Smartphone OLED shipments plummeted to 87 million units in the second quarter of 2020

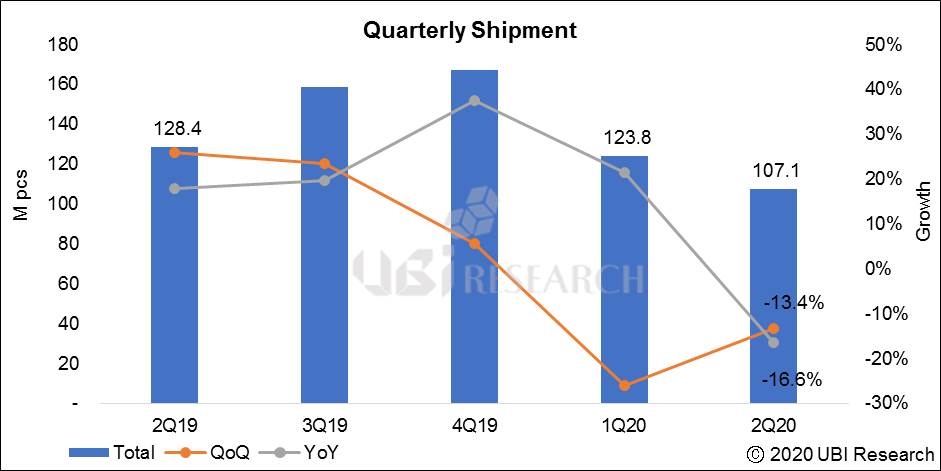

According to the market track for the second quarter of 2020 published by UBI Research, the total OLED shipments in the second quarter were 107 million units, down 13.4% (QoQ) from 124 million units in the last quarter. In addition, it decreased by 16.6% (YoY) compared to the 122 million units in the second quarter of 2019. This is because sales of OLED set devices decreased due to the aftermath of COVID-19.

However, it was found that the OLED market for smartphones that support the OLED market was significantly affected by COVID-19 compared to the overall market.

OLED shipments for smartphones in the second quarter were 87 million units, down 17% from the previous quarter (QoQ), and 23.1% from the same quarter last year (YoY). Compared to the decline in overall OLED shipments, the decline in OLED shipments for smartphones is even greater. However, the reason for the decline in OLED shipments for smartphones is concentrated on rigid OLEDs.

Despite the sharp decline in OLED shipments for smartphones, flexible OLEDs grew 38% compared to the same quarter last year.

However, the YoY of rigid OLED shipments was -40.3%, a sharp decline from the same quarter last year.

The reason why the increase in flexible OLED for smartphones has soared and the shipments of rigid OLEDs have fallen sharply is because Chinese smartphone makers reduced production of mid-priced smartphones using rigid OLEDs and increased smartphone shipments using flexible OLEDs.

According to UBI Research’s CEO Choong Hoon YI, the reason Chinese smartphone makers have increased their flexible OLED smartphone shipments is: First, due to the influence of Apple, Chinese smartphone makers also use OLED for their flagship models. In particular, Chinese smartphone makers use the name plus or max, which are used by Apple and Samsung Electronics, for the highest-end specifications, and imitate that they are making a product that is equivalent to Apple and Samsung Electronics, which are the most recognized in the smartphone market. The second reason is that Chinese display makers have improved OLED manufacturing technology, allowing them to produce panels similar to Samsung Display’s OLED. In particular, it is because Chinese panel makers are supplying panels at 60% of Samsung Display’s price, so Chinese smartphone makers have increased the choice of flexible OLEDs. The third reason is that Chinese panel makers can supply OLEDs at low prices because of the Chinese government’s subsidy policy.

YI said that the OLED industry will become more active due to the increase in OLED usage by Chinese smartphone makers, but the growth of Samsung Display’s OLED business, which has maintained a monopoly position in the smartphone OLED market, may stop growing due to the increase in production of Chinese panel makers.