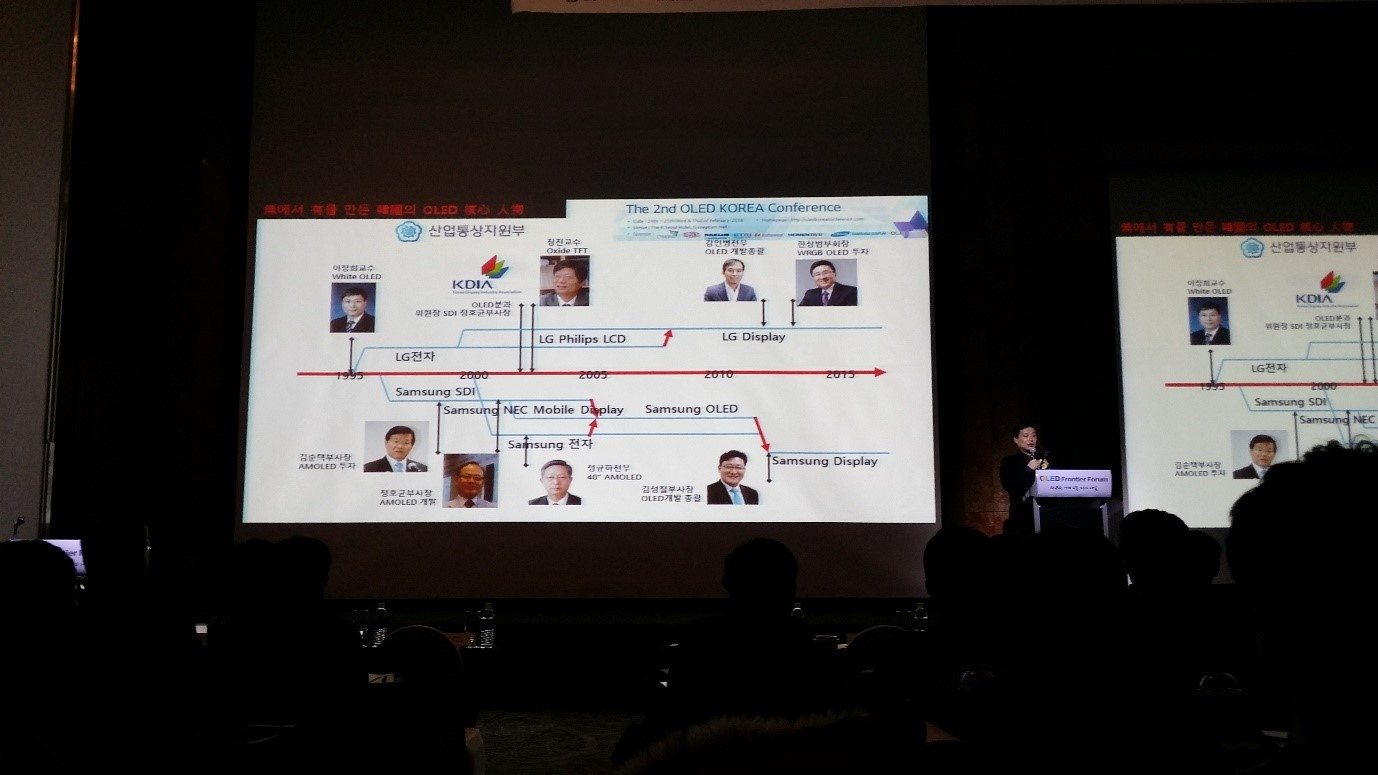

Leaders Who Created Korean OLED Industry

On January 28, OLED Frontier Forum, ‘OLED, Yesterday, Today, and Tomorrow’ was held in Seoul, Korea. With approximately 250 attendees from the industry, academia, and government organizations, experts discussed scenes from the early days of OLED development, the current market and technology competition status, and future industry development issues.

President of UBI Research, Choong Hoon Yi, was the first speaker of the first section, and gave a presentation titled ‘Korean OLED Industry Creating Something from Nothing’, introducing figures from the initial stages of OLED development and now. In 1996, Yi, in charge of Strategy Technology Planning of Samsung Display Devices (now Samsung SDI), calculated OLED to be the most powerful display inheriting from LCD. Asserting the need for development, Yi led the OLED research development investment.

Discussing the most influential people within the 20 years of OLED industry, Yi first mentioned Samsung SDI’s vice chairman Soon-taek Kim, explaining that despite the IMF crisis Kim decided on AMOLED investment and laid the foundation for Samsung’s main role within the OLED industry. On top of this baiss, Ho Kyoon Chung (then Samsung SDI’s vice president) began active development of small size AMOLED, and Samsung Display’s vice president Sung-Chul Kim is responsible for Samsung’s OLED for mobile device of now. Yi also introduced Miwon Commercial’s CEO Kyu-Ha Chung (then Samsung Electronics executive director) as the key player who suggested vision for large area OLED through world’s first development of 40 inch WRGB OLED. Within LG Display, vice chairman Sang-beom Han was mentioned as the person responsible for OLED TV’s market release through difficulty decision of large area OLED investment, and CTO In-byeong Kang for technological advances as the person in charge of OLED development. For academia, Yi discussed Seoul National University’s Professor Changhee Lee as the first person in Korea who began white OLED development and contributed to OLED standardization. Professor Jin Jang of Kyung Hee University suggested oxide TFT’s commercialization prospect and mentored many people who contributed to Korean OLED industry. Yi, together with Sung-Chul Kim and Dr. Nam-Yang Lee (then LG Philips LCD director) established OLED sector within Korea Display Industry Association. During the talk, he introduced how this formed the inter cooperative structure with OLED industry companies and contributed to Korean OLED industry success on the basis of governmental support.

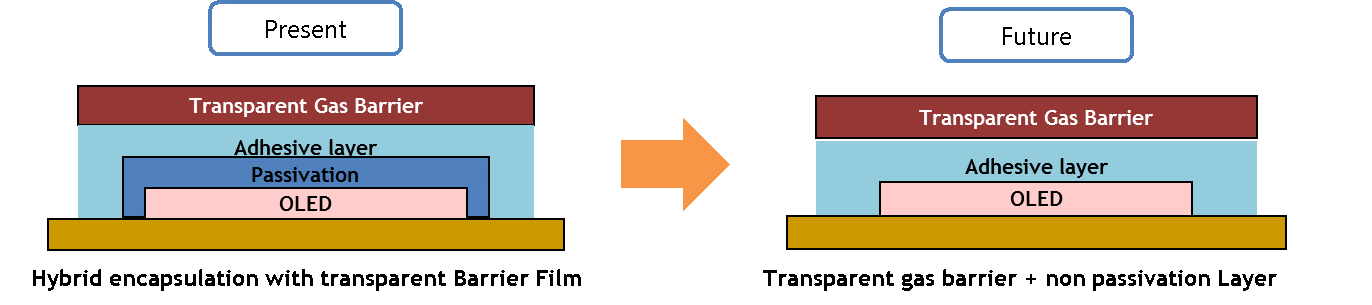

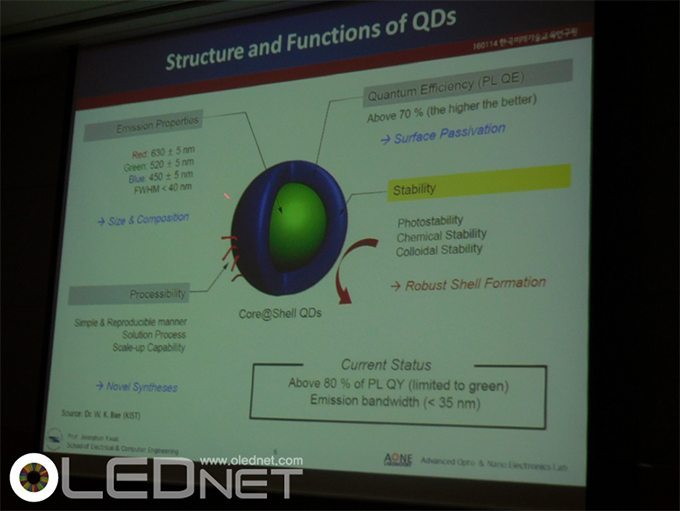

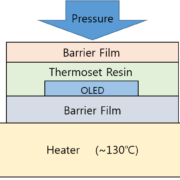

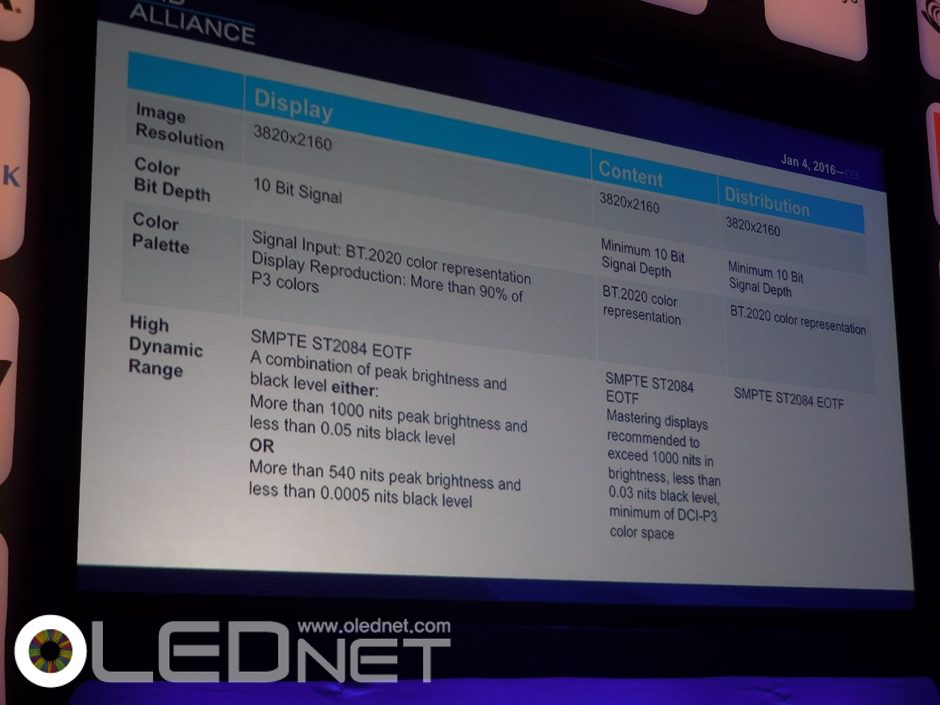

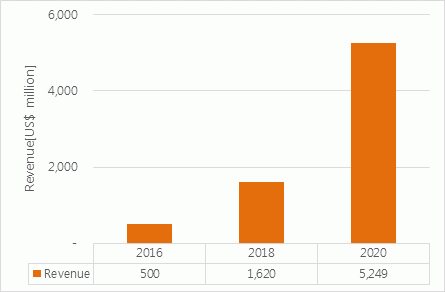

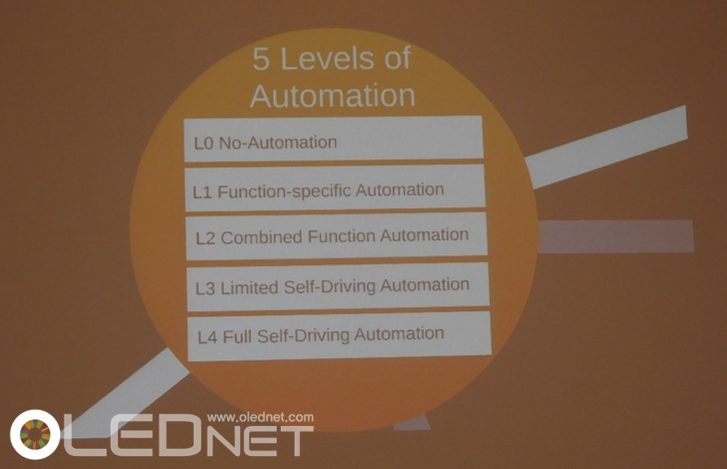

In the second section of the event, LG and Samsung’s CTOs presented on OLED industry’s key issues, and future innovative technology. The 2 companies both discussed current technology, products and projects that need to be solved in order to increase the competitiveness of OLED.

During the last section, the speakers panel discussion handled how to respond to China’s rapid growth. The speakers all agreed on the need for acquisition and hold on experts, corporation between industry and academy, and between companies, and new application areas.

LG Electronics Earnings Announcement

LG Electronics Earnings Announcement