Dr. Mauro Riva, SAES Group’s OLED/OLET business developer, discussed his views on OLED in general as well as SAES Group’s technology through his interview with the OLEDNET and presentation at the OLEDs World Summit (October 27-29) titled ‘The Encapsulation Question’.

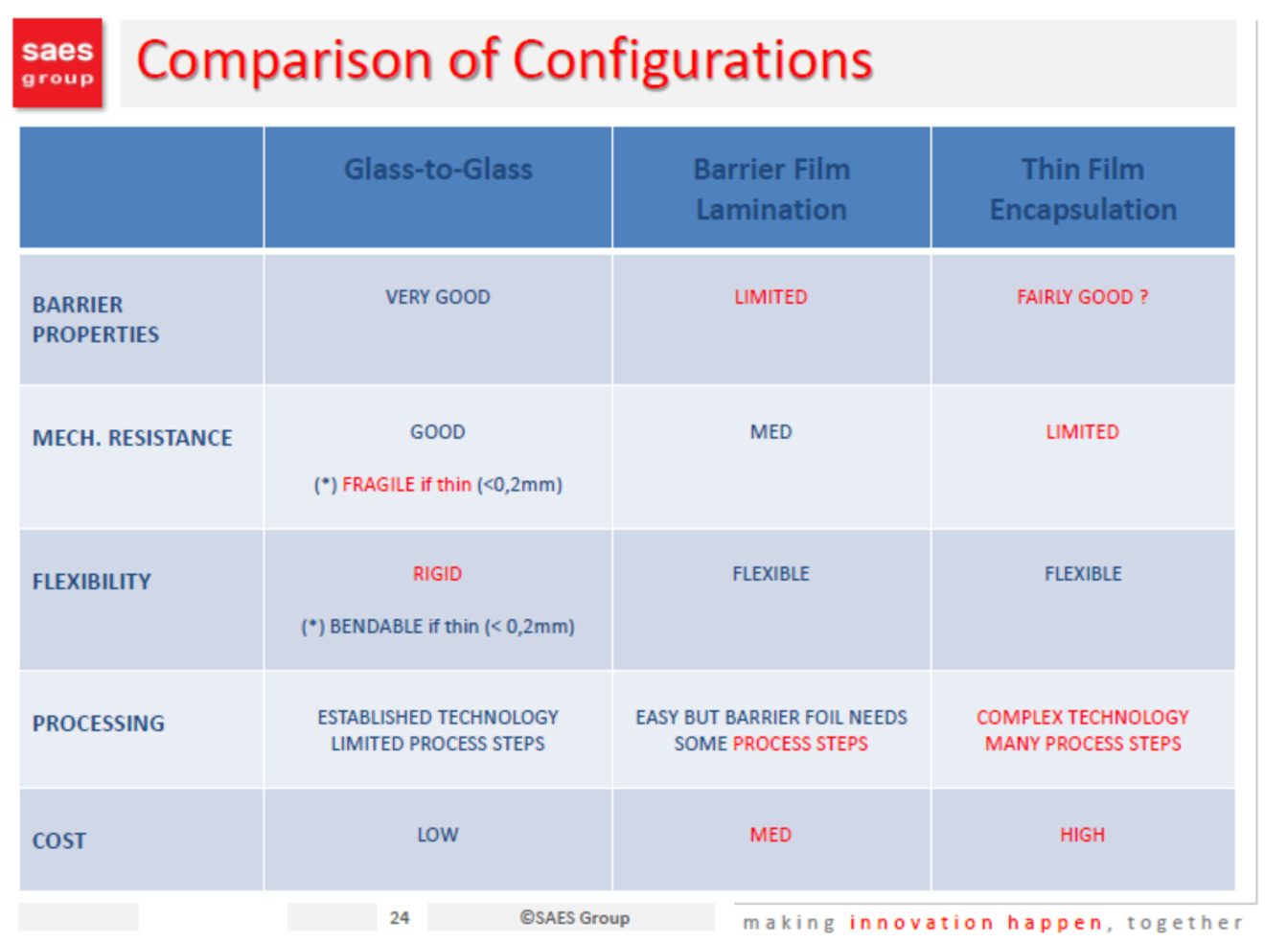

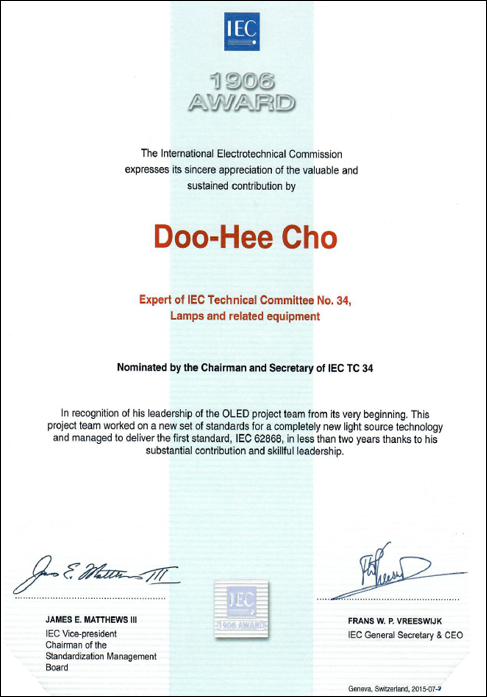

Encapsulation is required to prevent the oxidation of emitting and electrode materials by blocking moisture and oxygen. It also protects the device from mechanical and physical shocks. The basic configurations of encapsulation can be divided into 3: glass-to-glass, barrier film lamination, and thin film encapsulation methods. Glass-to-glass configuration is applied to rigid AMOLED for mass produced mobile, barrier film lamination and thin film encapsulation methods are used for flexible AMOLED, and barrier film lamination is used for large area AMOLED panel for TV.

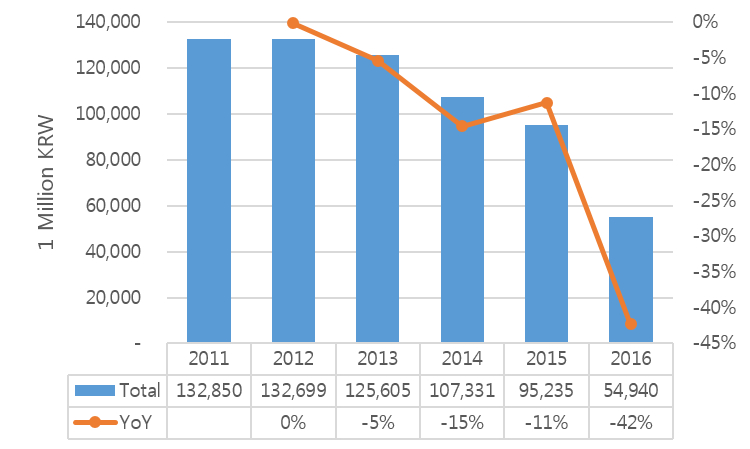

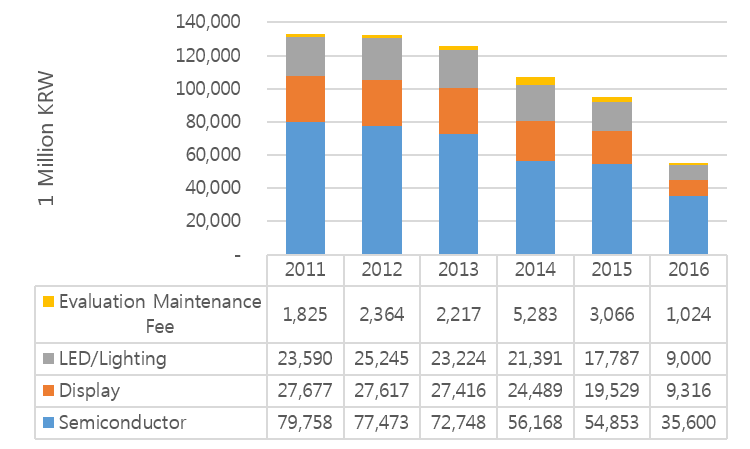

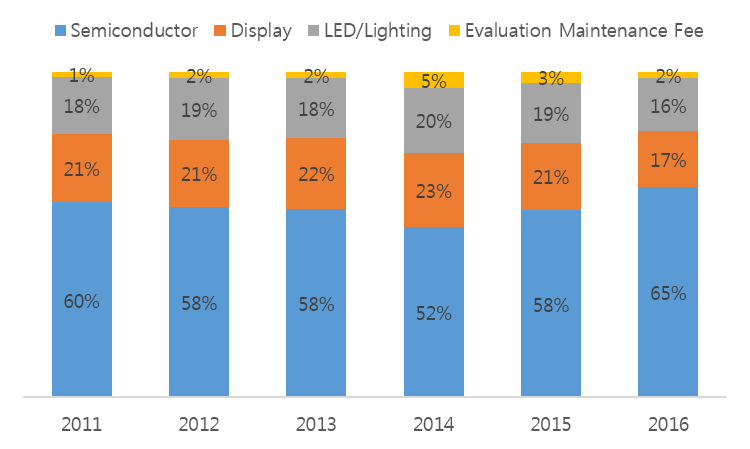

Source: SAES Group, OLEDs World Summit 2015

According to Dr. Riva OLED encapsulation is still facing the same issues it had since the beginning: OLED materials’ extreme sensitivity to oxidizing agents and moisture in particular. He added that OLED materials can also be very sensitive to heat or radiations, generating many process constraints. Encapsulation technology is directly related to the lifetime of the OLED device and Dr. Riva raised several questions regarding the current issues surrounding the technology including the appropriate target lifetime, best definition of “lifetime”, and reliability of the “accelerated tests”. He emphasized that while much progress have been made, a “single optimal, universal solution” does not exist yet to meet various encapsulation requirements depending on OLED architecture, materials, environment, applications, etc. As such, encapsulation materials have to be specifically engineered to meet different types of OLED devices while having “exceptionally high barrier properties, and active fillers or getters, capable of absorbing water on a single molecule basis”. Thus, perfecting this technology is a very challenging task, and, according to Dr. Riva, something that requires in depth collaboration between advance encapsulation materials providers and OLED makers.

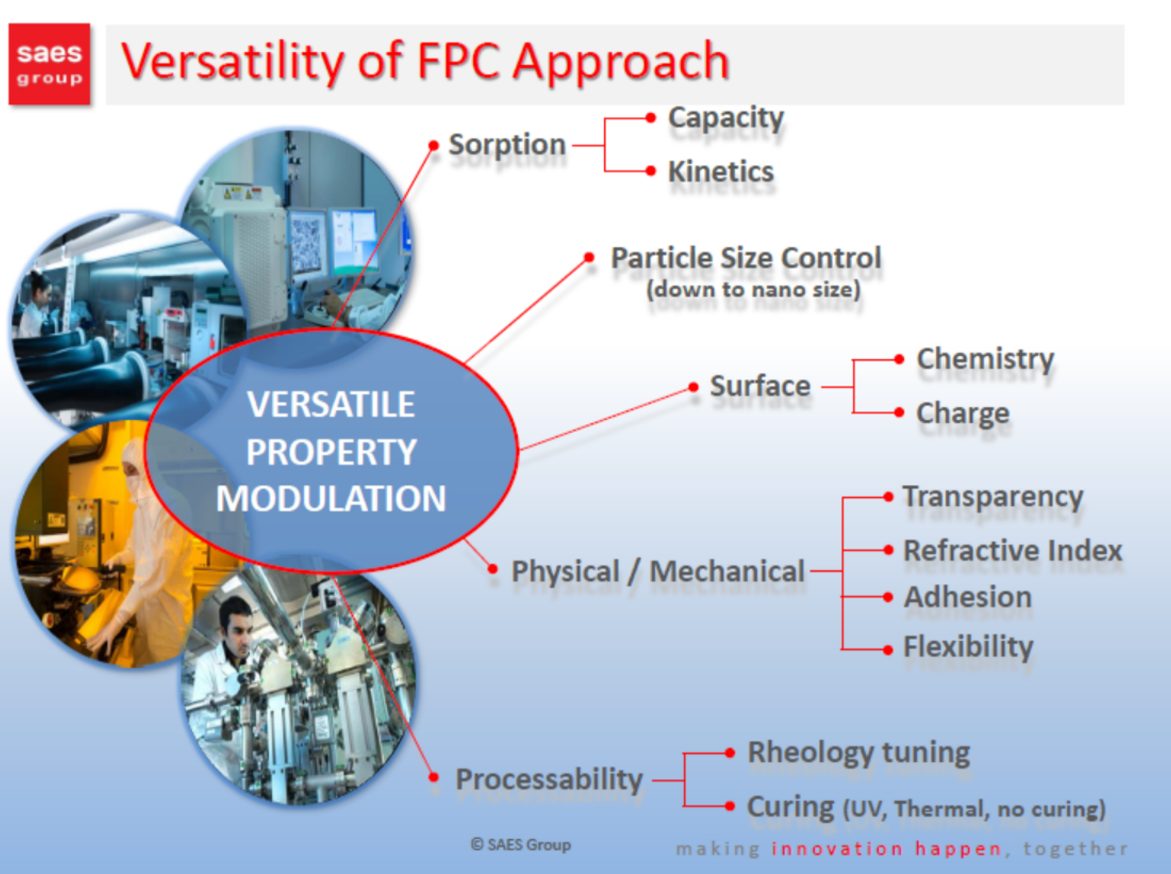

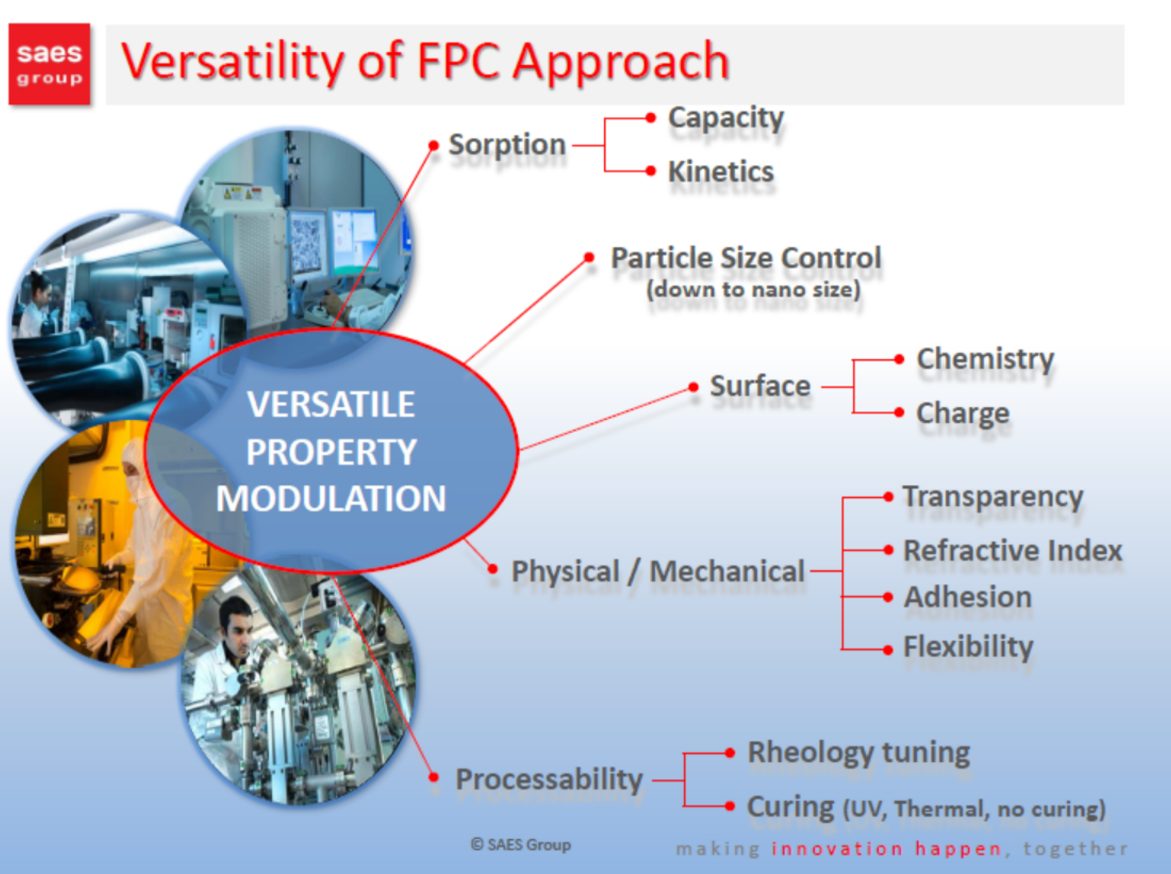

For their part in this technology progression, Dr. Riva reported that SAES Group provides a very large portfolio of active edge sealants, active transparent fillers, and dispensable getters. He explained that the portfolio is the results of deep know-how in functional polymer composites (FPC), “specially tailored to address customers’ specific OLED designs and processes”. Discussing the FPC during his talk in OLEDs World Summit, Dr. Riva emphasized the versatility of this approach.

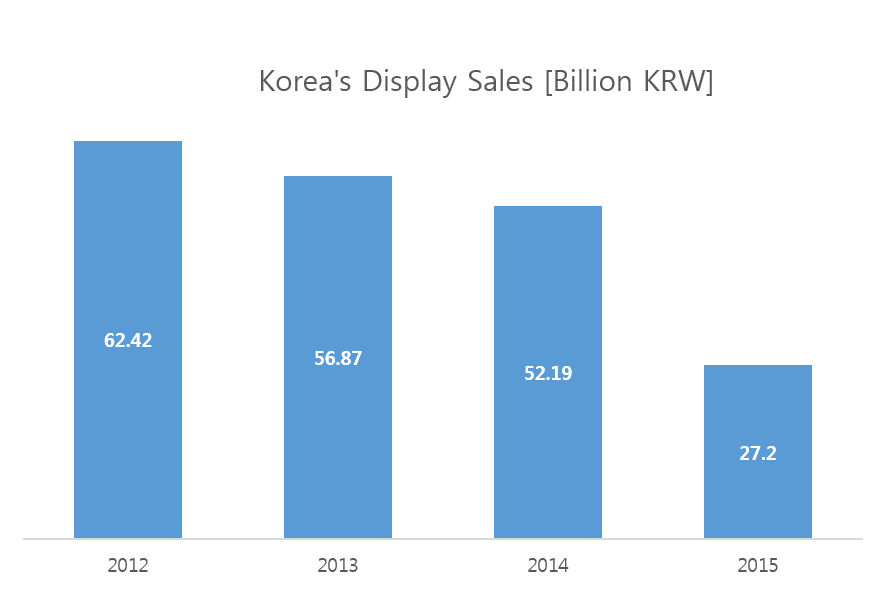

Source: SAES Group, OLEDs World Summit 2015

Regarding application methods for SAES Group’s FPC products, Dr. Riva explained that they can be dispensed via screen printing, blading, syringe, ink-jetting, ODF (one drop filling), and even be employed in thin film encapsulation structures, to make them simpler and more reliable. Furthermore, Dr. Riva reported that while SAES Group considers syringe dispensing as one of the main methods for applying their FPC, “ink-jetting is also becoming more and more widespread, together with ODF, especially for active fillers”.

Dr. Riva believes the FPC could play an important role in making the encapsulation more effective, and that SAES Group can “leverage on its advanced materials expertise” and in-depth getter/purification knowledge, to “perfect FPC based encapsulation solutions for OLEDs”. 11% of SAES Group’s net sales is allocated to Research and Innovation every year with strong cooperation with universities and R&D centers. The company is collaborating with many companies in diverse areas of interest such as OLED lighting, manufacturing equipment, specialized food packaging, and gas barrier films. This proactive and collaborating approach will enable the SAES Group to play a key role in developing more marketable OLED devices.