OLED Encapsulation, TFE is the Top Trend

- Expected application of TFE to all edge type and full screen use flexible OLED

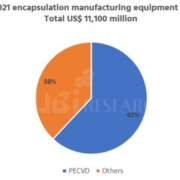

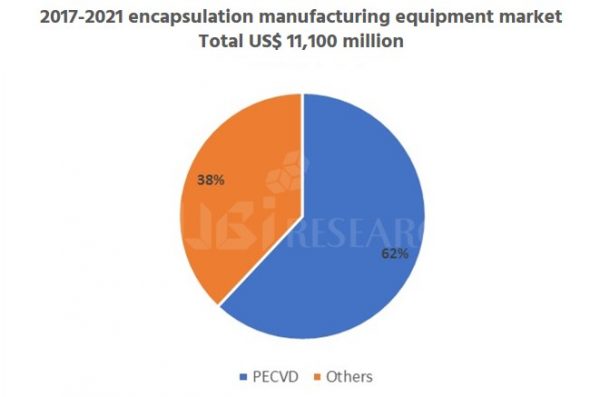

- PECVD manufacturing equipment, 62% of total encapsulation manufacturing equipment market

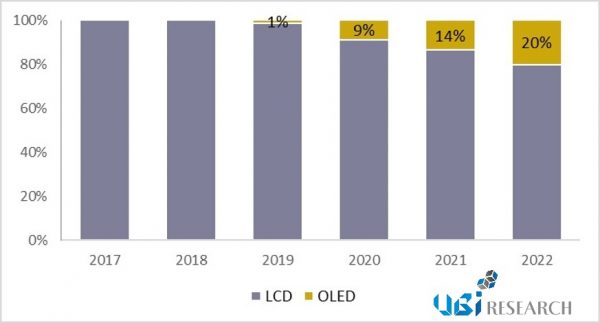

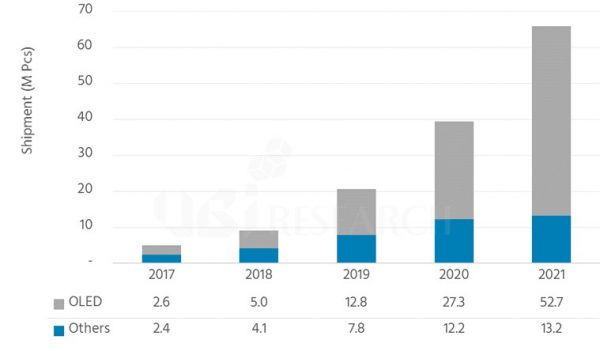

According to 2017 OLED Encapsulation Annual Report published by UBI Research, of OLED encapsulation technology, TFE (thin film encapsulation) will be applied to approximately 70% of total OLED panel in 2021, and become the key encapsulation technology.

OLED display trend is heading toward minimizing bezel for full screen actualization from edge type, and flexible OLED is being considered as the most optimal display for full screen. As such, Chinese panel companies, as well as Samsung Display and LG Display, are concentrating on flexible OLED mass production line investment rather than rigid.

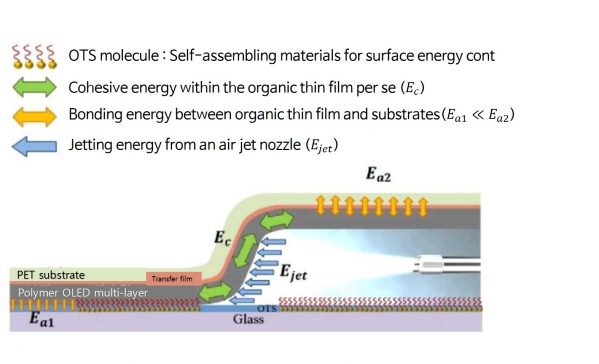

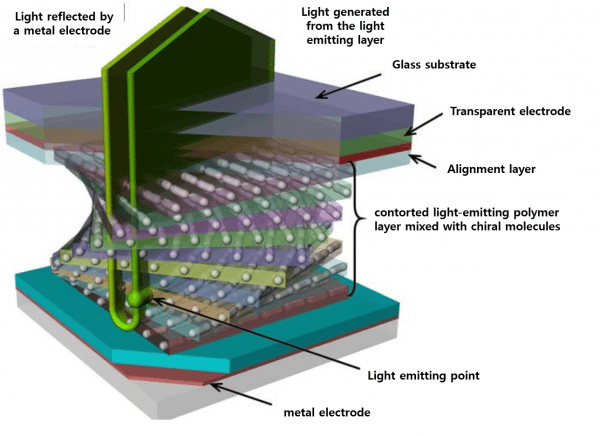

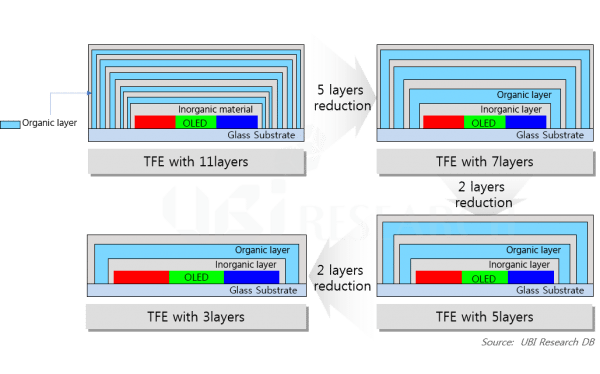

Flexible OLED must be thin and bendable; glass using frit encapsulation Is not suitable and TFE (thin film encapsulation) or hybrid encapsulation must be applied. TFE is a structure that is formed via laminating thin inorganic and organic materials. In the early stages of development, it had 11 layers of complex organic and inorganic material deposition with low yield. However, it now has been reduced to 3 layers and greatly improved productivity, yield, and cost and it is being applied to most of flexible OLED.

<Thin film encapsulation development history, 2017 OLED Encapsulation Annual Report>

Hybrid encapsulation, which uses barrier film, is being applied to some flexible OLED. However, due to the high cost of barrier film and relatively thick thickness, recent investment is focused on TFE application.

According to UBI Research analyst Jang Hyunjun, TFE encapsulation is expected to continue to be applied to edge type and full screen type flexible OLED panel, and related manufacturing equipment and material market will carry on their growth.

The report explains that TFE’s key manufacturing equipment are inorganic material forming PECVD and organic material forming ink-jet printer. In particular, PECVD is used in inorganic material film formation of hybrid encapsulation as well as TFE. Therefore, PECVD market is estimated to record US$ 6,820 million in 2017-2021, and occupy approximately 62% of the total encapsulation manufacturing equipment market.

<PECVD manufacturing equipment market volume, 2017, 2017 OLED Encapsulation Annual Report>

The report includes encapsulation related key manufacturing equipment and material market in addition to encapsulation development history and trend, and key panel companies’ trend.