[IFA 2022] Huawei (P50 Pocket, MateXs 2)

#ifa2022 #huawei #matexs #p50pocket

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

#ifa2022 #huawei #matexs #p50pocket

https://ubiresearch.com/en/

https://en.olednet.com/

marketing@ubiresearch.com

+82-2-577-4391

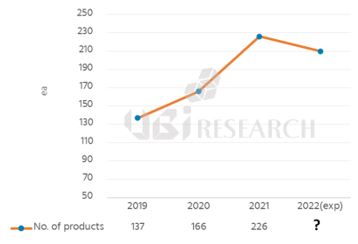

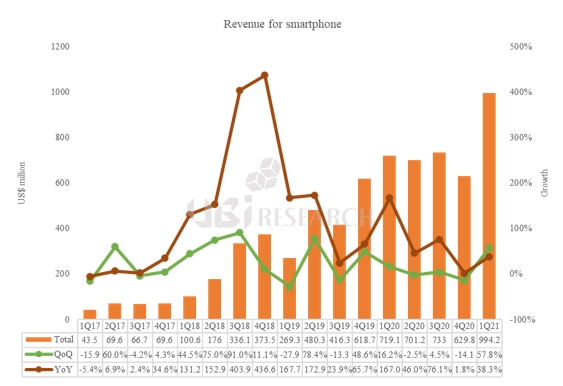

The number of OLED smartphone launches, which had steadily increased from 2019 to 2021 reached only 110 units in the first half of 2022. 137 units had been released in 2019, 166 units in 2020, and 225 units in 2021. If this industry trend continues in 2022, OLED smartphones expected release will only be similar to 2021 or even slightly fewer than it had been last year.

Most of the smartphones released in the first half of 2022 were made in China. 98 products from China accounted for 89% of market share, followed by 9 products from Korea, 2 from Japan, and 1 from India.

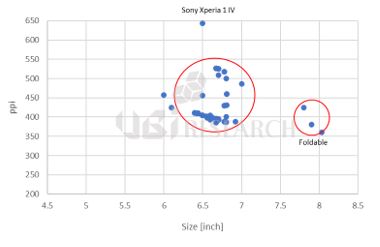

By size, 6.6-inch products were the most with 34 types, followed by 6.4-inch products with 31 types and 6.7-inch products with 21 types. The largest sized product was Vivo’s ‘X Fold’, which was an 8.03-inch foldable. Not including the foldables, Vivo’s ‘X Note’ was the largest at 7.0 inches. The smallest product was Sony’s ‘Xperia 10 IV’, which was 6.0 inches.

By design, 102 types of punch hole models were released, with 4 narrow bezel types, 2 notch types, and 2 UPC types. There were two types of smartphones with UPC (Under Panel Camera) applied: ZTE’s Axon 40 Ultra and Nubia Red Magic 7 Pro.

By resolution, 51 products with 300ppi range, 50 products with 400ppi range, and 9 products with 500ppi or higher were released. No products under 300ppi were released. The product with the highest resolution was Sony’s ‘Xpeia 1 IV’, which had a resolution of 643ppi.

There were three foldable phones released in the first half of the year: Vivo’s ‘X Fold’, Honor’s ‘Magic V’, and Huawei’s ‘Mate Xs2’. All three types of foldable phones have a punch-hole design. The resolution of ‘Mate Xs2’ was 424ppi, which is 10ppi higher than the average OLED smartphones released in the first half of the year. Whereas ‘X Fold’ and ‘Magic V’ were two products with the lowest resolution among OLED smartphones released in the first half of the year.

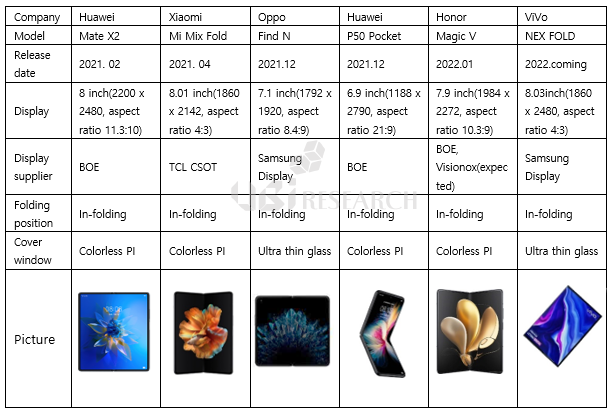

Samsung Electronics widely successful release of its foldable phones, Galaxy Z Fold 3 and Flip 3 last year has risen expectations for establishing foldable phones into the mainstream. Chinese companies such as Huawei, Xiaomi, Oppo are also releasing multiple foldable phones.

As the first foldable phone in China, Huawei has been releasing the Mate X series every year since its launch in 2019. The Mate X and the Mate Xs released in 2020 are 8 inches in size and folds outward. The external display is 6.6 inches with a resolution of 1148×2480 and an aspect ratio of 19.5:9.

Mate X2 was introduced in February 2021 with 8 inches for the internal display and the external display is 6.45 inches OLED with a resolution of 1160 x 2700 and an aspect ratio of 21:9. Colorless PI was applied to the cover window. Mate X2 folds inward instead of Mate X’s outward folding display.

P50 Pocket released in December 2021 is a clamshell phone similar to the Samsung Flip 3. The internal display is 6.9 inches with 120Hz refresh rate and an aspect ratio of 21:9. The cover window is 1.1 inches circular type.

Honor released a foldable phone, Magic V on January 10th 2022.

The internal display is 8 inches with 90Hz refresh rate and the external display is 6.5 inches with 120Hz refresh rate. The cover window is colorless PI. Both internal and external panels are made in BOE B11(Mianyang) line. The initial production is estimated to be 50,000 and the estimated total production volume is 100,000 to 200,000.

According to the sales result, the Visionox panel might be applied to the product.

Vivo is about to release a new foldable, the NEX FOLD. Vivo filed patents for NEX FOLD, NEX ROLL, and NEX SLIDE.

NEX fold’s internal display is 8.03 inches with QHD 120Hz and the external display is 6.53 inches with FHD 120Hz. Both internal and external display has the same refresh rate. The display panel is Samsung Display’s LTPO, and the cover window is planned to be 30 um thickness UTG.

It is planned to be released in March 2022, but no official announcement has been made.

Samsung Display is using UTG(Ultra Thin Glass) for the cover window and most Chinese panel companies are using Colorless PI. Many Chinese companies are introducing foldable phones, but durability issues are reported on many social network media posts. Chinese panel makers still have much to go in terms of quality in technology and production cost when compared to Samsung Display.

Despite the ongoing Corona-19 situation and the US government’s sanctions on Huawei, the adoption of OLED by Chinese smartphone makers is gradually increasing.

The Chinese market, which had been concentrated in the low-end smartphone market, has been expanding into the mid-to-high-end market as Huawei increased its global market share. In particular in the Chinese market, with only the iPhone remaining in the premium smartphone market, Huawei, Oppo, Vivo, and Xiaomi have rapidly increased their market share in the mid- to high-end market with OLED smartphones.

Based on this growth, following Royole and Huawei, Xiaomi also launched a foldable phone in 2021. Chinese display makers have risen to the top spot in LCD production, and their OLED production technology has reached a significant level, and they are also directly producing foldable OLED, which requires the highest level of difficulty in OLED production technology. Foldable OLEDs from BOE and CSOT are used in Huawei and Xiaomi’s foldable phones.

In the “Chinese OLED Trend Report for 2021” published by UBI Research, the OLED-equipped smartphone, TV, and watch industries produced in China were analyzed, and technology development/investment trends and market performance of OLED panel makers were analyzed. In addition, the size of the light emitting material and component material market used by Chinese OLED panel makers was analyzed and summarized.

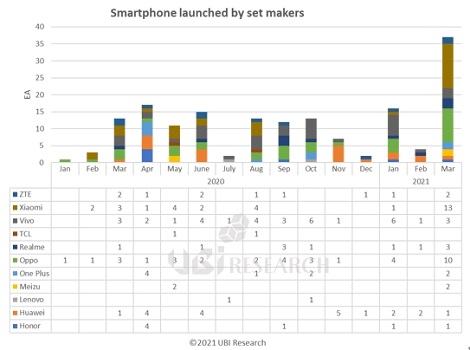

57 types of OLED smartphones released in the first quarter of 2021 were counted. This number is more than double the number of 27 species in the same quarter last year. This is because Chinese smartphone makers such as Oppo, Vivo, and Xiaomi have mass-released new OLED smartphones to occupy Huawei’s smartphone market.

The OLED market by Chinese panel makers is also growing explosively due to the active use of OLED by Chinese smartphone makers. In the first quarter of 2021, OLED sales for smartphones were counted at 990 million dollars, which increased by 38.3% compared to the same quarter of 2020 (YoY). The reason for the rapid growth of OLED sales is the increase in selling prices as OLEDs produced by Chinese panel makers move from low resolution to high resolution.

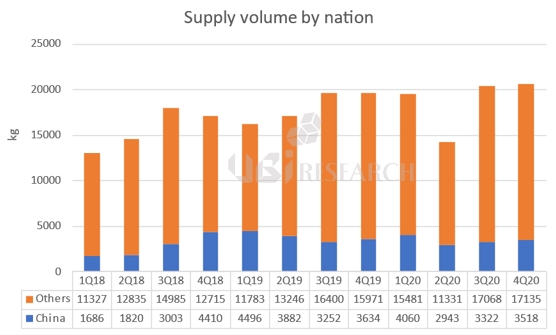

The amount of light emitting materials used by Chinese panel makers has not seen a significant increase yet. In the meantime, production was low due to low yield due to low production technology, but now production is increasing even with the same amount of material used. In 2020, 13.8 tons of luminescent material was used.

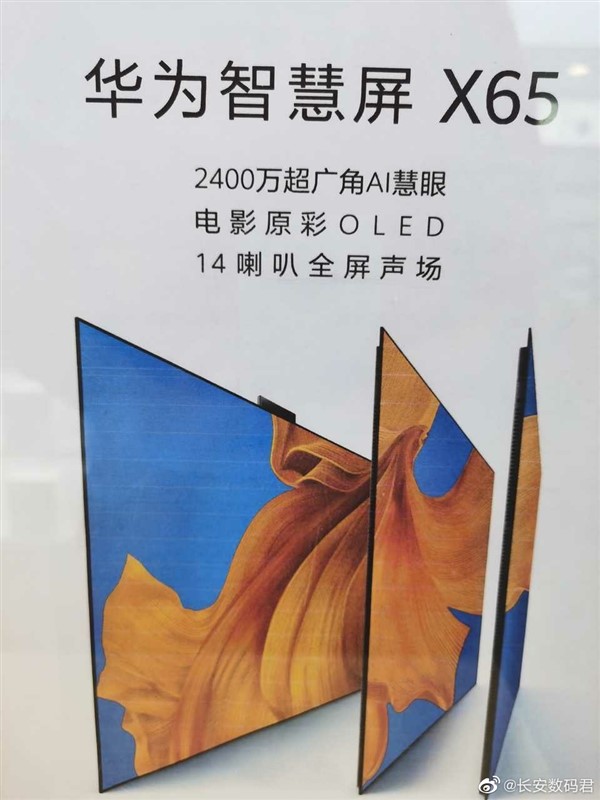

Huawei launch its first OLED TV and LG Electronics and Sony will launch a new lineup, a 48-inch OLED TV. As a result, the OLED TV camp and lineup are expected to become more diverse.

First, Huawei will launch its first OLED TV X65 soon. X65 is used a 24-megapixel camera to control the TV with a ‘gesture tracking’ function that recognizes the user’s face, motion, and posture, and is equipped with 14 under-screen speakers to automatically To correct the sound. The X65 used LG Display’s OLED will be released on April 8.

China’s OLED TV camp has increased to five camps from Skyworth, Konka, Changhong, and Xiaomi to Huawei. In addition, Huawei’s OLED TV launch, which is leading the Chinese smartphone market, can have a great influence on the premium TV market in the future.

Meanwhile, LG Electronics and Sony, which are leading the OLED TV market, will launch a new 48-inch OLED TV to make the lineup more diverse. Currently, OLED TVs have only 55-inch, 65-inch, and 77-inch lineups, and are evaluated to have a relatively short lineup compared to LCD TVs. LG Electronics and Sony are planning to target the Japanese or European market with high preference for small TVs through the launch of this 48-inch OLED TV.

LG Electronics and Sony’s 48-inch OLED TVs are scheduled to be released in May and July, respectively.

It is noteworthy whether OLED TV will exert great influence once again in the premium TV market in 2020, such as Huawei joining the OLED TV camp and LG Electronics and Sony launching the first 48-inch OLED TV.

LG Display is the top OLED company with a monopoly market in the production of OLED panels for TVs, but the performance was low in the flexible OLED market for smartphones until the first half of 2019.

LG Display built a flexible OLED line after Samsung Display and focused on panel sales, but failed to supply flexible OLED by pushing BOE to Huawei’s P30 Pro model in 2019. However, in the second half of 2019, it succeeded in supplying panels to Huawei for Mate30 Pro, and began supplying flexible OLED for iPhone to Apple.

Huawei’s P40 Pro shipment target is 12 million units, and LG Display is expected to supply 50%. The variable is a new coronavirus. It could change Huawei’s smartphone launch schedule and volume.

Huawei is highly dependent on domestic demand, and coronaviruses can reduce shipments by more than 10%.

Since Royole introduced ‘FlexPai’, a foldable OLED phone, Samsung Electronics and Huawei have also launched Foldable OLED phones, attracting great interest from the industry and the public.

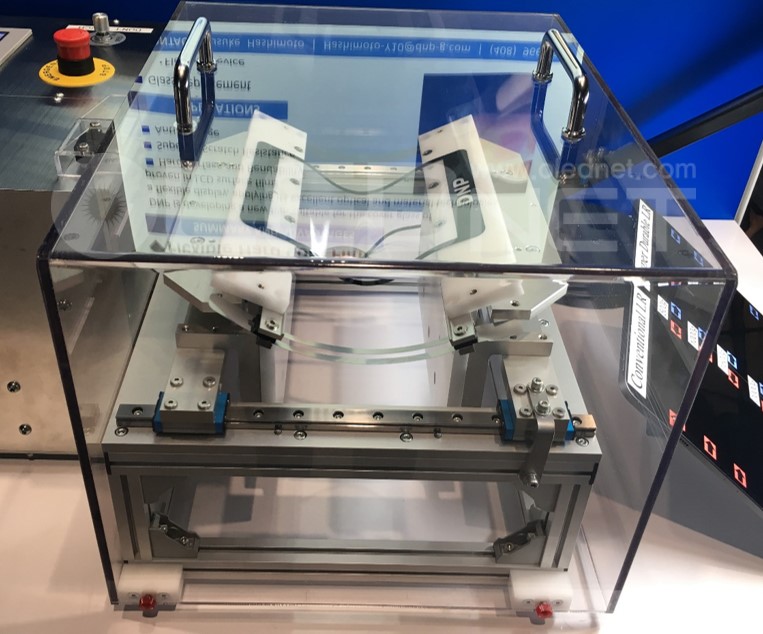

The biggest change of the foldable OLED phone currently being commercialized or under preparation is that the cover window of the glass material used in the existing flexible OLED has been changed to colorless PI material.

Colorless PI is thinner than conventional cover window glass, which is advantageous in reducing the radius of curvature and has the advantage of not breaking. UTG (ultra-thin glass), which has good surface touch-feel and scratch-resistant glass as thin as possible, is also attracting attention as a cover window material for foldable OLEDs.

At the SID Display Week exhibition in San Jose, KOLON exhibited colorless PI with hard coating. KOLON, which has been ready for mass production of colorless PI since 2018, is currently supplying colorless PI for foldable OLED cover windows to AUO, BOE, LG Display, and Royole.

Hard coating company DNP and TOYOCHEM also exhibited colorless PI with hard coating. DNP’s company official said that the film is under development and its main business area is hard coating, and TOYOCHEM’s company official said that it supplied hard coating samples to KOLON and SKC.

Meanwhile, SCHOTT, a UTG development company, also attracted the attention of the audience by displaying UTG for foldable OLED cover windows. An official of SCHOTT said that the UTG currently being developed is a cover window product for out-folding, not in-folding, and that the thickness is currently in development from 0.7 mm to 2.5 mm in accordance with customer requirements.

As the smartphone set makers are expected to release foldable OLED phones in the near future, competition for related materials is also expected to be intense. Whether the Colorless PI will continue to dominate or whether UTG will be able to exercise its influence is highlighted.

Reporter : Daejeong Yoon

Smartphone makers are promoting the new form factor, foldable phones at MWC 2019 started on February 27 and it runs until 29 in Barcelona Spain.

The show is buzzing with products from big-name tech companies, including Samsung Electronics and Huawei,TCL, LG Electronics being unveiled. That includes a variety of phones with foldable screens.

Samsung unveiled foldable phone ‘Galaxy Fold’ to customer, highly touted at the Samsung Galaxy unpacked event.

In folding ‘Galaxy Fold’ features a 7.3-inch QXGA + resolution OLED screen and it was built to be compact size with 4.6-inch HD + resolution OLED when folded.

And Huawei announced its own foldable phone “Mate X” uses roll out foldable technology, it is surrounded by a 6.6-inch main OLED on the front and a 6.38-inch on the back. It is 8.7 inches when it is opened, 1.4 inches bigger than Samsung Electronics’ Galaxy Fold.

Mate X’s front display has 2480 × 1148 resolution with a 19.5: 9 aspect ratio. The back OLED has a 2480 × 892 resolution with a 25: 9 aspect ratio. When you flip it open, the resolution is 2480 × 2200 with an aspect ratio of 8: 7.1. .

Also, TCL announced the prototype device uses the company’s proprietary “DragonHinge” mechanism to fold and unfold the screen, it has 7.2-inch screen.

According to TCL, this device will build a production version that is slated for release by 2021.

Lastly, LG showed off V50 which is similar to a folding phone, it does have an optional case with a whole second screen on it. With two near-identical phone displays next to each other, the functional split-screen allows multitasking and gaming easily.

By Hana Oh (hanaoh@ubiresearch.com)

Samsung Electronics and LG Electronics are going to unveil low to mid-end smartphones at CES 2018 instead of their mainstream smartphones.

Samsung Electronics will showcase 5.6-inch Galaxy A8 and 6-inch Galaxy A8 Plus at CES 2018. The Galaxy A8(2018) series are expected to adopt a 18: 9 ratio full screen OLED similar to Galaxy S8 design with almost zero bezel.

<Samsung Electronics’ Galaxy A8, Source: news.samsung.com>

LG Electronics is going to introduce four K series, K3, K4, K8, and K10. Among them, K10 has a 5.3 inch FHD LCD and it is changed to X series in Korea and is expected to be released at the end of January.

Meanwhile, there is an opinion that Samsung Electronics and LG Electronics’ plan to release low to mid-end smartphones is a bulwark against Huawei which announced the entry into the North American smartphone market.

Huawei has recently partnered with AT&T to sell the Mate 10 series in the US from February 2018. Mate 10 has a 5.9 inch IPS LCD, and Mate 10 PRO has a 6-inch OLED. Huawei announced that it will aggressively advance into the North American market to become the world’s second-largest smartphone maker, outpacing Apple this year.

Samsung Electronics and LG Electronics intend to strengthen their low to mid-end smartphone specifications up to the premium level as well as their flagship smartphones to dominate the smartphone market until new mainstream smartphones are launched and to check other companies including Huawei.

Meanwhile, more details such as the price and mobile provider of Huawei Mate 10 series to be released in North America will be disclosed at the CES 2018 exhibition.

<Huawei’s Mate 10 Pro, Source: GSMArena.com>

Following the success of Galaxy S Series using AMOLED, Apple’s iPhone has started to use flexible AMOLED as its basic display, resulting in the spike in demand for Chinese smartphone companies’ AMOLED.

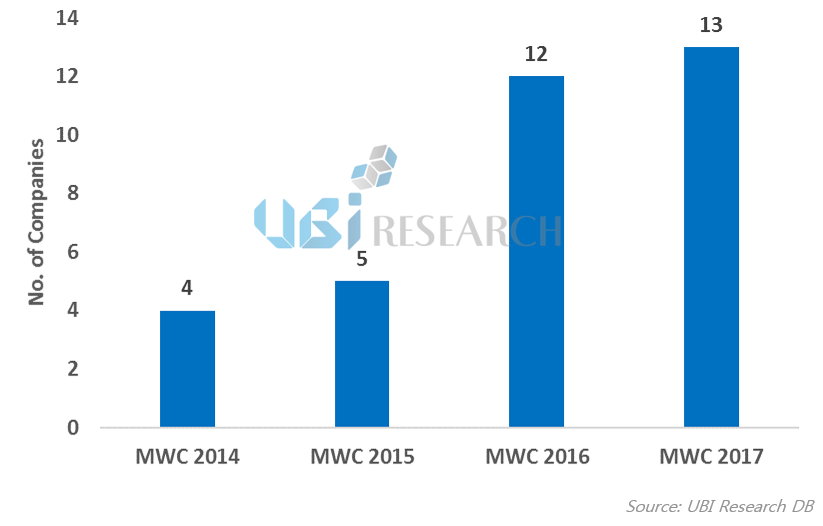

At MWC2017, 13 companies showcased AMOLED-based smartphones. The companies whose market share is expanding in China, the world’s biggest smartphone market, such as Huawei, Oppo, Vivo, Xiaomi, and ZTE are active to adopt AMOLED smartphone.

<The Number of AMOLED Smartphone Companies at MWC>

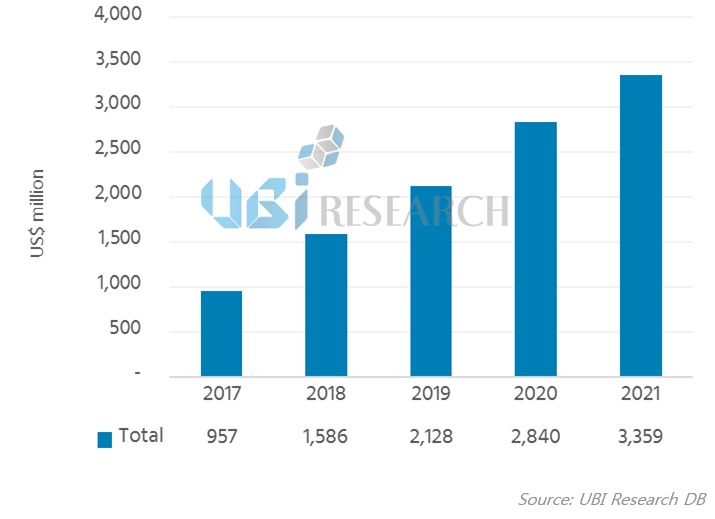

With this market trend, the emitting material market for AMOLED is expected to reach 1 trillion won this year.

Hyun Jun Jang, senior researcher of UBI Research forecast that the emitting material market will reach $960 million in 2017 and increase to $33.6 billion in 2021.

<Emitting Material Market Forecast>

According to Hyun Jun Jang, senior researcher, Apple’s AMOLED emitting material market is expected to account for $560 million among $33.6 billion of total emitting material market, and Korea will capture 70% as it is leading the AMOLED panel market while creating a 23.8 billion-dollar market.

Huawei booth

Shanghai = Hyunjoo Kang / jjoo@olednet.com

Huawei is expected to release 1.2 inch AMOLED panel equipped smartwatch for women in September if early.

In CES Asia 2016 (11-13 May) held in Shanghai, China, Everdisplay (EDO) revealed that the 1.2 inch AMOLED panel product will be released in July, and Huawei will launch smartwatch for women equipped with this panel in September.

Previously Huawei released smartwatch for men equipped with EDO’s 1.4 inch AMOLED.

EDO, whose main focus is on AMOLED panel for mobile device, showed new AMOLED panels through this exhibition. EDO explained that of AMOLED panels for smartphone, 1.2 inch, 1.41 inch, and 1.4 inch panels are not yet released, and that 1.2 inch panel will be launched in July and 1.4 inch in 2017.

During this event, EDO also revealed 6 inch AMOLED panel to be mass produced in future and beta version of VR device equipped with their own AMOLED.

CES Asia 2016’s participants greatly increased compared to last year, and 375 companies from 23 countries are taking part. Major companies such as Intel, Twitter, and BMW discuss wearable, VR, driverless cars, future of TV, etc. though conference.

OLED panel, mostly used for Samsung Electronics, is expanding its market and slowly entering China. In CES and IFA until now, Samsung Electronics and LG Electronics only exhibited OLED panel equipped smartphone. However, this time, China’s dark horse Huawei exhibited Samsung Display’s OLED onto new smartphone model Nexus 6P.

The panel used is 5.7 inch 518 ppi FHD OLED.

According to Huawei, although until now LCD has been used as OLED can produce profound black it is estimated OLED will be highly popular in Chinese market.

Huawei is already using OLED on smartwatch. Huawei Watch Active that began to be exhibited starting with CES 2015 uses 1.4 inch 286 ppi OLED panel with 400 x 400 resolution supplied by AUO. The thickness of the watch is 4.2 mm and rather thick, but the external design is highly detailed and beautiful much like luxury analog watch.

As Huawei, which has the highest market share out of Chinese set companies, started to actively push for OLED panel use in smartphone following smartwatch, other Chinese companies, including Xiaomi, are expected to rapidly join the OLED sector.

Choong Hoon Yi, Chief Analyst, UBI Research

BOE is intending to carry out a large amount of investment in order to operate Gen10.5 LCD line from 2018. Meanwhile, key set makers including Apple, Samsung Electronics, LG Electronics, and Panasonic are devising strategy to move from LCD to OLED for smartphone and premium TV displays. As such, it is becoming more likely for the LCD industry to be in slump from 2018.

At present, the area where LCD industry can create profit is LTPS-LCD for smartphone. The forecast smartphone market for this year is approximately 15 billion units. Of this, Samsung Electronics and Apple are occupying 20% and 15% of the market respectively. OLED equipped units are less than 2 billion.

However, from 2018 the conditions change greatly. Firstly, Apple, which has been using LCD panel only, is estimated to change approximately 40% of the display to OLED from 2017 earliest and 2018 latest. Apple is testing flexible OLED panels of JDI, LG Display, and Samsung Display, and recommending them to invest so flexible OLED can be applied to iPhone from 2017. The total capa. Is 60K at Gen6. As new investments for Gen6 line of Samsung Display and LG Display are expected to be carried out from 2016, supply is theoretically possible from 2017.

If 5inch flexible OLED is produced from Gen6 line, under the assumption of 50% yield at 60K capa. 65 million units can be produced annually, and approximately 1 billion units if the yield is 80%. If Apple’s iPhone shipment in 2017 is estimated to be around 2.7 billion units, within the 50-60% yield range approximately 25% of the display is changed to OLED from LCD, and if yield reaches 80% around 40% will change. The companies that are supplying Apple with LCD for smartphone, LG Display, JDI, and Sharp, are expected to show considerable fall in sales and business. These 3 companies could be reduced to deficit financial structure just from Apple’s display change

Furthermore, as Apple is not producing low-priced phones, under the assumption that future iPhone could all have OLED display, Apple could cause the mobile device LCD industry to stumble after 3 years.

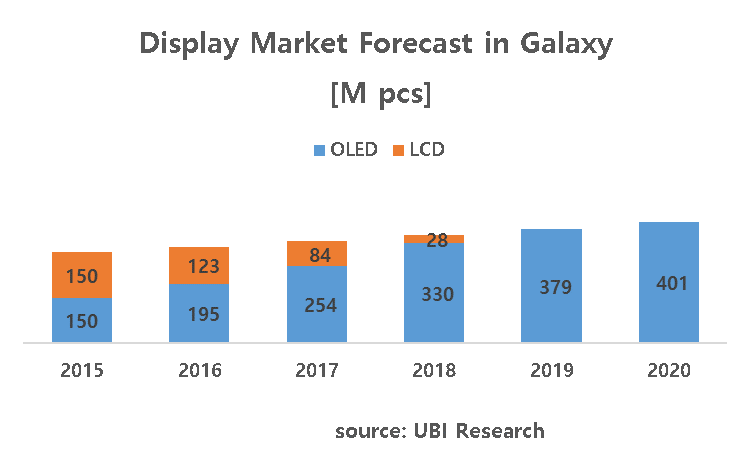

Samsung Electronics also is gradually changing Galaxy series display to OLED from LCD. Of the forecast 2015 shipment of 3 billion units, 50%, 1.5 billion units, has OLED display, but Samsung Electronics is expected to increase flexible OLED and rigid OLED equipped products in future. Particularly, as Apple is pushing for flexible OLED application from 2017, Samsung Electronics, whose utilizing OLED as the main force, is estimated to increase flexible OLED usage more than Apple. It is estimated that all Galaxy series product displays will be changed to OLED from 2019.

Under these assumptions, of the estimated smartphone market in 2020 of approximately 20 billion units, Samsung Electronics and Apple’s forecast markets’ 7 billion could be considered to use OLED.

Samsung Display is strengthening supply chain of set companies using their OLED panels. Samsung Display is supplying OLED panels to diverse companies such as Motorola and Huawei as well as Samsung Electronics, and also expected to supply rapidly rising Xiaomi from 2016. If smartphone display is swiftly changed to OLED from LCD from 2017, Chinese display companies that are currently expanding TFT-LCD lines are to be adversely affected.

Additionally, in the premium TV market, LG Electronics mentioned that they will focus on OLED TV industry at this year’s IFA2015. As a part of this, LG Display is planning to expand the current Gen8 34K to 60K by the end of next year. Furthermore, in order to respond to the 65inch market, Gen9.5 line investment is in consideration. In the early 2015, Panasonic commented that they were to withdraw from TV business but changed strategy with new plans of placing OLED TV on the market in Japan and Europe from next year.

As Samsung can no longer be disconnected from the OLED TV business, there are reports of investment for Gen8 OLED for TV line in 2016. Although OLED TV market is estimated to be approximately 350 thousand units this year, in 2016, when Panasonic joins in, it is expected to expand to 1.2 million units. The OLED TV’s market share in ≥55inch TV market is estimated to be only 4% but in premium TV market it is estimated to be significant value of ≥10%.

If Samsung Display invests in Gen8 OLED for TV line in 2016, from H2 2017 supply to Samsung Electronics is possible. As OLED Gen8 line’s minimum investment has to be over 60K to break even, it can be estimated that Samsung Display will invest at least 60K continuously in future.

Under these conditions, LCD industry can only be in crisis. Firstly, it becomes difficult for Sharp to last. Sharp, which is supplying TFT-LCD for Apple’s iPhones and LCD for Samsung Electronics’ TV, will lose key customers. Secondly, BOE, AUO, and JDI, the companies selling LCD panels to these companies, are not ready to produce OLED and therefore damage is inevitable.

BOE is carrying out aggressive investment with plans to lead the display industry in future with operation of Gen10.5 LCD line. Therefore, from 2018, as the main cash cow items disappear, administration pressure could increase.

UBI RESEARCH / CEO:Choong Hoon Yi / Business License Registration Number 220-87-44660

ADDRESS: A-1901, Samho Moolsan Bldg, 83, Nonhyeon-ro, Seocho-gu, Seoul, Republic of Korea (Zip) 06775 TEL:+82-2-577-4390 / E-MAIL:marketing@ubiresearch.com