QD-OLED TV, is it to be the next generation premium TV?

Samsung Electronics is currently occupying the premium TV market with QD-LCD TVs, which use ‘PL-QD (photoluminescence quantum dot) technology’. This technology has a mechanism in which the material stimulated by external light re-emits light.

The operating profit of the consumer electronics division (CE), which controls QD-LCD TVs, fell more than Korean won 1 trillion in last year and the operating profit ratio was only 3.6%.

On the other hand, LG Electronics’ HE business division achieved a record operating profit of Korean won 1,566.7 billion and an operating margin of 8.1% through OLED TV. Sony also turned its operating profit into a surplus by quickly taking over the premium TV market with OLED TV.

OLED TV has had a positive effect in driving corporate sales growth.

Samsung Electronics has been developing EL-QLED, with EL-QD (electroluminescence quantum dot) technology, to increase its market share in the premium TV market. However, efficacy, lifetime and mass production technology of quantum dot, which is the material of QLED, is not yet secured.

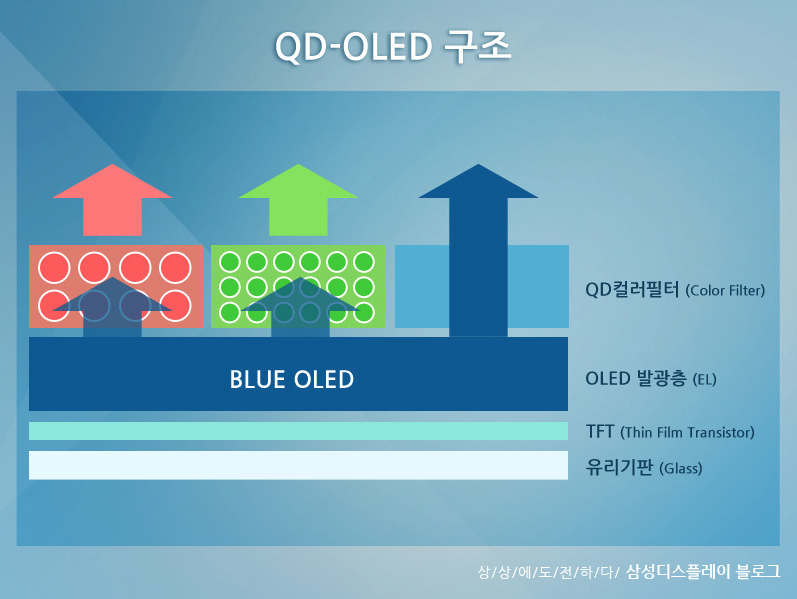

Recently, QD-OLED TV technology, which uses blue OLED as a light source and that implements red and green colors through a quantum dot color filter (QDCF), is attracting attention.

<Expected structure for QD-OLED, Source: Samsung Display Blog>

By using QDCF, it is possible to easily make desired colors by adjusting the size of the QD material and improve the color reproduction rate. This is because the color gamut is enlarged to BT2020, so it is close to natural color and it is possible to deliver vivid picture quality more clearly. In addition, QD-OLED TV has a top emission structure, which makes it easy to secure the aperture ratio, thereby improving resolution and screen uniformity.

However, in QD-OLED TV, there are various problems to be solved such as lifetime and efficiency of blue OLED, and technology of ink-jet printing process. Given that the industry is still in the early stages of reviewing the business possibility, QD-OLED TVs are expected to go into mass production after 2020.

Attention is focused on the QD-OLED TV’s entry into the premium TV market and its impact.