[MWC 2016] Surge of AMOLED in China

A surge of AMOLED panels by Chinese set companies is starting. Chinese set companies exhibited many AMOLED panel applied products in MWC 2016 (Feb 22 – 25), forecasting that the demand for AMOLED panel could greatly increase.

6 companies, including Huawei, ZTE, LENOVO, and Gionee, exhibited AMOLED panel applied smartphones. Particularly, Hisense and KONKA, well known as TV set companies, presented AMOLED panel smartphones and the Chinese set companies’ increased interest in AMOLED panel could be confirmed.

The majority of the AMOLED panel smartphones exhibited by Chinese set companies had 5 inch level panel with HD and FHD level resolution, and analyzed to have been supplied by Samsung Display.

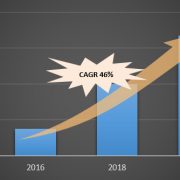

Samsung Display is known to have significant amount of mainstream AMOLED panels to Chinese set companies in 2015. Following this trend, over 100 million units of AMOLED panels are expected to head toward China in 2016.

The key points are Samsung Display’s rigid AMOLED panel production capa. and whether the Chinese AMOLED panel companies can carry out mass production. The current Samsung Display’s rigid AMOLED panel mass production capa. is estimated to be insufficient to meet the demands for Samsung Electronics’ mainstream Galaxy model and Chinese set companies. Chinese panel companies have also announced active mass production from the first half of this year.

From the significant occupation of Chinese set companies that applied AMOLED panel within the Chinese smartphone market, panel companies’ supply ability of AMOLED panel for Chinese set companies is expected to be one of the issues in 2016.

Huawei’s Nexus 6P

LENOVO’s Moto X Force