[28TH FINETECH JAPAN] Denso, Automotive displays that are directly connected to safety are OLED

At the 28th FINETECH JAPAN held in Makuhari Messe, Japan during December 5-7, 2018, Hiroyuki Hara, manager of Denso said that OLED will be used as future automotive displays due to their various advantages.

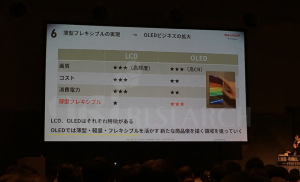

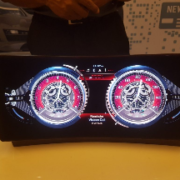

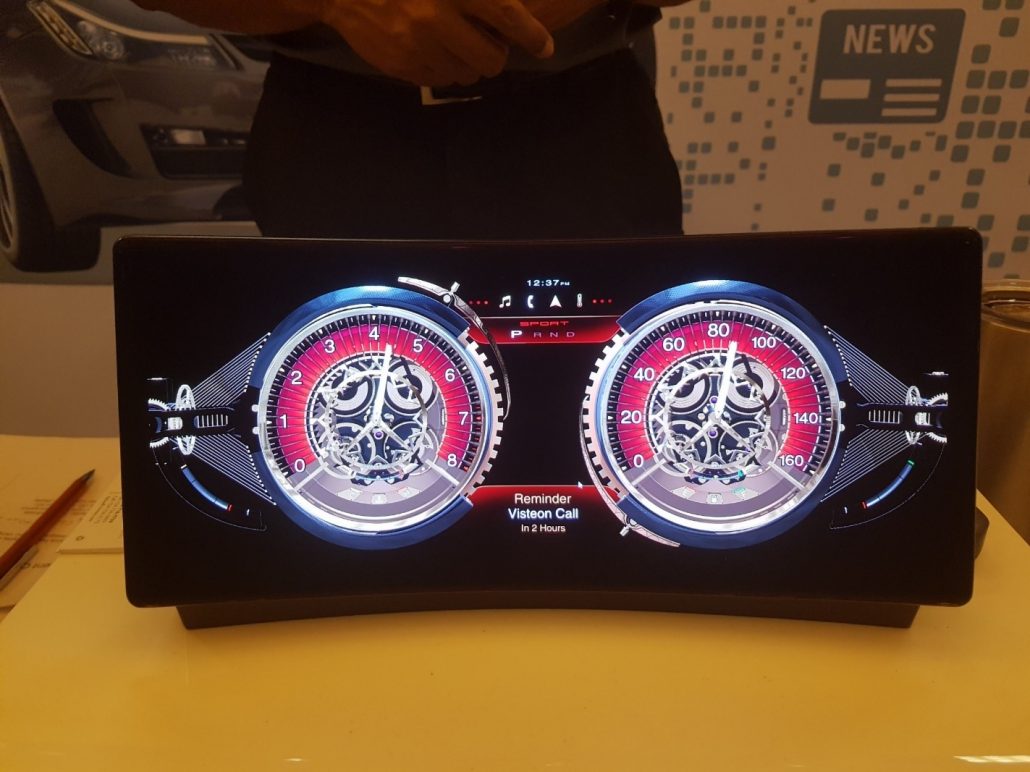

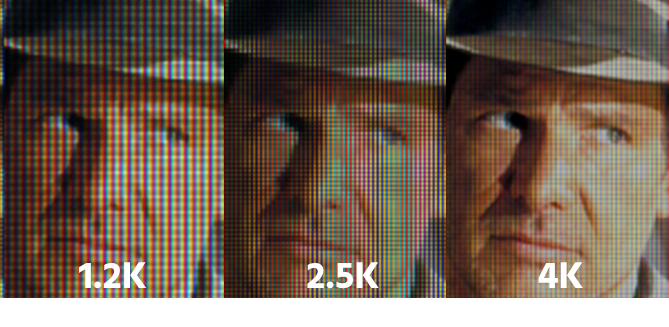

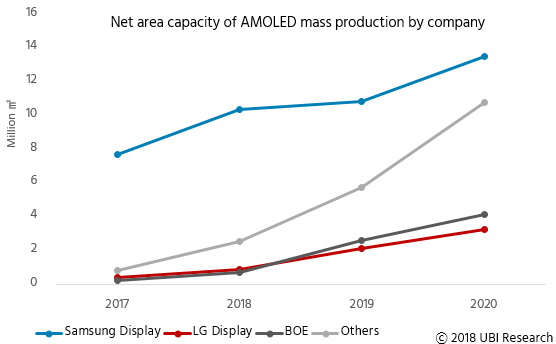

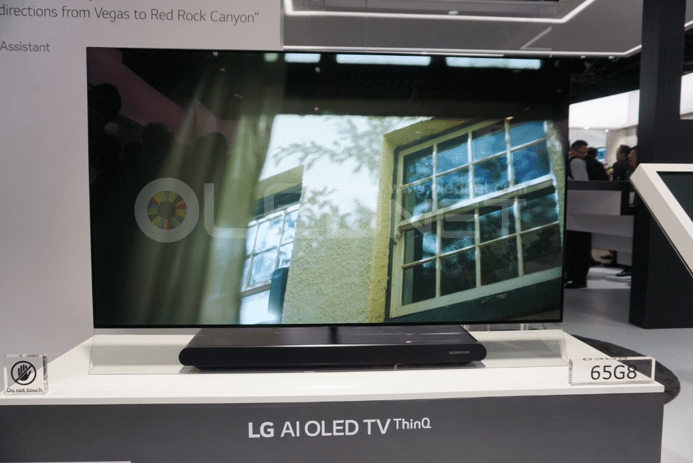

Hara refers to the large screen including the touch panel as the latest trend of automobile display, and now LCD is mainly used. However, OLED is expected to be used more and more in automobiles as the automotive electronics makers and drivers demand high-quality displays.

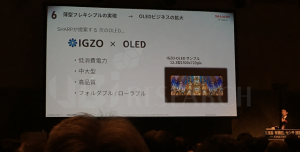

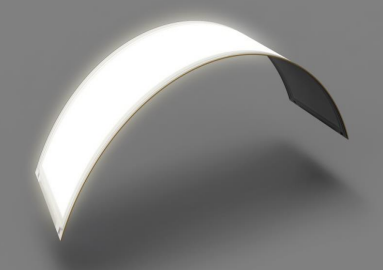

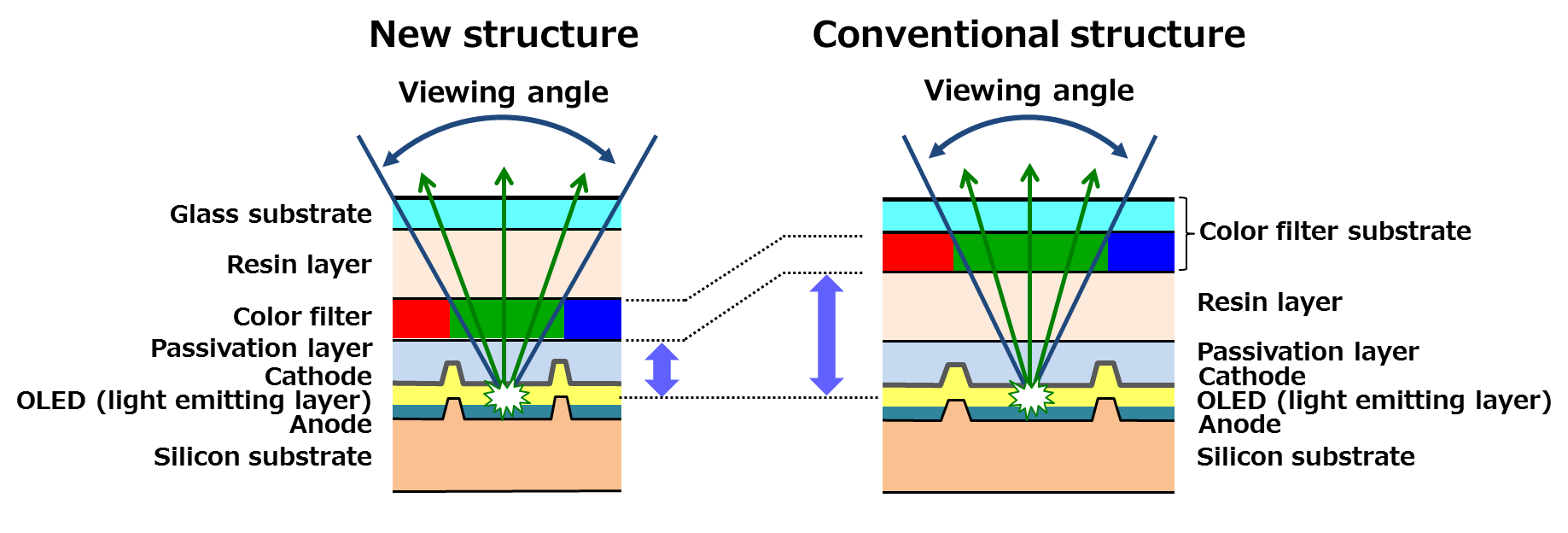

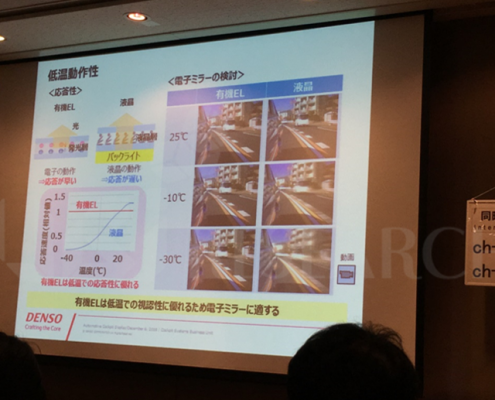

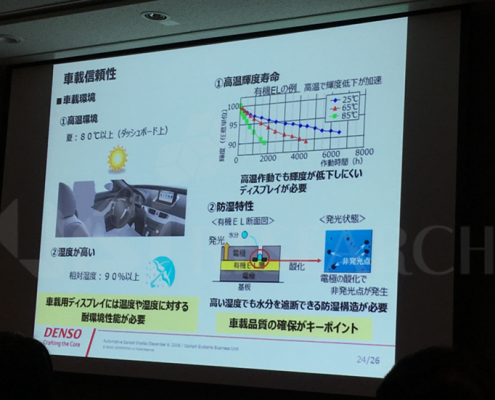

Saying that key elements in automotive displays are high contrast ratio, wide viewing angle, design autonomy, light weight, low reflection and reliability, Hara emphasized that the display that can satisfy all of these key elements is OLED. In addition, the factors related to image quality such as contrast ratio and viewing angle are directly related to safety for the driver. Thus, OLED is to be adopted more. Referring to the requirements of automotive OLED, he finally commented that improving reliability, such as lowering the luminance drop due to temperature changes and preventing damage to OLED due to high humidity, will be key to OLED for its entry into the automotive display market.

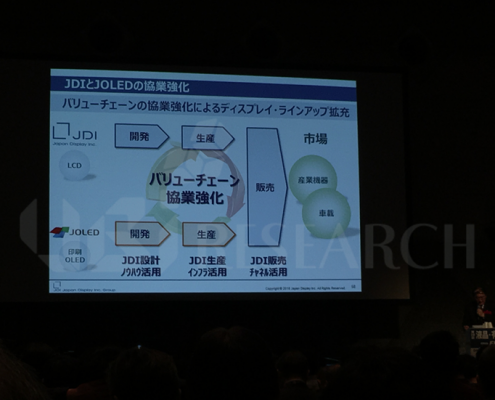

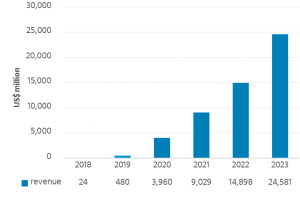

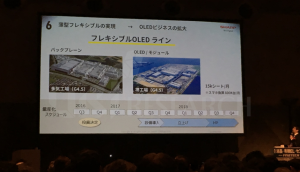

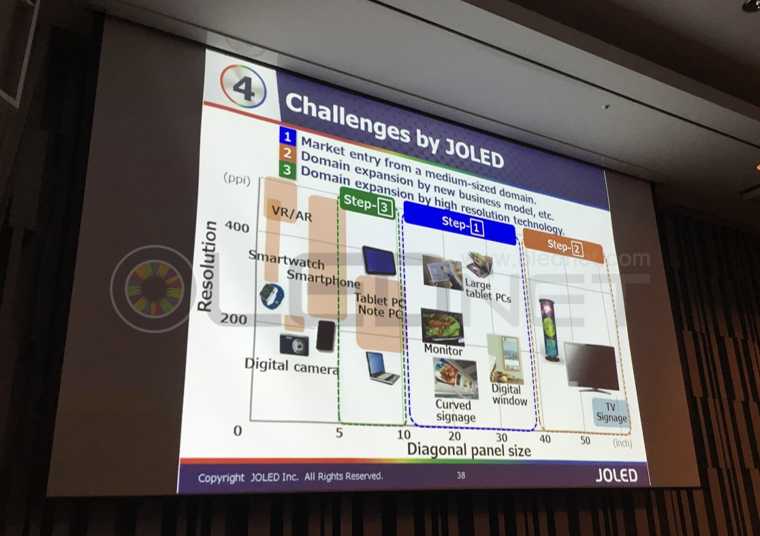

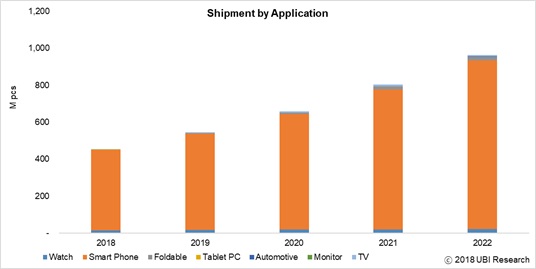

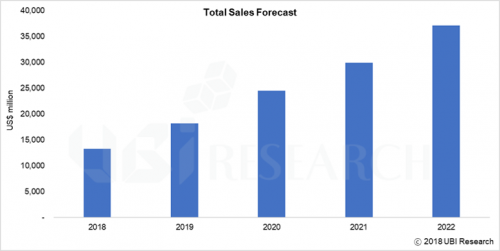

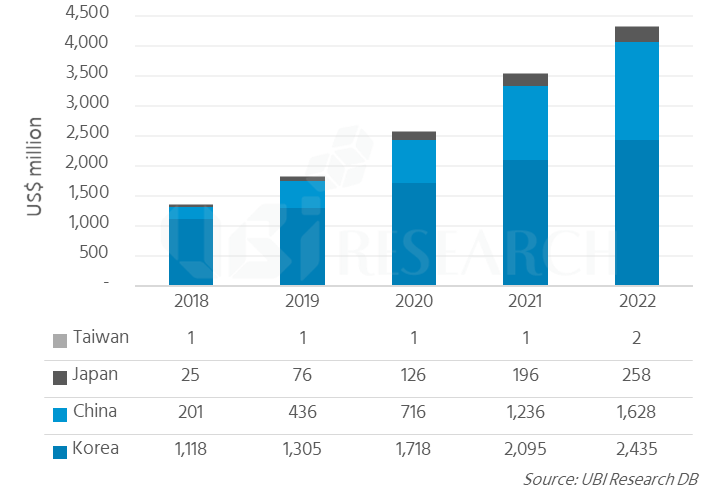

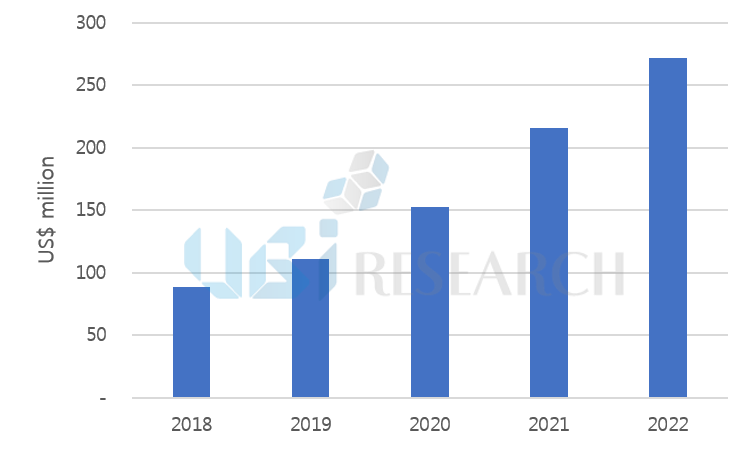

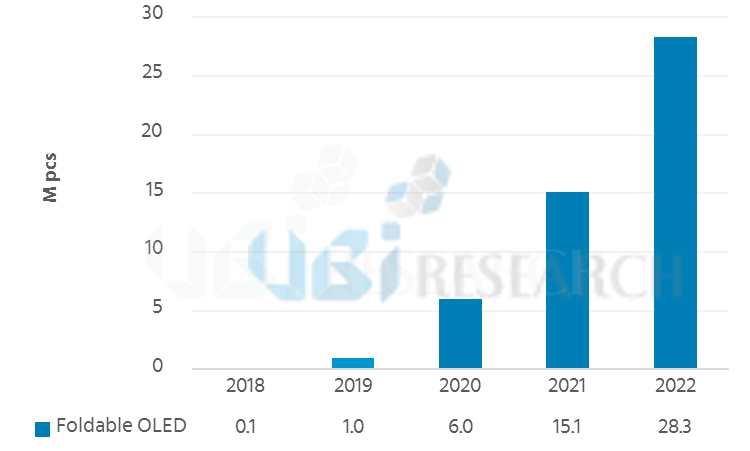

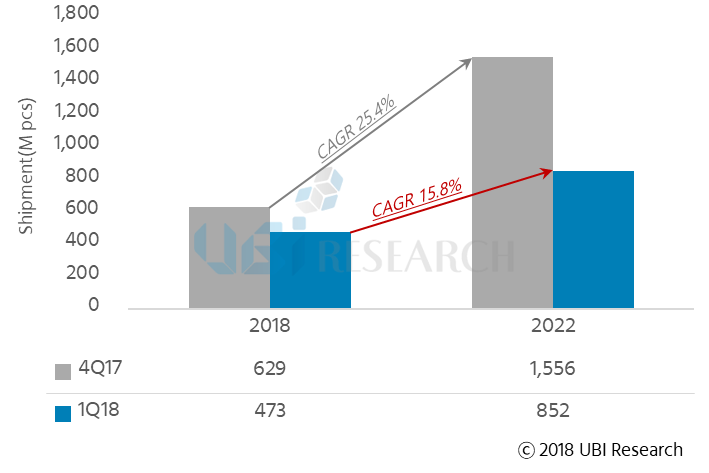

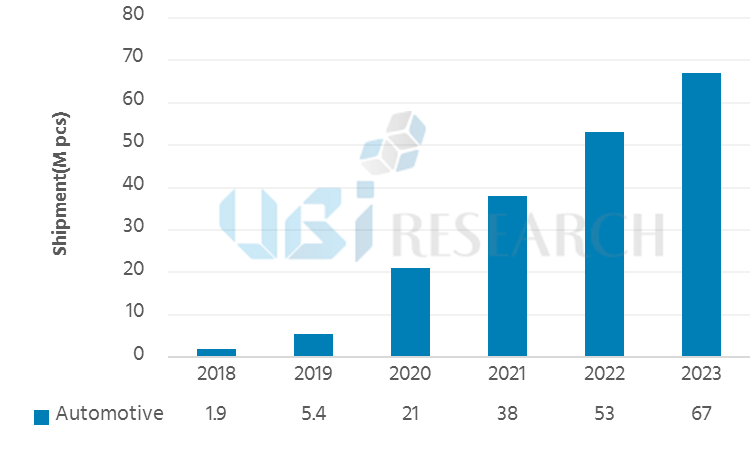

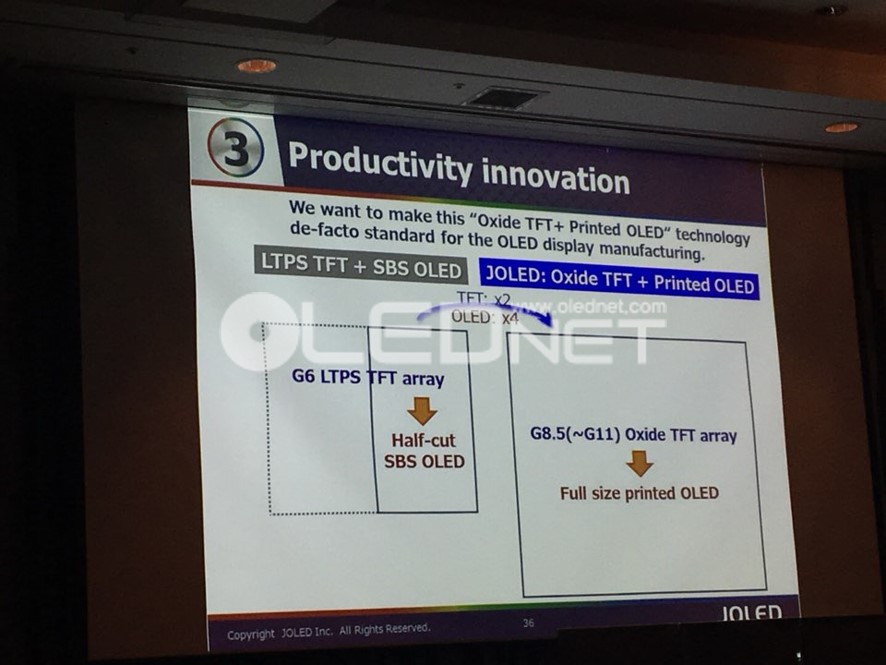

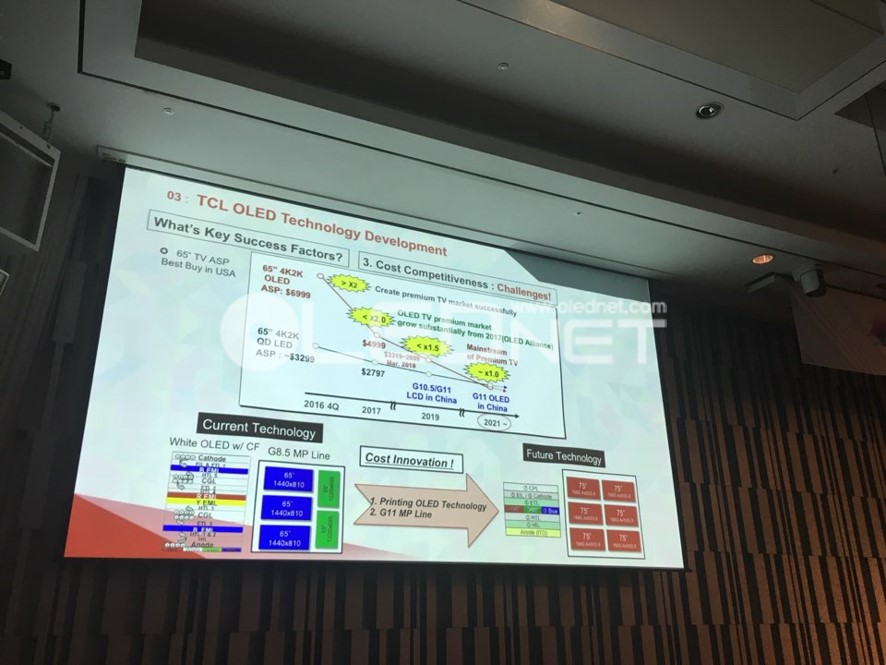

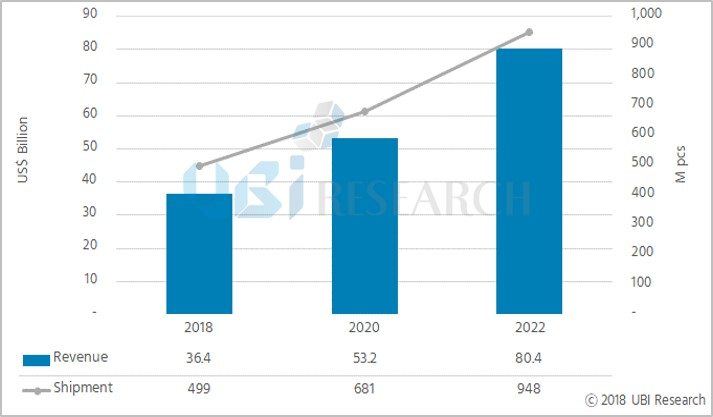

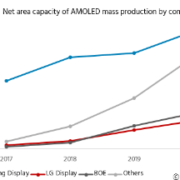

The automotive display is likely to lead the market for next-generation displays following mobile devices and TVs. Various OLED panel makers such as BOE and Visionox, as well as LG Display and Samsung Display, are showing automotive displays at domestic and international exhibitions. Denso also invested Japanese yen 30 billion in JOLED early 2018 to compete with Korean panel makers. Meanwhile, the market for OLED displays for automobiles led by Samsung Display and LG Display is expected to grow to US$ 540 million in 2023 according to UBI Research’s recently published “Automotive OLED Display Report”.