Consumer reports, being dissent from an evaluation of premium TV launched in this year

Consumer reports picked OLED TV of LG Electronics as the best 4K TV to buy right now, while gave QLED TV of Samsung Electronics 10th place.

<THE BEST 4K TV LG OLED65C7P selected by Consumer Reports, Source: Consumer reports>

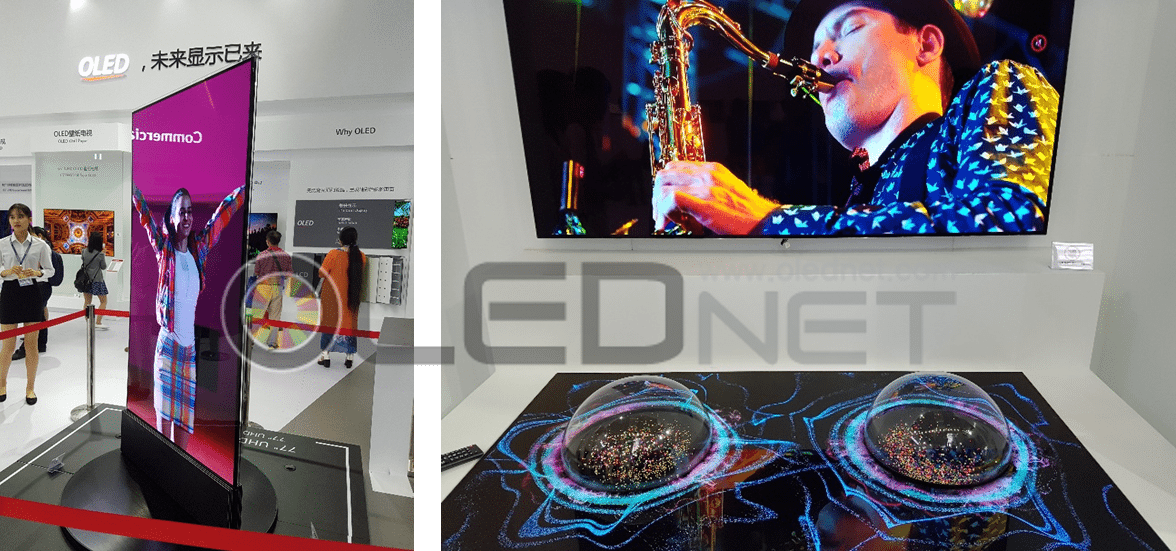

Consumer Reports which is a consumer magazine in US, selected OLED TV OLED65C7P of LG Electronics launched in this year as the ‘Best 4K TVs to Buy Right Now’ on 16th, since ‘OLED TV is the best for expressing black, so it can provide entirely different image quality’.

Consumer Reports evaluated that OLED65C7P has high resolution, excellent image quality and outstanding sound performance. It has the best HDR performance among the products tested this year and it will be hard to find a better TV than it.” Consumer Reports gave 88 points, the highest score ever. This is higher score than 86 points that OLED65G6P of LG Electronics received in November.

In addition, OLED65G6P of OLED TV model in 2016 of LG’s got 86 points and OLED65E6P was followed as 85 points. OLED55E6P and OLED55B6P jointly received 83 points.

<Samsung Electronics’ QN65Q8C, Source: Consumer Reports>

QLED TV QN65Q8C of Samsung Electronics launched in this year gained 79 points. Consumer Reports explained that it is excellent in resolution, image quality, and sound quality, however there was black mark for the high price in spite of backlighting existence, limit of expression for black due to backlighting and cloud phenomenon. And Consumer Reports quoted the words of industry source that it would take more than three years for launching of true self-emitting QLED TV.

In the ‘Solution process OLED annual report’, UBi research expected that QLED deposition materials have issues on a short life-span compared to phosphorescence OLED deposition materials that are currently being commercialized, efficiency problem, development of eco-friendly devices, lack of infrastructure compared to OLED. In case of not establishing infrastructure and aggressive investment such as manpower recruitment and expansion of the development investment, the time of commercialization will be far from here.