Ahead of Samsung Electronics’ unpacking event, interest in the foldable phone cover window material is hot. There was a concerned surprise that the Galaxy Fold, which was scheduled to be released in the first half of last year, was delayed for several months due to the tearing issue of the protective film. This year’s concern is whether Ultrathin Glass (UTG), which has emerged as a substitute for Colorless Polyimide (CPI), can be mass-produced without major issues.

Samsung Electronics will release the Galaxy Z flip known as “Clamshell” in the first half of this year and the Galaxy Fold 2 known as “Winner 2” in the second half of this year. The Clamshell is known to adopt UTG. This material is advantageous in terms of the hardness required for the use of the S Pen, the luxurious visibility and the soft touch unique to the glass. Moreover, the major reason for adopting UTG is known to remove wrinkle at the center of the screen, which has been pointed out as a disadvantage of CPI.

Prior to adopting UTG, Samsung Display invested $ 40.8M in Dowooinsys, UTG maker, and became the largest shareholder with 27.7% stake. The intention is to secure the stable supply of UTG and reduce its dependence on Japan for major materials.

<Ultrathin Glass (UTG) (Source : Dowooinsys homepage)>

However, there are also concerns about the adoption of UTG. Schott, AGC and Corning are also developing the product and they can produce substrates with a thickness of about 100 mm by the floating method or the slit nozzle method. To make it even thinner, Dowooinsys uses hot drawing or HF etching. The thickness of UTG to secure durability is believed to be 100 mm or more and with this thickness, the radius of curvature is about 2 ~ 3mm (~1mm for CPI), which reduces design freedom of the foldable phones. To improve durability, the UTG surface is coated with a polymer resin, which also prevents glass fragments from scattering when broken. The current problems of UTG are that mass production and yield are not yet secured due to the difficulty of the process, and that there exist traumatic worries on unexpected durability issues when released to the market.

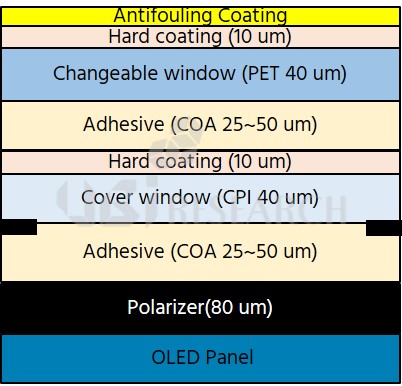

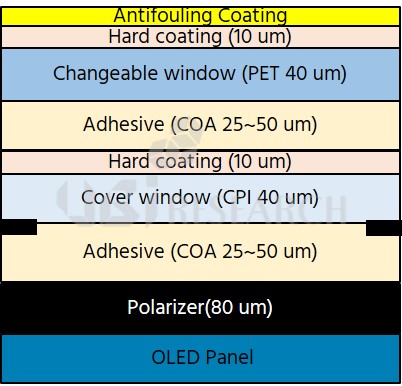

Meanwhile, CPI material companies, which have been threatened by the news that UTG will be adopted for Clamshell, are also preparing to fight back. In order to remove the changeable window film (protective film) of PET material applied to Galaxy Fold, they are increasing the hardness of the hard coating on the CPI and developing a functional coating to give a glassy gloss. In particular, Dongwoo Fine-Chem, which did hard-coating on the CPI for Galaxy Fold, is known to simplify the process by developing hard coating materials including antifouling function. With all efforts added up , the CPI cover window structure is changed from the first generation foldable phone (PET + COA + CPI + COA) to the second generation foldable phone (CPI + COA), enabling the thickness to be reduced from about 200 mm to half, and the material cost and the process to be reduced.

<2019 Released Samsung Galaxy Fold Structure (Source: UBI Research Report)>

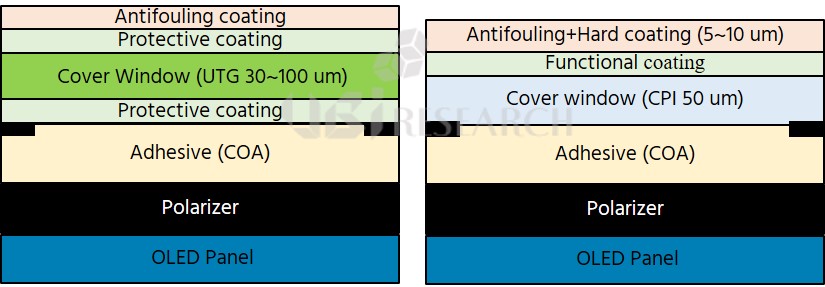

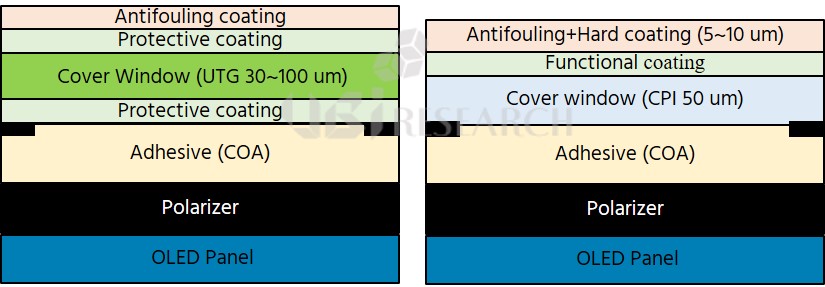

<Structure Prediction of the Samsung Galaxy Fold Follow-up Models: When Using UTG (Left) and CPI (Right) (Source: UBI Research)>

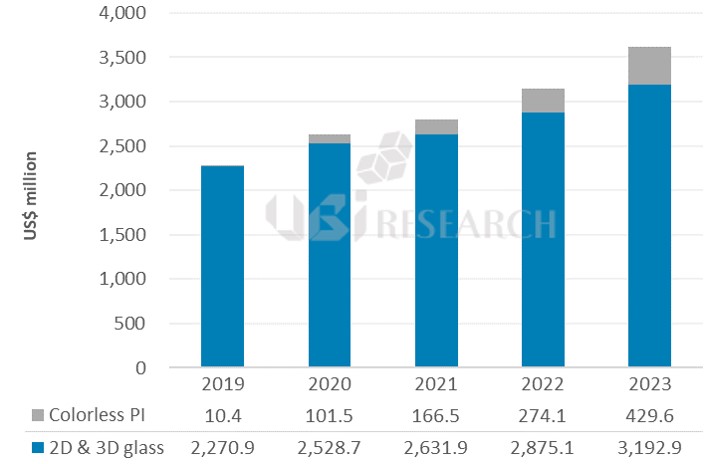

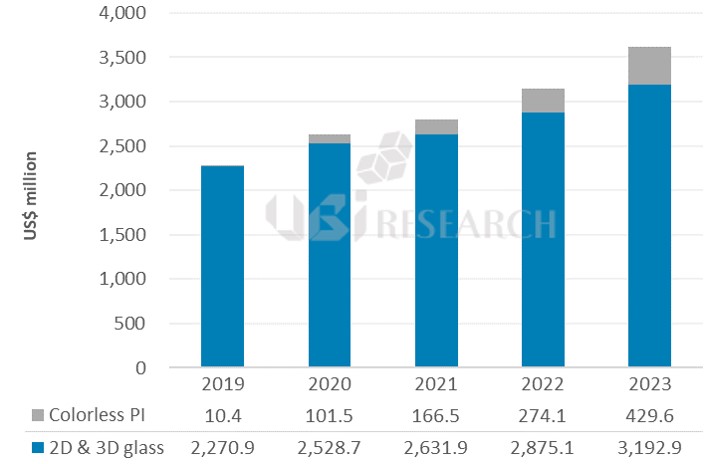

In addition to Sumitomo Chemical, which supplied to Galaxy Fold, Kolon Industries and SKC are also preparing for mass production of CPI. While UTG adoption seems to benefit to Clamshell with small screens, CPI is advantageous for larger screen sizes. UTG must make up for durability at the thickness retaining design freedom, and secure mass production system and price competitiveness through process improvement. CPI should strive to improve the hardness and appearance close to glass, and also increase price competitiveness. The material selection criteria will vary with the foldable phone models and customer response. Therefore the customer response for the Clamshell will be an important step in the future direction of the foldable phone cover window material. The market for the material is expected to grow rapidly, reaching $ 429.6M by 2023. The competition between UTG and CPI to take the market first has now begun.