At IPEC 2015 (International Printed Electronic Conference), held on September 1, Professor Sang-Ho Kim of Kongju National University announced that silver nanowire technology is in initial stages of commercialization and will become display market’s key material.

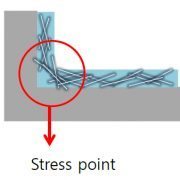

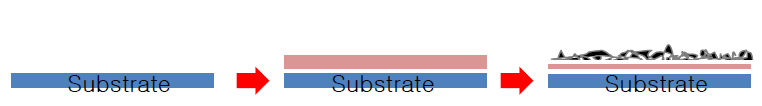

Kim reported that when the bending radius of flexible display is reduced, 2 key issues occur with silver nanowire used as TSP (touch screen panel) material. First, the wiring that are crossed when bending is loosened as can be seen in figure 1. Due to this effect the bending stability decreases.

Fig. 1, Source: Professor Sang-Ho Kim, IPEC 2015

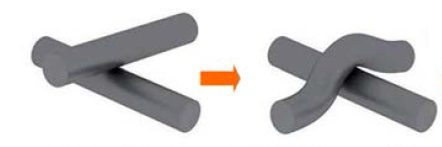

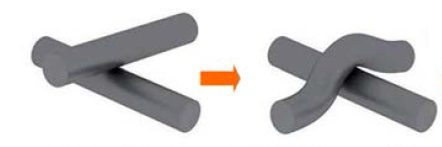

Kim explained that this effect can be solved by welding the two wires as shown in figure 2 using thermal annealing technology, laser process, and IPL photo-sintering technology.

Fig 2, Source: Professor Sang-Ho Kim, IPEC 2015

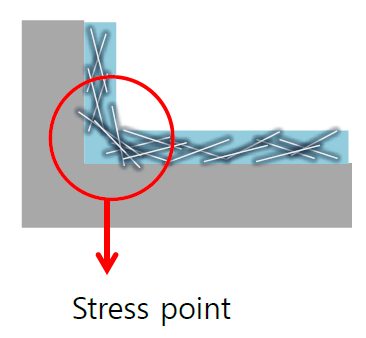

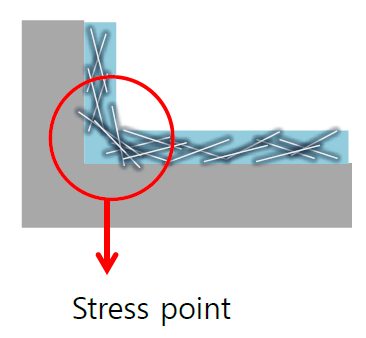

Another issue is a decrease in contact stability between nanowires at stress points when bending radius is reduced as shown in figure 3.

Fig 3, Source: Professor Sang-Ho Kim, IPEC 2015

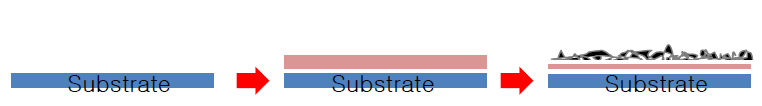

During the presentation, Kim explained that this can be solved through undercoating process. This process involves mixing 2 polymers with different Tg (glass-transition temperature) and layering it as in figure 4, and placing TSP on top.

Fig 4, Source: Professor Sang-Ho Kim, IPEC 2015

Silver nanowire has benefit of being more flexible and less resistant compared to transparent electrode material, ITO. As such, it was spotlighted as TSP material most suitable for flexible OLED. Nonetheless, silver nanowire has been considered to fall behind ITO in panel mass production unit cost in display market.

However, haze effect which happens when sunlight is reflected off the silver nanowire TSP has been solved recently, and new touch technology that requires improved TSP functions, such as post-touch technology, has been developed. Accordingly, products that use silver nanowire are increasing despite the unit cost difference.

Kim reported that as TSP sheet resistance can be reduced through undercoating and welding technology and greatly increase bending stability, it is estimated that silver nanowire’s marketability will grow for flexible display.