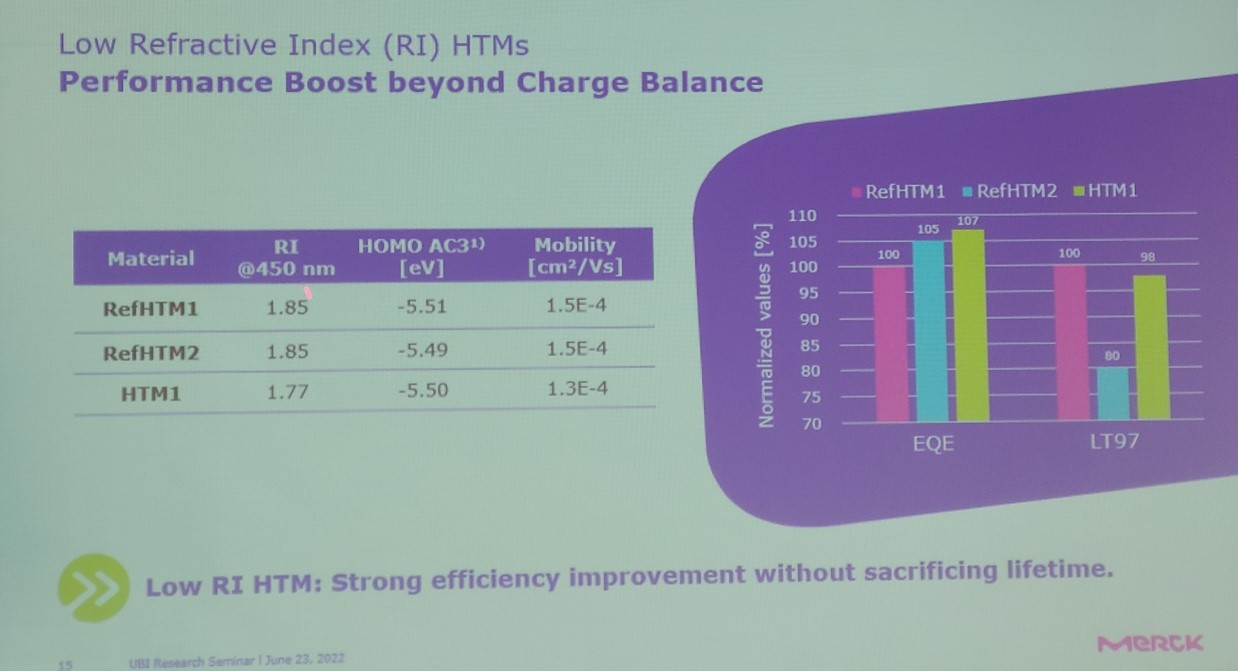

Next, Kim said, “Because the refractive index of HTL has a trade-off relationship with the hole transport capacity, it is difficult to adjust the refractive index,” and “Even though it was lowered to 1.77 from 1.85, the light extraction efficiency could be improved by 7% without an increase in the driving voltage or a decrease in electron mobility.”

Recently, panel makers are continuously developing the OLED light extraction efficiency. This is because by increasing the light extraction efficiency, as a result, the battery life can be increased. Representative examples include a high-refractive capping layer and micro lens array, and an on-cell film that removes the polarizer and uses a color filter.

The concept of the refractive index of the light emitting, which had been concentrated on the capping layer, is extended to the common layer, and it is expected that panel makers will intensify technological competition, and that there will be many changes in the supply chain of emitting materials of panel makers in the future.