[UBI Research China Trend Report] Will BOE Provide UPC Panel with Transparent PI Substrate to Oppo?

Reporter : Daejeong Yoon

As foldable smartphones begin to be sold by Samsung Electronics, the flexible OLED industry (including foldable OLED) is expected to continue to grow.

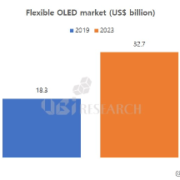

Yi Choonghoon, CEO of UBI Research, predicts that the flexible OLED panel market will grow to $ 18.92 billion this year and expand to $ 32.65 billion by 2023.

<Source: Flexible & Foldable OLED Report, UBI Research>

According to Yi, there are four types of flexible OLED products, including smartphones, foldable phones, watches and automobiles, and flexible OLEDs will be used in the monitor market next year. LG Electronics began to sell rollable OLED TVs, but the sales volume is so small that it will take much time to form the market. The foldable smartphones that Samsung started to sell are expected to be supplied to the market by 800,000 by the end of this year.

In addition, Yi predicted that Chinese panel companies’ flexible line production will expand very rapidly in line with the expansion of the flexible OLED market.

As of 2019, Korean display companies have an annual substrate area of 7.3 million square meters and China’s 4.6 million square meters, but by 2023, China’s production capacity will expand to 11 million square meters, accounting for 57% of the total production capacity.

China is expected to have the world’s largest facility for flexible OLED production following LCD.

<Source: Flexible & Foldable OLED Report, UBI Research>